Consumer Price Index

In this article, Bijal Gandhi (ESSEC Business School, Master in Management, 2019-2022) elaborates on the concept of Consumer Price Index.

This reading will help you understand the meaning, calculation, uses and limitations of Consumer Price Index.

What is Consumer Price Index?

The Consumer Price Index (CPI) is a statistical estimation to measure the aggregate price level in an economy. It measures the change in the price level of a basket of consumer goods and services, purchased by households and businesses. This basket is a market basket which is an amalgamation of goods and services most used by consumers. The CPI is a means to acknowledge the changes in the purchasing power of a country’s currency. It can be further used to compute the cost of living. The change in CPI is used to measure inflation in the economy.

Statistical agencies compute CPI to understand the price change of various commodities and keep a track of inflation. CPI is also an important medium to understand the real value of wages, salaries, and pensions. In most of the countries, CPI is one of the most closely watched national economic statistics.

The index is usually computed monthly, or quarterly including different components of consumer expenditure, such as food, housing, apparel, transportation, electronics, medical care, education, etc.

Calculation of CPI

The consumer price index is calculated as an expression of the change in the current price of the market basket for a particular period by comparing it to a base period. It is calculated as an expression to represent the expenditure pattern that includes people of all ages throughout the population. It is calculated as follows:

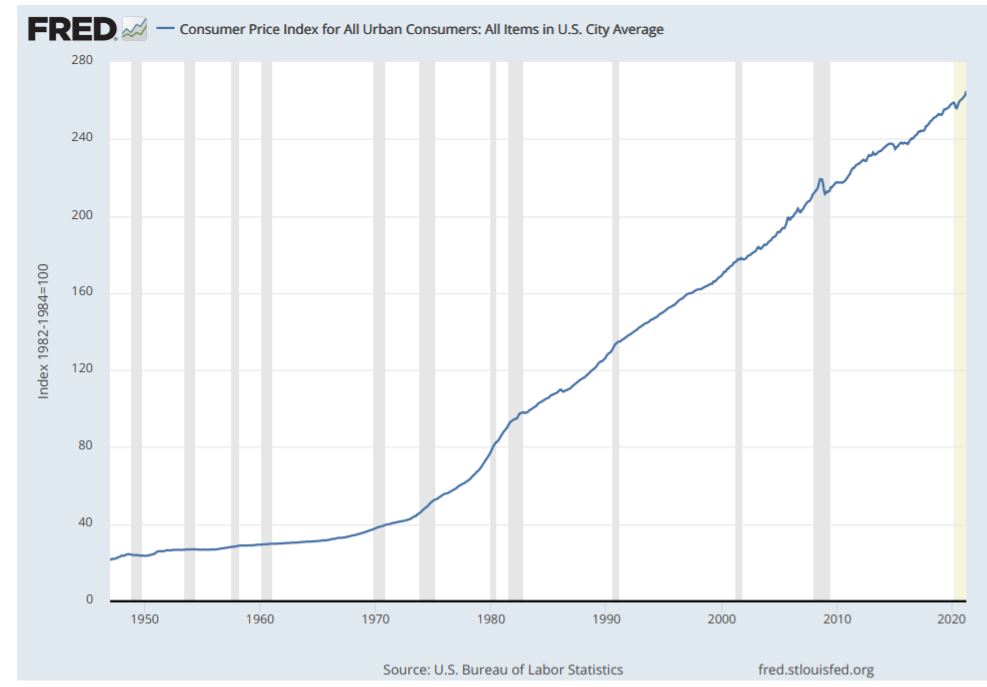

The calculated CPI acts as an indicator for inflation in an economy. For example, if the CPI is 120, it means that there has been a 20% rise in the prices of the market basket compared to the base period. Similarly, an index of 95 indicates a 5% decrease in the prices of the basket compared to the base period. The following graph tracks the CPI from 1950 till 2020 for the U.S city average.

Determining the Market Basket

A suitable basket of commonly used goods and services is developed using detailed expenditure information. The government spends a considerable number of resources including money and time to accurately measure this expenditure information. The source of this information includes surveys targeted at households and businesses.

A specific good or service is added to the basket after an initiation process. For example, the initiation process for shoes goes as follows: let us assume that there are three types of shoes A, B, and C, which make up 70%, 20% and 10% of the shoe market, respectively. The choice of the shoe is directly related to the sales figures. In this case, shoe A is being chosen as it represents 70% of the market share. After the selection, this shoe will continue to be priced each month in the same store for the next four years after which a new representative will be chosen.

Uses of the Consumer Price Index

CPI acts as an economic indicator since it is a measure of inflation in an economy. It can help in determining the purchasing power of an economy. It also aids the government in the formulation and effective implementation of a government’s economic policies. It is also used for the adjustment of other economic indicators for price changes. For example, the CPI is used to adjust various components of national income. Since CPI is an indicator of the cost of living in an economy, it helps to provide adjustments to the minimum wages and social security benefits available to the residents of a country.

Limitations of the Consumer Price Index

- The consumer price index may not be perfectly applicable to all population groups. For example, the CPI of an urban area will be able to represent the urban population in the economy, but it will not be able to reflect the status of the population living in the rural areas.

- CPI does not provide an official estimation for subgroups of a population.

- CPI is a conditional cost of living measure and it does not include every aspect that affects the living standards of the consumers.

- CPI provides the change in the price level of a basket of goods and services by comparing the prices of the basket’s current price with a base price. Hence two areas cannot always be compared since the base price of the basket may differ. Therefore, a higher index in one area does not necessarily mean that the prices are higher in that area.

- CPI does not consider the social and environmental factors in the scope of its definition.

Limitations in measurement of the CPI

- It is highly prone to sampling error since there is always a scope that the sample of the population chosen might not accurately represent the entire population.

- The estimation of CPI can be prone to errors arising out of price data collection and errors associated with operational implementations.

- One of the biggest drawbacks of CPI is that it does not include energy costs (for example, gas) in its basket of commonly used goods and services even though energy costs are a major part of the household expenditure.

Related posts on the SimTrade blog

Useful resources

About the author

Article written in May 2021 by Bijal Gandhi (ESSEC Business School, Master in Management, 2019-2022).