Expeditionary experience in a Chinese investment banking boutique

In this article, Suyue MA (ESSEC Business School, Global Bachelor of Business Administration, 2017-2021) shares his experience as an intern at InvesTarget, an investment banking boutique in China focusing on capital raising and M&A.

About myself

I have been interested in finance ever since I started my study at ESSEC Business School in 2017. By acknowledging more about finance, during my 2nd year of study, I decided to build up my career in corporate finance, focusing on the primary market. By sending around 400 resumes to different companies and banks, I finally received my first internship offer in a top 10 securities company doing Real Estate Investment Trusts (REITs) and Commercial Mortgage-Backed Securities (CMBS) projects in China. Until now, I have finished 4 internships in the field of corporate finance, private equity, capital-raising advisory, and Mergers and acquisitions (M&A).

In this article, I would like to share with you about my internship in a capital-raising advisory team of a Chinese new-type investment banking boutique. This company mainly focuses on M&A and fundraising advisory; some of those companies will also play a role as venture capital if they have their own money to invest or they find some profitable projects.

My mission

In this internship, my primary exposure covered in Technology & Industrial sector, including Industrial Drone, Intelligence Vehicle, and Advanced Materials.

Main tasks

As an intern, my main tasks were mainly as followed:

- Perform pro forma financing consequences, capitalization table, Discounted Cash Flows (DCF) analysis, and accretion/dilution analysis

- Perform in-depth financial, accounting, and operation due diligence, which includes financial analysis, team’s background, and technology support on client companies

- Prepare materials for internal business plan, business proposal, and financial advisory presentation

- Conduct reports of industry research and company analysis on Telecom Media and Technology (TMT) specific sectors.

Details of a deal

Since a round of fundraising process is normally around six months, I had a chance to close two live deals. Let me take one of the deals as an example: we had a client company that is a top intelligent driving-technology startup with valuation around US$250m. The company was looking for US$30m Series B round funding (round of growth stage financing). Our role as a fundraising advisor was to screen potential investors (normally they are Venture Capitals (VCs), since B round is still in growth stage) who are interested in such field at first. We also helped and guided the client company to prepare the material needed for the fundraising, such as business plan, business contract, and company’s financial analysis. Subsequently, if VCs are interested, we will assist VCs to do the due diligence on the client company. It usually includes financial, accounting, law, and compliance documents. After the valuation of VCs, if they agree to invest in company’s shares, both VCs and client company will sign a Term Sheet and finish the transaction within a period mentioned by the contract.

Preparatory work

We also need to do industry and company research report in Technology and Industrial sector, in which industry research report should include the industry’s definition, category, history, political trends, market analysis, competition status, core technology, industry development trend, capital market research, etc. For the company research report, we should present the company’s background information, capitalization table, business category and products, team, financing history, cooperation relationship, etc.

Takeaway from my internship

Thus, by doing such work, as an intern, I could have a deep understanding regarding specific sectors and build up relationship with some top VCs and Private Equity (PE) firms. This is quite important for the students who want to work in the investment field of primary market.

Financial concepts

Venture Capital

Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and any other financial institutions. However, it does not always take a monetary form; it can also be provided in the form of technical or managerial expertise. Venture capital is typically allocated to small companies with exceptional growth potential, or to companies that have grown quickly and appear poised to continue to expand.

Though it can be risky for investors who put up funds, the potential for above-average returns is an attractive payoff. For new companies or ventures that have a limited operating history (under two years), venture capital funding is increasingly becoming a popular – even essential – source for raising capital, especially if they lack access to capital markets, bank loans, or other debt instruments. The main downside is that the investors usually get equity in the company, and, thus, a say in company decisions.

Capital funding

Capital funding is the money that debt and equity holders provide to a business for daily and long-term needs. A company’s capital funding consists of both debt (bonds and loans) and equity (stock). The business uses this money for both capital expenditures (Capex) and operating expenditures (Opex). The debt and equity holders expect to earn a return on their investment. The form of returns is interests for debt holders, and dividends and capital gains for equity holders. However, in my internship, since the company is still a startup at growth stage, so it only includes equity financing, which means that the investors will directly own the company’s share rights by investment money.

Discounted Cash Flow (DCF)

The discounted cash flow (DCF) method is a valuation method used to estimate the value of an investment based on its expected future cash flows. DCF analysis attempts to figure out the value of an investment today (present value) based on projections of how much money it will generate in the future. This applies to investment decisions of investors in companies, such as acquiring a company, investing in a technology startup, or buying stocks in the secondary market. For business, owners and managers are looking to make capital budgeting or operating expenditures decisions such as opening a new factory, purchasing or leasing new equipment.

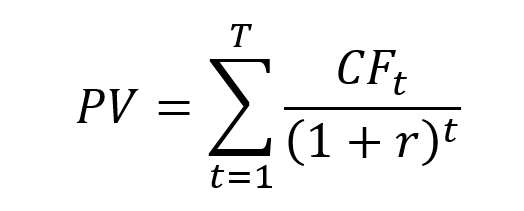

The DCF formula is shown below:

where PV is the present value of the investment, CF the series of cash flows generated by the investment (CF1 is for year 1, CF2 is for year 2, …, CFT is for the last year T) and r the discount rate.

Relevance to the SimTrade certificate

The experience shared above is strongly related to the SimTrade Certificate. The primary market is where securities are created, while the secondary market is where those securities are traded by investors. The boundary between primary and secondary market is the IPO. Once stocks are traded in public, it comes to secondary market. From my perspective, most parts of the investment analysis and logic are the same, such as fundamental analysis, DCF, P/E ratio, etc. so we can benefit from SimTrade by learning how business factors will affect the company’s stock performance and why and when should we make the right investment.

Related posts

▶ All posts about Professional experiences

Useful resources

Investopedia Venture Capital

Investopedia Private Equity

About the author

Article written in June 2021 by Suyue MA (ESSEC Business School, Global Bachelor of Business Administration, 2017-2021).

1 thought on “Expeditionary experience in a Chinese investment banking boutique”

Comments are closed.