In this article, Anouk GHERCHANOC (IE University, Bachelor in Business Administration (BBA), 2021-2025) shares her experience as a financial analyst for companies in the French overseas territories in the 2IF Department of the Inter Invest Group.

About Inter Invest Group

Founded in 1991, the Inter Invest Group is a significant player in the financing and investment sector. Based in Paris, the group operates in various fields, including corporate finance, real estate projects, and wealth management advice. Thanks to its expertise and ability to offer tailor-made solutions, the Inter Invest Group supports its clients’ development strategies. Its authorization by the Autorité de Contrôle Prudentiel et de Résolution (ACPR, CIB 17808) guarantees rigorous and transparent financial practices, reinforcing its reputation as a trusted partner for private individuals, companies, and institutional investors.

Logo of Inter Invest Group.

Source: the company.

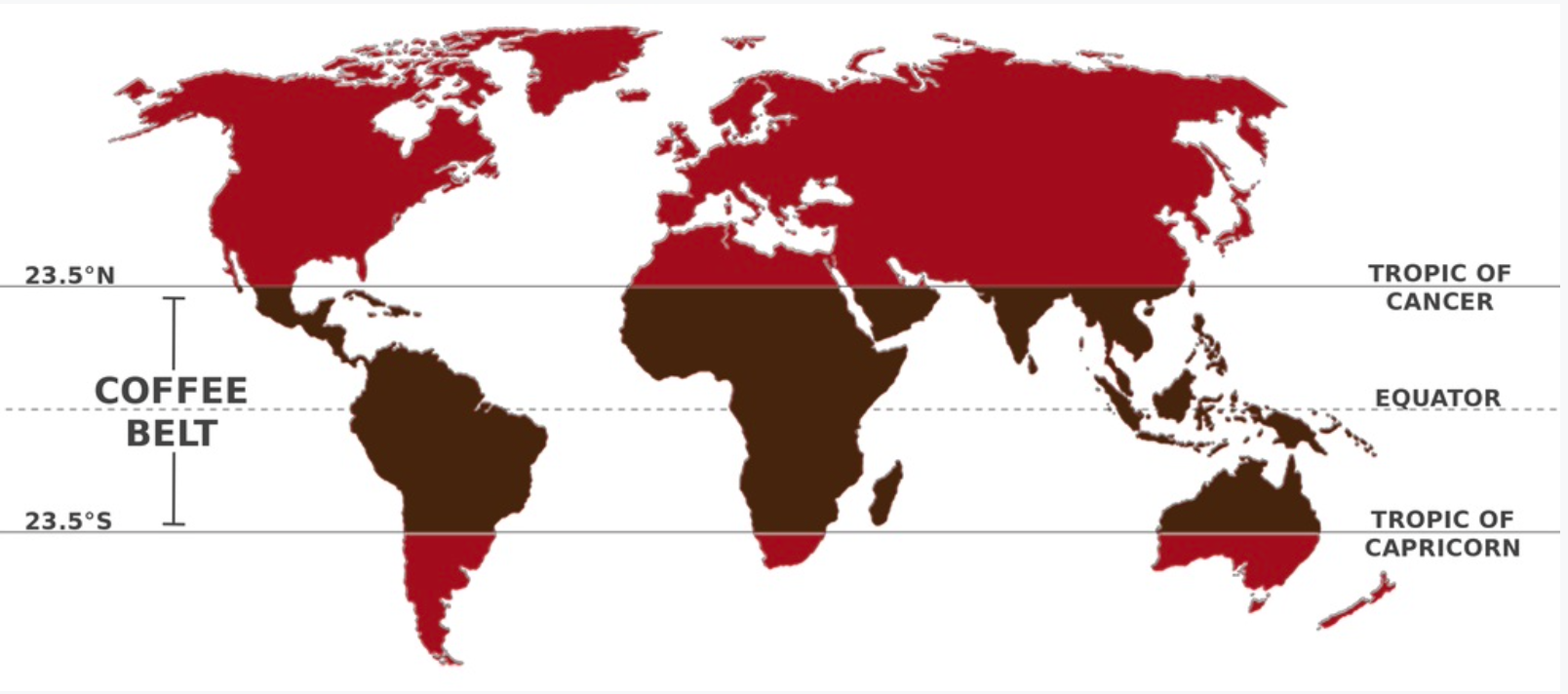

During my internship in 2024, I joined the 2IF department, which specializes in providing financing solutions for companies in French overseas territories (Guadeloupe, Martinique, Saint-Martin, Saint-Barthélemy, French Guiana, Réunion, Mayotte, French Polynesia, New Caledonia). Central to the department’s operations is the SOFIDOM offer, a financing scheme designed to address the specific needs of businesses in these regions. This offer supports companies by providing funds for equipment renewal, business expansion, and operational costs, whether the financing falls under tax exemption schemes or not. A key priority of the department is to deliver rapid and efficient responses to financing requests, allowing businesses to move forward with their projects without delays. This approach ensures efficiency and reflects a deep understanding of the unique economic and logistical challenges faced by companies in French overseas territories, enabling tailored financial support that meets local needs.

My internship

My internship in the 2IF department of the Inter Invest Group was a rewarding and formative experience. This department, which specializes in financing companies located in the French overseas territories, enabled me to actively contribute to assessing financing requests for small businesses. These businesses included newly established structures seeking to develop their activities and others facing financial difficulties requiring appropriate support.

An essential part of my job was analyzing the financial files, taking into account the specific economic features of the overseas territories, particularly their geographical remoteness, operating costs, and dependence on key sectors such as construction and food processing. This enabled me to develop an in-depth understanding of the unique challenges faced by these businesses while applying my theoretical knowledge of finance to real-life situations.

The 2IF department stands out for its responsiveness and efficiency, two essential assets for responding to companies’ immediate needs. This dynamic has led me to work to tight deadlines, requiring clear task prioritization and rapid but rigorous decision-making. Combining these demands with detailed financial analysis taught me to balance precision and efficiency, an essential skill in the financial sector.

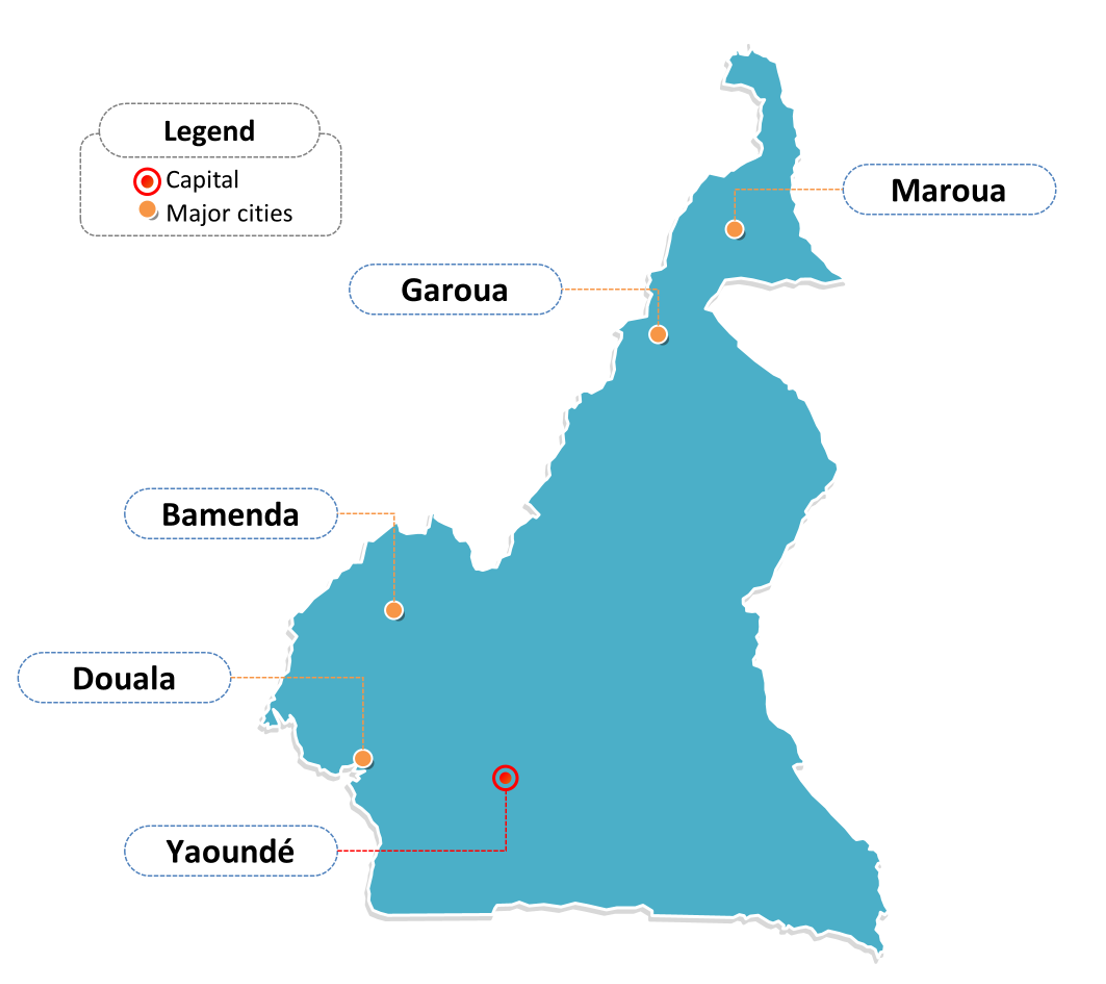

Financed overseas territories.

Source: the company.

My missions

Verification of document conformity. My first task was to ensure the conformity of the financial and legal documents submitted by companies as part of their application for financing. I rigorously analyzed the conformity of balance sheets, income statements, Kbis (a document that certifies the legal existence of a French company), company articles of association, bank or personal guarantees, and bank statements for the last three months. These checks were carried out in compliance with LCB-FT (Lutte Contre le Blanchiment et le Financement du Terrorisme) obligations to identify any inconsistencies or irregularities in the data provided. For example, some files revealed anomalies in the financial statements or bank movements, which led to an in-depth review of the projects before a financing decision could be made. This verification stage was essential to lay a solid foundation for a reliable financial analysis and to ensure regulatory compliance.

In-depth financial analysis. Once the documents had been validated, I conducted in-depth financial analyses using key indicators such as profitability, solvency, and liquidity ratios. Specific calculations supplemented these analyses to refine the assessment of the companies, including the net debt ratio to measure their dependence on debt, the operating margin to assess the efficiency of core activities, the net operating profitability to analyze their ability to generate sustainable profits, and the level of equity about the total balance sheet to assess their financial strength. My analyses were based mainly on the passive balance sheets of the last two years and the profit and loss accounts, supplemented by a study of interim sales, to obtain an up-to-date and accurate view of the companies’ performance. Thanks to this methodology, I could identify significant elements, such as differences in financial structure or revenue dynamics, which were used to support my favorable or cautious recommendations.

Preparation of structured reports. The conclusions of my analyses were then summarized in detailed reports, structured around several key sections: presentation of the company, its directors and partners, description of the financing plan requested, in-depth analysis of the balance sheets and income statements, assessment of the sureties proposed and viability of the guarantees provided. Finally, I drew a reasoned conclusion on the financing request, with a favorable, reserved, or unfavorable opinion, depending on the case. These reports were then submitted to the Director of Financing, responsible for making the final decision. He could give conditional approval, requiring adjustments to the financing plan depending on his feedback.

Required skills and knowledge

My skills in financial accounting, operations management, corporate finance, and financial analysis, which I applied through my university education, played an essential role in effectively executing my day-to-day analyses. These skills enabled me to evaluate financial data and provide actionable information. My expertise in Excel proved invaluable in accurately processing balance sheets, cash flows, and income statements, enabling me to identify patterns, assess financial health, and make strategic recommendations. In addition, my mastery of Power BI helped me to design dynamic and visually appealing reports for the board of directors. These reports summarize the department’s financial results and strategic objectives, providing a clear and actionable overview that facilitates informed decision-making at the management level, a task I was given during my internship. Together, these tools enhanced the depth and effectiveness of my analyses, ensuring that critical points were addressed and presented with clarity.

On an interpersonal level, my soft skills played a key role in meeting the demands of my assignments. My ability to approach problems analytically enabled me to break down complex issues and propose practical, data-driven solutions. Effective organization and prioritization of tasks were essential in managing competing deadlines, ensuring that every product delivered met the high standards expected within the department. In addition, my strong communication skills enabled me to articulate written and verbal results.

Working in a fast-paced, dynamic environment increased my flexibility and responsiveness, enabling me to adapt to changing priorities and unexpected challenges without compromising quality. This adaptability has proved essential in managing multiple responsibilities simultaneously while maintaining a strategic focus on key objectives. Overall, the combination of technical expertise and non-technical skills I developed during this internship has greatly enhanced my ability to contribute effectively to financial projects.

What I learned

This internship was a vibrant learning experience that enabled me to move from academic theory to professional practice. I developed concrete expertise in financial analysis, particularly in evaluating financing applications and interpreting economic data. I have also honed my ability to detect anomalies in financial documents while producing clear, structured reports essential for supporting strategic decisions.

One of the priorities of my assignments was to provide a rapid, well-argued response to the acceptance or rejection of financing requests. Working to tight deadlines enabled me to strengthen my time management skills and develop my ability to manage multiple priorities effectively. This experience prepared me for complex challenges in the demanding finance sector.

The internship also confirmed my ambition to pursue a career in finance, making the most of my analytical skills and my interest in projects with a strong economic and social impact. The opportunity to work on concrete projects in a demanding, structured environment gave me a better understanding of the complexity of corporate finance and the importance of personalized support to ensure the success of projects.

Financial concepts related my internship

I present below three financial concepts related my internship: net margin, shareholders’ equity, and cash flow.

Net margin

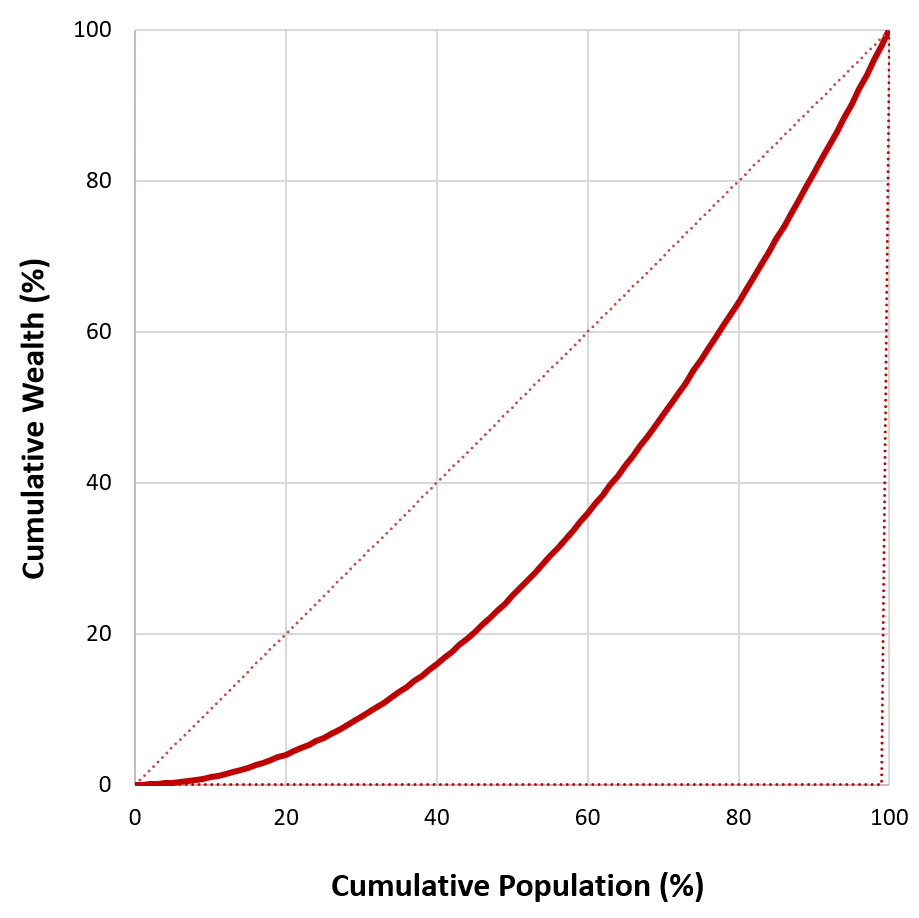

During my internship, net margin came to the fore as a key indicator in company valuations. This ratio, calculated from net income divided by sales, measures a company’s ability to generate profits after covering all its costs, including tax and financial expenses. This analysis enabled me to understand the overall performance of the companies I studied and their ability to maintain a sufficient level of profit to sustain growth or cope with unforeseen financial events. I could identify the companies’ structural strengths and weaknesses by examining the net margin. High profitability reflected effective cost management, reasonable control of monetary expenses, and efficient operational activity. Conversely, low or negative profitability could indicate problems such as insufficient margins, an overly heavy cost structure, or competitive pressure on prices.

For example, one construction company I analyzed had a stable net margin thanks to rigorous management of operating costs and efficient project planning. This cost control, combined with the diversification of its contracts, reinforced my recommendation in favor of financing to modernize its equipment fleet and support its expansion into new markets. Conversely, a company in the agri-food sector showed a negative net margin. This was due to a significant rise in raw material costs, which had not been passed on to its sales prices, considerably reducing its margins.

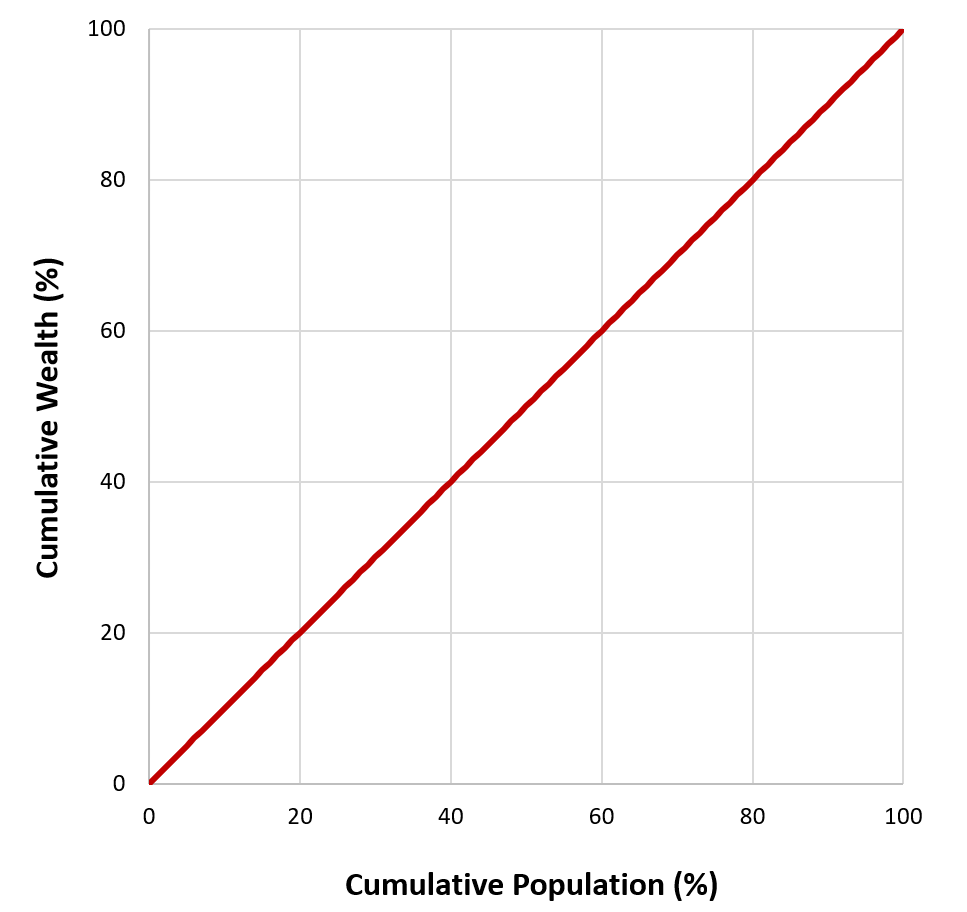

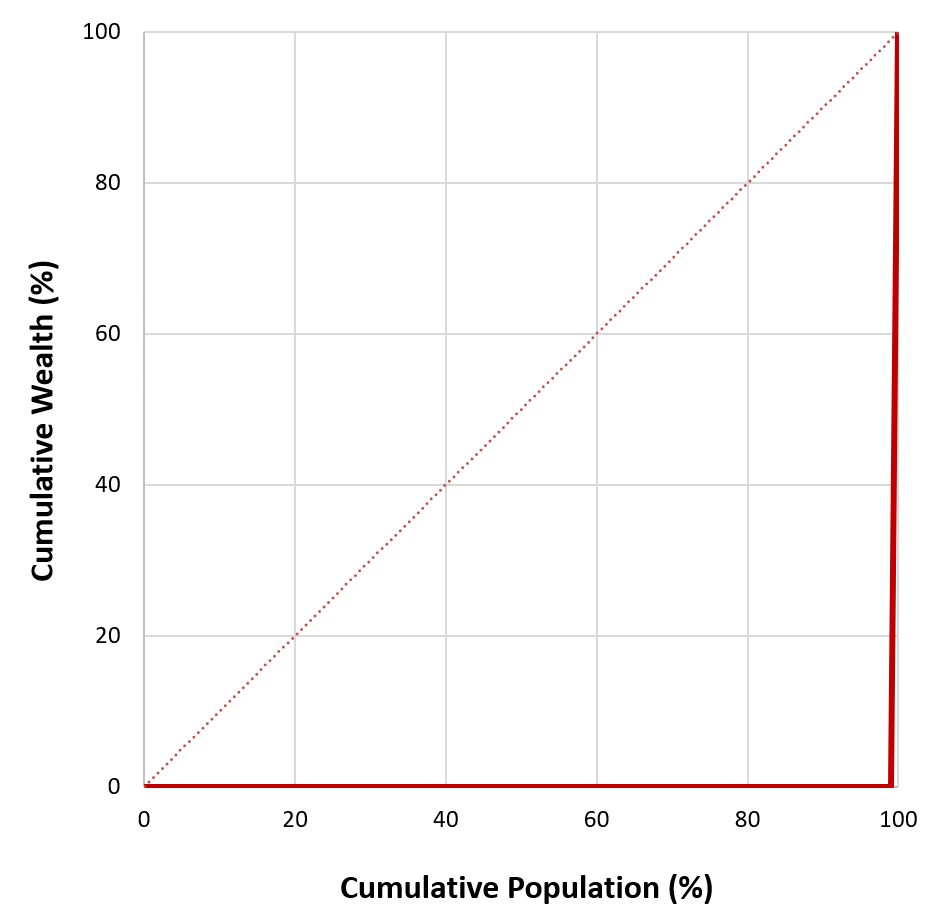

Shareholders’ equity

Shareholders’ equity is essential for assessing a company’s financial strength. It comprises share capital, reserves, and retained earnings and appears on the liabilities side of the balance sheet. These elements are crucial in measuring a company’s ability to finance its activities over the long term, absorb losses, and limit its dependence on creditors. Share capital represents the contribution made by shareholders at the time of the company’s creation or capital increase, while reserves correspond to retained earnings used to strengthen shareholders’ equity. Retained earnings are profits or losses from previous years, reflecting the company’s past performance. Solid shareholders’ equity reflects the company’s financial stability, enabling it to withstand economic crises and finance its projects without excessive borrowing. This reduces the risk to creditors and allows the company to obtain more advantageous financing terms.

Within the 2IF department, a strict rule applied specifically to tax-exempt financing. The latter, governed by precise criteria, required that the equity shown in the last balance sheet liabilities exceeded half of the company’s share capital. This requirement guaranteed a solid financial base and minimized the risks for tax-exempt projects. If this condition was not met, the application for tax-exempt financing could not be accepted.

Cash flow

Cash flow analysis was essential to my work, in compliance with LCB-FT (Lutte Contre le Blanchiment et le Financement du Terrorisme) standards. It was based on examining the companies’ last three minimum bank statements, enabling me to assess their capacity to absorb the financial burden associated with the requested financing.

Based on these statements, I analyzed the consistency between payments received and contracts provided while checking for any other significant debts that might limit their financial room for maneuvering. This approach also ensured the traceability of financial flows and detected anomalies, such as unjustified transfers or discrepancies between actual transactions and the declarations provided. By ensuring complete transparency of financial operations, this cash flow analysis played a decisive role in formulating my recommendations and ensuring the company had the necessary resources to manage its current commitments and the requested financing.

Why should I be interested in this post?

This article is aimed at students and young professionals wishing to better understand the particularities of corporate finance, especially in the French overseas territories. It focuses on analyzing the unique challenges of these regions and applying key skills in financial analysis, risk management, and strategic decision-making. The Inter Invest Group offers a unique opportunity to gain practical experience and contribute to relevant financial projects.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Majd MAHRSI My Internship Experience as a Data Analyst at Africa Verify in Casablanca

▶ Lara HADDAD My Internship Experience as a Market Analyst at L’Oréal

Useful resources

Inter Invest Group

Inter Invest Overseas

Banque de France Les fonds propres des TPE et PME

AMF Règlementation LCB-FT

Autorité de contrôle prudentiel et de résolution (ACPR)

About the author

The article was written in January 2025 by Anouk GHERCHANOC (IE University, Bachelor in Business Administration (BBA), 2021-2025).