Revenue

In this article, Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) delves deeper into the accounting concept of revenue.

This read will help you understand in detail the meaning, types and calculation of revenue along with relevant examples.

What is revenue?

Revenue is referred to the money brought into a company from the sale of either goods, services, or both. Revenue is synonymous to sales and top line. This is because it first line on the income statement and it is a good indicator of a business’s performance. Revenue consists of two components, the price and the number of products/services sold. It is then calculated in the following manner:

Gross revenue vs net revenue

Gross revenue is simply the income generated from a sale without consideration for any expenses that might have occurred. Net revenue is the income after subtracting all the cost of goods sold and other expenses related to running the business.

For example, if Alpha sells 2,000 toy cars at $100 each, its gross revenue for the month would be $200,000. If the cost of producing each car was $25, their net revenue would be 2,000 x ($100 – $25) toy cars or $150,000.

Revenue example: LVMH

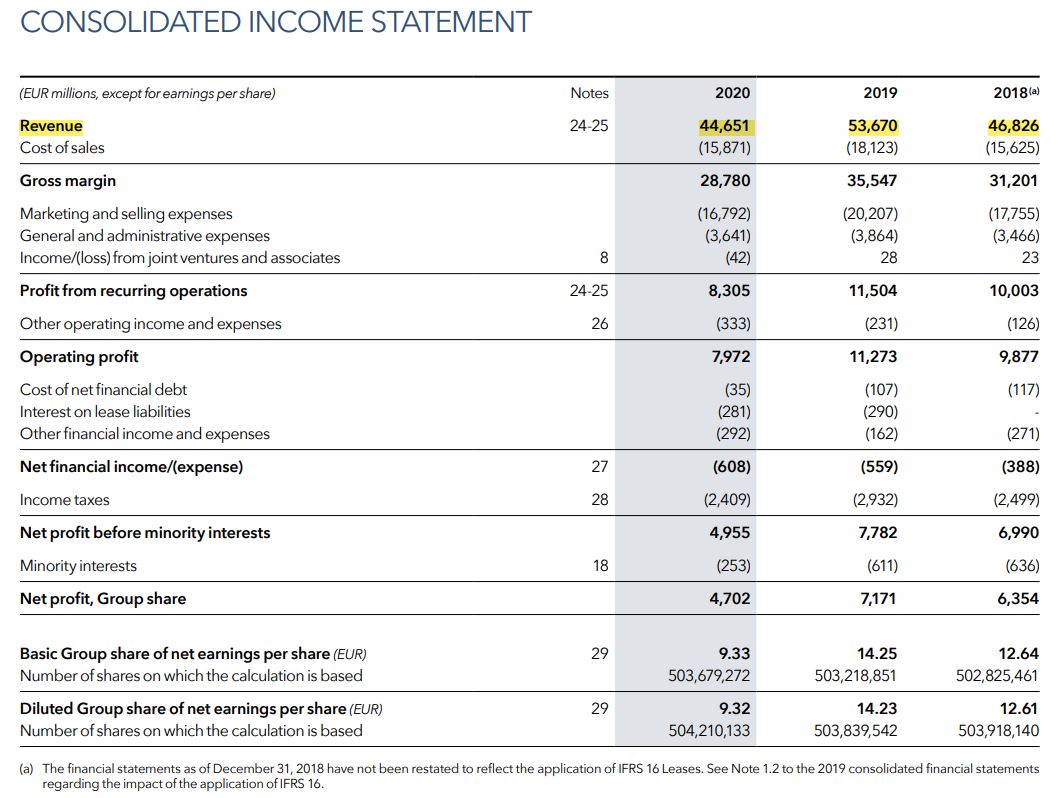

Let us once again take the example of LVMH. The French multinational company LVMH Moët Hennessy Louis Vuitton was founded in 1987. The company headquartered in Paris specializes in luxury goods and stands at a valuation of $329 billion. It is a consortium of 75 brands controlled under around 60 subsidiaries. Here, you can find a snapshot of LVMH Income statement for three years: 2018, 2019 and 2020.

Here, the revenue, also known as top line, is 44,651 million euros for the year 2020. The revenue is the sum of income generated from all divisions. In the snapshot below, the revenue is a consolidation of income generated by several brands that sell wines, spirits, fashion, leather goods, perfumes, etc.

Accrued vs deferred revenue

Accrued revenue refers to the revenue earned by a company for which the goods are delivered but the payment is yet to be received. In this type of accounting, the revenue is recorded irrespective of whether the cash is received or not.

Deferred revenue refers to the revenue for which the customer has already made the payment, but the company is yet to deliver the goods. Here, in accounting the company will record the cash payment but that the revenue is unearned, but it will not recognize the revenue on the income statement.

How do revenue & earnings differ?

Revenue refers to the income generated by a company before deducting expenses, while earnings refer to the profit earned by the company after deducting the expenses, interest, and taxes from revenue.

Earnings is synonymous to net income or the bottom line. Along with revenue, it is also a very important indicator of a company’s performance.

How do revenue & cash flows differ?

Cash flow refers to the total amount of cash that moves into or out of the company. While revenue is the indicator of a company’s overall effectiveness, the cash flow is an indicator of liquidity.

Related posts on the SimTrade blog

▶ Bijal GANDHI Income statement

▶ Bijal GANDHI Cost of goods sold

About the author

Article written in May 2021 by Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).