In this article, William LONGIN (EDHEC Business School, Global BBA, 2020-2024) shares his experience as a junior financial analyst at ACE Finance et Conseil, which is a wealth management firm specialized in financial investments.

ACE Finance et Conseil

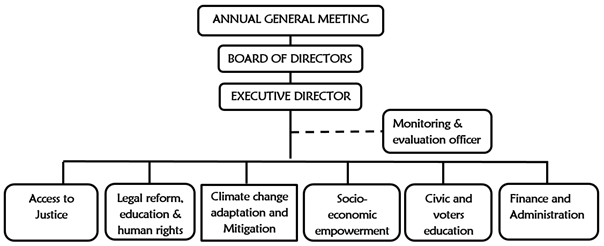

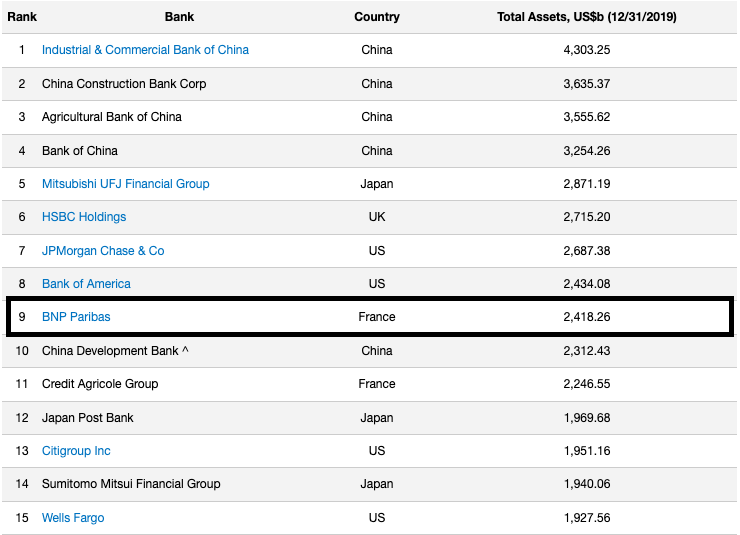

First, let me present ACE Finance et Conseil. It is a wealth management firm created by Gabriel Eschbach in 2002. It is located in Strasbourg in the East of France. ACE Finance et Conseil currently manages a portfolio of 230 clients who are individual investors. The profile of these investors varies in terms of wealth and investment objectives. Most of the clients of ACE Finance et Conseil are living in the East of France, especially in the Strasbourg area. The ambition of the company is to expand its base of clients at the national and even international level.

Logo of ACE Finance et Conseil.

Source: ACE Finance et Conseil.

The founder of the company, Gabriel Eschbach, is a graduate student from the University of Strasbourg. Gabriel also attended a program in wealth management at ESSEC Business School. Building on his past professional experience in large financial institutions and insurance companies, he has developed extensive skills and knowledge on financial markets and asset management.

My personal experience at ACE Finance et Conseil

My job was to find relevant information on the firms of interest for ACE. To find such information, I used the Bloomberg Terminal. Beyond the search of information about companies, I also spent time on building a portfolio based on our current knowledge of the market conditions. During my internship, the stock market was bullish (Summer 2021). ACE’s strategy was to find the most interesting stocks based on the risk level that the firm was willing to take on behalf of its clients.

Bloomberg – Terminal and keyboard

Source: Bloomberg.

My most valuable experience in the firm was to be able to understand the investment philosophy of the firm, which relied on a rigorous analysis of the relationship between risk and (expected) return on the one hand, and on a clear understanding of the investors profile of its clients on the other hand.

Everything is planned! And what I came to realize is that investing has nothing to do with gambling. No technical analysis, no gibberish, only careful analysis of companies through the fundamental analysis of their financial accounts (balance sheet and income statement), financial ratios and company news. As we are unable to predict the future, ACE has an investment philosophy based on the rigorous investment process combining the analysis of the relationship between risk and (expected) return of financial assets and a clear understanding of the risk profile of its clients on the other hand.

The ACE Finance Conseil team.

Source: ACE Finance et Conseil.

Core missions and duties

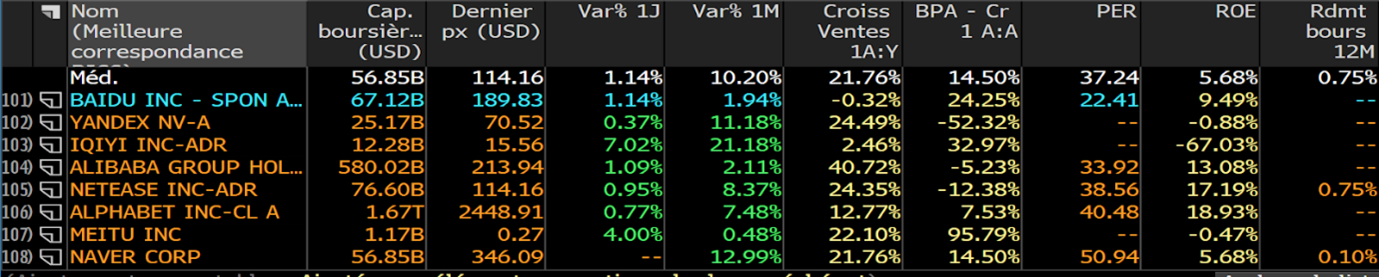

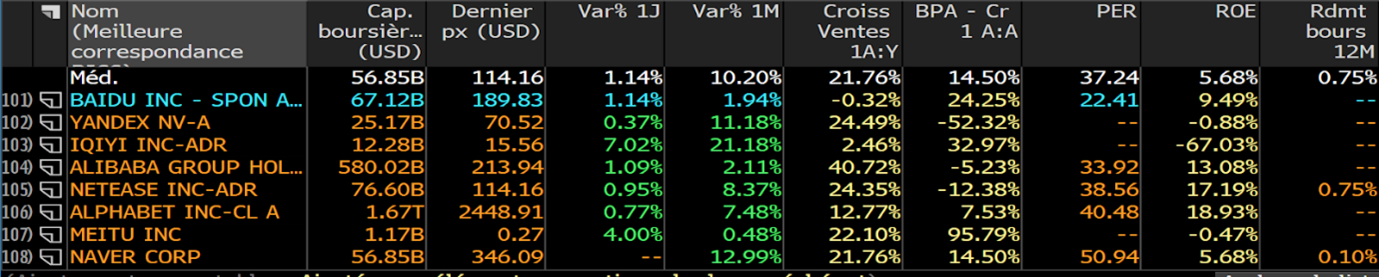

During my internship I had to do research on companies and create short presentations for ACE clients. For example, I prepared presentations on Chinese companies for a new client who was not familiar with the Chinese stock market. The Chinese companies involved were the so-called BATX that stands for Baidu, Alibaba, Tencent and Xiaomi. My presentations’ focus was on Tencent and Alibaba, two companies that stroked our interest at that time. The Bloomberg Terminal gave information about the profits made by each business units of the company, and its future estimates. Unlike other sources of information, Bloomberg standardizes information about the different drivers that generate revenue in a company. This gives an excellent overview of the current state of the company in addition to the existing important financial indicators such as the P/E and EPS ratios, the working capital, and the quick ratio (these financial indicators are defined below).

At ACE everyday was a different day, I had many types of missions. Every morning, I prepared a morning briefing. This allowed me to learn many things on the link between political news and companies. I really enjoyed the diversified aspect in my work, and I hope to find a job where I can thrive the same way I did at ACE Finance et Conseil.

About the skills and knowledge

For this type of internship, the prerequisites were to know how to read financial statements as well as knowing what the key financial indicators are, how they are calculated, and how they can be interpreted. Being able to browse the internet with ease and to be familiar with financial tools like the Bloomberg Terminal were important to be efficient in the job. Have an interest in the geopolitical field was an advantage to be able to interpret the news and extract the important information that would affect the economic world and the value of companies.

At ACE I understood that there is a whole other side to the iceberg, companies that are focused on b2b sales (business to business) that play a major role in the economy. These companies in the shadows are mostly part of a supply chain for major b2c (business to consumer) whose brand is known by the public. b2b businesses rarely make it on to the front pages of mainstream news medias but a lot of information is available on media for investors.

Unfamiliar with the region of the East of France I learned many things on the culture and way of living in an anchored European city. Strasbourg is considered as a capital of Europe as it hosts major European institutions such as the European Parliament and the Council of Europe. Because of its ties to both Germany and France after World War II, Strasbourg served as a symbol of reconciliation between peoples.

Key concepts

I present below some key concepts that are useful to understand the internship that I did at ACE Finance et Conseil.

Asset management

Asset management consists in managing capital in the best way by respecting the level risk decided to be taken by the manager, with respect to an estimated rate of return. The responsibility of asset management’s firm is to know how to invest and manage assets correctly and accurately.

ACE Finance provides private investors with more comprehensive advice as part of their investment advisory services and fully documents discussions. The objective is to create transparency regarding the costs and risks associated with their investments. With ACE, clients can module their portfolios and are able to express their preferences after receiving advise from the firm based on fundamental research.

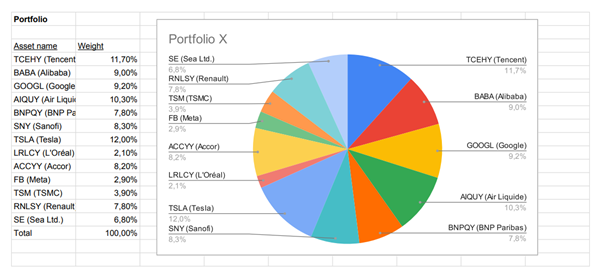

Asset allocation

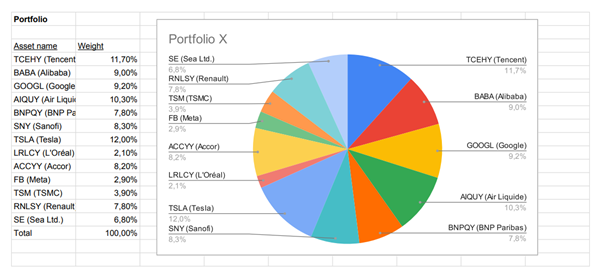

Asset allocation is a step-in asset management which consists in defining the weight to be given to each category of assets within an investment portfolio. Allocation is generally made by sector (cyclical, defensive, sensitive), by profile (growth, value), by geography and/or by asset class (equities, bonds, real estate, commodities, etc.)

In determining the best asset allocation, the key is to be able to balance between the expected return on assets and the riskiness associated with each of them. Asset allocation depends on the time the investor is intending to invest his/her assets, his/her tolerance for risk and the volatility of the various assets.

As mentioned earlier ACE accompanies clients in their investment and gives them the opportunity to have a say on the way of allocating assets. The level of risk, the geographical or sectoral distribution of the portfolios and the type of products used, or the time horizon of the investments is different specific to each client.

Example of equity portfolio.

Source: ACE Finance et Conseil.

Active and passive asset allocation</h3 >

There are two types of asset allocation management styles: passive and active. Passive management is management based on a buy-and-hold strategy. Active management is based on rebalancing of the portfolio via discretionary decisions or decisions based on quantitative models. Stock picking and market timing are key to a successful active management.

ACE is mostly focused on active management of assets. The goal in active management of assets is to be able “beat the market”, the benchmark. The work done by ACE is to select the assets, using various analysis tools, the mostly likely assets that are likely to grow faster than the benchmark and market in general. This management method, as opposed to passive management, concerns all funds and portfolios that do not aim to reproduce the performance of a reference market, but to do better than the reference market.

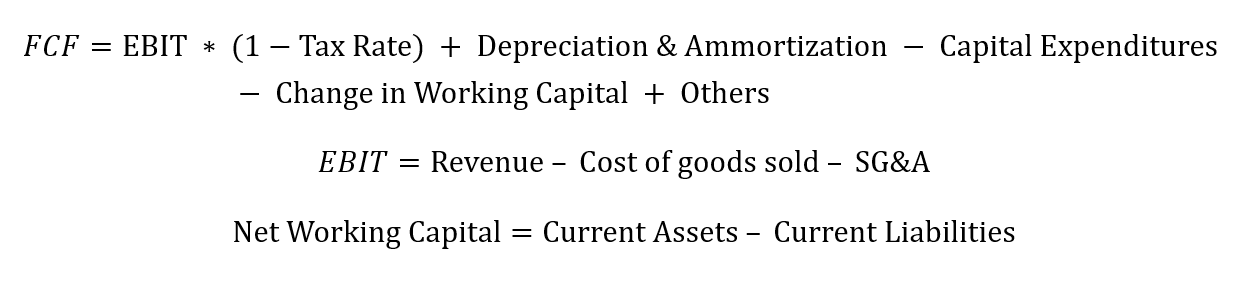

Stock picking

Stock picking is a methodic process were an investor searches for stocks that are likely to bring future cash flows. The analyst’s or investor’s view for the price of the stock will determine whether the position is long or short.

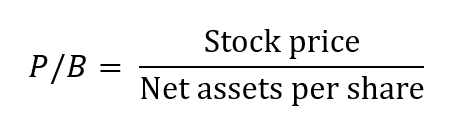

When it comes to stock picking ACE does research on various companies and keeps track of the news. The financial statements (balance sheet, income statement and cash flow statement) with the focus on key business indicators (sales and profits) are important to understand the structural investments in the company. ACE also pays great attention to key financial ratios such as: P/E, EPS, working capital, quick ratio, and the EBITDA.

ACE also has partner companies such as JP Morgan and Gemway Equity that collaborate with ACE in this process. Getting insight and trying to understand other people point of view is part of the culture at ACE and how it has done so well for these past 20 years.

Financial indicators

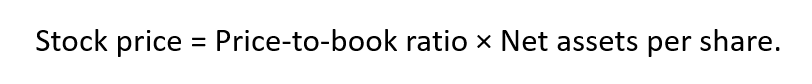

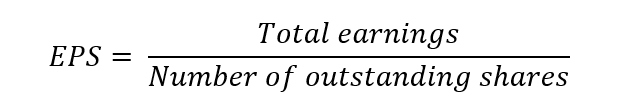

EPS ratio

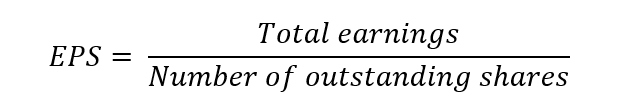

The Earnings Per Share (EPS) ratio is a financial ratio that shows the amount of net profit that a stock can generate. To calculate the EPS, we divide the total earnings (net income) of the company by the number of outstanding shares issued by the company (or average of outstanding shares).

Note that if the company issued common and preferred shares, the EPS ratio is adjusted to take into account the preferred dividends. The EPS can be positive or negative based on the positive or negative earnings (profits or loss). In case of a negative EPS the company in question does not present a profitable overall activity. However, having a negative EPS is not as rare as you might think. As firms are not always making a profit due to heavy investment (start-ups for example). A company which presents a very fluctuating EPS from one year to another or an EPS which does not stop decreasing from year to year, could cause the downfall of the stock price.

At ACE, the EPS is a ratio that we looked at as an indicator of where the wind was blowing but did not base our decisions uniquely on this ratio since it does not look at the investments made by the firm that could generate important future cash flows.

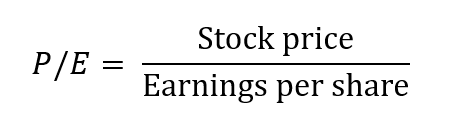

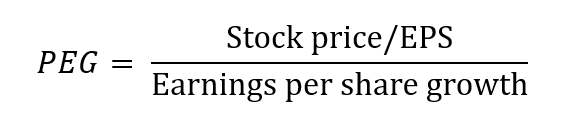

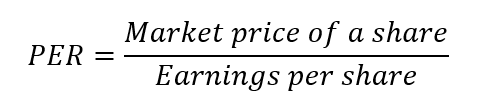

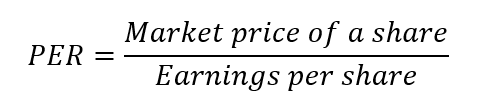

P/E ratio

The price to earnings ratio (P/E or PER) is an indicator used in stock market analysis. The calculation of PER is very straightforward, divide the market capitalization by the net earnings or by dividing the market price of a share by the earnings er share (EPS). Another way of calculating it is by dividing the individual price of a share by the net income per share. You can calculate PER based on quarterly and yearly results and even projected results which would give the expected PER ratio.

The PER represents the number of years it would take for a company to buy all its stocks. For example, a PER of 20 means that a company would take 20 years to “redeem” all its floating capital with constant profits.

This indicator can be used to evaluate a company to its competitors despite their differences in size as it looks at firm valuation according to their profits. A lower PER indicates a cheap stock, a higher PER an expensive stock.

Analysts may consider two types of PER: the trailing PER and forward PER. Simply put, the trailing PER looks at historical earnings to calculate PER. The forward PER considers expected earnings.

Bloomberg Terminal – Relative value function (RV) – Baidu – 14.06.2021

Source: Bloomberg.

The RV function on the Bloomberg Terminal gives us indications on the relative value of the firm. At ACE when doing some research on Baidu, the PER was one of lowest amongst its competitors. The value of the PER is important as it reflects investors’ expectations. Thus, the PER can reveal the speculations of investors, who anticipate a strong increase in future profits: in which case, the higher the PER, the greater the expected increase in profits. So it is important to monitor and the progress of the PER.

Working capital

Working capital is an accounting concept which represents the amount the business has available to pay total operating expenses such as suppliers and employees. This indicator gives information on the company’s ability to cover its expenses.

Quick ratio or Acid test

The quick ratio, or acidity test, is used to determine short-term liquidity in a company. To calculate this ratio, the value of the company’s current assets, excluding inventory, is divided by the company’s current liabilities (see formula). The goal of an acid test is to estimate the financial stability of a firm by measuring the company’s ability to immediately pay its debts using cash.

Assets used to calculate the quick ratio include cash and other very liquid assets such as marketable securities and accounts receivables. Inventory is also excluded from the quick ratio formula because it cannot be sold immediately to generate cash flow.

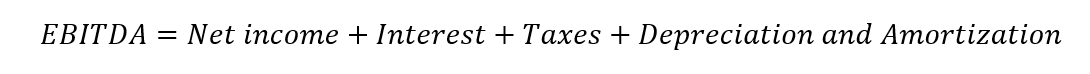

EBITDA

EBITDA (earnings before interest, taxes, depreciation, and amortization) is an indicator that is used to compare companies on their potential ability to generate wealth regardless of the balance sheet differences. EBITDA does not consider the investment and financing policy and the impact of taxes. On the contrary, a negative EBITDA means that the company is not profitable. The EBITDA is computed as follows:

EBITDA is a financial indicator that measures a company’s revenue before subtracting interest, taxes, depreciation and amortization charges and provisions on fixed assets.

Why should you be interested in this post?

If you are looking at getting an internship in an investment firm, this post will surely be interesting to you. This post provides a little reminder of the basics of asset management. There are plenty of investment firms in the world however ACE is unique by its approach to understanding the markets and counselling its clients. In this post I detail some of the core missions that I had as a newcomer to the professional investing field.

Word of conclusion

As my first internship inside of an asset management firm, this initiation to the financial world was exactly what I was looking for before applying at ACE Finance et Conseil. ACE Finance et Conseil differentiates itself from other companies by its simplicity in functioning and the richness of its experience. This unique experience has made me want to explore the financial world even more.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Alexandre VERLET Classic brain teasers from real-life interviews

▶ William LONGIN How to compute the present value of an asset?

Useful resources

ACE Finance et Conseil

Bloomberg terminal

Bloomberg market concepts

About the author

Article written in March 2022 by William LONGIN (EDHEC Business School, Global BBA, 2020-2024).

▶ Read all articles by William LONGIN.

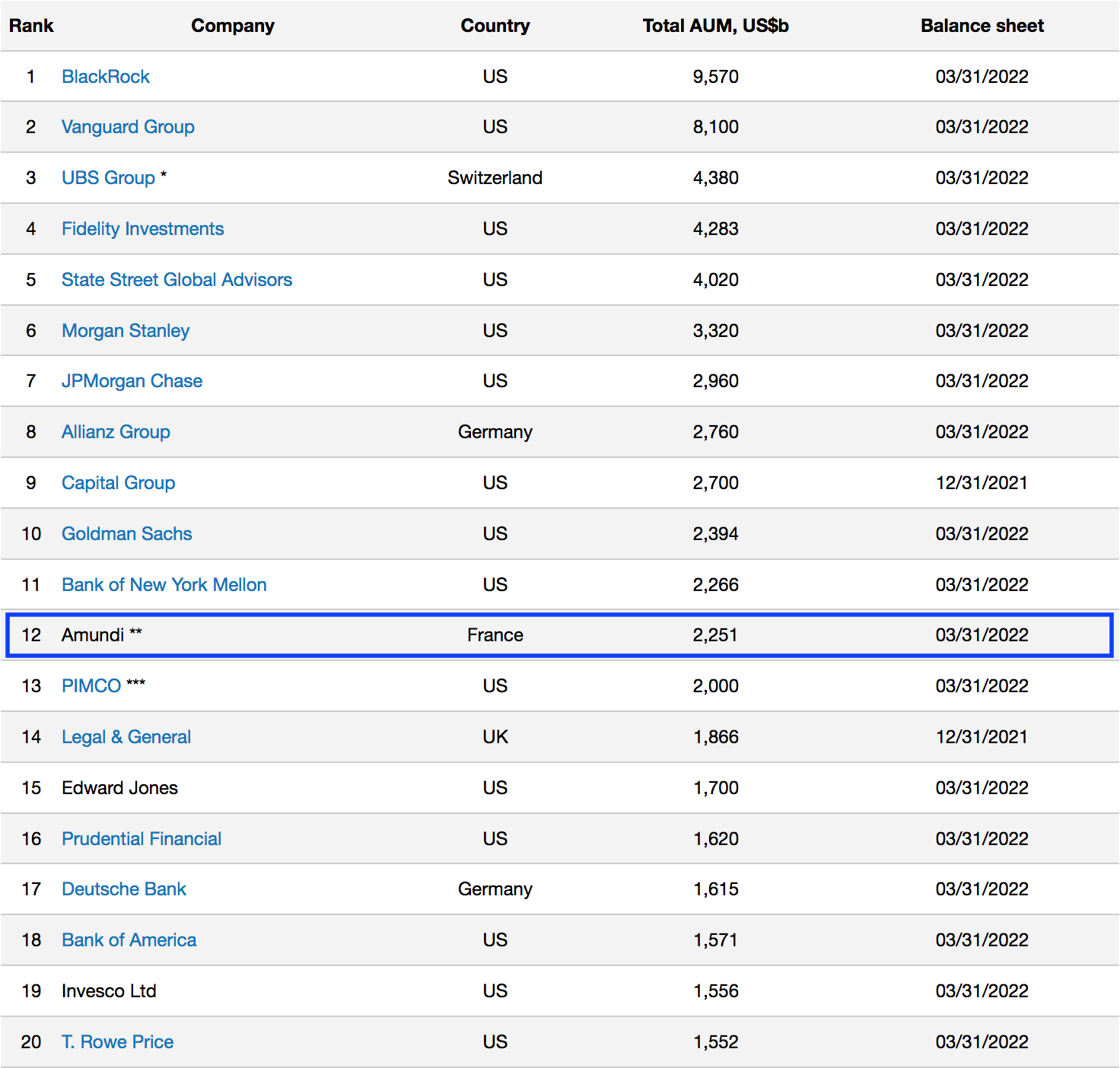

Source: www.advratings.com

Source: www.advratings.com Source: Amundi

Source: Amundi