In this article, Liner SHI (ESSEC Business School, Global Bachelor of Business Administration (GBBA) – Exchange Student, 2024-2025) shares her analysis about Visa’s business model, industry conditions, and future trends.

What is Visa

Visa is a specialized bank card clearing institution that resolves authorization and transaction issues between banks.

Logo of VISA.

Source: Visa.

How visa was built : In 1950s, under the trend of installment payments, Bank of America became a leading credit card company. However, due to US banking laws, expansion outside California faced challenges. To overcome this, Bank of America started a franchise model. To deal with initial complications arising from complex authorization and currency exchange between banks, National BankAmericard Inc. was established. In 1973, transaction settlement costs was significantly reduced due to automation of the authorization process and then NBI was renamed to Visa.

In essence, Visa operates as a professional payment technology company under a four-party clearing model: banks, merchants, consumers, and clearing institutions. In 2023,Visa boasts 4.3 billion users, collaborates with 14,000 financial institutions, and records a payment volume of $12.3 trillion.Visa gained net revenue of $32.7 billion in 2023, representing a 11% increase compared to the previous year.

Visa’s Business Model

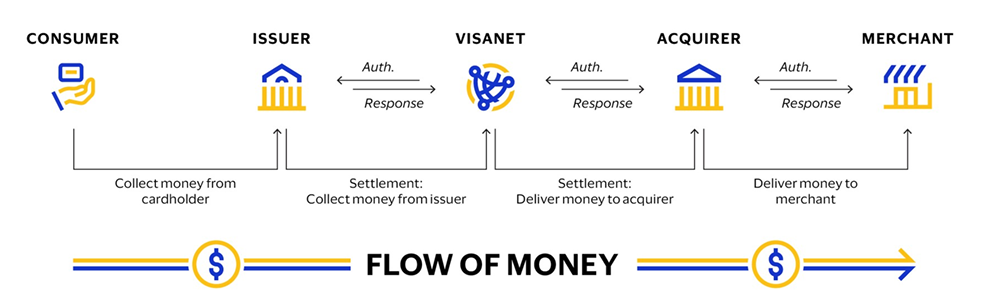

A typical Visa payment transaction

Visa payment process.

Source: VISA.

Source: Annual Report 2023

In a Visa C2B payment, the consumer uses a Visa card to buy from a merchant. The merchant sends the transaction to an acquirer, who sends it to VisaNet. VisaNet then checks with the issuer for authorization. Once authorized, the issuer pays the acquirer, minus fees. The acquirer pays the merchant, minus their fee. Visa earns by facilitating global money movement among consumers, merchants, and banks through innovative tech.

How Visa Makes Money—Visa’s Fee Structure

Visa earns revenue through various methods: transaction amount-based revenue and transaction count-based revenue.

Transaction Amount-based Revenue

- Service Revenue ($14.8B in 2023): This includes income from Visa’s payment processing services and technological solutions like transaction processing, clearing, settlement, risk management, and security services.

- International Transaction Revenue ($11.6B in 2023): Generated from cross-border transaction processing and currency conversion activities. Visa charges fees for these transactions due to their complexity, involving currency conversion and higher fraud risks.Nominal payment volume serves as a hedge against inflation, making it a primary revenue driver. If commodity costs rise, Visa’s revenue automatically increases.

Transaction Count-based Revenue

C.Data Processing Revenue ($16.0B in 2023): Visa earns revenue by processing transaction data and offering analytical services to partners. These services assist in customer behavior analysis, risk management, and marketing, thereby adding more value. In recent years, international transaction revenue has steadily increased while data processing revenue has slightly decreased, possibly influenced by inflationary growth.

Business Model Evaluation

Profitability

From 2017 to 2022, Visa’s average Return on Invested Capital (ROIC) stood impressively at 87%. This remarkable performance is primarily driven by a consistently high profit margin. Since 2011, Visa’s net profit margin has shown a steady increase, surpassing 50% after 2018. This growth is largely fueled by economies of scale. While Visa requires significant upfront capital investment, its operational costs per unit are comparatively low, almost negligible when compared to traditional banking institutions. Consequently, as Visa processes more transactions through its network, its profitability naturally expands. In the four-party model of bank card clearing, Visa avoids bearing customer acquisition costs and credit risks, thus enjoying the highest profit margins.

Business moat

- Technology: Visa provides users with a network technology known for its high real-time performance and security. Notably, Visa excels in managing fraud by utilizing extensive labeled transaction data and advanced algorithms like neural networks, Bayesian, and SVM. This enables Visa to construct effective risk control models, preemptively intercepting risky transactions.

- Brand and Switching Costs: In the payment industry, brand reputation significantly influences consumer choices. Visa’s strong brand power consistently attracts new customers. Moreover, existing customers are deterred from switching their bank cards to other clearing institutions due to substantial switching costs.

- Economies of Scale: As transaction volume expands, the clearing industry benefits from economies of scale, leading to an oligopolistic competitive structure. Similar to logistics systems such as gas pipelines and highways, once convenient and cost-effective clearing networks are established in the market, new entrants find little to no space for market penetration.

Visa’s Future Assessment

Market Trends

Overview

Overview

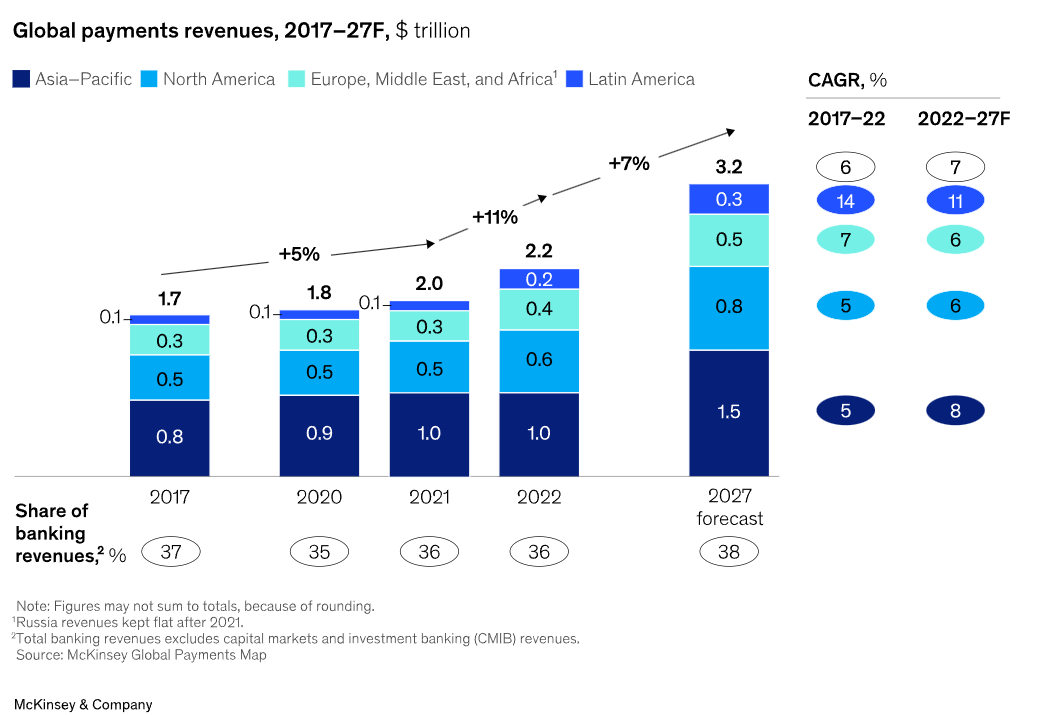

The payments industry revenue pool expanded by 8.3% from 2017 to 2022 to reach $1.6 trillion. However, according to BCG, slower growth is on the way. Their estimates suggest that overall revenue growth will decline from today’s levels to a CAGR of 6.2% from now through 2027, increasing the global revenue pool to $2.2 trillion at the end of that period.

Global payment revenue trend.

Source: McKinsey.

Specific Analysis

- Positive Factor 1: Personal consumption expenditure is the main driver behind the growth in payment transaction volumes. Over time, as living standards improve and inflation rises, personal consumption expenditure tends to increase. Technological advancements, such as the rise of contactless cards (NFC) and electronic wallets, make payment methods more convenient, leading to higher transaction frequencies for credit cards. Visa’s data shows that contactless bank cards have an average transaction frequency about 20% higher than regular bank cards, expanding the industry scale for clearing institutions. Moreover, following the COVID-19 pandemic, the surge in e-commerce adoption has shifted more people from cash to credit card payments, boosting the penetration rate of non-cash payments and driving payment amounts and volumes.

- Positive Factor 2: At the same time, the global small-value payment systems’ total transaction volume stands at approximately $235 trillion, with B2B transactions accounting for about $125 trillion (53%), C2B transactions at $50 trillion (21%), and B2C transactions at $30 trillion (13%). Both the B2B and B2C payment markets still hold significant growth potential, offering opportunities for further scale expansion for clearing institutions like Visa.

- Risk: Firstly, in the post-pandemic era, economic slowdown could lead to a decrease in transaction volume growth or even a decline. This presents challenges for clearing institutions on multiple fronts. They may face reduced revenue due to fewer transactions while also needing to navigate more stringent risk management and regulatory requirements. Secondly, according to the latest estimates from BCG, the emergence of new payment networks and the increasing popularity of electronic currencies may result in an overall reduction in scale. Market Trends

Competitive Analysis

Overview

Among existing competitors, Visa demonstrates robust performance, but concurrently, it may face threats from digital wallets and encrypted cryptocurrencies.

Specific Analysis

- Existing competitors: Visa maintains a competitive edge over its rivals in market share, revenue performance, organizational efficiency, and technological prowess. Contrasting Visa with its primary competitor, Mastercard, between 2018 and 2022, Visa boasted an average Return on Invested Capital (ROIC) of 88% and a net profit margin of 48.5%, surpassing Mastercard’s 54% ROIC and 41.3% net profit margin. This superiority stems from Visa’s early market entry advantage, higher market penetration, and lower customer acquisition costs. Moreover, Visa exhibits greater efficiency in internal organizational management, particularly focusing on clearing operations, while Mastercard’s management expense ratio tends to be approximately 10 percentage points higher. In terms of technology, Visa’s transaction processing capability outshines Mastercard’s, with Visa processing 65,000 transactions per second compared to Mastercard’s 5,000 transactions per second.

- Substitute competitors: Visa’s primary threat comes from other payment networks and digital wallets such as Apple Pay, Google Pay, and PayPal. These services are increasingly popular among consumers and may eventually erode Visa’s market share. Additionally, the rise of cryptocurrencies may lead to reduced demand for traditional payment networks like Visa.

Conclusion

Visa possesses a strong advantage in the current payment industry market development and competitive landscape. However, it is likely to be impacted in the short term by macro-market fluctuations and in the long term by the development of emerging payment technologies

Why should I be interested in this post?

This article will give you a better understanding of Visa as a company, while also providing you with more knowledge and information about similar clearing institutions and the payment industry. This will help you prepare for job interviews by equipping you with valuable insights into the workings of Visa and its counterparts, enabling you to demonstrate a deeper understanding of the industry during the interview process.

Related posts on the SimTrade blog

▶ Frederic ADAM Senior banker (coverage)

▶ Akshit GUPTA My apprenticeship experience within client services at BNP Paribas

▶ Snehasish CHINARA Bitcoin: the mother of all cryptocurrencies

Useful resources

BCG Global Payments Report 2023

Visa Annual Report 2023

McKinsey The-2023-mckinsey-global-payments-report

Goldmansachs 2008-entire-annual-report

About the author

The article was written in June 2024 by Liner SHI (ESSEC Business School, Global Bachelor of Business Administration (GBBA) – Exchange Student, 2024-2025).

▶ Read all posts written by Liner SHI