Earnings per share

In this article, Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) explains the meaning and calculation of Earnings per Share.

This reading will help you understand the earnings per share in detail with relevant examples.

Introduction

The earnings per share (EPS) indicates the total amount of money that the company earns for each share of its total stock. A high EPS is a good indication as investors will be willing to pay more for each share owing to higher profits and vice versa. There are several methods to derive EPS.

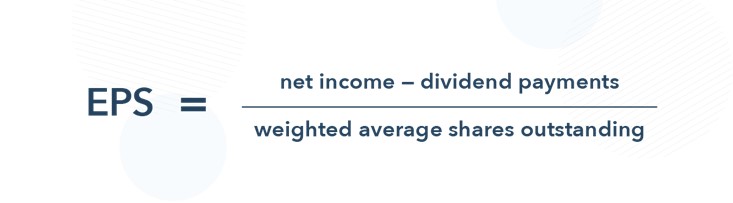

Calculation of EPS

One direct way to calculate EPS is by simply dividing the net income by the number of common stocks that are outstanding for that period of the earnings. To understand the calculation for net income, refer to our blog on Income statement.

A refined way to calculate the EPS would be to adjust both the numerator and denominator. For the numerator, the net income should be adjusted for any dividends paid for preferred shares. For the denominator, a weighted average number of common shares should be taken since the number of outstanding shares tend to vary over time.

EPS example

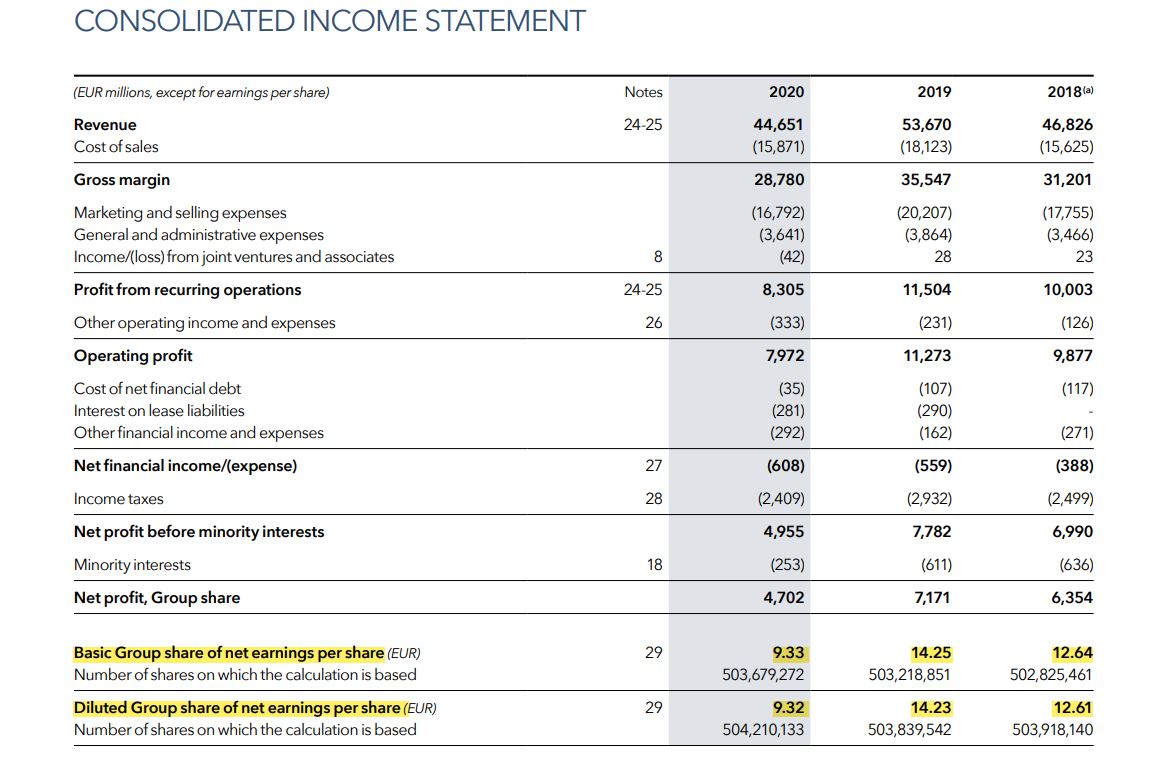

Here, we again take the example of LVMH. The French multinational company LVMH Moët Hennessy Louis Vuitton was founded in 1987. The company headquartered in Paris specializes in luxury goods and stands at a valuation of $329 billion (market capitalization in June 2021). It is a consortium of 75 brands controlled under around 60 subsidies. Here, you can find a snapshot of LVMH Income statement for three years: 2018, 2019 and 2020. The last line highlights the basic and diluted EPS of the group for each of the three years.

Net income for the group= 4702 millions

Average number of shares= 503,679,272

Basic EPS= 9.33 euros per year.

Basic EPS vs. Diluted EPS

Basic EPS eliminates the dilutive effect of warrants, stock options, convertible debentures, etc. These instruments will increase the total number of outstanding shares if exercised by the holders. For example, warrants when exercised will result in dilution of equity.

Diluted EPS considers all the potential sources of equity dilution and therefore it gives a clear picture of the actual earnings per share. In the above LVMH example, the diluted earnings are derived after adding the dilutive effect of stock option like described below,

Net income for the group= 4,702 millions

Average number of shares outstanding: 503,679,272

Dilutive effect of stock option and bonus share plans: 530,861

Average number of shares after dilution: 504,210,133

Diluted earnings per share: 9.32

How is EPS used?

EPS is one of the best indicators of a company’s profitability and performance. It is a helpful indicator to choose stocks as it is one of the sole metrics that isolates net income to find the earnings for shareholders. A growing or a consistent EPS means that the company creates value for the shareholders while a negative EPS might indicate losses, financial trouble or eroding investor value.

It also helps calculate the price to earnings (PE) ratio where the market price per share is divided by the EPS. This ratio helps understand how much the market is willing to pay for each euro of earnings.

Related posts on the SimTrade blog

▶ Bijal GANDHI Income statement

▶ Bijal GANDHI Revenue

▶ Bijal GANDHI Cost of goods sold

About the author

Article written in May 2021 by Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).

1 thought on “Earnings per share”

Comments are closed.