My experience as a student assistant at KMD

In this article, Magnus NIELSEN (ESSEC Business School, European Management Track, 2023-2024) shares his professional experience as a student assistant at KMD. A company located in Denmark, mainly focusing on software solutions for the public sector in Denmark.

About the company

KMD A/S, is a Danish IT company, within development and delivery of software and service solutions tailored for municipalities, government entities, and businesses in Denmark, alongside selected segments in Scandinavia. The company, with branches in all major cities in Denmark, operates as a subsidiary of the NEC Corporation (Japanese multinational corporation). The KMD group works primarily in Denmark, but has recently expanded to Norway, Sweden, Finland, and Poland, boasting an annual turnover of approximately DKK 4.8 billion and a workforce exceeding 3,000 employees.

A significant player in the Danish IT landscape, KMD traces its roots back to 1972 when it was established as “Kommunedata” (translated to; “municipality data”), a merger of all Danish municipal IT centers. Until March 2009, the company was owned by Kommune Holding A/S, giving it close relations to the government. After 2009 it was privatized in a large selloff by the municipalities.

KMD’s systems play a crucial role in administering various Danish income transfers, including welfare, child benefits, maternity benefits, unemployment benefits, disability pensions, and old-age pensions. With a clientele exceeding 1,500 from both the public and private sectors, KMD serves around 800 Danish and international companies. Main competition comes from NNIT, Netcompany, TDC Group and SimCorp. Representing the forefront of the Danish IT industry.

In the evolution of its ownership structure, KMD transitioned from municipal ownership to becoming part of “EQT Partners and Arbejdsmarkedets Tillægspension” (a special pension fund system in Denmark) in 2009. Subsequently, in 2012, EQT Partners sold its stake to the private equity firm Advent International. Notably, KMD expanded its portfolio in 2015 through the acquisition of Banqsoft, a Nordic software company specializing in financial services.

The year 2019 marked a significant milestone for KMD as Japanese company NEC acquired the company for 8 billion DKK, solidifying KMD’s position in the ever-evolving landscape of IT solutions.

Logo of the company.

Source: the company.

My internship and the department

Being a part of KMD in the role of a student employee within the Finance department is an enriching and dynamic experience. The company’s role in developing and managing over 400 IT systems that support the welfare of Denmark adds a sense of purpose to the work environment.

The focus of my position is primarily on maintaining and enhancing financial reporting for the business. The responsibilities extend to supporting the monthly closing process in collaboration with experienced controllers. This hands-on experience allows for a deep dive into the intricacies of financial operations, providing valuable insights into the core of KMD’s activities.

The role involves working with a substantial amount of data, requiring proficiency in tools such as Excel, PowerPoint, SAP, and Power BI. This emphasis on data analysis and modeling adds a layer of complexity to the tasks, making it an intellectually experience.

The position was for 15-hour per workweek which is normal in Denmark to do besides studies. Instead of internships, students often work in between 15-25 hours a week whil also keeping track of their academic

My missions

Strengthening Financial Reporting: Playing a key role in maintaining and enhancing financial reporting for the business.

Monthly Closing Support: Collaborating with senior controllers to facilitate the monthly closing process, involving the analysis of statistics from the previous month. This includes identifying areas where company performance may have fallen short and investigating the underlying reasons. Additionally, overseeing the tracking of consultants’ work hours and assessing their productivity.

Data Analysis and Modeling: Participating in data-related tasks, encompassing analysis and model development. Leveraging tools such as Excel, PowerPoint, SAP, and Power BI for efficient data management. SAP serves as the primary system for obtaining accountable data, subsequently analyzed using Excel and Power BI.

Required skills and knowledge

My position in KMD’s Finance department demanded a blend of both soft and hard skills essential for the dynamic responsibilities associated with financial reporting and analysis. On the soft skills front, effective communication was paramount, as conveying complex financial insights to diverse stakeholders required clarity and precision. Including the elaboration and communication of complex financials to non-financial employees.

Additionally, a high degree of analytical thinking was indispensable for interpreting data and contributing meaningfully to the monthly closing process. Being detail-oriented was crucial, ensuring accuracy in financial reporting and tracking of consultants’ work hours.

On the hard skills side, proficiency in tools like Excel, PowerPoint, SAP, and Power BI was fundamental. The ability to navigate and extract actionable insights from SAP, the primary system for accountable data, was essential for comprehensive financial analysis. Moreover, a solid foundation in data analysis and modeling techniques facilitated the creation of meaningful reports that contributed to the strategic decision-making processes within the department. The use of PivotTables thus exemplifies how technical skills, in this case, mastery of Excel functionalities, played a crucial role in the success of tasks within the dynamic environment of financial analysis at KMD.

What I learned

Financial Analysis and Communication

- Analyzed corporate information and financial statements

- Prepared pitch-books and presentations for effective communication with stakeholders

- Utilized evidence-based conclusions and strategic thinking to propose innovative initiatives aligned with industry innovations and key success factors

- Enhanced collaboration skills through engaging with diverse stakeholders.

Global Industry Understanding

- Understanding value creation within the IT industry, drawing parallels with academic studies in competitor theory

- Explored potential channels for international expansion, broadening perspectives on global finance dynamics

- Applied financial modeling and analysis skills in a real-world context.

Financial concepts related my internship

DuPont Analysis

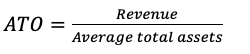

A powerful and simple financial tool, holds particular relevance in the financial reporting function at KMD. Rooted in financial ratio analysis, DuPont Analysis breaks down Return on Equity (ROE) into three key components, providing an understanding of the drivers behind financial performance.

The theoretical foundation of DuPont Analysis lies in the decomposition of ROE using the formula:

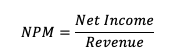

Net Profit Margin (NPM): The first component assesses profitability, reflecting the proportion of each revenue dollar that translates into net income. The formula for Net Profit Margin is:

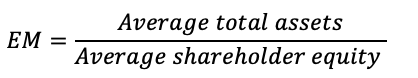

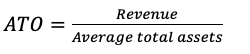

Asset Turnover (ATO): The second component, Asset Turnover, evaluates the efficiency of asset utilization in generating sales. The formula is:

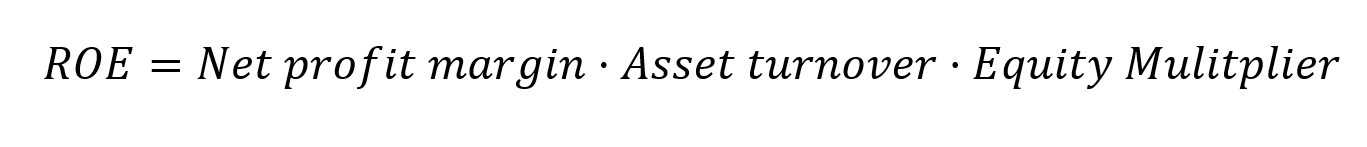

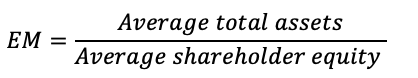

Equity Multiplier (EM): The third component, Equity Multiplier, gauges the financial leverage used to magnify returns. It is calculated as the ratio of total assets to shareholders’ equity:

By breaking down ROE into these components, DuPont Analysis enables a more structured assessment of financial performance. The application of DuPont Analysis enhances the finance department’s ability to interpret and communicate the multifaceted nature of financial performance within the context of KMD’s operations. Likewise, it provided an opportunity to pinpoint areas where improvement actions could be initiated.

Real options valuation

The application of real options valuation (ROV) methods in the context of KMD’s IT projects involves adapting and selecting appropriate models to capture the dynamic and uncertain nature of these projects. Considering that KMD’s projects may span various stages and encounter multiple uncertainties, the valuation method addresses American-styled exercises and incorporate flexibility throughout the project lifecycle.

When large uncertainties surround costs and revenues of a complex IT project, where development costs already is initiated before the actual contract is won, the traditional Black-Scholes approach can be used to estimate the value. When multiple uncertainties exist Monte Carlo simulation can also be a way to estimate the value of a project.

One must understand the concepts of IT projects, as these are put out to tender. And development cost almost always arise before the company even know if they have won the tender offer. Thus, there is a chance that the option will never get exercised, and the value is lost.

In the context of an IT project, the real option is often more analogous to a call option than a put option.

Call Option Characteristics:

A call option provides the holder with the right, but not the obligation, to buy an asset at a predetermined price (strike price) within a specified period (expiration date).

Similarly, in an IT project, the company holds the real option to proceed with the project but is not obligated to do so. The company has the flexibility to exercise the option if the conditions (such as winning a tender) are favorable.

With a call option, the holder’s downside is limited to the premium paid for the option.

In the case of an IT project, the development costs incurred before knowing the tender outcome represent a limited downside. If the tender is not won, the company may choose not to exercise the option, limiting the financial exposure.

This is a simple case. And the real option of KMD’s IT projects are often much more complex.

Monte Carlo simulation can be a powerful tool instead of the Black and Scholes formula.

In the context of an IT project’s real options valuation, Monte Carlo simulation involves modeling the project’s uncertainties using stochastic variables and running numerous simulations to estimate the project’s value. Here’s how it can be applied:

1. Identify Stochastic Variables

- Project Success Probability: The likelihood of winning the tender or securing the project

- Development cost: The cost associated with developing the IT project

- Exogenous factors: External factors impacting the project, such as changes in technology, regulatory environment, or market demand.

2. Define Probability Distributions

Assign probability distributions to the identified stochastic variables. For example:

- Probability of success: Following a beta distribution representing high degree of uncertainty/

- Cost of development: Triangular distribution based on optimistic, most likely, and pessimistic estimates

- Market conditions: Following a gaussian distribution

Denote that one can assign any distribution to the stochastic variables, depending on what is assumed to fit best.

3. Run the Monte Carlo Simulation

Generate random values for the stochastic variables based on their probability distributions. For each set of randomly generated values, calculate the project’s Net Present Value (NPV) or other relevant financial metrics. Repeat the process for thousands of iterations to create a distribution of possible outcomes.

Finally one may analyze the result, and present the obtained results for a managing director, who will take the final decision together with the executives. Depending on NPV of the project and the degree of uncertainty, the executives may agree to bid for the tender offer, or not to engage.

Why should I be interested in this post?

For an ESSEC student aspiring to build a career in finance, this post offers an opportunity to explore the intersection of finance and information technology. The practical application of financial concepts, such as DuPont Analysis and Real Options Valuation, within the IT industry at KMD provides a valuable insight in the daily life of a Danish software firm.

The position requires a holistic understanding of financial operations within the company. Working with technologies like SAP and Power BI enhances your skill set, making you more versatile and competitive, particularly in a digitalized financial landscape.

The exposure to real-world scenarios involving strategic decision-making under uncertainty, as emphasized by Real Options Valuation, equips you with a strategic mindset—vital in finance roles where decision-making is critical.

Understanding the inner workings of a major IT company operating in Denmark and other Nordic countries, like KMD, provides insights into the challenges and opportunities in the competitive IT market. If you ever aspire to work in Denmark, this post offers international experience, giving you a taste of the Danish business environment and company culture.

Related posts on the SimTrade blog

Professional experiences

▶ All posts about Professional experiences

▶ Alexandre VERLET Classic brain teasers from real-life interviews

▶ Snehasish CHINARA My Experience as an External Junior Consultant with Eurogroup Consulting

▶ Nithisha CHALLA My experience as a Risk Advisory Analyst in Deloitte

Options

▶ All posts about Options

▶ Akshit GUPTA Options

▶ Jayati WALIA Black-Scholes-Merton option pricing model

▶ Jayati WALIA Monte Carlo simulation method

Useful resources

About KMD

Goran Avlijaš (2019) Examining the Value of Monte Carlo Simulation for Project Time Management Management Journal of Sustainable Business and Management Solutions in Emerging Economies

Black F. and M. Scholes (1973) The Pricing of Options and Corporate Liabilities The Journal of Political Economy, 81(3) : 637-654.

About the author

The article was written in December 2023 by Magnus NIELSEN (ESSEC Business School, European Management Track, 2023-2024).