In this article, Maxime PIOUX (ESSEC Business School, Global Bachelor in Business Administration (GBBA) – 2022-2026) explains the importance of international accounting standards and highlights the key differences that finance and business students should be aware of.

Why International Accounting Standards

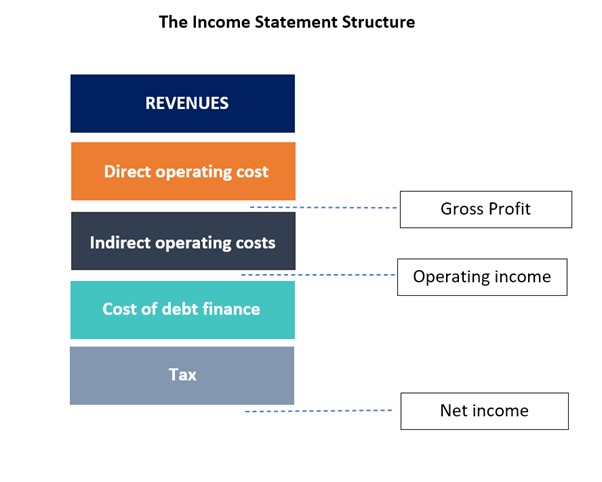

Financial statements are the primary source of information used by investors, managers, and other stakeholders to assess a company’s financial position and performance. However, without common accounting rules, it would be difficult to compare the results of two companies operating in different countries and industries. International accounting standards were developed to address this challenge.

In a context of globalization in financial markets, international accounting standards aim to harmonize accounting practices in order to ensure better comparability between companies regardless of their country or sector. These rules also play a key role in financial transparency. By defining how transactions should be recorded, measured, and presented, they enhance transparency and reduce information asymmetries (situations in which some parties, such as investors, have less information than others about a company’s actual financial situation).

Finally, international accounting standards help improve the quality of financial reporting by imposing disclosure requirements in the financial statements and their notes. These guidelines therefore provide more reliable and consistent financial information, facilitating economic decision-making and strengthening market confidence, as highlighted by Richard Grasso, former Chairman of the NYSE (New York Stock Exchange, the main American stock exchange), “It should strengthen investors’ confidence. This is done through transparency, high quality financial reports, and a standardized economic market.”

IAS: First International Accounting Standards and reference framework

The first international accounting standards to emerge were the IAS (International Accounting Standards), developed from 1973 by the International Accounting Standards Committee (IASC). This international organisation, composed of representatives from multiple countries, was responsible for developing accounting rules applicable worldwide by proposing a common accounting framework.

The IAS were created to meet the needs of investors and markets for reliable, transparent, and consistent information. They cover numerous areas and provide detailed rules on how to account for and present financial transactions and events. Initially, they primarily concerned multinational companies and listed entities seeking to publish financial statements comparable internationally. At the beginning, their application was often voluntary, but some jurisdictions gradually required their adoption.

IFRS: the emergence of a modern international accounting framework

In 2001, the International Accounting Standards Board (IASB) replaced the IASC, representing a significant shift with the former committee. While the IASC focused mainly on developing voluntary standards to harmonize accounting practices, the IASB introduced a more structured, rigorous, and coherent framework, with a mission to supervise and continuously develop international standards in order to strengthen their adoption and credibility worldwide. The IFRS (International Financial Reporting Standards) were born from this process. Their primary objective is similar to that of the IAS: to improve the reliability and comparability of financial statements. However, IFRS go further by imposing a uniform framework with precise principles. They aim to provide a single accounting reference, ensuring that all relevant companies present their financial transactions and events transparently and in a standardized way.

Today, IFRS apply to a wide range of companies, mainly listed and multinational entities, but some countries have adopted them for all companies. In the European Union, for example, all listed companies must prepare their consolidated financial statements according to IFRS, while in other countries, such as the United States, IFRS may be applied voluntarily or for certain subsidiaries of international groups.

To better understand the purpose of IFRS, it is useful to remember three fundamental principles these standards adhere to:

- Completeness: Financial statements must reflect the company’s entire activity and limit off-balance-sheet information.

- Comparability: Financial statements are standardized and identical for all companies.

- Neutrality: Standards should not allow companies to manipulate their accounts.

The application of these standards today

Today, IFRS constitute the main framework for international accounting standards, used in 147 countries (98% of European countries and 92% of Middle Eastern countries). Some IAS, developed before 2001, continue to apply (such as IAS 1 on the presentation of financial statements) as long as they have not been replaced by an equivalent IFRS.

In France, the application of IFRS is mandatory for all listed companies, particularly for the preparation of their consolidated financial statements. Large unlisted companies and certain mid-sized enterprises can also choose to apply them in order to harmonize their international reporting, although this is not compulsory. In contrast, SMEs remain largely subject to the French General Accounting Plan (PCG “Plan Comptable Général”), which provides simplified rules suited to their size and structure.

Impact of IFRS

The impacts of IFRS on companies have been numerous and have varied by industry. However, overall, these impacts have remained relatively limited. For instance, according to a FinHarmony study on the transition to IFRS, the equity of CAC 40 companies changed by only 1.5%.

Three IFRS standards that have led to significant changes in corporate accounting are presented below.

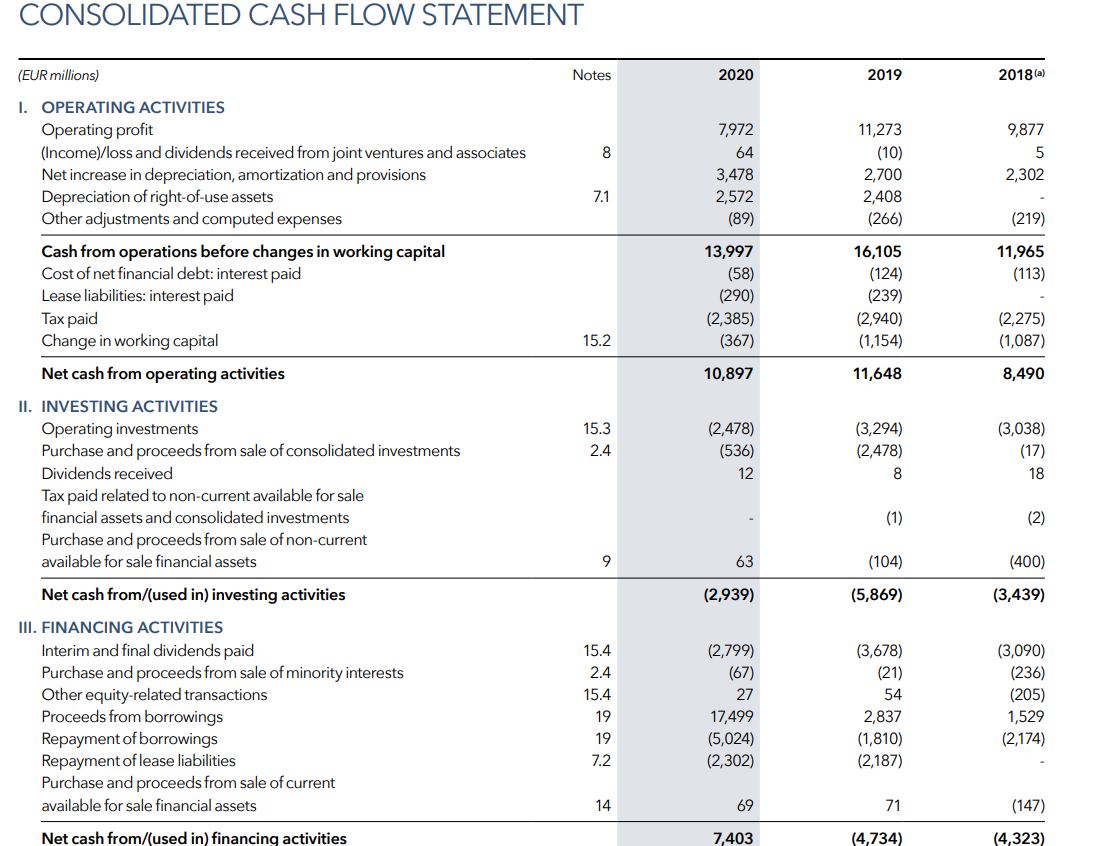

IFRS 16: Leases in the Balance Sheet

Before the introduction of IFRS 16 in January 2019, the accounting treatment of leases was governed by IAS 17 (leases). This standard distinguished between two types of leases:

- Finance leases, for example when a company leases a machine with a purchase option, for which the company recognized an asset corresponding to the leased item and a liability corresponding to future lease payments.

- Operating leases, for example when a company rents office space, which were recorded as expenses in the income statement and remained off-balance-sheet.

With IFRS 16, this distinction disappears for most leases: now, all leases must be recognized in the balance sheet as a “right-of-use” asset and a lease liability. The only exceptions are short-term leases (less than 12 months) or leases of low-value assets (less than 5,000 USD). This reform aims to improve the transparency and comparability of financial statements by reflecting all lease obligations on the balance sheet.

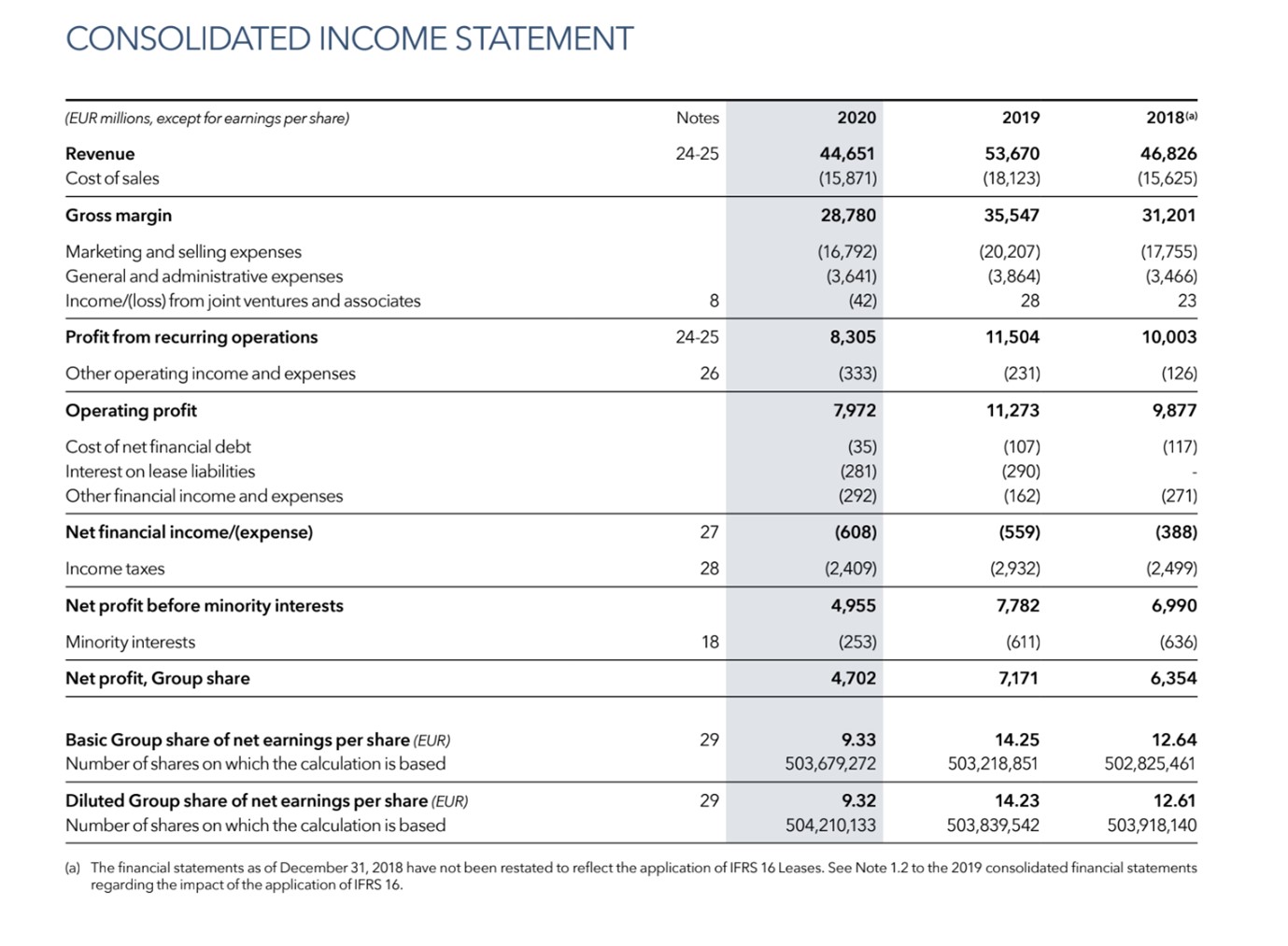

As a result, companies with numerous operating leases, such as retail chains or airlines, have seen their assets and liabilities increase significantly, thereby affecting certain financial ratios and indicators (such as debt-to-assets or EBITDA).

Let’s take the example of an airline that leases 10 aircraft under operating lease contracts, with a total annual rent of €10 million over a 10-year period. The company generates revenue of €500 million, an EBITDA of €100 million, and has debt of €250 million.

- Before IFRS 16, these contracts were classified as operating leases, with an annual lease expense of €10 million recorded in the income statement and no recognition on the balance sheet, despite this significant long-term financial commitment.

- With IFRS 16, the company must now recognize a right-of-use asset on the balance sheet (corresponding to the present value of future lease payments) along with a lease liability of the same amount. Assuming a discount rate of 2%, the present value of the lease payments over 10 years is approximately €90 million, recorded as both an asset and a liability.

In the income statement, the lease expense is replaced by depreciation expenses on the right-of-use asset and interest expenses on the lease liability.

The EBITDA, which excludes depreciation and interest, therefore increases to €110 million, compared to €100 million under the previous treatment. The former annual lease expense of €10 million no longer affects EBITDA because it has been replaced by depreciation and interest. However, the apparent leverage increases significantly, as the lease liability rises by €90 million (from €250 million to €340 million). Consequently, the debt-to-EBITDA ratio, for example, moves from 2.5 (250/100) to 3.1 (340/110), which can affect the perception of investors and banks.

This example illustrates that the increase in EBITDA and debt results from a change in accounting standards rather than a real improvement in the company’s economic performance.

IFRS 13: Historical Cost vs Fair Value

A significant change introduced by IFRS 13 in January 2013 concerns the measurement of assets and liabilities. Indeed, under certain IAS and in many national practices, assets were often recorded at historical cost, meaning their original purchase price.

By contrast, IFRS 13 promotes the concept of fair value, which represents the price at which an asset could be sold in a market at the closing date.

Fair value accounting can lead to significant fluctuations in the balance sheet and income statement, particularly for companies holding financial assets, securities, or significant real estate, as it reflects market variations. Companies in sectors such as finance, real estate or hotel industry may thus see their balance sheets and financial ratios change from one period to another, reflecting market realities. However, this approach provides a more realistic and transparent view of the financial situation.

Let’s take the example of a real estate group that owns a portfolio of buildings recorded at a historical cost of €500 million. In other words, the total purchase price of all the group’s buildings amounts to €500 million, whether they were acquired recently or several years ago. The company also has a bank debt of €200 million.

- Before IFRS 13, the buildings were recorded under “property, plant, and equipment” in non-current assets at their historical cost of €500 million, regardless of changes in the real estate market. Equity and financial ratios therefore reflected this fixed value, without taking market fluctuations into account.

- With the application of fair value as defined by IFRS 13, buildings are now valued at their market value at the reporting date. This fair value corresponds to the price at which the asset could be sold under normal market conditions and is generally estimated using real estate appraisals or comparable transactions.

Let’s assume that the current market value of the portfolio is €600 million. The balance sheet increases by €100 million in assets and equity. In practice, this revaluation directly affects certain financial ratios. For example, the debt-to-equity ratio decreases from 0.4 (200/500) to 0.33 (200/600). Investors and banks then perceive the company as less leveraged and with a larger asset base, even though the company’s actual operating activity has not changed.

By contrast, if the market value drops to €400 million, equity decreases by €100 million, and the debt-to-equity ratio rises from 0.4 to 0.5 (200/400), which could negatively affect the perceived risk of the company.

This example illustrates that fair value accounting more accurately reflects the current economic situation of assets, but leads to visible fluctuations in the balance sheet and financial ratios.

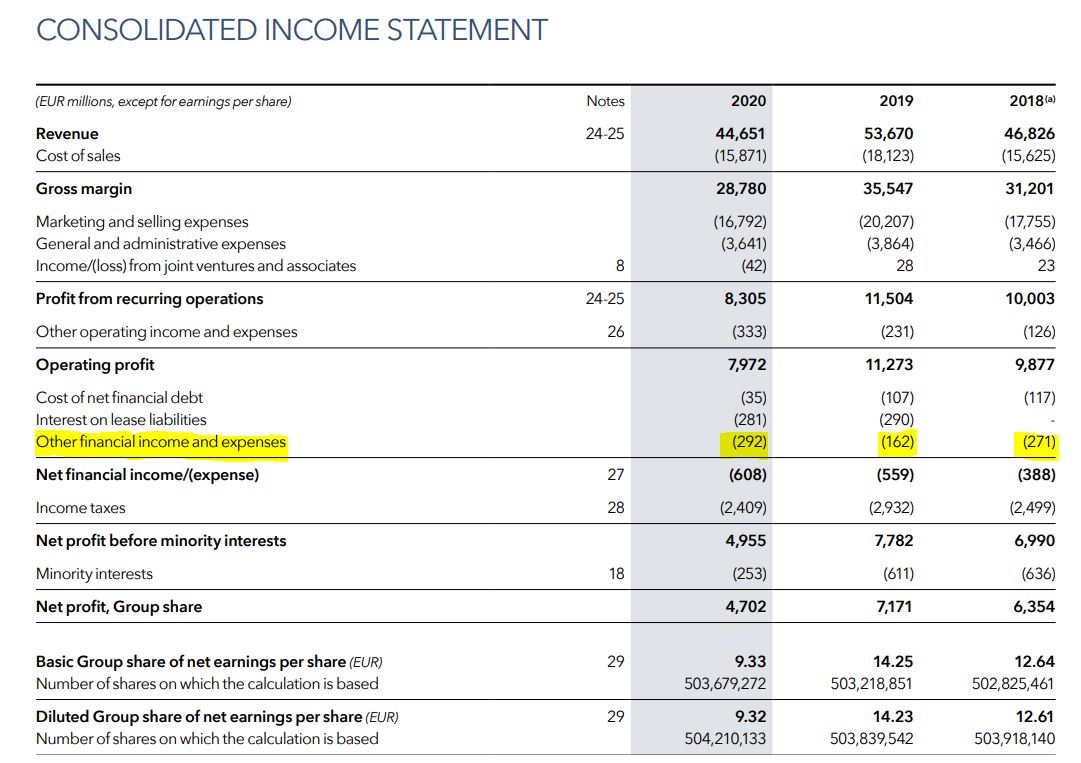

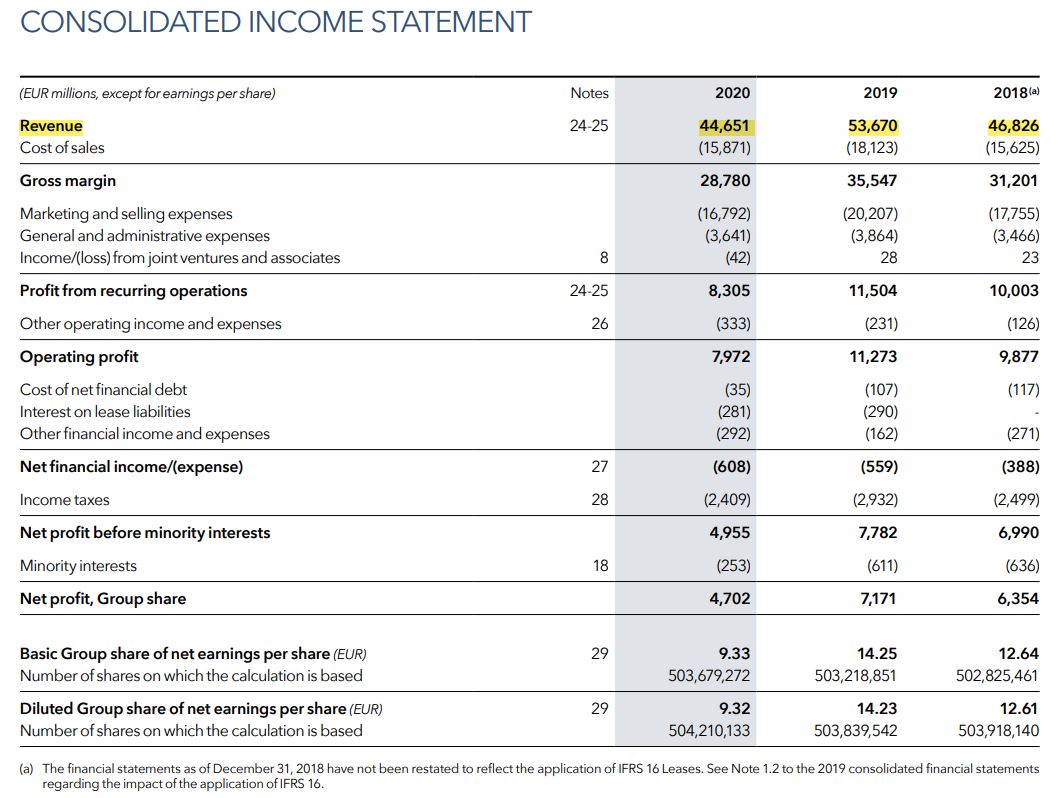

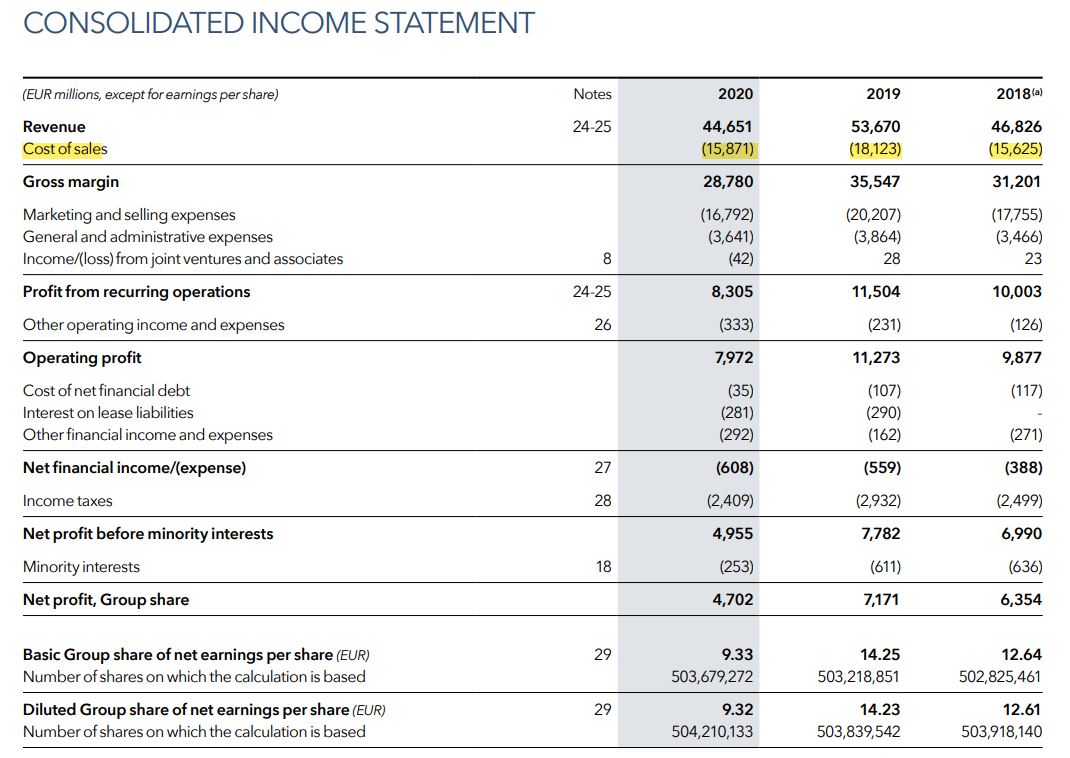

IFRS 15: Revenue from Contracts with Customers

IFRS 15, which came into effect in January 2018, replaced IAS 18 (Revenue) and IAS 11 (Construction Contracts), introducing a single and standardized approach to revenue recognition.

Before IFRS 15, revenue was recognized differently depending on its nature:

- Under IAS 18, revenue from goods was recognized at delivery, and revenue from services was recognized at the time they were performed.

- Under IAS 11, revenue from construction contracts was recognized over time based on the percentage of completion of the project.

With IFRS 15, revenue recognition is based on a single principle: the transfer of control of the good or service to the customer, regardless of physical delivery. In other words, revenue is recognized when the customer obtains control of the good or service. In practical terms, this means:

- For goods sold, revenue is recognized when the customer can use the item and benefit economically from it.

- For services (subscriptions or IT services for instance), revenue is recognized progressively as the service is provided, in proportion to the progress or consumption by the customer, rather than at the end of the contract or at invoicing.

- For construction contracts, revenue is allocated to each stage of the contract as the customer gains control of the corresponding performance.

This approach standardizes revenue treatment across all sectors and reduces discrepancies between companies and countries. IFRS 15 has changed the way companies record revenue in the income statement. Some transactions must now be spread over time, while others can be recognized more quickly, depending on when the customer obtains control of the good or service. The most affected sectors are construction, technology, telecommunications, and services. This standard therefore improves comparability and transparency of revenue, enabling investors and financial analysts to better understand a company’s actual economic performance.

Let’s take the example of a construction company that signs a contract to renovate a residential complex for a total amount of €50 million, over a period of 2 years. Let’s suppose the total estimated cost of the project is €20 million.

- Before IFRS 15, revenue recognition could differ depending on the applicable standard: under IAS 11, revenue was generally recognized progressively based on the percentage of completion of the project, but some companies could wait until invoicing or delivery to record revenue. This could lead to divergent practices, for example recognizing revenue too early to artificially improve performance, or on the contrary, postponing revenue to smooth results.

- With IFRS 15, revenue recognition is based on the unique principle of transfer of control to the customer. In practice, this means that the company must recognize revenue as the customer obtains control of the work performed, even if payment has not yet been received.

Let’s assume that, at the end of the first year, 60% of the work is completed and the customer can use this part of the complex: the company will then record €30 million of revenue (60% of the total contract) in its income statement, and the corresponding costs of €12 million (60% of the project costs). The net profit for this part of the project is therefore €18 million (30 – 12).

On the balance sheet, assets increase by €30 million: in cash if the customer has already paid, or in accounts receivable if payment has not yet been received. Equity increases by €18 million, corresponding to the net income from this portion of the project. On the liabilities side, a trade payable of €12 million is recorded, corresponding to costs incurred but not yet paid. This debt will disappear when the company pays its suppliers, reducing cash and maintaining the balance sheet equilibrium.

This approach allows the financial statements to more accurately reflect the economic reality of the contract and makes results more transparent for investors. Without this method, revenue for the first year could have been zero, thus hiding the true performance of the project.

What about US GAAP ?

In addition to IFRS, there are also US GAAP (Generally Accepted Accounting Principles), which constitute the accounting framework used in the United States (US). US GAAP are mandatory for all U.S. listed companies, as IFRS are not permitted for the preparation of financial statements of domestic companies. However, foreign companies listed in the United States may publish their financial statements under IFRS without reconciliation to US GAAP.

US GAAP have existed since 1973 and are developed by the Financial Accounting Standards Board (FASB). They are based on a more rules-based approach, with a much larger volume of standards and interpretations than IFRS, often estimated at several thousand pages (compared with only a few hundred pages for IFRS). This approach reduces the degree of judgment and interpretation but makes the framework more complex.

Why should I be interested in this post?

Understanding the differences between IAS and IFRS standards is essential for any student in finance, accounting, auditing, or corporate finance who wishes to pursue a career in finance. International accounting standards directly influence how companies present their financial performance, measure their assets and liabilities, and communicate with investors. Mastering these concepts makes it easier to read and understand financial statements and to develop a more critical view on a company’s actual performance.

Related posts on the SimTrade blog

▶ Samia DARMELLAH My experience as an accounting assistant at Dafinity

▶ Louis DETALLE A quick review of the accountant job in France

▶ Alessandro MARRAS My professional experience as a financial and accounting assistant at Professional Services

▶ Louis DETALLE A quick review of the Audit job

Useful resources

YouTube IFRS 16

YouTube IFRS 13

YouTube IFRS 15

Academic resources

Colmant B., Michel P., Tondeur H., 2013, Les normes IAS-IFRS : une nouvelle comptabilité financière Pearson.

Raffournier B., 2021, Les normes comptables internationales IFRS, 8th edition, Economica.

Richard J., Colette C., Bensadon D., Jaudet N., 2011, Comptabilité financière : normes IFRS versus normes françaises, Dunod.

André P., Filip A., Marmousez S., 2014, L’impact des normes IFRS sur la relation entre le conservatisme et l’efficacité des politiques d’investissement, Comptabilité Contrôle Audit, Vol.Tome 20 (3), p.101-124

Poincelot E., Chambost I., 2015, L’impact des normes IFRS sur les politiques de couverture des risques financiers : Une étude des groupes côtés en France, Revue française de gestion, Vol.41 (249), p.133-144

About the author

The article was written in February 2026 by Maxime PIOUX (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2022-2026).

▶ Read all articles by Maxime PIOUX.