Producer Price Index

In this article, Bijal Gandhi (ESSEC Business School, Master in Management, 2019-2022) elaborates on the concept of Producer Price Index.

This reading will help you understand the meaning, calculation, uses and limitations of the Producer Price Index.

What is Producer Price Index?

Producer price index or PPI is a statistical estimation used to measure the change in the prices of goods and services. It is used to track the selling prices of the products received by domestic producers for their output. Producer price index can be calculated in two ways:

- the goods leave the place of production called the Output PPI

- the goods enter a new production process called the Input PPI

PPI is an estimation of the change in the average prices that a producer receives, and it is not generally what the consumer has to pay for that same product. PPI in manufacturing measures this change in the prices of products when they leave the producer i.e., they exclude any taxes, transportation, and trade margins that the consumer may have to pay. Due to this very reason, PPI cannot be used to calculate the standard of living in an economy due to the difference in the price paid by a producer and the final consumer. PPI tracks the price change in goods and services and therefore provides a general overview of inflation in an economy.

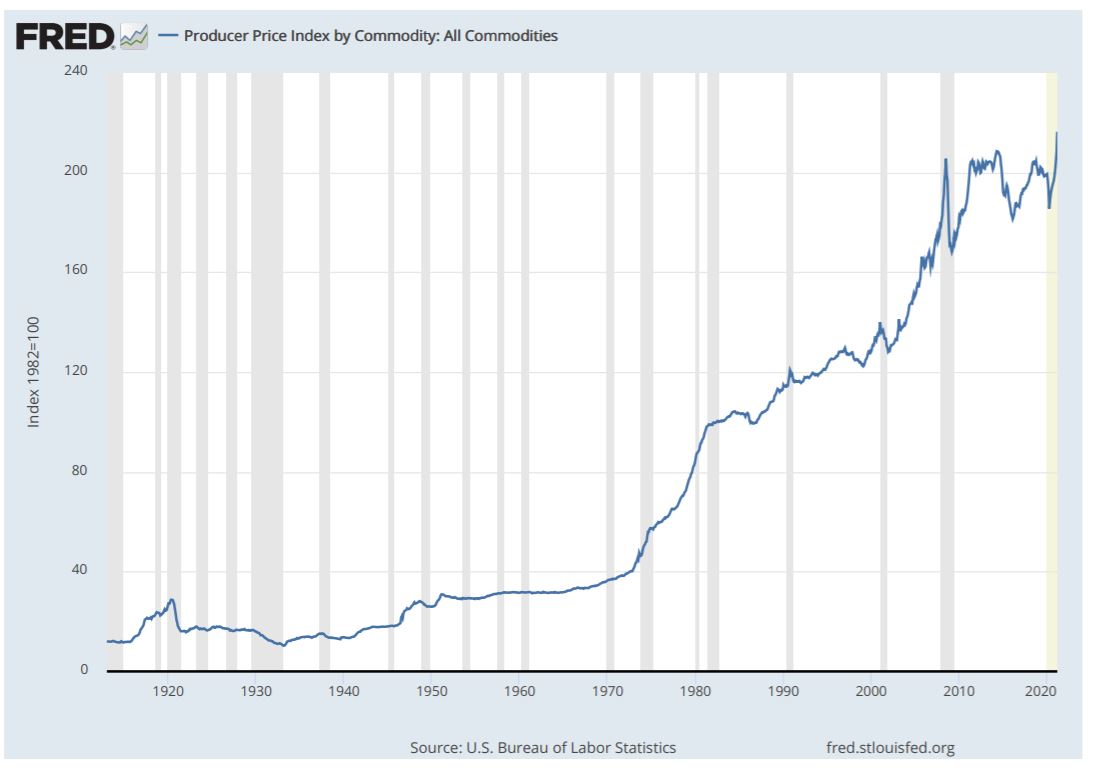

The Producer Price Index acts as a good leading economic indicator since it identifies various price changes in the economy before the goods enter the final marketplace. It is useful for the Government to formulate fiscal and monetary policies for the economy. Here, you can see the evolution of PPI from 1920 to 2020 for all commodities in the US.

Understanding Producer Price Index (PPI)

This index tracks the change in the cost of production. And due to the variety of businesses available, PPI is often classified using broad categories. In the US, the Bureau of Labor Statistics (BLS) distinguishes three categories:

1. Industry Level Classification

This level of classification measures the cost of production incurred at an industry level. It measures the changes in prices incurred for an industry’s output which is outside the sector itself by calculating the industry’s net output.

2. Commodity Classification

This is the second category of classification. This classification neglects the industry of production and instead amalgamates goods and services based on similarity and product make-up.

3. Commodity-Based Final Demand-Intermediate Demand (FD-ID)

This is the last category of classification where the system groups commodity indexes for various goods, services, and construction into sub-product classes (the specific buyer of products). This classification revolves around the physical assembly and processing required for goods.

Example of the use of Producer Price Index (PPI)

Usually, businesses indulge in long-term contracts with suppliers. And since price fluctuation is a common phenomenon over time, long-term deals are bound to be a difficult situation with only a single fixed price for this supply of goods or services. To curb the situation, the purchasing businesses and suppliers normally include a clause in the contracts that adjust the cost of these goods and services by external indicators, such as the PPI.

For example, firm X purchases a key component for its manufacturing unit from firm Y. The initial cost to procure that component is $10 along with the provision in the contract that the price will be adjusted quarterly, according to the PPI. So, after the end of a quarter, the cost of the component would be adjusted at a price higher or lower than $10 according to the change in the PPI (if it went up or down and by the degree with which it changed).

Benefits of Using Producer Price Index

1. Accurate Measuring of Inflation

Inflation causes an increase or decrease in the cost of consumer goods purchased by the people, affecting the purchasing power. Since the calculation of the Producer Price Index occurs before than the calculation of the Consumer Price Index, the Producer Price Index can be utilized to minimize or eliminate the effects of inflation in the economy. The PPI can be used to accurately determine the inflation rate by considering the price of goods whether the price increases or decreases when the goods are sent for distribution.

2. Predictive Value on Retail Changes

While the consumer price index indicates the prices of products when they reach the marketplace of end-consumers, the producer price index mentions the cost of goods before they are released in the market, ready to be consumed. Hence PPI can have a projecting value directly concerning their retail prices.

3. Contract Negotiations

A longer sale agreement usually involves the dynamic nature and uncertain consequences of inflation and how I can alter the future market. The PPI can help with the negotiation of these clauses because it can correspond to an independent measurement of price alterations.

Related posts on the SimTrade blog

Useful resources

About the author

Article written in May 2021 by Bijal Gandhi (ESSEC Business School, Master in Management, 2019-2022).