My first experience in corporate finance inside a CAC40 group

In this article, Pierre BERGES (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2020-2021) shares with us his experience in the Finance Department at Bouygues (a French firm included in the CAC40 index).

About Bouygues

Born in 1952 under the impulsion of Francis Bouygues and now managed by his son Martin, the Bouygues group has become in 70 years a gigantic and well-oiled machine which diversified in many fields along the years such as construction (Bouygues Construction), Telecommunications (Bouygues Telecom), Real Estate (Bouygues Immobilier), Road (Colas) and Media (TF1). Operating in over 80 countries with 129,000 employees, Bouygues is one of the biggest actors of the building industry around the world and the second French building company behind Vinci. As a major actor of the CAC 40 index and because of its numerous actions in M&A (Colas in 1985, TF1 in 1987…), Bouygues has developed a strong financial expertise especially regarding corporate finance.

My experience at Bouygues

My goal as an ESSEC’s student was to develop my skills in finance in order to find a job that will challenge me and help me learn each day, that’s why I chose to search for an internship in corporate finance and, if possible, inside a French historic group. I had the chance to join the team of the Finance Department of Bouygues SA and work with the senior financial managers on two missions. The first mission was to report all the critical financial information of the Bouygues’s subsidiaries to the Chief Financial Officer (CFO) and Top Management Team (TMT) each month and monitor the results of the subsidiaries in order to adapt the strategy in case of unusual results. The second mission was the construction of the rating files dedicated to the two rating agencies, Moody’s and S&P, for the rating of Bouygues. I had also to work on more punctual missions related to Bouygues’s stocks (share buyback, stock options, employees saving plan, protection thought derivatives…).

The process of rating

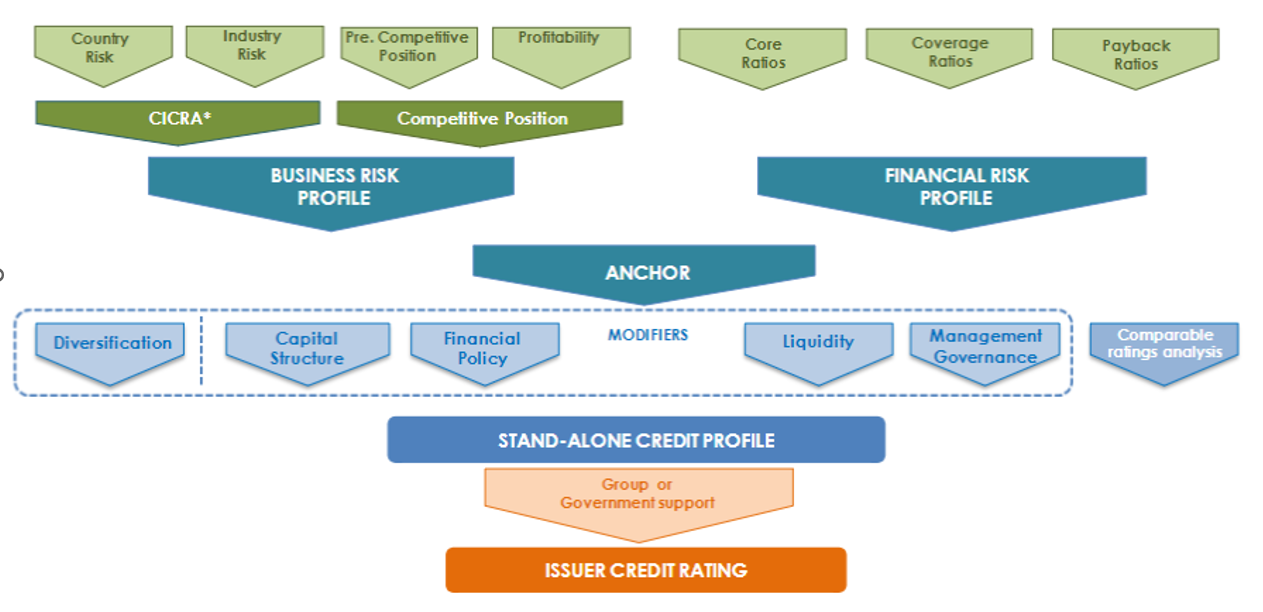

My main mission was to support the managers during the construction of the rating files for the rating agencies Moody’s and S&P. The aim of those files was to help the agencies during their decision process by giving all the information needed under the best light possible to increase or at least maintain the rating of Bouygues. Even though it’s almost impossible for a company to influence the financial aspects of the rating, the company can still work on more flexible aspects of the rating process such as the country risk (risks of the countries where the firm operates), the industry risk (risk of the industry the firm chose to develop). For Bouygues some flexibility is possible regarding the repartition of the earnings coming from media, construction, telecommunication…) or the management governance for example. Our work was to find the best way to optimize those topics and therefore the best way to improve Bouygues’s rating for future market operations.

Figure 1: Structure of the S&P rating.

Source: S&P.

What I’ve learnt during this internship

This internship taught me a lot about corporate finance and how companies use finance to maximize their profits and protect their assets. It also taught me about the central position of rating agencies in the strategy of a company, especially if this company plans to expand through bonds or other financial instruments. Finally, I’ve learnt the way a company can and have to interact with other actors and how the market can influence both the company strategy and its behavior on a daily basis.

Relevance to the SimTrade certificate

The SimTrade certificate is a powerful ally especially regarding the missions linked to Bouygues’s stocks. It allows me to quickly understand the concepts of stock-options or derivative and increase my effectiveness regarding those topics. The certificate is a very good way to learn the basics of financial markets and build on those basics to progress on more complex subjects

Related posts on the SimTrade blog

▶ All posts on Professional experiences

▶ Raphaël ROERO DE CORTANZE Credit Rating Agencies

▶ Bijal GANDHI Credit Rating

▶ Jayati WALIA Credit Risk

Useful resources

Academic articles

Louizi, A., Kammoun, R., 2016. Le positionnement des agences de Notation dans l’évaluation du système de gouvernance d’entreprise, Gestion 2000, 33(5-6):149-175.

Business

Bouygues Presentation and history of Bouygues group

About the author

The article was written in September 2021 by Pierre BERGES (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2020-2021).