My Experience as an External Junior Consultant with Eurogroup Consulting

In this article, Snehasish CHINARA (ESSEC Business School, Grande Ecole Program – Master in Management, 2022-2024) shares his experience as an External Junior Consultant with Eurogroup Consulting, which is a consulting company specialized in organization and operations (supply chain).

About Eurogroup Consulting

Eurogroup Consulting, founded in 1982, is a French consulting firm with a European approach to management, strategy and organization. With a focus on freedom to take risks, requirements of the clients and the projects, and solidarity to the success of their entrepreneurial partners, Eurogroup consulting has been able to expand its network to 16 countries and clientele to all sectors of activity. They have grown significantly in the areas of banking and finance, business, insurance and welfare, logistics and transportation, retail, energy and the environment, and public sector, including healthcare. Today, Eurogroup Consulting stands out as a highly reputable and able partner for companies seeking all-encompassing solutions and knowledgeable advisory in the areas of Digital, Operational Excellence, and Transitions.

Eurogroup Consulting Logo

Source: Eurogroup Consulting.

Junior Consultant Experience

As a part of my Master in Management program at ESSEC Business School, I and a few other students a ESSEC (my team) collaborated as an External Junior Consultant with Eurogroup Consulting for a consulting project in the aviation sector based in Singapore. With my team, I closely worked with the managing partner of Eurogroup Consulting in Singapore to offer strategic recommendations to one of the firm’s clients in the aviation sector dealing with logistics (for the maintenance, repair and overhaul (MRO) of airplanes). Our focus was on addressing the real-world challenges faced by the aviation industry in the post-Covid era in the Asia-Pacific region.

My project with Eurogroup Consulting dealt with logistics and supply chain within the aviation sector. Efficient logistics and supply chain management are vital for businesses to remain competitive in today’s globalized marketplace as they ensure the efficient flow of goods, services and information from the point of origin to the point of consumption.

Our focus was on Contract Logistics in the aviation sector, which is a type of third-party logistics (3PL) service where a company delegates certain aspects of its supply chain operations to a specialized provider. This provider, known as the contract logistics provider, oversees a portion or all the company’s supply chain, which includes transportation, distribution, and related activities, as per the contractual agreement. The primary objective of contract logistics is to enhance the efficiency of the customer’s supply chain, reduce expenses, and optimize overall performance. By leveraging expertise, resources, and technology, contract logistics providers enable clients to concentrate on core business activities while entrusting the management of their logistics operations to the specialized service. Contract logistics providers provide services such as warehouse management, inventory management, order fulfillment, distribution and transportation management. In the aviation sector, contract logistics play an important role in offering services like space part logistics. Airlines face challenges with “Inoperable parts” (INOPs), which necessitate costly replacements or risk grounding the aircraft indefinitely. Major companies provide essential services to address this spare parts availability issue, such as Order Tracking & Tracing, spare parts storage management, advanced stock organization, and repair logistics management.

My missions

The objective my project was to achieve the following:

- Identify the post-Covid supply chain strategies of major multinational corporations (MNCs) in the aviation sector, including the evolution of their supply chain footprints and their expectations from contract logistics providers (an intermediary between the different manufacturers and an airline company).

- Evaluate the current positioning and services offered by prominent contract logistics providers and anticipate how their positioning and offerings might evolve in the future.

- Recommend new potential offerings and analyze their suitability and key factors for success.

Required skills and knowledge

As a part of a cross-functional team of ESSEC students to achieve the shared project objectives through efficient cooperation, and decision-making, I gained an understanding of the aerospace Third Party Logistic (3PL) and Maintenance, Repair and Overhaul (MRO) industry in the Asia-Pacific region as we conducted comprehensive market research. We gathered and analysed large sets of data related to the aviation contract-logistics market, customers, competitors, and industry trends to identify growth opportunities. Following the analysis, we had weekly meetings with the managing partner of Eurogroup consulting, a professor-mentor of the team at ESSEC and the client to discuss our approach to the problem statement, challenges faced by the team to gather access to information, since aviation industry is well-known for its confidentiality norms, and the assessments produced after detailed analysis of the data. Attending the weekly team-mentor meetings was vital to our learning, providing us with first-hand exposure to the real-life operations within a consulting firm. In these meeting we decided upon the objective targets for the coming weeks and how to address the challenges faced this week.

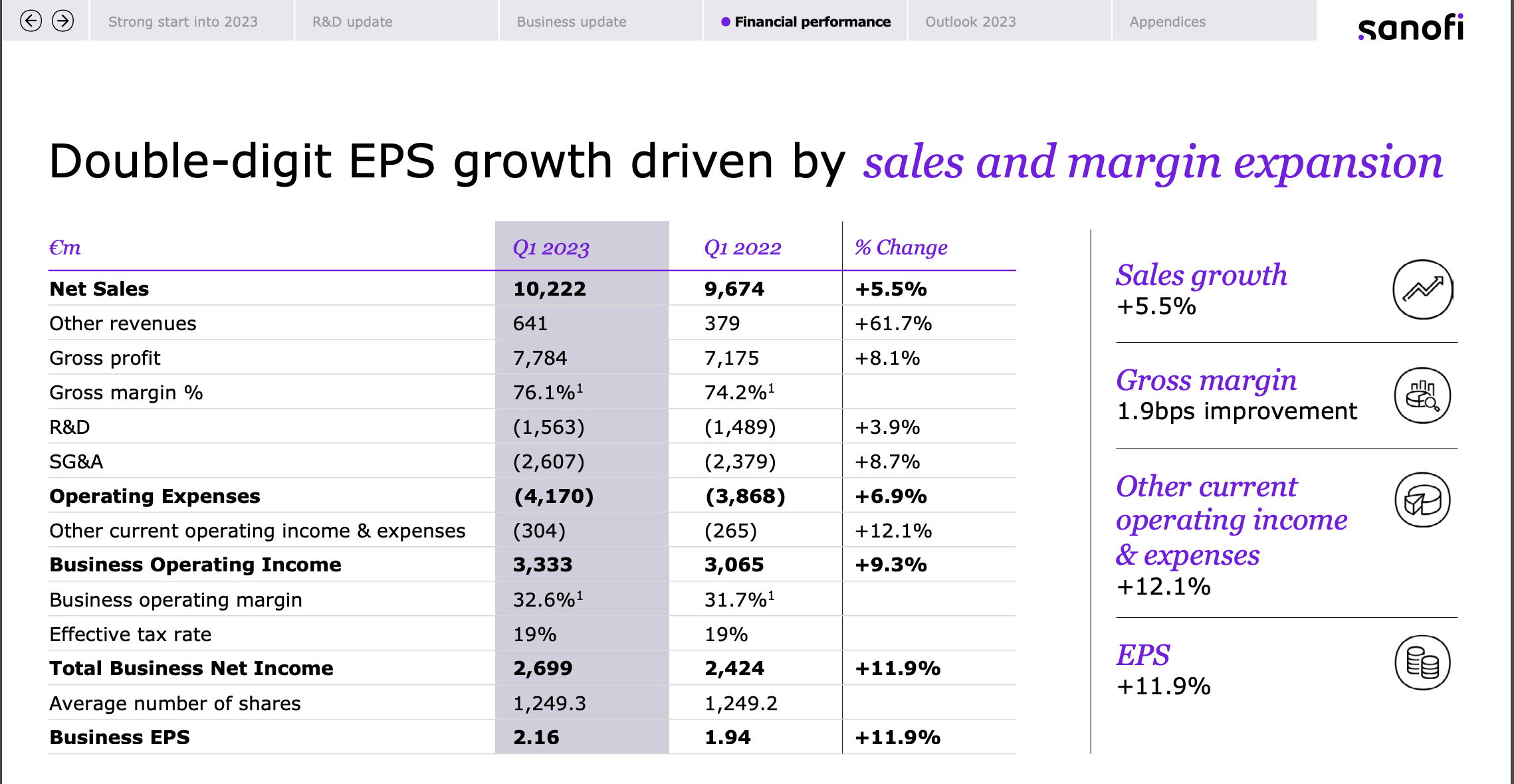

As a junior consultant, I engaged with subject matter experts in the region in order to gain a holistic understanding of the impact of Covid-19 on the aviation contract-logistics industry. I conducted detailed financial statement analysis to understand how the larger players and competition were leveraging their cash flows, and debt to counter the crisis caused on the industry by the pandemic. In order to measure the risk of the competitors of the client, we conducted a fundamental calculation of Altman’s Z-Score and developed a credit rating model based on key financial indicators, both quantitative and qualitative, in Excel. This allowed us to scrutinize the key players in the current market and identify competitors to be focused on. Based on our discussions with experts, and analysis conducted, we identified the gap in the service offerings which allowed us to provide strategic recommendations for the client company. This 3-month long learning-by-doing experience gave me immense exposure to the operations of a consulting firm and the way they respect the needs of the stakeholders of the project.

What I learned

Key Learning Outcomes of this project :

- To utilise evidence-based conclusions and strategic thinking to propose new strategic initiatives that aligned with industry innovations and key success factors.

- To analyse corporate information and financial statements, preparing pitch-books and presentations while collaborating with stakeholders.

- To define the value chain of aviation contract-logistics industry in Asia-Pacific region and observe potential channels to expand.

- To develop custom credit rating tool based on key performance indicators.

Concepts related my internship

Third-Party Logistics in Aviation Sector

Third-Party Logistics (3PL) is a crucial aspect of Logistics and Supply Chain Management, that has transformed how businesses handle the transportation and storage of products and services. Through strategic outsourcing, companies delegate specific logistics tasks to external service providers, known as 3PL providers. These service providers streamline supply chain processes, resulting in increased efficiency, cost reduction, and improved overall performance. Within the aviation sector, 3PL is crucial for aiding airlines, aircraft manufacturers, and associated enterprises with intricate global logistics. Due to the complexity and time-sensitivity of aviation operations, 3PL providers offer customized solutions to address the unique demands and challenges of the industry. 3PL companies in the aviation industry offer a range of essential services to streamline operations. These include arranging the transportation of aviation-related cargo and goods, managing efficient warehousing and inventory systems for quick access to items, handling customs clearance for international shipments, ensuring prompt last-mile delivery to designated destinations, managing the distribution of critical spare parts for airlines’ maintenance facilities worldwide, and facilitating smooth transportation of large components and sub-assemblies for aircraft manufacturers. These services contribute significantly to the industry’s efficiency and help reduce aircraft downtime, making them indispensable partners for aviation businesses.

Aviation 3PL Services:

- Freight Transportation: 3PL companies arrange timely transport of aviation cargo to airports, maintenance facilities, and aircraft assembly lines.

- Efficient Warehousing: These providers manage aviation-related inventory in well-organized warehouses, reducing lead times.

- Customs Compliance: 3PLs handle international shipments’ customs documentation, ensuring smooth clearance.

- Last-Mile Delivery: They ensure prompt delivery of aviation components to their destinations.

- Spare Parts Distribution: Airlines rely on 3PLs for critical spare parts distribution, minimizing aircraft downtime.

- Aircraft Manufacturing Support: Specialized 3PLs facilitate smooth production by transporting large components for aircraft manufacturers.

Aviation companies benefit from the expertise of 3PL providers in handling complex logistics. Outsourcing these services saves on capital investments and allows them greater flexibility in scaling services based on demand. 3PL providers’ extensive network aids in smoother international operations for the customers.

Credit risk

The evaluation of credit risk holds significant importance in financial risk management, especially concerning lending and investment activities. It pertains to the potential financial loss that a lender or investor might encounter in the event of non-payment or failure of a borrower or counterparty to fulfil their financial commitments. Credit risk occurs when people, companies, or governmental entities take loans or offer credit with the possibility that they might be unable to repay the borrowed amount according to the agreed terms.

Several key concepts allow us to gauge the risk involved with an investment and make better decisions. The Probability of Default (PD) is a measure that evaluates the probability of a borrower being unable to fulfil their contractual obligations and defaulting. Although defaulting doesn’t always result in immediate losses, it can raise the risk of bankruptcy and eventual losses. PD is expressed as a percentage, with higher percentages indicating a higher risk of default. Loss Given Default (LGD) is a commonly used expression to describe the ‘loss severity’ of an investment. It calculates the proportion of an exposure (such as a bond or loan equivalent) that is expected to remain unrecovered if a default occurs. It is a percentage of the outstanding debt or investment that is not recoverable after a default occurs.

Credit agencies are responsible for assigning credit ratings to both corporations and governments based on their ability to fulfil financial obligations. These credit ratings serve as indicators for lenders regarding the entity’s capacity to repay loans. Each credit agency employs slightly varied approaches in determining credit ratings. On the other hand, credit scores pertain to individuals and reflect their creditworthiness, considering their credit history and financial conduct. Credit risk models play a vital role in the financial industry as they employ mathematical techniques to foresee the probability of default, evaluate potential losses, and handle credit risk. These sophisticated tools aid both financial institutions and investors in making well-informed choices concerning lending and investment matters. As the global economy continues to evolve, understanding and managing credit risk will remain paramount for safeguarding financial stability and ensuring sustainable growth in lending and investment sectors. By employing comprehensive credit risk analysis, stakeholders can navigate potential challenges, capitalize on opportunities, and foster a resilient financial landscape for the future.

The evaluation of credit risk had a vital role in the extensive market research conducted for the top players in the aviation contract logistics segment. Although credit risk analysis mainly concentrates on appraising the creditworthiness of potential collaborators or customers, it offered valuable insights that prove beneficial for competitive intelligence and market research objectives. Conducting credit risk analysis on companies within the industry allowed for the identification of major players and their market position. Assessing financial stability, including liquidity, profitability, and debt levels, helped evaluate potential investment opportunities and market disruptions. Additionally, studying competitors’ credit risk provided insights into their market share, customer base, and potential risks of default or bankruptcy. Understanding their financial strength aided in formulating effective strategies for competitive positioning in the aviation contract logistics niche.

Corporate Risk Management

In order to mitigate various types of financial risks, such as credit risk, market risk, liquidity risk, and operational risk, investors and management can use risk analysis to identify, measure, and mitigate these risks effectively. Instabilities and losses in financial markets generally caused by fluctuations in stock prices, currencies, interest rates and more lead to rise in financial risks. Market risk reflects the fluctuations of interest rates, currencies, and prices of raw materials. Probability of failing to pay creditors such as banks or lenders leads to credit risk. Liquidity risk is the inability of a company to meet its short-term financial obligations (to pay the salaries of its employees, to settle the invoices to its suppliers, to pay back the capital and interests to the bank, to pay the taxes to the State, etc.) and is generally signs of cashflow inefficiencies. Flawed policies, processes, events or systems disrupt business operations and are known to cause operational risks. Financial risks are measured by calculating specific ratios that indicate the overall health of a company, which are then compared against the industry benchmark.

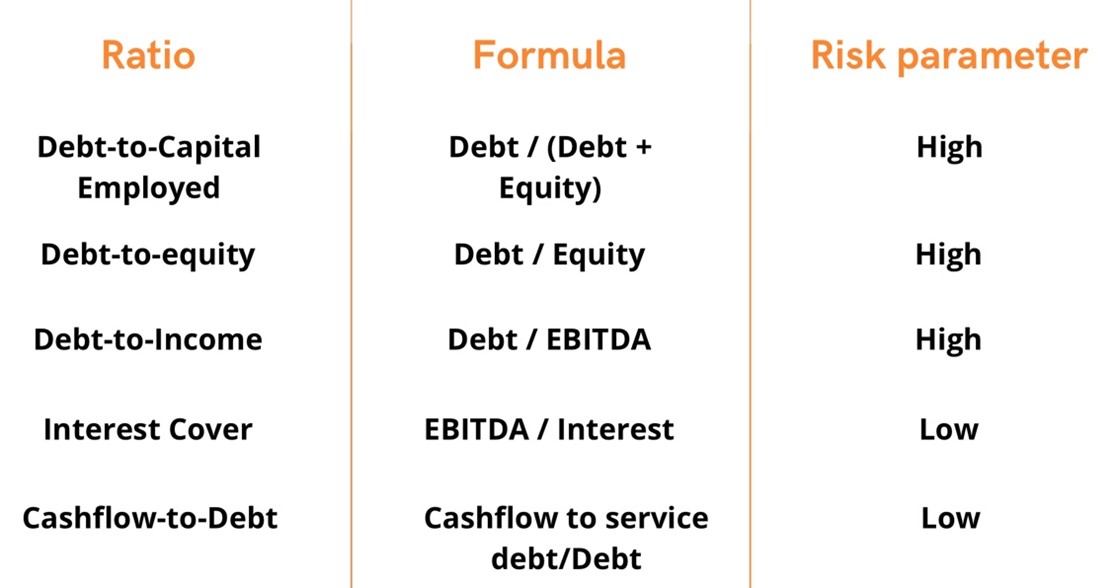

The following table provides some of the important financial ratios used to estimate the risk of a company. High financial risk is implied by high or low measure according to the ratio.

Table 1. Financial ratios

Source: The author.

Ratios are most useful when compared between companies in similar sectors and over time. Multiple measurements may be necessary for each given firm to fully comprehend the financial risk.

Why should I be interested in this post?

Working closely with subject matter experts and engaging in financial statement analysis to assess the impact of Covid-19 on the various industries equipped us with valuable skills and knowledge in financial analysis and risk assessment. Additionally, learning to calculate Altman’s Z-Score and developing a credit score model allowed us to evaluate the financial health of companies, a crucial skill in the finance industry. The exposure to strategic decision-making, data analysis, and client interactions during this consulting project helped me develop problem-solving capabilities and communication skills, which are highly sought-after attributes in the finance job market. Overall, this hands-on experience provided me with practical experience for finance roles, especially in consulting firms.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Jayati WALIA Value at Risk

▶ Jayati WALIA Stress Testing used by Financial Institutions

▶ Diana Carolina SARMIENTO PACHON Risk Aversion

▶ Nithisha CHALLA My experience as a Risk Advisory Analyst in Deloitte

Useful resources

Financial Risk – Allianz Trade

About the author

The article was written in August 2023 by Snehasish CHINARA (ESSEC Business School, Grande Ecole Program – Master in Management, 2022-2024).