In this article, Yann-Ray KAMANOU TAWAMBA (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2024-2025) explains the discount rate, which is a key concept in finance.

About the Discount Rate

The discount rate is a fundamental concept in finance, playing a crucial role in investment valuation, corporate finance, and monetary policy. It represents the interest rate used to determine the present value of future cash flows, making it essential for evaluating investment opportunities and financial decision-making. The discount rate is widely applied in areas such as capital budgeting, bond pricing, and central banking policy, making it a critical concept for students and professionals in finance.

The discount rate is a fundamental concept in finance, used in both monetary policy and investment valuation. In central banking, it represents the interest rate at which commercial banks borrow from the central bank, influencing economic activity and inflation. In corporate finance, it is used to discount future cash flows in investment valuation, often calculated using the Weighted Average Cost of Capital (WACC) or the Capital Asset Pricing Model (CAPM). It reflects the opportunity cost of capittal, risk, and expected returns, playing a crucial role in decision-making for investors, businesses, and policymakers.

The Discount Rate in Investment Analysis

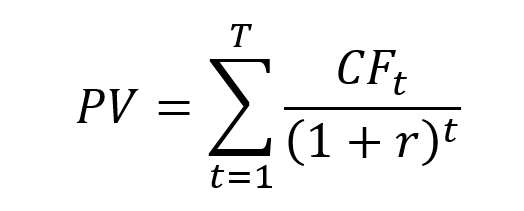

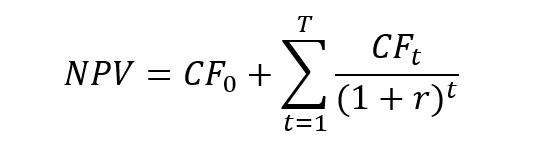

One of the most common applications of the discount rate is in the Discounted Cash Flow (DCF) model, which is used to assess the intrinsic value of an investment. In this method, future cash flows are discounted to the present using an appropriate discount rate. The formula for present value (PV) and net present value (NPV) of future cash flows is:

Where CF represents the expectation of the future cash flow, r is the discount rate, and T is the number of periods. If the NPV of an investment is positive, it indicates that the project is expected to generate more value than its cost, making it a viable option.

The discount rate affects bond prices and yields. When it rises, borrowing becomes expensive. New bonds offer higher yields, making them more attractive. Older bonds with lower fixed rates lose value. Investors use the discount rate to calculate the present value of a bond’s future payments:

Central banks, like the Federal Reserve in the US and the European Central Bank in the Eurozone, set the discount rate as the interest rate for banks borrowing directly from them. When central banks increase the discount rate, loans become expensive. Banks lend less, slowing inflation and economic growth. When they lower the discount rate, borrowing is cheaper. Banks lend more, encouraging spending and investment.

Why should I be interested in this post?

Understanding the discount rate is essential. Whether you are aiming for roles in investment banking, asset management, financial consulting, or central banking, a solid grasp of this concept will allow you to make informed financial decisions. This topic is particularly relevant for students preparing for financial modeling exercises, valuation case studies, and investment strategy planning.

Related posts on the SimTrade blog

▶ Alexandre VERLET Classic brain teasers from real-life interviews

▶ William LONGIN How to compute the present value of an asset?

▶ Maite CARNICERO MARTINEZ How to compute the net present value of an investment in Excel

▶ Andrea ALOSCARI Valuation methods

Useful resources

Berk, J. B., & van Binsbergen, J. H. (2017) How Do Investors Compute the Discount Rate? They Use the CAPM Financial Analysts Journal 73(2), 25–32.

Hirshleifer, J. (1961) Risk, The Discount Rate, and Investment Decisions, The American Economic Review, 51 (2), 112-120.

Roley, V. V., & Troll, R. (1984) The impact of discount rate changes on market interest rates. University of Washington. Center for the Study of Banking and Financial Markets, Graduate School of Business Administration.

Woon, G.C. (1999) Estimating the discount rate policy reaction function of the monetary authority, Journal of Applied Econometrics, 14(4), 379-401.

About the author

The article was written in February 2025 by Yann-Ray KAMANOU TAWAMBA (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2024-2025).