In this article, Guylan ABBOU (ESSEC Business School, Global Bachelor’s in Business Administration (GBBA) – Exchange Student, 2025) shares his professional experience in marketing and explains how it connects to finance.

Introduction

Hello, my name is Guylan. While studying marketing in Spain, I completed several internships across marketing departments. I interned in four roles across internal marketing, content, and B2B growth: at Bolletje (Netherlands), I created factory-floor packaging norm sheets to reduce errors and waste; at Rejolt (France), I helped onboard partners to a B2B2B catering/events platform and contributed to a CSR label; at Descapada/Grupo Masala (Spain), I prospected B2B partners in new markets and supported targeted campaigns; and in a local clinic in Granada, I produced content and campaign materials for social channels. Those roles taught me how to navigate a professional environment and, more importantly, how different areas of a company connect: marketing, Human Resources (HR), finance, and operations don’t sit in silos; they shape each other’s outcomes every day. I decided to take the SimTrade course at ESSEC to practice disciplined decision-making under pressure and to build habits I could apply back to marketing.

When marketing picks up the HR baton (internal marketing)

In many firms, headcount pressures have shrunk traditional HR teams. Some companies outsource HR; others reassign parts of it, culture initiatives, internal communication, and employer branding to marketing. Marketers are trained to communicate clearly, align people, and move them to action. What works just as well inside the company as outside it.

At Bolletje for example, my internal marketing work focused on aligning teams on quality and execution. In practice, this included organizing cross-department discussions to reduce friction between production, quality, and operations; translating quality standards and product updates into clear, usable guidelines for factory teams; and supporting internal communication to clarify priorities, reinforce standards, and make expectations visible on the production floor.

Consumers rarely see this work, yet it’s critical. Internal marketing improves employee perception and strengthens execution: clearer priorities, faster coordination, and fewer dropped handoffs. That “invisible” efficiency shows up later in lower churn, better customer experience, and higher lifetime value. And that is exactly where finance enters the story.

Marketing ↔ Finance bridge

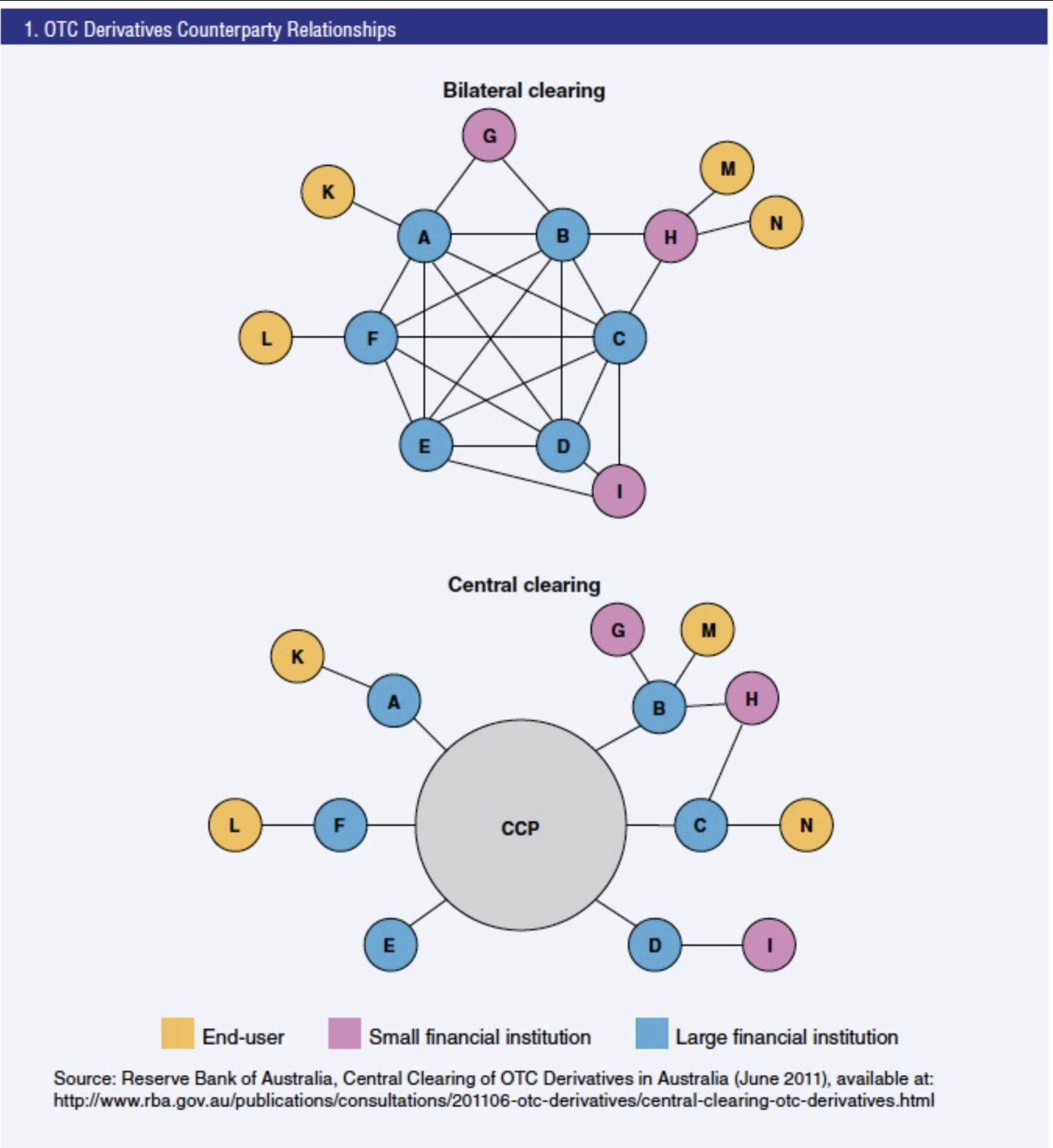

Finance focuses on cash flows and risk; marketing shapes both. The points below describe how common marketing situations translate into finance-oriented views.

Demand signals and market depth

In digital marketing, demand appears through search trends, click-through rates, and conversions. In finance, the order book displays supply and demand at each price level. Looking beyond surface metrics to factors such as audience saturation, competitive pressure, and funnel health provides an analogue to market depth.

Pricing, promotion and order types

In marketing, discounts and launch timing influence volume and margin. In trading, the contrast between market and limit orders represents urgency versus price discipline. The parallel highlights how conditions and thresholds determine when value is created or eroded.

The execution gap (slippage)

The difference between plan and live results constitutes an execution gap. In markets, this is slippage between expected and actual fill; in campaigns, it appears as divergence between forecast and realized metrics, often tied to targeting, timing, or creative constraints.

Risk management & guardrails

Marketing spends, like a portfolio, aggregates position-level risks. Guardrails, such as budget caps, pause thresholds (e.g., a customer acquisition cost level sustained over several days), time boxes, and brand-safety filters; define the acceptable risk envelope before execution begins.

Experimentation discipline

Attribution depends on isolating variables. Changing a single factor at a time and documenting a brief hypothesis, metric, result, and follow-up preserves causal clarity. Clean experimentation produces forecasts that map more directly into credible budgets.

Marketing and the economy

Marketing is more than ads or catchy lines. It is how useful ideas travel from creators to people who need them. When a product’s promise is explained in simple words, what it is, who it helps, and why it’s better, adoption speeds up. Faster adoption of good solutions raises productivity for everyone: households save time and money, and companies run more efficiently. New products often fail because no one understands them; good marketing teaches the market about the problem, the solution, and the proof. Clear, repeated messaging shortens the education curve and helps innovations become normal faster.

Case study: Bolletje, an internal marketing project

Last summer, I was employed by a Dutch company named Bolletje for an internal marketing task: how to communicate the standards of the company to all employees, to increase the quality of all products made, and to reduce waste by giving clear guidelines and instructions.

Logo of Bolletje.

Source: the company.

Company snapshot

Bolletje is a long-standing Dutch bakery brand best known for Beschuit (rusk), crackers/crispbread, and seasonal biscuits like kruidnoten, usually sold between September and December (for Sinterklaas, Dutch St-Nicolas). The brand’s roots trace back to the 19th century; today, it operates from Almelo in the east of the Netherlands. Beyond rusks, Bolletje’s range spans everyday “bread replacers” Dutch consumers keep in the pantry, as well as sweet treats. In 2013, Bolletje joined Germany’s Borggreve group.

Selected Bolletje products.

Source: the company.

My task (more depth)

My task, very concretely, was to design a packaging norm sheet, a clear, visual reference displayed for all factory employees on the production floor. The goal was twofold: first, to help operators correctly adjust the different types of packaging machines they use every day; second, to make sure everyone shares the same understanding of the quality standards expected from a brand that is widely recognized in the country for its high quality. The sheet set out, in simple terms and with pictures where useful, what “good” looks like for each product and pack, so that a worker can quickly check settings, compare what they see in hand to the standard, and correct issues before they become waste.

Just as important, the norm sheet explained when a product must be rejected and why. For example, if a seal is incomplete, a label is misaligned, or a pack is damaged, even if the food inside seems fine. For each type of defect, it also included a short “what to do next” section, describing the remediation steps to fix the root cause: which knob to adjust, which sensor to clean, which film tension to change, or when to call a line leader or maintenance. By making the decision rules explicit (keep, rework, or discard) and by linking each rule to a practical fix, the sheet helped reduce both food waste and packaging waste. In short, it turned quality standards into everyday actions: the right settings up front, faster problem detection, smarter corrections, and fewer products thrown away.

What I learned

I learned that clarity beats volume. People don’t need a thick manual; they need one clear page that shows exactly what “good” looks like. When the standards are written in plain words and supported by photos, operators can check, adjust, and move on without guessing. Because the company employs some foreign workers, photos and simple phrases were far more helpful than complex written instructions. Putting the norm sheet at the point of work, right next to the machine, also matters. If the guide is visible where decisions happen, it actually gets used.

I also saw that rules work better when they include the reason, not just the instruction. The “why” increases compliance. Alongside that, making the choices explicit (keep, rework, or discard) reduces hesitation. For each defect, pairing the decision with a short fix (adjust heat, clean the sensor, change film tension, call maintenance) turns standards into action and cuts waste.

Another lesson was to build the standard with the people who use it. Operators and line leaders know the real problems and edge cases. Co-creating the sheet with them made it more accurate and kept it alive after my project ended. Small visuals were surprisingly powerful: a couple of photos of correct and incorrect packs removed long debates on the line, sped up decisions, and reduced stoppages.

Measurement closed the loop. Tracking a few simple indicators and the most common defect types showed where the process truly struggled and which fixes worked. Training also worked best in the flow of work: two-minute huddles at the machine were more effective than long classroom sessions far from the line, because people could apply the information immediately.

Finally, I learned the importance of small details, and the importance in general of having as much information as possible. One example of a small detail was that products could have lower quality just because of one small change in the quality of the ingredients, like having less protein in the flour bought, or the heat of the oven not being perfectly evenly distributed. Those small details, those small pieces of information, can cause great change in the perception consumers might have over a company, changing, of course, the perception investors will have of it. To conclude, many people in the financial industry claim that the stock market is uncertain, changing without apparent reason. I would reply that maybe the information wasn’t used well enough, or that we didn’t look for it carefully enough. Like a butterfly effect, one very small event can cause great damage to the financial structure of the company. For example, a person with influence online could have an unlucky experience with your company, and by talking about it and by rumors, a company could suffer greatly.

Closing: how the SimTrade habits transfer

I took SimTrade to practice decisions under pressure. The habits I use every day now are simple: define entry conditions before spending, set guardrails to control risk, measure the gap between plan and reality, and write short post-mortems so the team learns fast. Those same habits made my factory-floor project calmer, clearer, and more effective, and they make marketing outcomes easier for finance to trust.

Find related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Alexandre VERLET Classic brain teasers from real-life interviews

Useful resources

About the author

The article was written in January 2026 by Guylan ABBOU (ESSEC Business School, Global Bachelor’s in Business Administration (GBBA) – Exchange Student, 2025).

▶ Discover all articles by Guylan ABBOU