Why is Apple’s new iPhone 14 release line failing in the first few months?

In this article, Aastha DAS (ESSEC Business School, Bachelor’s in Business Administration, Exchange Student from Northeastern University) discusses events about Apple’s products, their impact on Apple’s share price and the link with market efficiency.

Brief reminder of the facts

On Tuesday October 18th, 2022, Apple stocks saw a downturn after the announcement of the limit of one of its iPhone suppliers for the newly released iPhone 14 Plus due to demand issues.

Figure 1. Event about Apple.

Source: Bloomberg.

With the new release, Apple took a large risk with eliminating certain failing lines like the “mini” model. Within the iPhone 14 range, the largest changes and upgrades were to the “Pro” models in hopes of diversifying its product line while pricing remained consistent in appropriate increases, as done in the past. Unfortunately, this has been highly unsuccessful with many reports revealing how the sales of the “iPhone 14” line have been subpar of expectations.

Impact on company

This is concerning for the company since Apple had increased its sales projections in the few weeks prior to the iPhone 14 family release in September as it does annually and many of its suppliers had already started making preparations for a 7% boost in orders after the release. This incident had direct financial consequences on the company as the stock immediately dropped by $4 from $145. There are mixed reports on consumers’ preferences to buy either the iPhone 14 Plus or iPhone 14 as preferences between the features and affordability of the two vary greatly. It is difficult for the company to gauge the fluctuations in demand, especially as the new iPhone 14 has not been doing as well as anticipated. This can also be attributed to the decrease in global demand because of surging inflation and the impending recession and war in Ukraine. The smartphone market is projected to decrease by 6.5% this year, 2022. Following an official announcement in a press release from Apple, the stock price immediately dropped in regard to the production halt for the iPhone 14 Plus at one of the plants in China. Apple shares fell 3.9% on the New York stock Exchange (NYSE) on Wednesday morning to $145.90. The shares are additionally also down about 18% this year in 2022, compared to a 23% drop in the S&P 500 Index. Still, many professionals state they are not surprised about this due to more preference toward the more premium models of the iPhone 14 family. The share price quickly leveled out but it revealed how volatile the stock is to the market and each decision they make.

Figure 2. Event about Apple.

Source: Google Finance.

Relations to market efficiency

Market efficiency involves a market where the current price of a stock/security quickly reflects information of that security and/or its respective company in a wholly rational manner.

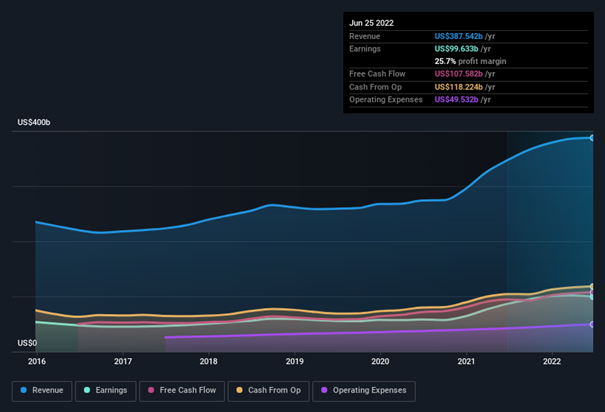

There are many ways to evaluate a market’s efficiency, even as novice market watchers, starting with reevaluating the lag in the time that information is released regarding a security to when it is reflected in the security’s price. The changes in price are usually a product of announcements that are novel and unexpected which can be compared to the press release by Apple to limit the supply chain of its iPhone 14 production as this is uncommon for the company to do, so soon after the company’s fall release, as it does annually. It also relates to a company’s share price in relation to its earnings per share outcomes and the share price growing following the EPS, in an efficient market, as EPS growth reveals positive growth for long-term investors, and it is still optimistic to observe that Apple has managed to grow EPS by 28%/year over the past three years. This restores faith in the stock as though it has proven to be volatile, it regulates itself and has clearly been on the rise in a long-term perspective, revealing sustainable growth. A real positive is seen with Apple’s similar EBIT margins to 2021 as revenue grew by 12% to $388B USD.

At this point in time, the Apple security can be seen as semi-strong efficiency. This can be attributed to how public Apple is with there being much historical market data and public information like company accounts, hundreds of reports on the renowned company which regularly are reflected in the company’s stock price.

Figure 3. Apple financial statistics.

Source: Forbes Digital Covers.

Why did I choose this event?

I chose this event as a financial event of Apple’s stock taking a downturn dip because it reveals much about the smartphone and personal electronics market despite being a quite small event in the trajectory of its iPhone releases. This shows how smartphones will also suffer from raising inflation and the Ukrainian-Russia war despite popular demand and so-called need for smartphones like the iPhone. I am also an avid consumer of Apple products and find it interesting how emotional many stakeholders are based on how they react to even the smallest aspects of its product line. It reveals how despite the rationality of the market being beneficial, human beings chose to act on fear and precautionary measures to ensure that they will be safer rather than opting in favor of risk, within reason.

Why should you be interested in this topic?

There are many reasons why it is important to stay on top of the regular markets and this article discusses a company which is regularly changing in the markets. As a SimTrade student, or anyone interested in financial markets, market efficiency is a key aspect to refer to when making financial decisions and trading. It is worthwhile to consider companies with strong efficiency and those which do not, allowing a broader outlook into how they might function. It is necessary to see if there is a possibility of beating the market because any information available to a trader is already involved in the market price so it is difficult to beat it for the higher returns.

Useful resources

SimTrade course Market information

Yahoo! Finance (October 25, 2022) Here’s Why We Think Apple (NASDAQ:AAPL) Is Well Worth Watching

Apple Newsroom (November 6, 2022) Update on supply of iPhone 14 Pro and iPhone 14 Pro Max

Bloomberg (September 28, 2022) Apple Ditches iPhone Production Increase After Demand Falters

Related posts on the SimTrade blog

▶ Aamey MEHTA Market efficiency: the case study of Yes bank in India

▶ Henri VANDECASTEELE inancial markets are not accounting enough for the Ukraine-Russia conflict

About the author

The article was written in December 2022 by Aastha DAS (ESSEC Business School, Bachelor’s in Business Administration, Exchange Student from Northeastern University).