Turning one euro into a billion euros is the simplest thing in the world. All you need is one euro – and a nearly infinite amount of time.

In this article, Hadrien PUCHE (ESSEC Business School, Grande École Program, Master in Management, 2023-2027) comments on Benjamin Franklin’s famous quote and explores why treating time as both a scarce resource and a wealth multiplier can radically improve your productivity, your mindset, and your financial outcomes.

About Benjamin Franklin

Benjamin Franklin (1706-1790) was one of the founding fathers of the United States. Beyond politics, he was also a scientist, inventor, writer, and, more relevantly here, an economist.

Benjamin Franklin

Source: portrait by Joseph Siffrein Duplessis

About the quote

The aphorism ‘Time is money’ comes from his 1748 essay Advice to a Young Tradesman. In it, Franklin advises working men to use their hours wisely in order to maximize the productivity of their labor. Remarkably, this 18th century advice remains more relevant than ever in the modern age of finance and personal efficiency.

Another modern interpretation relates to financial investments: the more time you leave capital to grow via interest, the higher its accumulated value. Time literally multiplies money through compounding.

To my Friend A. B.

As you have desired it of me, I write the following Hints, which have been of Service to me, and may, if observed, be so to you.

Remember that Time is Money. He that can earn Ten Shillings a Day by his Labour, and goes abroad, or sits idle one half of that Day, tho’ he spends but Sixpence during his Diversion or Idleness, ought not to reckon That the only Expence; he has really spent or rather thrown away Five Shillings besides.

Analysis of the quote

Franklin’s phrase can be interpreted on several levels. Fundamentally, it highlights that time is a limited resource and money is a stored form of that time. Think of money as a stock, and time as the flow that feeds it.

Every euro you earn is, in essence, a small unit of your time and effort converted into a convenient medium of exchange. You trade your own work hours for money, and later spend this money to buy someone else’s time and effort — the chef who prepared your lunch or the engineer who built your car.

While you can always earn back money, you can never regain lost time. Time is therefore much scarcer, and ultimately more valuable. Treating it with the same discipline as any limited resource can transform the way you approach productivity, work, and value creation.

You should also aim at buying back your time whenever possible. Whether through automation, delegation, or investing, let your capital work for you and use the proceeds to buy back your own time. In the end, true wealth is measured by how much time you can recover.

Economic and financial concepts related to this quote

The time value of money

The time value of money (TVM) is one of the most important concepts in finance: a euro today is worth more than a euro tomorrow.

Reasons:

- People are risk averse and prefer present consumption over future consumption.

- Inflation erodes purchasing power over time.

- Money today can be invested to earn interest.

If you lend 100 euros today and only get back 100 euros next year, you’ve lost value. Lenders charge interest to compensate, even before accounting for default risk. This principle underpins most of modern finance.

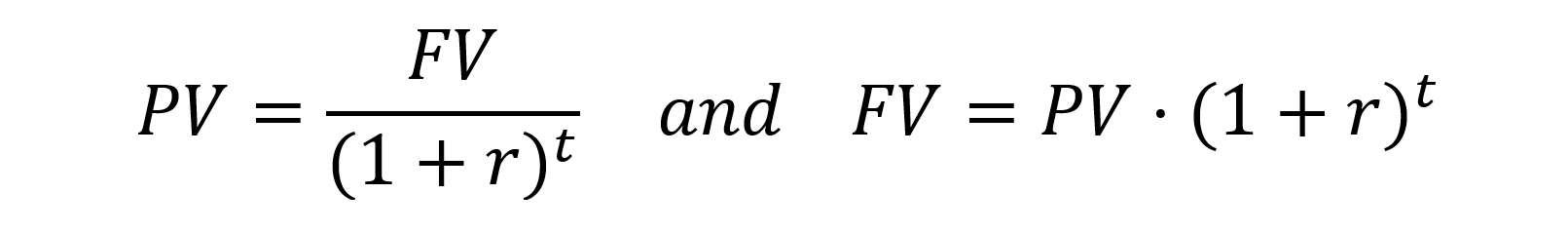

The formula below gives the relation between the present value (PV) and the future value (FV).

Formula to link PV (Present Value) and FV (Future Value)

where r is the discount or compounding rate and 𝑡 t is time.

The opportunity cost

Opportunity cost reminds us that inaction carries a cost. By not investing your time or capital, you miss potential returns.

Example: €1,000 idle in a bank account for one year:

- Lend it at 5% and earn €50.

- Do nothing and earn €0.

The opportunity cost is €50. This principle extends beyond finance: career, education, or hobbies — always evaluate what you forgo by not choosing the alternative.

Discounting and compounding

Money grows over time through compounding, and its future value can be discounted to present value. These mechanisms allow investors to determine how much a future cash flow is worth today.

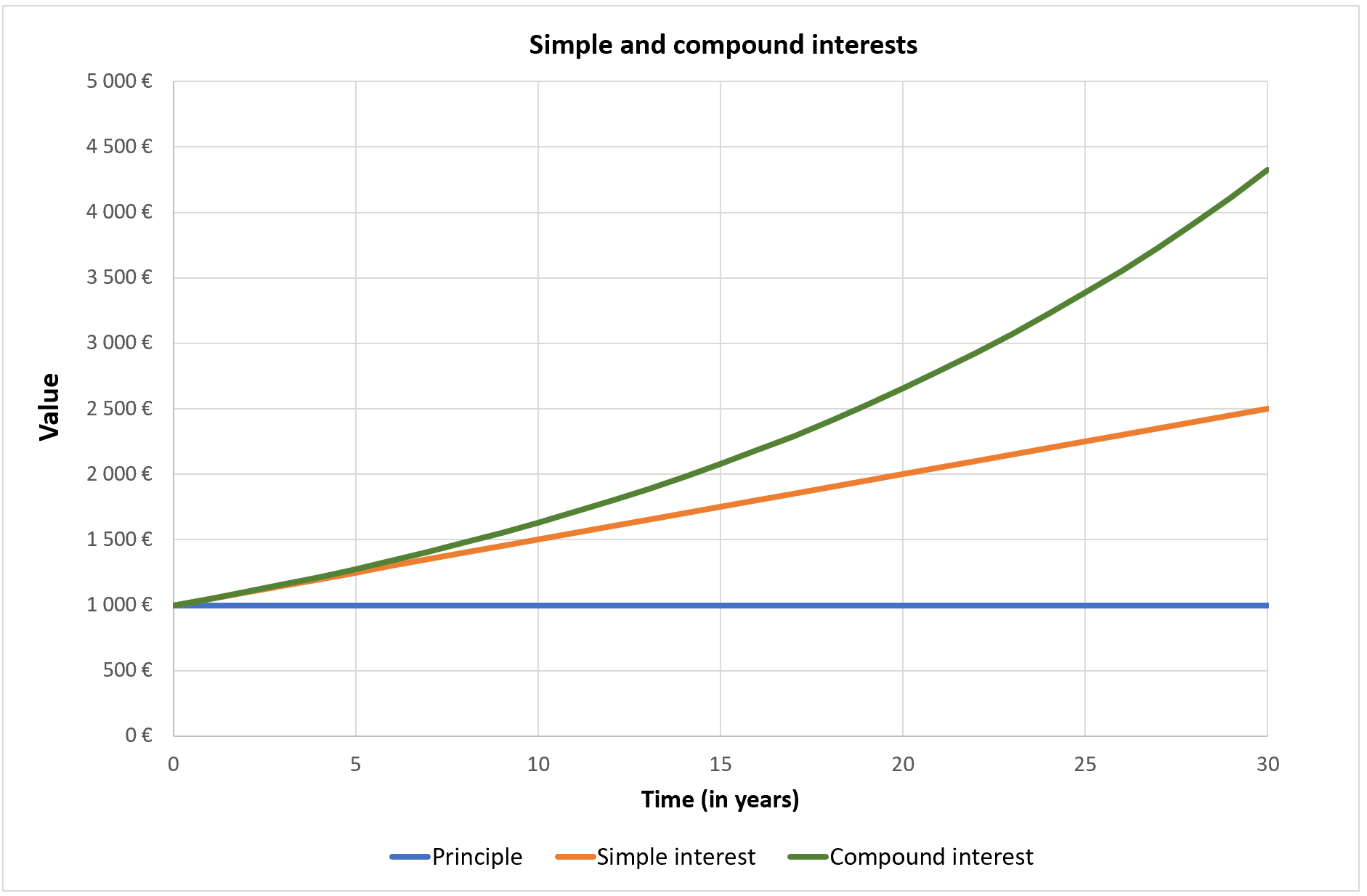

Compounding: earnings generate additional earnings over time, as interest accrues on interest. The longer the investment, the faster growth accelerates.

Example: €10,000 invested at 7% annually yields:

- €19,671 after 10 years

- €76,123 after 30 years

- €294,570 after 50 years

Discounting: brings future sums back to present value, reflecting that a euro today is worth more than a euro tomorrow.

Together, compounding and discounting illustrate the fundamental relationship between time and value: time itself can create, or erode, wealth (when we consider the future or the present).

The figure below represents the impact of time on the value of an investment with simple and compound interests.

Source : The author

You can download the Excel below to study the impact of time on money.

My opinion about this quote

This quote is especially relevant today — many forget that just as time is money, money is also time. We exchange time for money and spend money to access others’ time, often without reflection.

Example: buying a risotto at a restaurant — you pay not only for the food, but for the time of the chef, farmer, and delivery staff, who contributed hours of their lives for your convenience.

Franklin also reminds us of productivity: in many professions, including finance, people work long hours with diminishing returns. Working more isn’t the same as working efficiently; the challenge is maximizing value per unit of time.

Why should you be interested in this post?

Understanding the dual nature of time (scarce resource and wealth multiplier) is key for personal, professional, and financial success.

Whether investing, studying finance, building a business, or learning a skill, remember: every hour counts and starting early amplifies returns.

- Allocate your time wisely.

- Invest your time strategically.

- Let both your time and capital work for you.

Related posts on the SimTrade blog

▶ How to compute the present value of an asset

▶ Understanding discount rate : a key concept in finance

Useful resources

Benjamin Franklin (1748) Advice to a Young Tradesman.

Morgan Housel (2020) The Psychology of Money.

Aswath Damodaran Time Value of Money (Aswath Damodaran) NYU Stern – Foundations of Finance Course.

About the Author

This article was written in October 2025 by Hadrien PUCHE (ESSEC Business School, Grande École Program, Master in Management, 2023-2027).

▶ Discover all articles by Hadrien PUCHE