Mon expérience de contrôleuse de gestion chez Edgar Suites

In this article, Chloé POUZOL (ESSEC Business School, Grande Ecole Program – Master in Management, 2022-2024) partage son experience de contrôleuse de gestion chez Edgar Suites.

L’entreprise : Edgar Suites

Edgar Suites est une start-up fondée en 2016 par Xavier O’QUIN, Maxime BENOIT et Grégoire BENOIT. Elle propose à ses clients de vivre une expérience au cœur de la ville en logeant dans une suite urbaine : un mix idéal entre appartement et hôtel. Pour cela, l’entreprise loue des locaux initialement occupés par des bureaux, qu’elle transforme en T1 (studio), T2 (2 pièces) et T3 (3 pièces).

Exemple de suite

Source: Edgar Suites

En mai 2021, Edgar Suites a levé 104 millions d’euros auprès du fonds d’investissement BC Partners. Depuis cette levée de fonds, l’entreprise a triplé son activité avec presque 150 suites urbaines à Paris, Levallois Perret, Bordeaux, Lille et Cannes.

Logo de l’entreprise Edgar Suites

Source: Edgar Suites

Mes missions

En tant que stagiaire, j’ai eu plusieurs missions bien différentes, certaines seulement temporairement et d’autres tout au long de mon stage.

Lorsque je suis arrivée chez Edgar Suites, il n’y avait pas encore de contrôle de gestion mis en place. L’entreprise avait juste quelques fichiers Excel avec lesquels elle faisait tant bien que mal les calculs de chiffres d’affaires (CA) et d’excédent brut d’exploitation (EBE) qui représente le bénéfice d’une société avant les intérêts, impôts, amortissement et provisions (EBITDA pour Earnings before interest, taxes, depreciation, and amortization)…

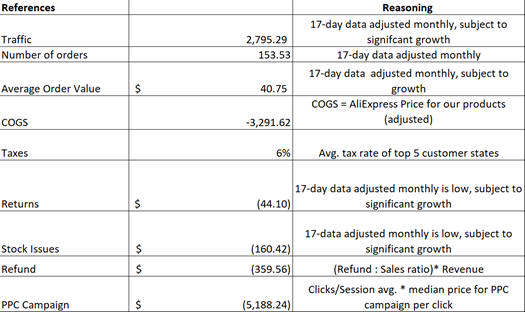

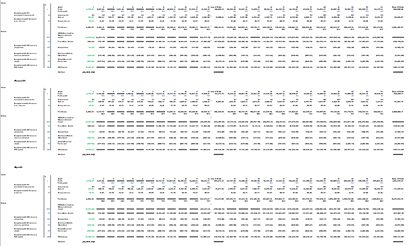

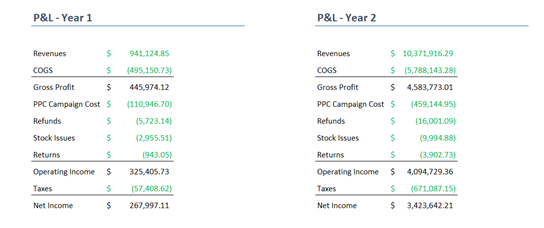

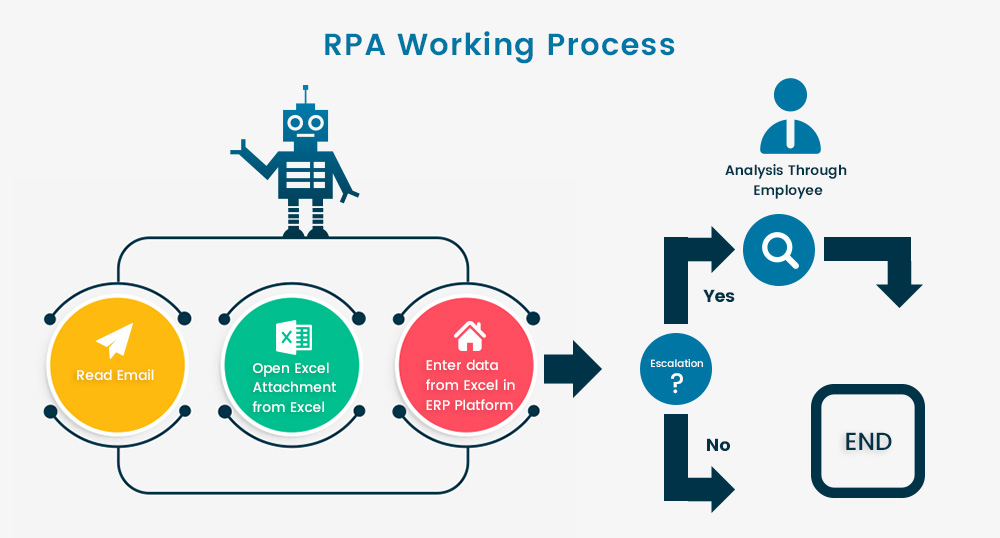

L’entreprise avait embauché un prestataire extérieur pour construire des fichiers de reporting financier et comptable grâce à un tableur (Excel) et une suite de logiciels qui permettent de transformer des données disparates en informations visuelles, immersives et interactives (Power BI). J’étais chargée de surveiller l’avancée du dossier, de superviser le respect des dates limites (deadlines) et surtout de vérifier la cohérence des fichiers envoyés (écarts, cohérences entre les grands livres, les résultats de l’entreprise (P&L pour Profit & Loss) et les budgets). Cela m’a ainsi permis d’apprendre à maîtriser un éditeur de requêtes de données (Power Query, un des logiciels de la suite Power BI) pour importer des données de l’entreprise dans le tableur Excel.

En plus de cette première responsabilité, j’ai été chargée d’améliorer les fichiers internes de suivi d’indicateurs utilisés pour l’aide à la décision et pour mesurer l’efficacité d’une mesure (KPI pour key performance indicator) notamment le coût au check-in et le coût par équivalent temps plein (ETP) qui est une unité de mesure permettant d’évaluer la charge de travail et la capacité d’un employé.

Réalisation des reportings mensuels

En plus de ces missions, j’étais responsable de la rédaction de tous les reportings mensuels pour BC Partners (le fonds d’investissement auprès duquel Edgar Suites a levé des fonds pour financer son développement) et pour les propriétaires d’immeuble à loyer variable (loyer calculé selon un certain pourcentage du chiffre d’affaires) où il s’agissait de calculer le chiffre d’affaires, les coûts fixes, les coûts variables du mois et ainsi les bénéfices du mois. Je devais aussi m’occuper des rapprochements bancaires (contrôle de la concordance entre les relevés des comptes bancaires et les comptes correspondant dans la comptabilité) et de la gestion des factures qui s’effectuaient à l’aide du logiciel Pennylane.

Réflexion sur la responsabilité sociétale des entreprises (RSE)

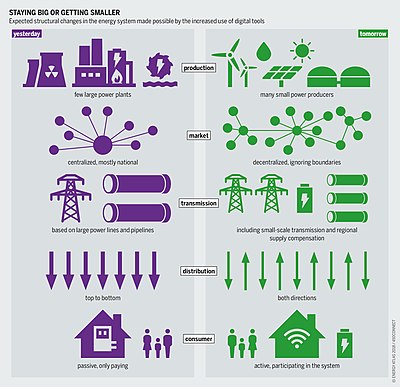

Enfin, j’ai également participé à la réflexion sur la responsabilité sociétale des entreprises (RSE) pour prendre en compte les enjeux environnementaux et sociaux d’Edgar Suites. Les dirigeants souhaitent, en effet, être labellisés B-Corp (Benefit Corporation). Une entreprise peut recevoir la certification B-Corp lorsque ses actions sont en adéquation avec les exigences sociales, environnementales et de gouvernance du public. Il s’agit d’une certification qui s’obtient après un long processus. J’ai donc effectué des recherches et conduit des entretiens pour trouver le cabinet de conseil adéquat pour nous accompagner tout au long de ce projet. J’ai également participé aux réunions de réflexion sur les actions d’Edgar Suites afin d’atténuer l’impact social et environnemental de l’activité.

Compétences et connaissances requises pour ce stage

Les principales compétences et connaissances techniques (hard skills) requises sont de maîtriser un tableur comme Excel et d’avoir de bonnes bases en comptabilité et en finance. En effet, pour réaliser les reportings, il était nécessaire de comprendre les données importantes de l’activité pour pouvoir les analyser et les synthétiser. Ces données importantes chez Edgar Suites étaient le coût par check-in, l’EBITDA, les coûts fixes et les coûts variables (notamment les loyers variables). De même, pour faire de la modélisation financière, il est essentiel d’avoir de bonnes connaissances financières afin de créer une logique et une présentation cohérente au sein du fichier.

Enfin, les compétences humaines et comportementales (soft skills) essentielles étaient principalement de savoir travailler en équipe ; cela permet de mettre à contribution les idées et les compétences de tous les membres du groupe pour améliorer le résultat du travail sur l’entreprise.

De façon générale, je suis très satisfaite de mon premier stage que j’ai effectué à la fin de ma première année à l’ESSEC. J’ai été responsabilisée et j’ai pu découvrir le fonctionnement comptable d’une entreprise ainsi que me familiariser avec la finance d’entreprise. En effet, j’ai pu manipuler les états financiers d’Edgar Suites pour me familiariser avec leur lecture et leur analyse. De plus, j’ai pu observer le fonctionnement des finances de l’entreprise : comment l’entreprise gérait ses coûts ; comment Edgar Suites essayait d’améliorer sa rentabilité ; quelles étaient les répercutions sur le plan financier des décisions de management …

Concepts clés

Je détaille ci-dessous quelques concepts clés qui m’ont été utile de maîtriser pendant mon stage :

Contrôle de gestion

Le contrôle de gestion est un service au sein d’une entreprise, chargé d’aider à la prise de décision. Il est responsable de l’élaboration des budgets, de la mise en place de procédures de gestion et de règles, du suivi des résultats, du choix des indicateurs clés dans les tableaux de bord et de la production et la diffusion d’outils de pilotage. L’objectif principal du contrôleur de gestion est d’optimiser les performances matérielles et financières de l’entreprise.

Chiffre d’Affaires

Le Chiffre d’Affaires (CA) correspond à la somme des ventes des produits ou services d’une entreprise. Il se calcule en multipliant les quantités vendues par leur prix de vente. Il s’agit donc d’un indicateur principal sur les performances de l’entreprise.

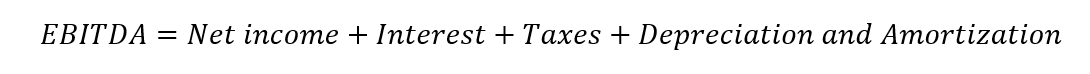

EBE ou Ebitda

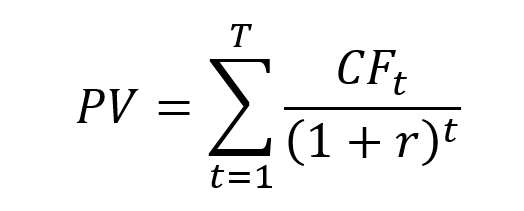

L’Ebitda (Earnings before interest, taxes, depreciation, and amortization) correspond au bénéfice avant les intérêts, les impôts, les taxes, la dépréciation et l’amortissement. Il mesure donc la création de richesse avant toute charge. Il s’agit d’une notion assez proche de l’EBE (Excédent Brut d’Exploitation). Il existe deux formules pour calculer l’Ebitda :

Ebitda = Chiffres d’affaires – achats – autres charges externes – charges du personnel – autres charges

Ebitda = Résultat net + charges d’intérêts + charges d’impôts + amortissements et provisions

Lorsque l’Ebitda est positif, cela signifie que l’entreprise est rentable au niveau opérationnel mais pas forcément qu’elle est bénéficiaire (après la prise en compte d’autres éléments comme les charges financière).

Responsabilité sociétale des entreprises (RSE)

La responsabilité sociétale des entreprises (RSE) correspond à la contribution des entreprises aux enjeux du développement durable. Cela consiste à faire des efforts pour la protection de l’environnement et pour l’amélioration de la société. Ces efforts se font en collaboration avec toutes les parties prenantes (fournisseurs, clients, employés, actionnaires…). Il existe aujourd’hui de nombreuses certifications, comme la certification B-Corp, qui reconnaissent l’investissement des entreprises dans la RSE.

Articles à lire sur le blog SimTrade

▶ All posts about Professional experiences

▶ Anna BARBERO Career in finance

▶ Emma LAFARGUE Mon expérience en contrôle de gestion chez Chanel

▶ Ghali EL KOUHENE Asset valuation in the real estate sector

Ressources utiles

A propos de l’auteure

Cet article a été écrit en mai 2022 par Chloé POUZOL (ESSEC Business School, Grande Ecole Program – Master in Management, 2022-2024). Vous pouvez me contacter via mon adresse mail ESSEC pour plus d’information sur mon stage.