Eurobonds

This article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) explains Eurobonds traded in financial markets.

Introduction

In financial markets, bonds are debt securities used by issuers to raise capital from investors. In return investors get an interest payment on the principal invested over the life of the bond. The bonds can be issued by governments, municipalities, financial institutions, and companies. The duration of the bonds can cover different time periods.

Eurobonds are a special kind of bonds issued by companies or governments to raise capital from financial markets. These bonds are denominated in a currency different from the currency of the country where they originated. The Eurobonds help issuers to raise capital in a foreign currency and at a lower cost. Let’s take the example of an American company which would like to issue debt in euros to finance its operations in Europe. If it borrows in European markets, it will get a higher interest rate as it is less well known in the foreign markets that in the domestic market. With Eurobonds, the company can benefit from the same level of interest rates as for its domestic bonds, thereby lowering its cost of capital.

These instruments have a medium to long term maturity and are highly liquid in the market. They are traded over the counter (OTC) and the market for Eurobonds is made up of several financial institutions, issuers, investors, government bodies, and brokers. Many brokerages across the world provide trading platforms facilities to investors and borrowers for trading in different kinds of Eurobonds.

Characteristics of Eurobonds

Eurobonds are unsecured instruments and investors demand high yields on these instruments based on the credit ratings of the issuer. The issuer can issue Eurobonds in a foreign currency and a foreign land based on their capital needs. The name of a Eurobond carries the name of the currency in which they are dominated. For example, a French company willing to do business in the United States, can issue a Eurobond in the UK financial market denominated in US dollars which will be called as euro-dollar bond.

A Eurobond should not be confused with a foreign bond issued by an issuer in the foreign market denominated in the local currency of the investor. A Eurobond can be issued in a foreign country and can be denominated in a currency different from the local currency of the issuer. For example, a French company willing to invest in Japan can issue a Euro-yen bond in the US markets denominated in the local currency of Japan.

These bonds are traded electronically on different platforms and can have maturities ranging from 5 years to 30 years. The bonds can have fixed or floating interest rates with semi-annual or annual payments. These bonds have a relatively small face value making it attractive even to small investors.

Benefits of Eurobonds

Eurobonds can serve different benefits to issuers and investors.

Major advantage of Eurobonds for the issuers

- Access to capital at lower rates – Companies can choose countries with lower interest rates to issue Eurobonds, thereby avoiding interest rate risks

- Access to different bond maturities – As Eurobonds can have maturities ranging from 5 years to 30 years, companies can have a wide range of maturities to choose from depending on their requirements

- Access to international markets – By issuing Eurobonds denominated in a different currency, companies can access different markets with more ease with a wide investor base.

Major advantage of Eurobonds for the investors

- Access to international markets – By buying Eurobonds, investors can gain easy access to international markets thereby diversifying their fixed income portfolios.

- Access to different bond maturities – As Eurobonds can have maturities ranging from 5 years to 30 years, borrowers can have a wide range of maturities to choose from depending on their investment profile.

- High liquidity – As the market size for Eurobonds is very large, investors can enjoy higher liquidity and can exit their positions as per their needs.

Example

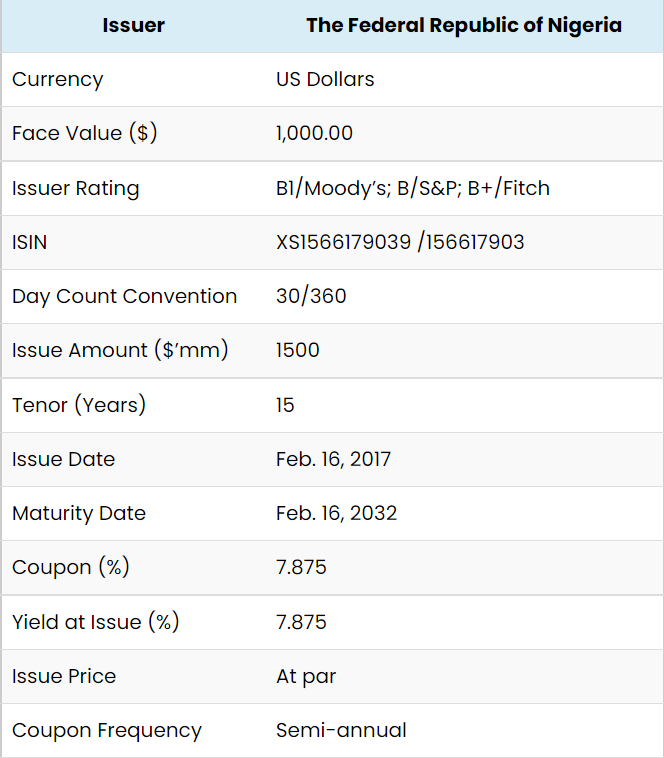

The figure below gives an example of Eurobonds issued by the Federal Republic of Nigeria.

Characteristics of the Eurobonds issuance.

Source: FMDQ.

Related posts

▶ Akshit GUPTA Green bonds

▶ Jayati WALIA Fixed-income products

▶ Jayati WALIA Credit Risk

Useful resources

International Capital Market Association (ICMA) History of Eurobonds

About the author

Article written in March 2022 by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).