Top 5 Private Equity firms

In this article, Alessandro MARRAS (ESSEC Business School, Global Bachelor in Business Administration (GBBA), Exchange Semester, September 2023-December 2023) presents the top 5 Private Equity firms globally.

Introduction

In the dynamic landscape of finance, private equity firms wield significant influence driving innovation, growth, and value creation. These firms are renowned for their strategic investments and operational expertise, generating substantial returns for investors. In this post, we embark on a journey to uncover the top 5 Private Equity firms globally guided by specific metrics that underscore their reputation and success.

Methodology

To define the top 5 global Private Equity firms, we developed a methodology rooted in a detailed selection process and comprehensive data analysis. Given the vast landscape of private equity firms, our first step was to narrow down our focus by seeking rankings from reputable independent research institutes, such as Private Equity International and Forbes. These rankings served as a benchmark, helping us identify firms that consistently garnered recognition for their excellence within the industry.

From these rankings, we selected firms that appeared most frequently in the top 5, ensuring that our pool consisted of widely acknowledged and respected entities. This approach enabled us to narrow down our analysis to a manageable number of firms, facilitating a more in-depth assessment of their performance and standing.

With our selection criteria in place, we turned to publicly listed firms, as their annual reports provide accessible data crucial for our analysis. It is important to understand that being publicly listed means that the private equity firm is listed on stock exchanges, and anyone can buy shares in the company. However, this is a big difference from investing in private equity funds, where the capital raised is used to buy portfolio companies.

From this we obtained the 5 firms to rank:

- Blackstone Inc.

- KKR & Co Inc.

- The Carlyle Group Inc.

- Apollo Global Management, Inc.

- TPG Inc.

To rank these firms, we will be guided by essential measurement metrics that illuminate their standing and impact within the industry. Our evaluation method hinges on key indicators, including Assets Under Management (AUM), fundraising totals, and performance metrics such as gross returns. From an investor’s perspective, this comprehensive approach ensures a deep understanding of each firm’s financial health, strategic positioning, and potential for generating future returns, allowing for informed decision-making in investment opportunities.

Let’s have a more in depth look at the metrics (criterion) used:

Fundraising Totals Over the Last 5 Years. This metric provides insight into each firm’s ability to attract capital from investors over an extended period, reflecting investor confidence and the firm’s fundraising track record.

Total Private Equity AUM (in 2023). Total AUM for the private equity segment in 2023 serves as a measure of the firm’s scale and market presence within the private equity industry.

Private Equity Portfolio Returns (gross returns 2023). This metric represents the firm’s performance in generating returns from its investments in corporate private equity, providing a measure of investment effectiveness and value creation.

For each criterion, we will assign ranks to each firm based on their performance relative to others, with 1 being the highest rank and 5 being the lowest. We will then calculate the average score for each company and rank them accordingly. Each criterion weights the same.

Blackstone

Logo of Blackstone.

Source: the company.

Fundraising Totals: 126bn$

AUM: 304bn$

Gross returns: 12.1%

KKR

Logo of KKR.

Source: the company.

Fundraising Totals: 104bn$

AUM: 176bn$

Gross returns: 16%

The Carlyle Group (CG)

Logo of the Carlyle.

Source: the company.

Fundraising Totals: 70bn$

AUM: 161bn$

Gross returns: 5%

Apollo Global Management.

Logo of Apollo Global Management.

Source: the company.

Fundraising Totals: 23bn$

AUM: 75.9bn$

Gross returns: 10.2%

TPG

Logo of TPG.

Source: the company.

Fundraising Totals: 55bn$

AUM: 97.8bn$

Gross returns: 14.1%

Conclusion

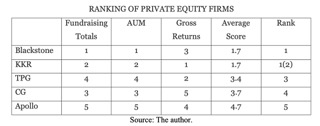

Once we consider all these elements, here are the ranks we obtain for each criterion and their average for each firm:

Therefore, our final ranking for the top 5 Private Equity firms globally in 2023 is:

- Blackstone

- KKR

- TPG

- The Carlyle Group

- Apollo Global Management

Note: Blackstone is ranked first in more criteria/metrics compared to KKR, demonstrating superior performance across multiple dimensions, and affirming its position as the top-performing firm in the final ranking.

Why should I be interested in this post?

As an ESSEC student enrolled in the SimTrade course, delving into the realm of Private Equity could be of great interest to you. This post serves as an insightful exploration into the industry’s key players, offering valuable insights into their distinctive characteristics. It presents an opportunity to deepen your understanding of the sector and potentially discover your future employer among these influential firms.

Related posts on the SimTrade blog

▶ Chloé ANIFRANI Top 5 Asset Management firms in Europe

▶ Lilian BALLOISDiscovering Private Equity: Behind the Scenes of Fund Strategies

Useful resources

Forbes Top 10 U.S. Private Equity Firms Of March 2024

Apollo Global Management, Inc.

About the author

The article was written in March 2024 by Alessandro MARRAS (ESSEC Business School, Global Bachelor in Business Administration (GBBA), Exchange Semester, September 2023-December 2023).