Social Impact Bonds

In this article, Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) talks about Social Impact Bonds.

Introduction

Social impact bonds (also known as a social benefit goods or social bonds) are one-of-a-kind public-private partnerships that use performance-based contracts to fund effective social services. They are a type of financial security that provides capital to the government to fund projects that improve social outcomes while saving money. Impact investors provide capital to help high-quality service providers scale their operations. If and when the project achieves outcomes that generate public value, the government repays those investors.

Social impact bonds transfer the risk from the public sector to the private sector and further align project partners on the achievement of meaningful impact projects. For example, these projects can help low-income mothers have healthy births, reduce carbon emission, or support refugees through job training. In 2010, Social Finance UK issued the first ever social impact bond in the market. Over 160 social impact bonds have been issued in 28 countries, with more than 25 in the United States.

Purpose of Social Impact Bonds

The goal of social impact bonds is more than just to make money. The securities are designed to bring together the interests of various entities, such as governments, investors, social enterprises, and the general public, in order to develop effective solutions to public-sector problems.

Despite the fact that these securities are called bonds, they lack many of the characteristics of traditional bonds. Social impact bonds have a fixed term, but investors do not receive a fixed interest rate of return. Instead, the success of the project that was subsidized with the bonds is what determines whether the bonds are repaid or not.

If a project is successful, the government repays the investors by using the savings generated by the project. The investors, on the other hand, receive nothing if the project fails. As a result, social impact bonds carry a high level of risk for investors.

How Does a Social Impact Bond Work?

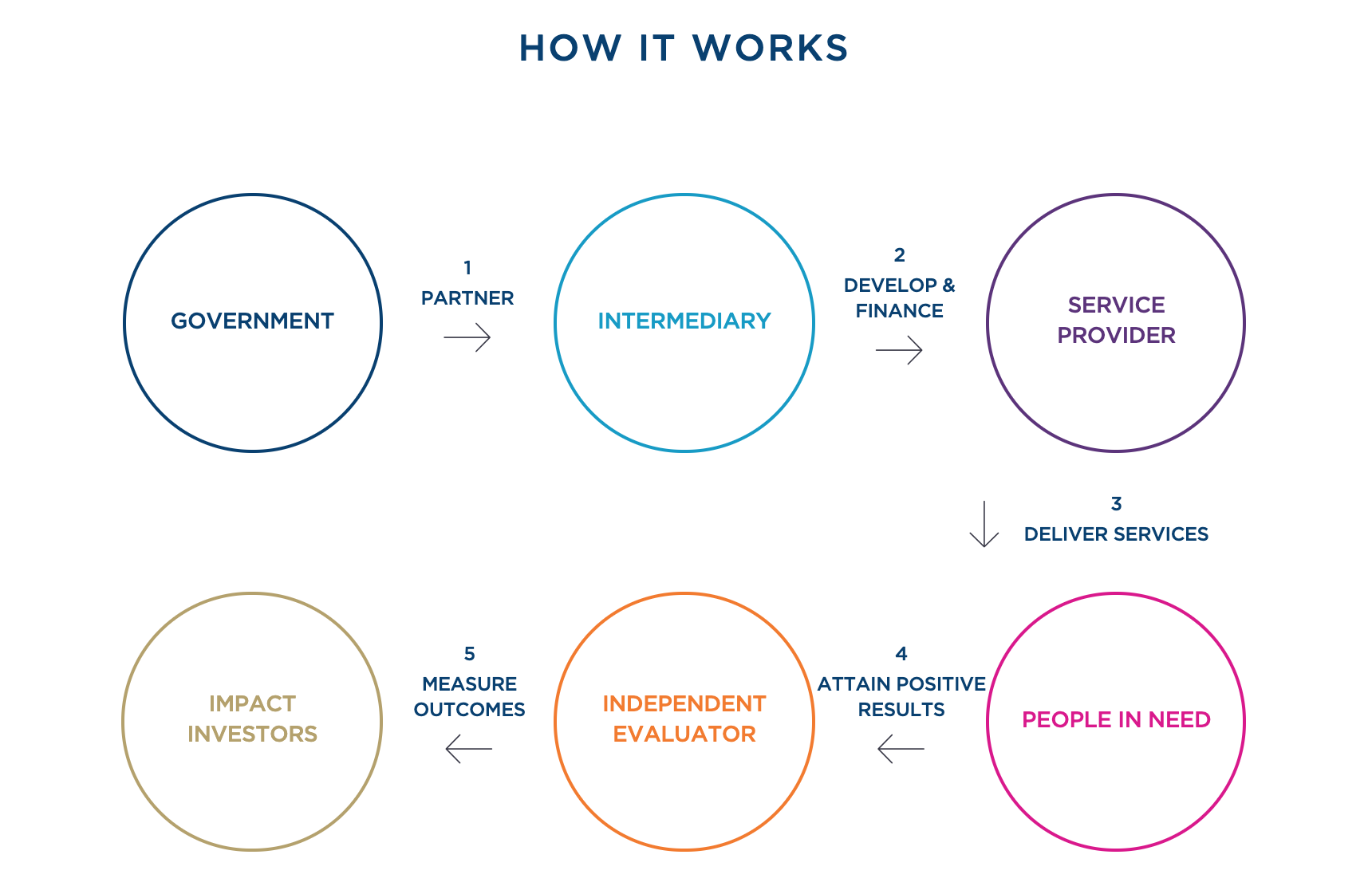

Social impact bonds are often differentiated from other fixed-income securities by the number of key players involved in the capital-raising process. It is further illustrated by Figure 1 and the steps involved are mentioned below.

Figure 1. Social Impact Bond Working Process.

Source: Social Finance, UK .

1. Partner

The government determines the social issue and the goal by working with an intermediary, such as Social Finance, and high-performing service providers (organizations with a track record of success and evidence that their programs work) to achieve its goal.

2. Develop & finance

The project’s design, negotiation, and financial structure are all driven by Social Finance in collaboration with the government and the provider. Then, to provide upfront, flexible funding, the project raises capital from impact investors.

3. Deliver services

With ongoing support from Social Finance, the provider provides services to the target population, including governance oversight, performance management, course corrections, financial management, and investor relations.

4. Attain positive results

People in need can improve their lives by having healthy births, raising kindergarten-ready children, staying out of prison, and finding and keeping good jobs with the help of high-quality services.

5. Measure the outcomes

The impact of the project is measured by an independent evaluator using predetermined outcome metrics. If the project is a success, the government reimburses the project’s backers. The government, on the other hand, only pays based on the level of results achieved.

A Social Impact Bond in Practice

In 2010, the United Kingdom’s Peterborough Prison issued one of the world’s first social impact bonds. The bond raised £5 million from 17 social investors to fund a pilot project aimed at lowering short-term prisoner re-offending rates. Over the course of six years, the relapse or re-conviction rates of Peterborough inmates will be compared to the relapse rates of a control group of inmates.

The Peterborough Social Impact Bond was declared a success by the Ministry of Justice in 2017, with a 9 percent reduction in reoffending of short-sentenced offenders compared to a control group, exceeding the bond’s target of a reduction 7.5 percent. As a result, investors received a yearly return of 3%.

Related posts on the SimTrade blog

Useful resources

Reducing reoffending in Peterborough

About the author

The article was written in May 2022 by Anant JAIN (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).