My experience as a sell-side equity research analyst

In this article, Tanmay DAGA (ESSEC Business School, Global Bachelor of Business Administration, 2017-2021) introduces equity research, shares his internship experience at a top sell-side equity research company named Kotak Securities and gives his opinions on what the future holds for the industry.

About Kotak Securities

Kotak Securities was founded in 1994 as a subsidiary of Kotak Mahindra Bank and is headquartered in Mumbai, India. It is headed by Mr. Jaideep Hansraj who is a leading figure and has over 20 years of experience in the equity research industry. The company has over 1.7 million customer accounts and handles over 800,000 trades every single day making it one of the biggest brokerage houses in the country. The company handles operations in over 394 cities in India and is well poised for further expansion helping it expand its customer base. Kotak Securities offers stock broker services, portfolio management services, depository services, research expertise, dynamic market data and international reach for clients looking for investment opportunities overseas.

What is equity research?

It is a mainstream finance position which entails fundamental analysis and subsequent recommendation of public securities. Fundamental analysis is a method of evaluating the intrinsic value of an asset (future cash flows discounted to the present) and analyzing the factors that could influence its price in the future. Hence, equity research is an investigation based upon the core business drivers of a particular business which are reflected in its financial statements. Hence, equity researchers use financial statements combined with other industry and macroeconomic reports to form their opinion about a certain company or a universe of companies (also called coverage list). Investors such as money/managers use this information to better investigate their potential or existing investment decisions. To conclude, the main purpose of equity research is to provide investors with detailed financial analysis and recommendations on whether to buy, hold, or sell a particular stock. The professionals working in brokerage firms which sell analysis reports to investors are called sell-side analysts. Professionals working for mutual funds or hedge funds and who make direct investment decisions are called buy-side analysts.

Read an interesting interview with an industry expert who shares his experience of working in the industry.

Me and Finance

I had gotten enrolled in ESSEC’s GBBA in 2017 owing to my curiosity in finance and the university’s premier status, especially in finance. At the end of the first year, I had the opportunity to apply my mind and practically learn a few things along with it. It had always been my mission to work in finance, particularly in valuation. My fascination with valuation is simple – you are allowed to deem the situation as you see fit provided you have a logical reasoning behind it. Nothing can narrow the scope of your thoughts as long as they are realistic and reasonable. It is a great way for individuals to look at things from a broader perspective and develop an analytical mindset to help comprehend several moving parts simultaneously. It does take time getting used to the idea of having to dig into minute details but it’s worth it! Valuation is not purely science per se. It is a blend between sound analytical reasoning that helps you come up with a story (forecast as experts call it) and simple objective mathematics to help validate your story’s credibility. The fact that valuation today in investment banking and other fields looks so complicated is partly to mask the simplicity involved in the process so big banks can continue to charge hefty fees for what they do. Moreover, it is not a skill that will ever go in vain. The mindset a sound valuer develops helps him/her analyze the pros and cons any situation better than a counterpart. It is a skill that I recommend everyone to acquire.

My internship in Kotak Securities

In 2018, at the end of my first year of my GBBA at ESSEC Business School, I did an internship at Kotak Securities equity research division in Mumbai, India. I was 18 years old and comparatively new to equity research. Resulting, I witnessed a steep learning curve requiring me to learn and apply several concepts in a short span of time. My main responsibility was to help the fundamental research team carry out due diligence (financial analysis to analyse the true or intrinsic value of an asset and all other factors affecting this value) for the companies under our coverage universe. This was done by performing rigorous research for the company’s business, its supply chain, its value drivers and all other factors that affect its value and ultimately its stock price. The conclusions were to be presented to the senior management and the sales team along with a thorough explanation behind the rationale of selecting a particular stock for client recommendation. Based on the findings, recommendations were to be published in a bi-monthly analysis report which also included other important topics like the economic analysis of the current situation and trends in the currencies traded in foreign exchange (FX) market. As the organization was agile and flexible with what responsibilities members could take, I had the opportunity of working with several other departments aside from fundamental research. Some of the other projects I worked on were developing a proprietary algorithm based on analysis of trading patterns for index companies alongside the technical analysis team (which is the motivation for me in selecting the SimTrade course) and a model project on sentiment analysis – how news and company perception (especially on Twitter) affect the stock price in the short run. I learnt several hard skills such as modelling in Excel, literacy in reading company’s financial statements and intermediate level of coding in Python. Overall, it was a great work experience for me.

Key takeaways from my internship

During my time at Kotak, I have come across some important financial concepts that I believe every individual, irrespective of their affiliation with the finance industry, must truly understand. They will help you better understand financial issues and make sound investment decisions.

Inflation

Inflation refers to the sustained increase in the price of goods and services in an economy. This increase in price is hard to pinpoint at any one factor but more often than not, it is a combination of various factors. This could range from increase in labor prices to jump in raw material costs. As prices rise due to inflation, you’ll be able to afford less and less over a given period of time. That’s why it is imperative to understand that long-term savings must be invested in a manner by which the returns surpass the inflation rate. That’s the only way one can continue to afford to buy more in a definite time period in the future. In many countries, the only reliable way to beat inflation is investing in stocks/equities. As Bonds or Bank savings do not offer any positive real interest realization.

Diversification

Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt at limiting exposure to any single asset or risk. The rationale behind this technique is that a portfolio constructed of different kinds of assets will, on average, yield higher long-term returns and lower the risk of any individual holding or security. This is a widely approved method for protecting capital against unexpected events in the global markets. By using the primary study of correlation, investors can diversify certain risk away. However, data on correlation is historical and thus, backwards looking, and might not always hold true in the future. For instance, during the shutdown of the global economy in March 2020, multiple assets like stocks, commodities and bitcoin (which have not been positively correlated in the past) collapsed together. All have had a positive recovery together since (again implying positive correlation as opposed to results from previous studies).

Time Value of Money

The time value of money (TVM) is the concept that money you have now is worth more than the identical sum in the future due to its potential earning capacity. This core principle of finance holds that provided money can earn interest, any amount of money is worth more the sooner it is received. For instance, assume a sum of $10,000 is invested for one year at 10% interest. The future value (FV) of that money is: FV = $10,000 x (1 + 10%) = $11,000. The formula can also be rearranged (reversed) to find the value of the future sum in present day dollars. For example, the present value (PV) of $5,000 one year from today, compounded at 7% interest, is: PV = $5,000 / (1 + 7% ) = $4,673.

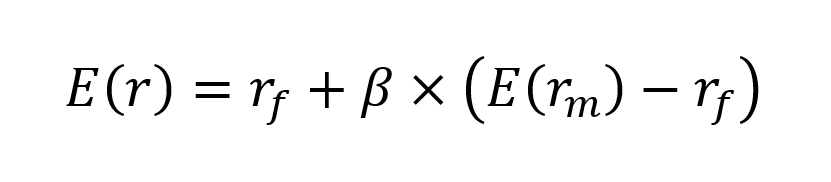

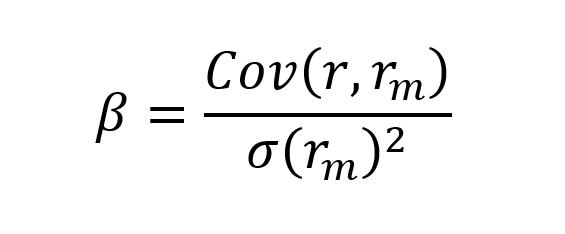

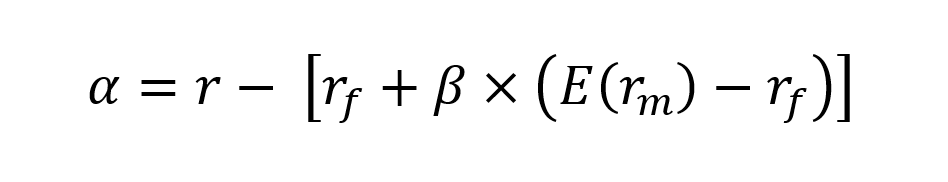

TVM is also sometimes referred to as present discounted value. This is a fundamental pillar on which company valuation is based. The true value of a company is the future free cash flows the company generates, discounted to the present time using an appropriate discount factor.

Future of equity research: my personal view

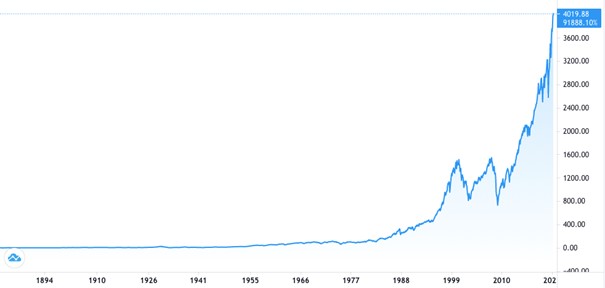

Equity research is an important role that has come into prominence since the bull market in the 1950s. Thousands of fund managers handling trillions of dollars in assets under management often use sell-side research to get an outsider’s opinion before making investment decisions. Certainly, the size of the industry has shrunk significantly since buy-side and IB analysts are being better compensated, causing a shift in the workforce. However, things are not bad. Companies are now letting analysts focus more on analysis than on sales. This is certainly going to attract new talents who want to focus purely on analysis.

Read this interesting counter-view on the future of the industry.

Relevance to SimTrade

This course helps in understanding the other side of the same coin – technical analysis (using price movements and other factors to predict the future of a security). Participants of this course can expect to gain practical knowledge about stock trading by using a real-world like simulator where multiple strategies can be applied and tested. Other benefits include gaining a broad understanding of the financial markets and concepts.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Louis DETALLE My experience as a Transaction Services intern at EY

▶ Aastha DAS My experience as an investment banking analyst at G2 Capital Advisors

▶ Basma ISSADIK My experience as an M&A/TS intern at Deloitte

Useful resources

Corporate Finance Institute Example of equity research report

About the author

The article was written by Tanmay DAGA (ESSEC Business School, Global Bachelor of Business Administration, 2017-2021).