In this article, Iris ORHAND (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2026) shares her professional experience as a Junior Financial Auditor at Ernst & Young.

About the company

EY (Ernst & Young) is one of the “Big Four” professional services firms, supporting companies across audit, consulting, strategy, tax, and transactions. In audit, EY’s mission is to provide reasonable assurance on financial statements, bringing together financial analysis, an understanding of risks, internal control review, and clear, structured documentation to back audit opinions and reinforce stakeholder trust. Today, the firm brings together nearly 400,000 professionals across more than 150 countries and generated around USD 51.2 billion in revenue in its 2024 fiscal year.

Logo of EY

Source: the company.

My internship

In 2024, I joined EY in Paris La Défense as a Junior Financial Auditor on a 12-month apprenticeship. This experience gave me hands-on exposure to the audit cycle, from planning to fieldwork to final deliverables, and helped me understand how auditors balance technical rigor, deadlines, and client interaction.

My missions

Over the year, I worked on the financial analysis of seven companies, ranging from €10 million to €1.5 billion in revenue. I was part of a business unit focused on associations and the public sector, which allowed me to discover organizations with very different missions and financial setups. My largest and longest engagement was with Universal, where I really had the chance to follow a full audit cycle and understand how such a large structure operates. On a daily basis, I reviewed financial statements like the P&L, balance sheet and cash flow, identified unusual trends, dug into variances, and tried to understand the story behind the numbers. I also prepared financial analyses and draft audit conclusions for internal teams as well as for client discussions.

Even though my main focus was on the non-profit and public sector, EY gives motivated juniors the chance to work with other business units from time to time, and I really wanted to take advantage of that. Thanks to this, I was able to join a mission in the defense sector for Thalès, which was a completely different environment and pushed me to adapt quickly and broaden my understanding of industry specific risks.

Throughout the year, I relied a lot on audit tools and automation, using audit software, macros and advanced Excel to structure testing, make our work more traceable, and gain efficiency during busy periods. I was also involved in internal control assessments and risk management topics, which helped me understand how processes and day to day workflows can directly impact the reliability of financial reporting. I also participated in reviewing management forecasts, comparing them with historical results, challenging assumptions and pointing out areas where further evidence was needed. Overall, this experience helped me build a strong analytical mindset and gave me a much clearer view of how different types of organizations operate behind their financial statements.

Required skills and knowledge

This role required a combination of both hard and soft skills, and I quickly realized how important it was to balance the two. On the technical side, I relied a lot on advanced Excel, basic automation and macro logic, and a structured approach to financial analysis. A solid understanding of accounting fundamentals was essential, as well as developing strong documentation habits to keep our work clear, traceable, and easy for reviewers to follow. But beyond the technical knowledge, soft skills mattered just as much, if not more. Attention to detail was key, as was maintaining a sense of professional skepticism without falling into mistrust. Clear and calm communication helped a lot, especially when dealing with tight deadlines or last-minute requests during busy periods. I also learned how important it is to be pedagogical and professional with clients. Sometimes, audit questions can make clients feel like they are being challenged or judged, even when that’s not the intention. Taking the time to explain why we need certain information, reassuring them, and keeping the conversation constructive made the whole process smoother and helped build trust. Overall, this mix of technical rigor and human sensitivity was at the core of the role.

What I learned

This apprenticeship strengthened my ability to turn raw financial data into meaningful audit insights. Over time, I became much more comfortable linking business reality to accounting outcomes, understanding why a number moved, what it implied, and what kind of evidence was needed to support it. I also learned to think with a risk-based mindset, focusing my attention on the areas that had the greatest impact on the reliability of the financial statements. Finally, working under tight deadlines taught me how to stay organized and efficient while still maintaining high quality standards and keeping my work clear and ready for review. This combination of technical understanding, prioritization, and discipline is something I really developed throughout the year.

Financial concepts related to my internship

I present below three financial concepts related to my internship: financial statement analysis, internal control and audit risk, and forecasts, assumptions and professional skepticism.

Financial statement analysis

Audit work involves understanding not only the numbers, but also the story behind them and the operational reality that drives financial performance. Financial statement analysis played a central role throughout my apprenticeship. Trend analysis, ratio analysis, and variance explanations were essential tools to detect anomalies, identify risks, and guide the direction of our testing. By comparing periods, analyzing shifts in key indicators, and questioning unusual movements, I learned to form a more accurate picture of how an organisation truly operates.

This analytical process goes far beyond reading figures. It requires understanding the client’s business model, the context behind certain decisions, and the internal processes that ultimately shape the financial statements. Through this approach, I learned to prioritize the most sensitive areas, challenge assumptions that did not align with expectations, and connect accounting outcomes to the real functioning of the organisation. This ability to translate raw numbers into meaningful insights became one of the most valuable skills I developed during the apprenticeship.

Internal control and audit risk

Internal control quality plays a key role in shaping audit strategy. Throughout my apprenticeship, I saw how understanding a client’s processes, identifying where the risks lie, and evaluating the controls in place helps determine the likelihood of misstatements. When controls are strong and consistently applied, the risk is lower, which allows auditors to adjust their testing. When controls are weak or not operating as intended, the audit must be more detailed and rely on additional evidence.

In practice, this involved mapping processes, speaking with client teams, and observing how transactions were handled on a daily basis. It also required professional judgment to identify the areas where real vulnerabilities might exist. This experience helped me understand how internal control and audit risk are linked, and how this relationship influences the entire audit approach.

Forecasts, assumptions and professional skepticism

Comparing forecasts with historical figures is a practical way to assess the reasonableness of management’s assumptions, whether they relate to growth, margins, or cash generation. This exercise helps identify when projections are aligned with past performance and market dynamics, and when they seem overly optimistic or require stronger supporting evidence. It is also a direct application of professional skepticism, since the auditor must question the logic behind the assumptions without falling into mistrust. Over time, this analysis strengthens judgment and helps determine what is reasonable, what needs to be challenged, and where additional documentation or explanations are necessary.

Why should I be interested in this post?

This experience is especially valuable for anyone interested in audit, accounting, corporate finance, risk, or advisory. It gave me a strong understanding of financial statements, but also taught me discipline, structure, and a more analytical way of thinking. Throughout the year, I learned how to interpret numbers in a real-life context, how to stay organised under pressure, and how to communicate clearly with both clients and team members. What I liked is that these skills are not limited to audit. They can be applied in many areas such as transaction services, FP&A, or even banking. Being able to analyze financial data, understand risks, and form a well-reasoned judgment is useful in almost any finance role, which makes this apprenticeship a great foundation for whatever comes next in a finance-related career.

Related posts on the SimTrade blog

Professional experiences

▶ Posts about Professional experiences

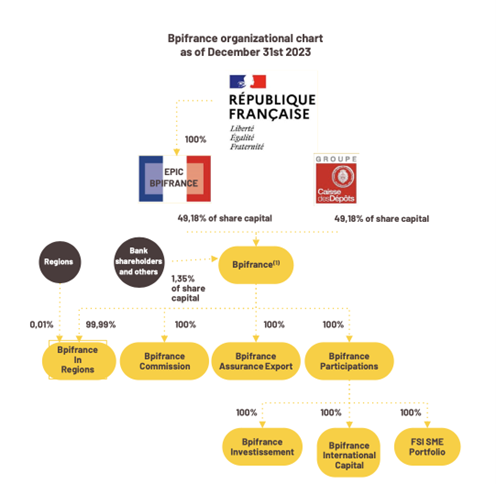

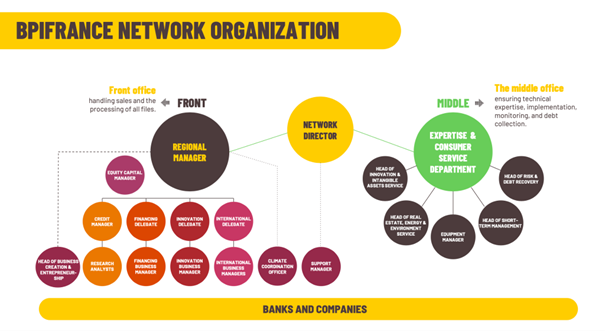

▶ Iris ORHAND My apprenticeship experience as an Executive Assistant in Internal Audit (Inspection Générale) at Bpifrance

▶ Annie YEUNG My Audit Summer Internship experience at KPMG

▶ Mahé FERRET My internship at NAOS – Internal Audit and Control

Financial techniques

▶ Federico MARTINETTO Automation in Audit

Useful resources

L’Expert-comptable.com La méthodologie d’audit : Les assertions

Wikipedia EY (entreprise)

Wikipedia Big Four (audit et conseil)

About the author

The article was written in December 2025 by Iris ORHAND (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2021-2026).

▶ Read all articles by Iris ORHAND