Environmental, Social & Governance (ESG) Criteria

In this article, Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) talks about Environmental, Social & Governance (ESG) criteria and its individual components.

Introduction

Environmental, social, and governance (ESG) criteria constitute a framework that helps socially conscious investors to screen potential investments which incorporate their personal values/agendas. The ESG criteria screen companies based on sound environmental practices, healthy social responsibilities and moral governance initiatives into their corporate policies and daily operations.

Environmental criteria analyze how an organization performs as an agent of nature. Social criteria examine how it manages relations with employees, suppliers, customers, and the communities where it operates. Governance criteria deal with a companies’ audits, taxation, and firm management (composition of boards, shareholder rights, etc.).

There has been a rise in social investing, particularly by the younger section of the potential investors such as millennials and Gen-Z. As a result, financial products (exchange-traded funds for example) following the ESG criteria appeared. According to the report from US SIF Foundation, “there has been an increase in the assets chosen by ESG criteria from $8.1 trillion in 2016 to $11.6 trillion in 2018.”

Components of ESG

ESG criteria provide investors insight into a company’s adherence (or lack of adherence) to ethical practices. The three components of ESG criteria are defined as follows:

Environmental Criteria

These criteria measure a company’s impact on the environment and its ability to alleviate potential risks that could harm the environment in the future. It includes issues such as a company’s energy use, waste, pollution, natural resource conservation, and treatment of animals.

Social Criteria

These criteria assess a company’s relations with other businesses, its standing in the local community, its commitment to diversity and incorporation among its workforce and board of directors, its charitable contributions, and whether it practices employee policies that foster health and safety.

Governance Criteria

These criteria assess a company’s internal processes, such as transparent accounting systems, executive compensation and board composition, and its relations with employees and stakeholders.

Types of ESG Criteria

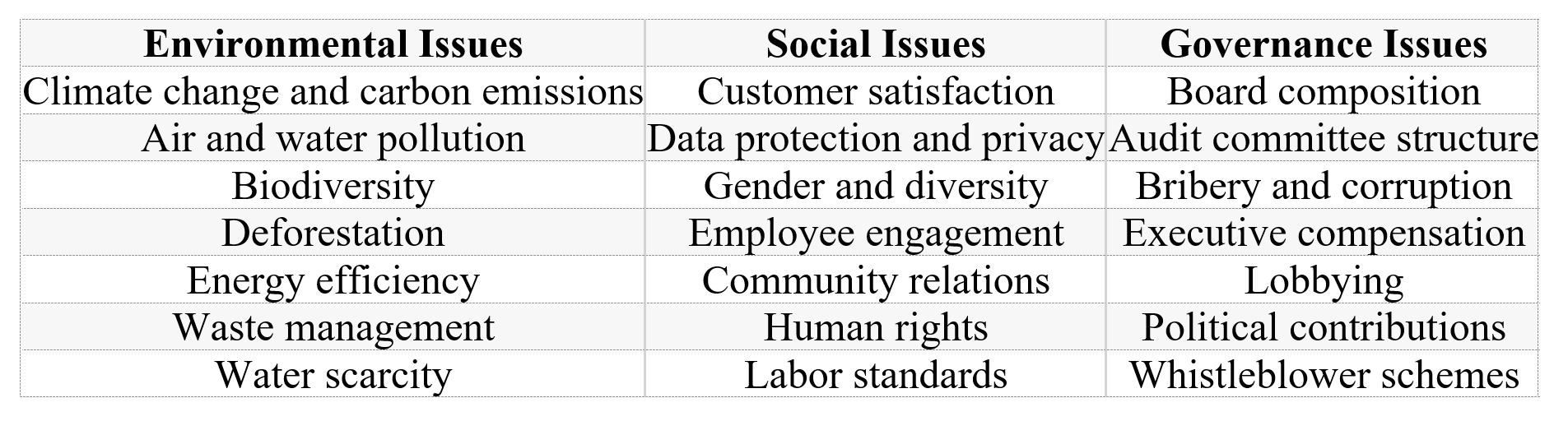

The table below provides the different types of issues mentioned by the CFA institute for each criterion of the ESG component. They are as follows:

Table 1. ESG components.

Source: MSCI.

Why is ESG Growth Accelerating?

Global sustainability challenges such as natural disasters, privacy and data security, and changes in demographics are introducing new risk factors for investors that may not have been seen previously. As companies face rising complexity at a global level, investors may re-evaluate traditional investment approaches. The demand for ESG criteria is increasing for the following reasons:

1. The world is transforming

Global issues, such as climate risk, increased regulatory pressures, social and demographic changes, and privacy concerns, represent new or increasing risks for investors. Companies face increasing complexities and more significant analysis if they do not adequately manage their ESG aspects.

2. A new era of investors

Millennial investors actively want to contribute back to society leading to rapid growth in ESG investment. In a 2018 survey, Bank of America Merrill Lynch said that “they could conservatively estimate $20 trillion of assets growth in U.S. ESG funds alone in the next two decades.”

3. Advancing technology

Advanced technology, including artificial intelligence (AI) and alternative data extraction techniques, reduces the dependency on voluntary disclosure from organizations. Machine learning and natural language processing are helping increase the timeliness and precision of data collection, interpretation and validation to deliver dynamic content and financially relevant ESG insights.

Working of ESG Criteria

To evaluate a company based on ESG criteria, financial investors look at a broad range of factors. They mainly follow any or all of the three criteria: Environment, Social, and Governance.

It is unlikely for a company to pass all the tests in every category. Therefore, investors need to prioritize their personal agendas that align with the ESG criteria. At a pragmatic level, investment firms that follow ESG criteria must also set priorities. For example, as of March 2020, Trillium Asset Management, with $2.8 billion under management, uses various ESG factors to help identify companies positioned for strong long-term performance. Trillium’s ESG criteria include avoiding companies with known exhibition to coal mining, nuclear power or weapons. It also avoids investing in companies with disputes related to workplace discrimination, corporate governance, and animal welfare, among other issues.

Conclusion

Earlier, only rating agencies specializing in sustainability paid attention to ESG criteria and similar concepts, with some dependency on information from the sector of the analyzed company. These agencies would collect information from the sustainability or CSR teams and provide their customers with their assessments.

In recent years, a rise in the interest of climate and social issues has led some of the most significant asset management companies to create specialized teams, developing internal methodologies to assign sustainable ratings. It is especially true with passive management funds (like Vanguard, State Street, BlackRock) and some active management funds.

As a result, in the year 2020, there was a striking increment in analysis and demand for information on environmental and social issues from investors.

Related posts on the SimTrade blog

▶ Anant JAIN Impact Investing

▶ Anant JAIN Socially Responsible Investing

▶ Anant JAIN MSCI ESG Ratings

Useful resources

The Bank of America Merrill Lynch Global Research Issues

About the author

The article was written in July 2021 by Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).

4 thoughts on “Environmental, Social & Governance (ESG) Criteria”

Comments are closed.