My experience as an EMEA Regional Treasurer intern

In this article, Isaac ALLIALI (ESSEC Business School, Bachelor in Business Administration (BBA), 2019-2023) shares his professional experience an EMEA Regional Treasurer intern at Sanofi.

Sanofi

During my internship at Sanofi, a leading global pharmaceutical company headquartered in Paris, I had the privilege of working in the Treasury Department. Sanofi is renowned for its extensive research, development, manufacturing, and marketing of pharmaceutical products across various therapeutic areas. With a steadfast commitment to improving global health, Sanofi’s portfolio includes treatments for diabetes, cardiovascular diseases, vaccines, and rare diseases. As a key player in the pharmaceutical industry, Sanofi holds a significant share of the prescription market.

Logo of Sanofi.

Source: the company.

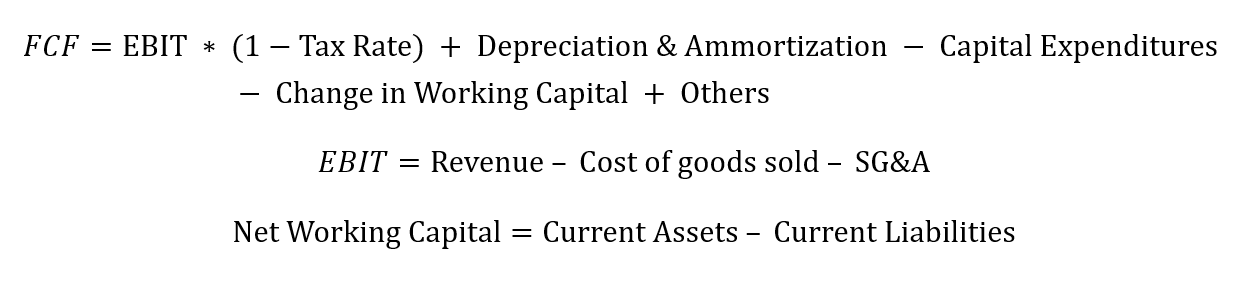

Financial accounts

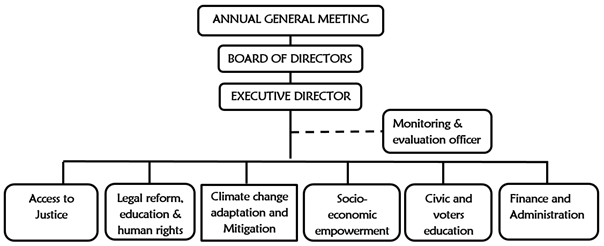

Income statement of Sanofi.

Source: the company.

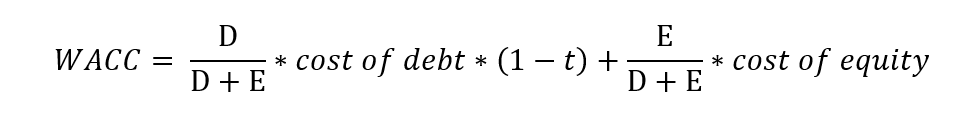

Strategy

Strategy of Sanofi.

Source: the company.

My internship

As a Europe Middle East and Africa (EMEA) Regional Treasurer intern at Sanofi, my internship involved two main aspects. Firstly, I was responsible for reporting on the performance of the company’s subsidiaries on a monthly basis, focusing on key financial metrics such as Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), Days Inventory Outstanding (DIO), and cash flows. This required analyzing financial data, preparing comprehensive reports, and providing insights into the subsidiaries’ financial health. I developed a deep understanding of financial ratios and gained proficiency in financial analysis and reporting.

Additionally, on a day-to-day basis, I played a vital role in implementing alternative banking channels to ensure the sustainability of cash receipts from high-risk countries. This involved close collaboration with banks and local teams to establish robust procedures and systems. To ensure accurate cash receipts matching with product sales, I diligently contacted banks and the local teams on a daily basis. This rigorous process involved verifying and validating each transaction, ensuring the precise quantity of products sold aligned with the corresponding justifying claims. By maintaining meticulous attention to detail, I ensured that every transaction was accurately registered and properly accounted for.

This aspect of my internship demanded strong communication skills, attention to detail, and the ability to manage complex transactions efficiently. It provided firsthand exposure to the challenges and intricacies of international banking operations, risk management, and compliance in high-risk countries.

During my internship as an EMEA Regional Treasurer at Sanofi, I had the additional responsibility of consolidating the representative offices’ register, which included all the bank accounts and power of attorneys (legal documents allowing appointed employees to make decisions on behalf of Sanofi).

This task required me to meticulously reconcile and align the information from various regions before the audit control. To ensure accuracy and completeness, I actively communicated with every regional treasurer, collaborating closely to verify the documentation and address any discrepancies. This process of effective communication and coordination with the regional treasurers was crucial in achieving a thorough and successful consolidation. By ensuring that everything was in order, I contributed to the smooth audit control process and maintained the integrity of the company’s financial records.

My missions

My internship involved two main aspects. Firstly, I was responsible for reporting on the performance of the company’s subsidiaries on a monthly basis, focusing on key financial metrics such as Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), Days Inventory Outstanding (DIO), and cash flows. This required analyzing financial data, preparing comprehensive reports, and providing insights into the subsidiaries’ financial health. I developed a deep understanding of financial ratios and gained proficiency in financial analysis and reporting.

Additionally, on a day-to-day basis, I played a vital role in implementing alternative banking channels to ensure the sustainability of cash receipts from high-risk countries. This involved close collaboration with banks and local teams to establish robust procedures and systems. To ensure accurate cash receipts matching with product sales, I diligently contacted banks and the local teams on a daily basis. This rigorous process involved verifying and validating each transaction, ensuring the precise quantity of products sold aligned with the corresponding justifying claims. By maintaining meticulous attention to detail, I ensured that every transaction was accurately registered and properly accounted for.

This aspect of my internship demanded strong communication skills, attention to detail, and the ability to manage complex transactions efficiently. It provided firsthand exposure to the challenges and intricacies of international banking operations, risk management, and compliance in high-risk countries.

During my internship,I had the additional responsibility of consolidating the representative offices’ register, which included all the bank accounts and power of attorneys (legal documents allowing appointed employees to make decisions on behalf of Sanofi).

This task required me to meticulously reconcile and align the information from various regions before the audit control. To ensure accuracy and completeness, I actively communicated with every regional treasurer, collaborating closely to verify the documentation and address any discrepancies. This process of effective communication and coordination with the regional treasurers was crucial in achieving a thorough and successful consolidation. By ensuring that everything was in order, I contributed to the smooth audit control process and maintained the integrity of the company’s financial records.

Required skills and knowledge

The EMEA Regional Treasurer role at Sanofi requires a combination of knowledge and skills. Here are key areas of expertise and proficiencies relevant to the position:

Financial Analysis: A strong foundation in financial analysis is essential for evaluating subsidiary performance, assessing financial health, and providing meaningful insights. Proficiency in financial ratios, financial modeling, and data analysis enables you to make informed decisions and recommendations.

Treasury Operations: Familiarity with treasury operations, including cash flow management, liquidity management, risk management, and financial reporting, is crucial. Understanding financial instruments, banking relationships, and compliance procedures ensures effective treasury operations and supports decision-making.

Communication and Collaboration: Effective communication skills are vital to engage and collaborate with internal stakeholders, such as regional financial management and local teams. Clear and concise communication fosters productive relationships and ensures the smooth execution of financial processes.

Attention to Detail and Compliance: Meticulous attention to detail is necessary when reporting on subsidiary performances and implementing alternative banking channels. Compliance with internal control procedures, risk mitigation protocols, and financial regulations ensures accuracy, transparency, and integrity in financial operations.

Analytical Thinking: Strong analytical skills are critical for analyzing financial data, identifying trends, and making data-driven decisions. The ability to evaluate risks, identify opportunities, and propose solutions contributes to effective financial management.

Adaptability and Problem-Solving: The dynamic nature of the role requires adaptability, as well as the ability to think critically and solve problems in a fast-paced environment. Resilience, flexibility, and a proactive approach enable you to navigate challenges and drive continuous improvement.

Financial concepts related my internship

Days Sales Outstanding (DSO)

DSO is a financial metric that measures the average number of days it takes for a company to collect payment after a sale is made. Monitoring DSO is crucial for assessing a company’s liquidity position and efficiency in collecting accounts receivable. During my internship, I actively analyzed and reported on DSO, gaining a practical understanding of its significance in cash flow management.

Days Payable Outstanding (DPO)

DPO is a financial metric that measures the average number of days it takes for a company to pay its suppliers after receiving an invoice. Managing DPO effectively is essential for optimizing working capital and maintaining strong supplier relationships. In my reporting responsibilities, I monitored and analyzed DPO, contributing to a comprehensive assessment of the company’s financial performance.

Cash Receipts and Compliance

Ensuring the accurate and timely recording of cash receipts is vital for financial integrity. Implementing alternative banking channels and verifying transactions from high-risk countries required a keen eye for detail and compliance with internal control procedures. This experience emphasized the importance of maintaining rigorous standards to mitigate risk and ensure accurate financial reporting.

Why should I be interested in this post?

The role of EMEA Regional Treasurer at Sanofi offers a compelling opportunity for individuals interested in finance, treasury operations, or the pharmaceutical industry. Here are a few reasons why you should be interested in this post:

Industry Leadership: Sanofi is a global leader in the pharmaceutical industry, renowned for its innovative research and development. Joining the Treasury Department of such a prominent company provides exposure to the complexities of finance within a multinational pharmaceutical corporation, offering a unique and valuable experience.

Financial Responsibility: As an EMEA Regional Treasurer, you would have a significant role in managing the financial assets of Sanofi across the EMEA region. This level of responsibility allows you to make strategic financial decisions, analyze financial performance, and contribute to the company’s financial health.

International Exposure: Working within the EMEA region exposes you to diverse markets, cultures, and business practices. It presents an opportunity to develop a global mindset, adaptability, and cross-cultural communication skills, which are increasingly valuable in today’s interconnected business world.

Learning Opportunities: The Treasury Department at Sanofi offers a dynamic and challenging environment where you can continually enhance your financial knowledge and skills. You will gain exposure to various aspects of treasury operations, financial risk management, liquidity management, and financial reporting.

Impactful Contributions: By actively participating in the implementation of alternative banking channels, you will contribute to ensuring the sustainability of cash receipts from high-risk countries. This responsibility allows you to make a tangible impact on the company’s financial operations and play a vital role in managing financial risks.

Useful resources

About the author

The article was written in June 2023 by Isaac ALLIALI (ESSEC Business School, Bachelor in Business Administration (BBA), 2019-2023).