In this article, Annie YEUNG discusses the historical development of tariffs and the evolution of tariffs over economic landscapes overtime.

Brief explanation of history of global tariffs

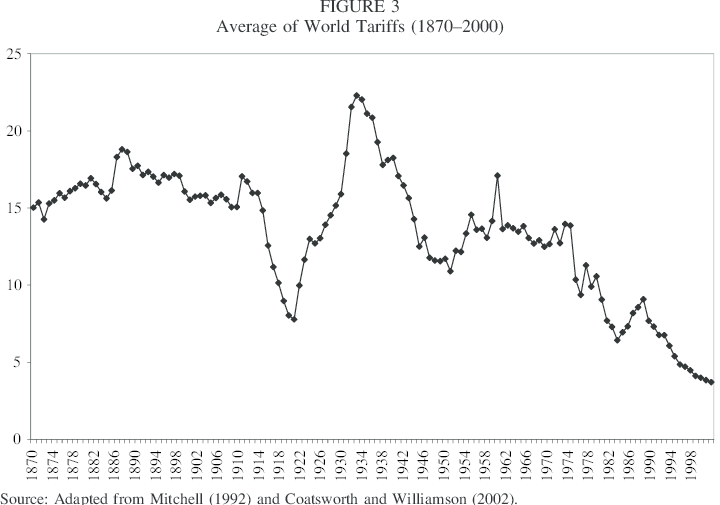

In the 19th century, tariffs were the main source of government revenue in aim for protectionism. Tariffs were widely used to protect domestic industries that were in their beginning stages. Many countries such as the United States and Europe has imposed high tariffs in order to ensure the development of their industrializing economies. For example, the U.S. implemented tariffs, such as the Tariff of Abominations in 1828 to protect its manufacturing industry. During the post World War II era, the General Agreement on Tariffs and Trade was established in 1947. In response to the post war devastation, countries lowered their tariffs in order to promote economic growth. Reciprocal lower tariffs were also implemented amongst countries and trading partners. Starting in near the beginning of the 21st center, the launch of the World Trade Organization in 1995 marked a significant evolution in global trade, where governance of trade tariffs were established through the launch of the WTO. The WTO emphasized on the trading of goods and introduced a governance structure for development considerations, granting special support for developing and less developed countries. The WTO also introduced an institutional structure for the dispute settlement procedures on global trading. Today, tariff reductions have continued due to negotiations and regional trade agreements, which deepened the harmonization of the global markets, facilitating increased global trade volumes. However, during the last decade, there has been an introduction of resurgence of tariffs amongst increased instability in the current geopolitical grounds. Tariffs has served as a political tool. For example, the U.S.- China trade war has seen tariffs as an economic tool under rising geopolitical tensions where billions of dollars of goods subject to tariffs. As two of biggest economies globally, this trade war has disrupted global supply chains. This has posed challenges as other countries have also employed tariffs for protectionism goals.

The Protectionism Approach

The United States has been maintaining high tariffs to nurture for its developing domestic industries during the 19th centuries. The United States has seen an increase in the average tariff rate over a century of time. During the beginning of the 19th century, the U.S.Average Tariff Rate was 35%, whereas by 1913, the U.S. Average Tariff Rate has increased to 40%. This historical evolution could be attributed to the need for domestic protection; early industrialization period during the early 19th century required protection, whereas in the beginning of the 20th century, tariffs needed to support the growing industry. European countries such as Germany and France also utilized tariffs to protect industrial growth during this period of time. However, developing countries struggled developing tariffs as threir internal markets were still in developing stages. However, beginning from the early 1900s, there has been a further rise in nationalism. Some tariffs rates exceeded 60%, and as a result, global trade decreased by 66% between 1929 to 1934. This was also during the period of the Great Depression, in which these tariff hikes and set-back in economy was a result of reduced international trade.

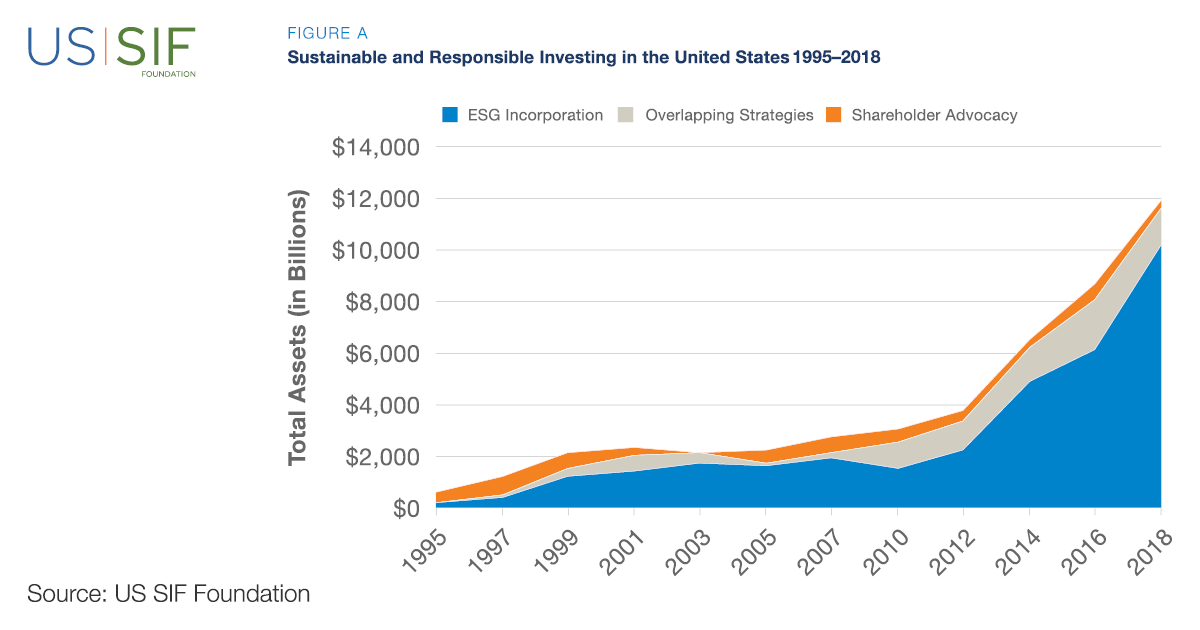

Trade Liberalization

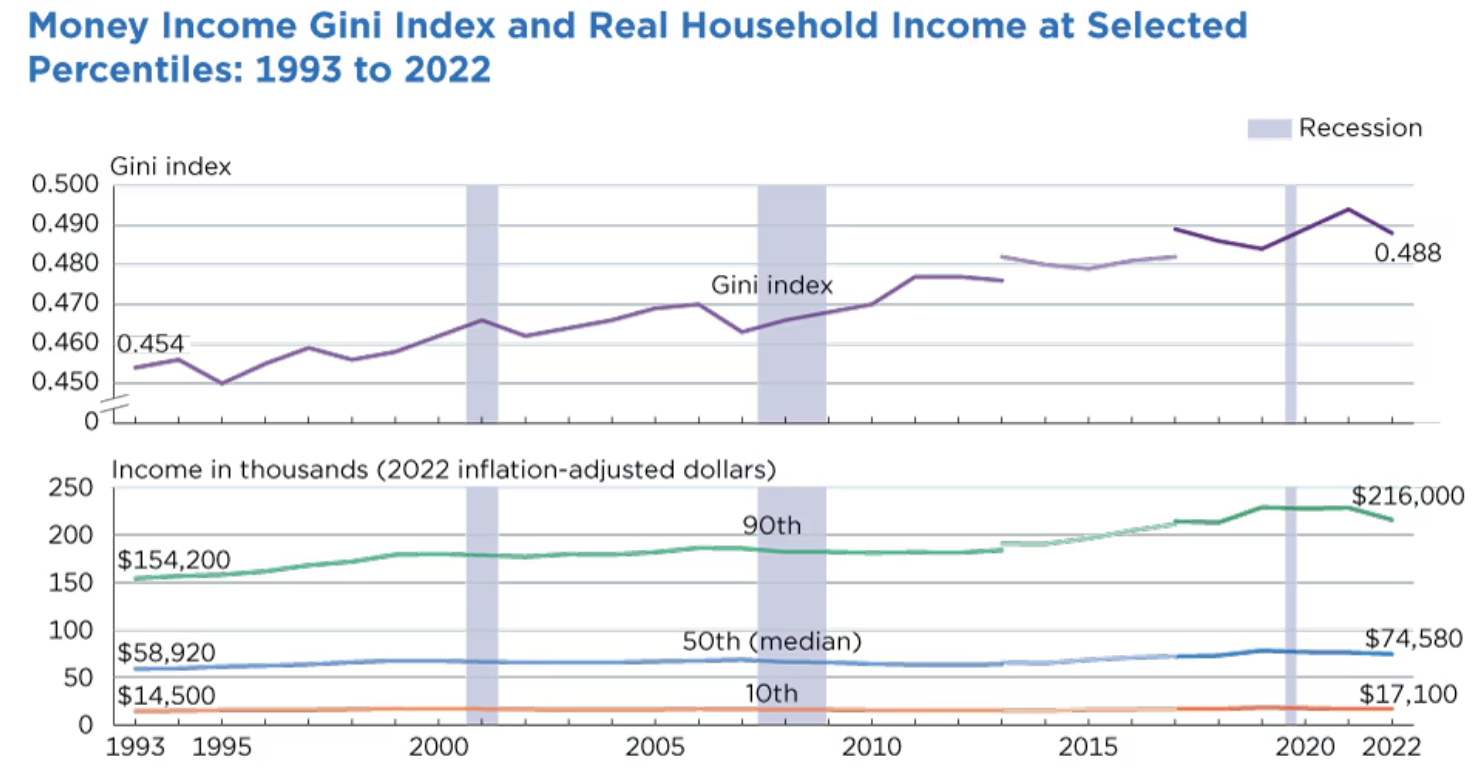

After the establishment of the General Agreement on Tariffs and Trade in 1947 to reduce tariffs, there have been successful negotiation amongst nations to cut average tariffs worldwide in order to reduce protectionism and open up markets to global trading activity. This is seen from the data presented from the World Bank World Development Indicators, which there has been a gradual deduction in average global tariff rate from 15% to 6% from from the year 1950 to 2000. Since the beginning of tariff reductions and the start of post-war rehabilitation and rebuilding of the economy in 1950, continued multilateral negotiations has resulted in a historic low of tariffs in the year 2000. As a result, trade volumes increased and there was a global economic growth.

Complex Socio-economical landscapes

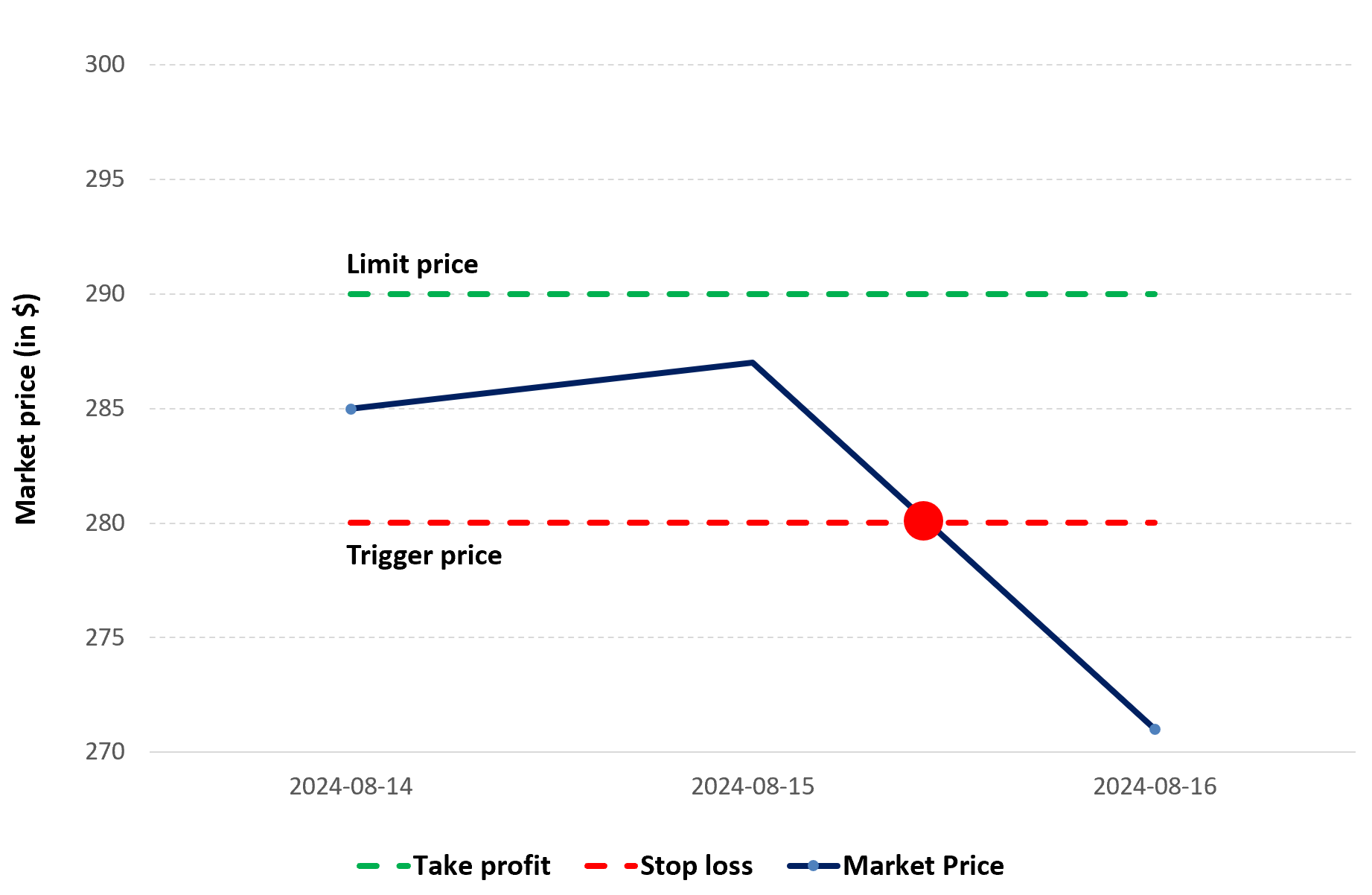

Despite the decreasing of average global tariff rate, trade policies in the 21st century, especially in the recent years, has grown to become more complex. For example, there has been targeted tariffs and trade conflicts, leading. To increased uncertainty in global trading markets. For example, U.S. has increased its tariffs from the year 2017 to 2020, with the average U.S. Tariff Rate of 1.6% in 2017 plummeting to 3.1% in the year 2020. This could have been attributed to the increased policies on tariffs on steel, aluminum, and the trade wars with China, resulting to much higher tariff rates compared to the beginning of the 2000s. For example, targeted tariffs has become a strategic target tariff, a tool with political goals. For example, the steel and aluminum tariff was to protective domestic industries, which the Trump administrated imposed a 25% tariff on steel and 10% on aluminum in March 2018. These tariffs were to uphold national security to maintain the U.S. domestic metals industry. However, this tariff led to price increases and resulted in retaliation of tariff policies from its trading partners.

< p> Increased tariffs from one country often results in retaliatory tariffs from its trading partners. Not just China, but there were also other countries that have responded to U.S.’s tariff hikes, including Canada, the European Union, and India. As a result, the increase in tariff has resulted in increased uncertainty to the global trade environment, affecting stock markets, companies, local businesses etc. Hence, the tariff can cast direct effects to each producer and consumer domestically, as investors raise concern over costs, and supply chains are rendered volatile, slowing businesses.A Case Study: The European Union’s tariff on Chinese Electric Vehicles

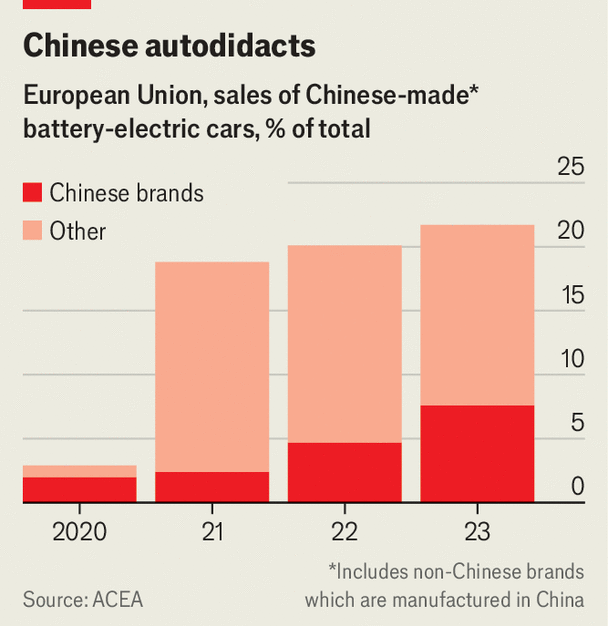

In the year 2024, the European Union imposed tariffs of 38.1% on Chinese imported electrical vehicles. This is an example of the shifting grounds of global trading market environments. Today, tariffs have increased globally, and this tariff is an example that has marked a shift in the European Union trade policy and has great implications for the global automotive industry as well as the international trading landscapes. For example, the EU has imposed different tariffs targeting on specific different companies. The SAIC Motor has an 38.1% tariff, whereas Geely experiences a 20% tariff, while BYD has a 17.4% tariff for all goods imported into the European Union from China. These tariffs were imposed by the EU due to the low prices that Chinese manufacturers deliver to the European market, which may potentially undermine local producers through competition. In response to the tariff, China has filed a complaint with the World Trade Organization to contend for EU’s actions, appealing that the EU may have constituted to protectionism under fair competition. The tariff casts a large impact on the European EV market, which European consumers are facing higher prices. Market share also shifts, as the tariffs has changed the competitive landscape; Chinese manufactured EVs are facing higher costs, which may benefit domestic European manufacturers. Hence, the EU’s recent tariffs on Chinese manufactured electric vehicles marks today’s international trade policies amongst the historical evolution of global trade and tariffs, and has sparked debate and challenges.

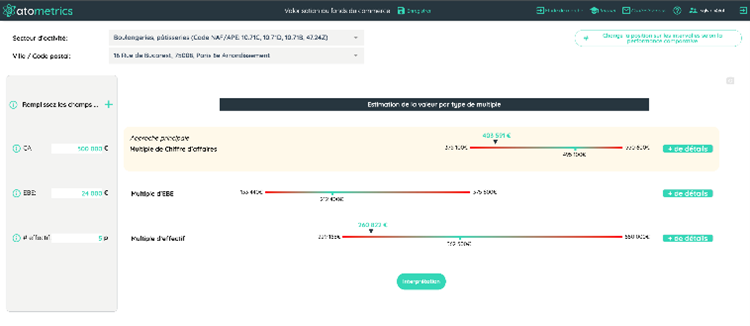

Evolution of tariffs

Source: ACEA.

Why should I be interested in this post?

Evolution of tariffs is crucial as it reveals how economic policies shape international trade dynamics, and this affects to domestic industries, producers, consumers, and also has a wider effect to the global market. Studying the changes of tariffs throughout time can allow us to gain insights into historical trends, and stay informed upon future policy decisions.

Related posts on the SimTrade blog

▶ Snehasish CHINARA XRP: Pioneering Financial Revolution

▶ Marine SELLI Trump Trade

▶ Nithisha CHALLA Statista

Useful resources

A history of free trade — and the deep irony of ‘liberation day’

History of U.S. tariffs and why it matters today

The Problem of the Tariff in American Economic History, 1787–1934

Financial Times Transcript: Tariffs past, present and future. With Doug Irwin

About the author

The article was written in June 2025 by Annie YEUNG (ESSEC Business School, Global Bachelor in Business Administration (GBBA) – Exchange Student, 2025).

▶ Read all posts written by Annie YEUNG