In this article, Anant JAIN (ESSEC Business School, Grande Ecole – Master in Management, 2019-2022) defines the key expressions used in the article “The Social Responsibility of Business Is to Create Value for Stakeholders” written by Edward Freeman and Heather Elms in 2018.

Summary Of The Article

In the article “The Social Responsibility of Business Is to Create Value for Stakeholders”, Edward Freeman and Heather Elms (2018) argue against the statement made by Milton Friedman in a famous article published in The New York Times in 1970 that “The Social Responsibility of Business Is to Increase Its Profits”. Friedman’s view corresponds to the traditional “Shareholder Approach”. Freeman and Elms state that businesses need to create value for all stakeholders (not only shareholders but also employees, customers, suppliers, communities, governments, etc.) if they want to be successful in the 21st century leading to the introduction of a new story: the “Stakeholder Approach”.

Key Expressions

We explain below key expressions to fully understand the article by Freeman and Elms: shareholders, stakeholders, corporate social responsibility, and mission statement.

Shareholders

A shareholder (also called stockholder) is a person, company, or institution that owns at least one share of a company’s stock called equity. The shareholders essentially own the company and therefore, reap the benefits of a business’s success. These benefits received may be in the form of the increase in the stock valuation or profits received as dividends. However, when a company incur losses, shareholders also incur them in the form of a decrease in the stock price or a decrease or absence in the dividends.

Stakeholders

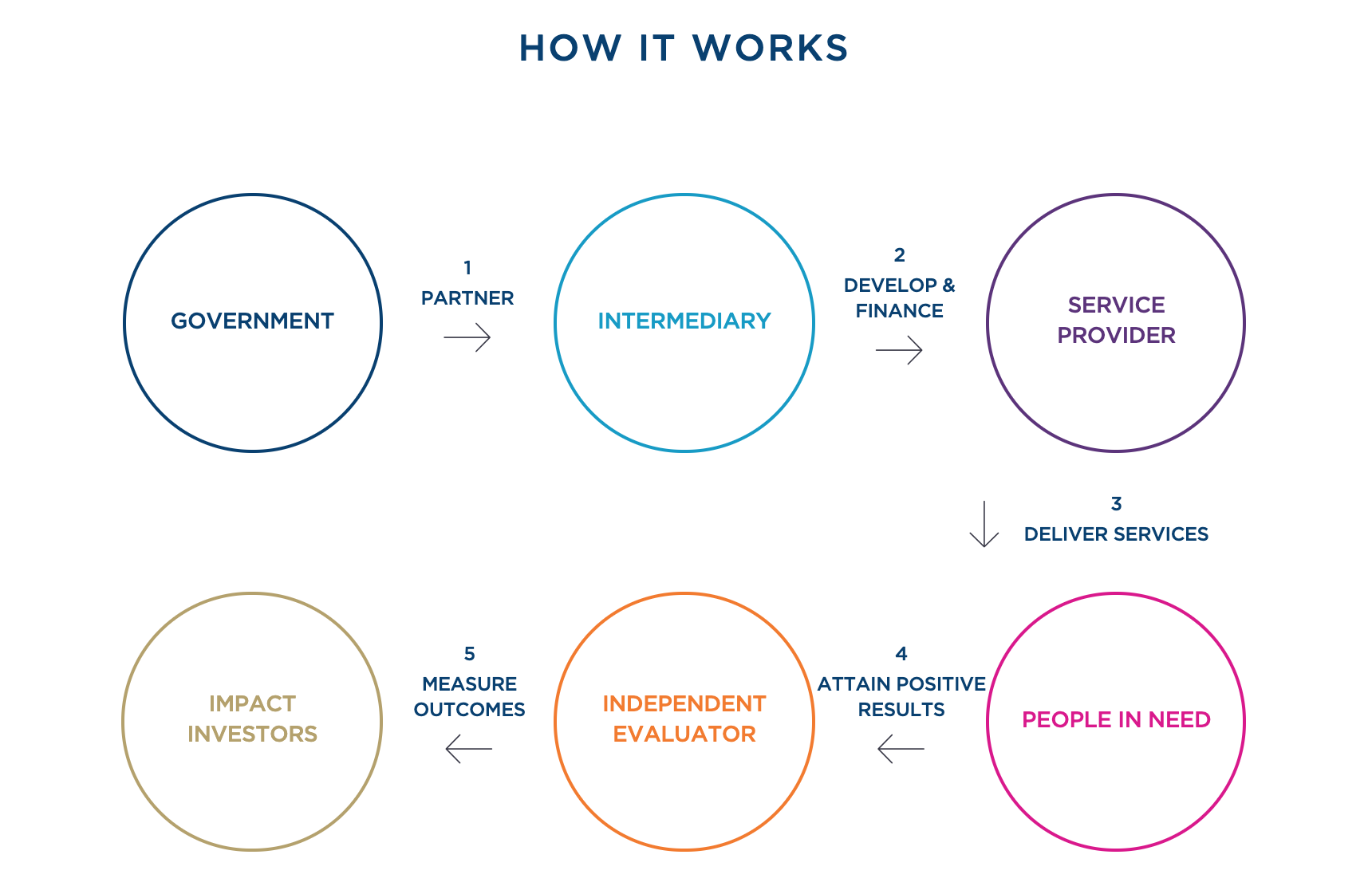

Stakeholders are a group / party that are involved with a company and affect and/or are affected by the company’s action, either directly or indirectly. The main stakeholders for a typical company would include employees, customers, suppliers, and investors like shareholders and creditors. However, as corporate social responsibility has gained traction, the notion has been expanded to encompass communities, trade groups (trade unions and chambers of commerce for example), and governments.

Stakeholders can be of two different types: internal or external. Internal stakeholders are a group / party which are directly involved with a company and its business activities such as employees and investors. External stakeholders are a group / party which are indirectly affected by the company and its business activities and outcomes such as customers, suppliers, communities, and governments, and more broadly the environment and society.

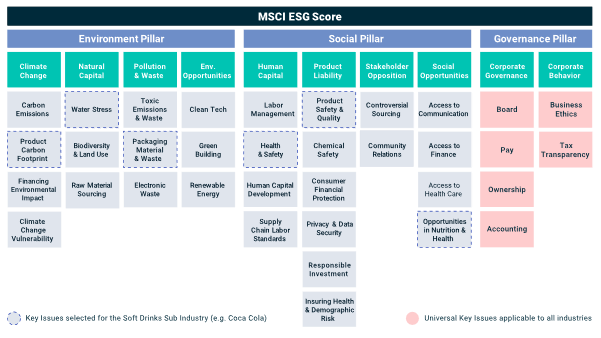

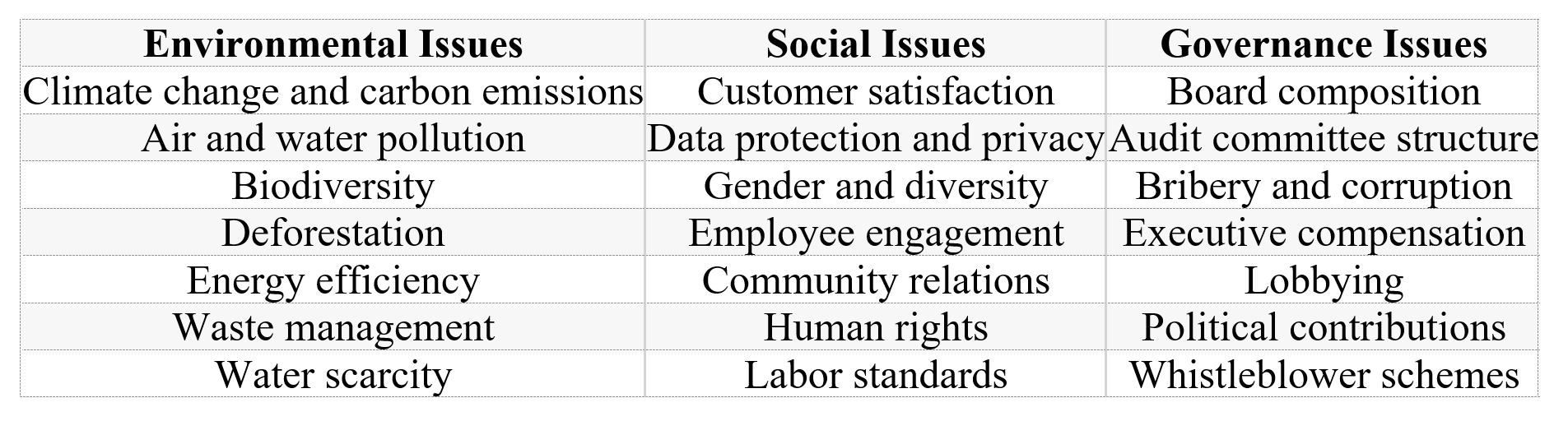

Corporate Social Responsibility

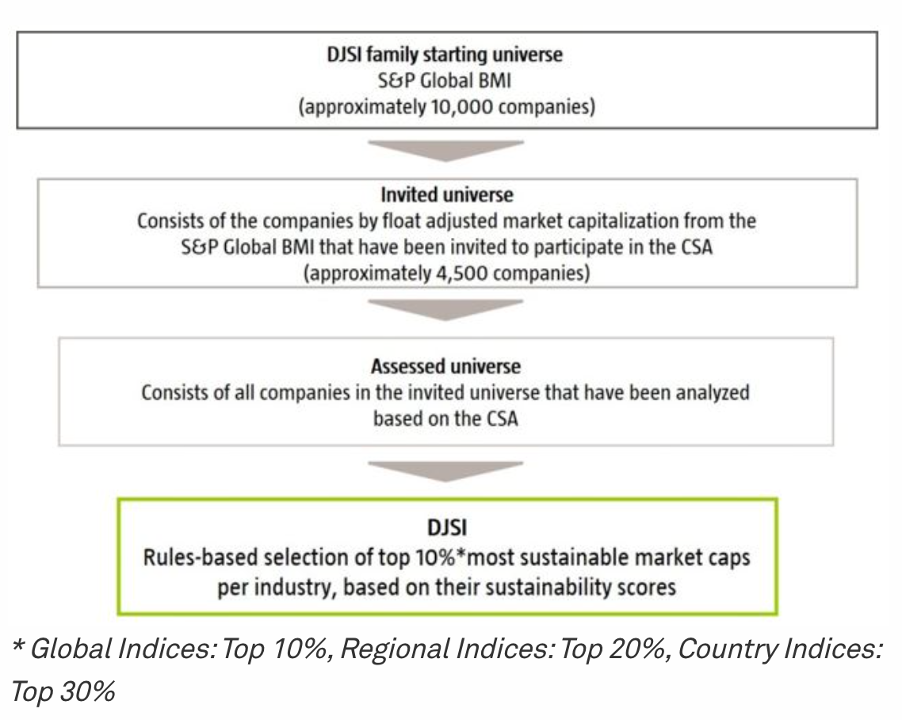

Corporate Social Responsibility (CSR) is a type of self-regulatory business model that enables a company to be socially responsible towards itself, its stakeholders, the public and the environment. Companies can be aware of their impact on all aspects of society, including economic, social, and environmental, by practicing corporate social responsibility. Corporate social responsibility is a broad concept that varies depending on the company and industry. Businesses can benefit society while boosting their brands through CSR programs, corporate philanthropy, and volunteer efforts.

CSR is important for the communities, but it is also important for businesses themselves. Companies and its employees can indulge in CSR activities, that can help to form stronger bonds between the company and its employees. As a result, it can boost morale and make both employees and employers feel more connected to each other and the world around them.

Mission Statement

A mission statement explains company’s purpose of existence. A mission statement defines the company’s values, ethics, culture, goals, and agenda. In addition to this, a mission statement also entails how each and every component of a mission statement is applicable to the distinction stakeholders of a company including its employees, customers, suppliers, investors, and society at large.

A mission statement includes “What, How & Why” for a company i.e., what a company does, how it does it, and why it does it. It can be used by various stakeholders to assess if a company’s values and goals align with their own or not.

A mission statement would be unique and distinct for every company. A few examples of mission statement by popular companies are mentioned below:

- Tesla: To accelerate the world’s transition to sustainable energy.

- JP Morgan: To be the best financial services company in the world.

- Starbucks: To inspire and nurture the human spirit—one person, one cup, and one neighbourhood at a time.

- Nike: To expand human potential by creating ground-breaking sport innovations, by making our products more sustainably, by building a creative and diverse global team and by making a positive impact in communities where we live and work.

Related Posts On The SimTrade Blog

▶ Anant JAIN Analysis Of “The Social Responsibility Of Business Is To Create Value For Stakeholders” Article By Freeman And Elms

▶ Anant JAIN Stakeholder

▶ Anant JAIN Shareholder

▶ Anant JAIN Mission Statement

▶ Anant JAIN Writing A Mission Statement

Useful Resources

Freeman E., H. Elms, 2018, The Social Responsibility of Business Is to Create Value for Stakeholders, MIT Sloan Management Review, 17/12/2020.

Jack Welch (2009) Welch condemns share price focus Financial Times.

About The Author

The article was written in August 2024 by Anant JAIN (ESSEC Business School, Grande Ecole – Master in Management, 2019-2022).

▶ Read all articles by Anant JAIN.