In this article, Aamey MEHTA (ESSEC Business School, Master in Finance, Singapore campus, 2022-2023) shares his experience as a credit analyst at Wells Fargo.

The Company

Wells Fargo is the fourth largest bank in the United States in terms of total assets, with $1.9 trillion AUM. It is headquartered in San Francisco. On February 2, 2018, account fraud by the bank resulted in the Federal Reserve barring Wells Fargo from growing its nearly $2 trillion-asset base any further until the company fixed its internal problems to the satisfaction of the Federal Reserve. In September 2021, Wells Fargo incurred further fines from the United States Justice Department charging fraudulent behavior by the bank against foreign-exchange currency trading customers. Under the leadership of the current CEO Charles W. Scharf the bank is aiming to stabilize and improve the bank’s public image and I was able to witness the transition first hand as well as the CEO’s vision and mission for the company.

I worked in the Subscription Finance Group (SFG) which is under the Corporate and Investment Banking (CIB) department of the organization. The team was newly set up in India to provide support to the main team in the US and UK. This gave me exposure to several different aspects of the business and allowed me to learn a lot.

What is Subscription Finance?

Subscription credit facilities typically take the form of a senior secured revolving credit facility secured by the unfunded capital commitments of the fund’s investors. The facilities are subject to a borrowing base determined based on the value of the pledged commitments of investors satisfying specified eligibility requirements, with advance rates based on the credit quality of the relevant investors.

The purpose of subscription credit facilities is usually to provide liquidity for the fund on a faster basis than calling for capital contributions. Under a credit facility, borrowed funds typically can be made available within a day, while under a typical limited partnership agreement, capital calls may take 10 business days or more.

Logo of Wells Fargo

Source: Wells Fargo.

My Internship

I worked at Wells Fargo full time for 16 months from March 2021 to July 2022 and was mainly involved in the credit risk and analysis of the various clients of the bank (investment funds like hedge funds and real estate funds). Subscription Finance is a niche part of finance which refers to the process by which investors sign up and commit to investing in a financial instrument, prior to the actual closing of the purchase. Wells Fargo lent money to different investment funds. The collateral was the uncalled capital that these funds could draw from their respective investors. Wells Fargo would internally review the investors in each fund and come up with a risk profile for each client. The fees for these loans were LIBOR plus a negotiate premium.

My missions

- Part of the team that undertook the task of preparing an Annual Review credit memo for the first time in India as well as teaching 7 new members of the team on how the process is done.

- Co-Led the setup and work of the 5-member Deal Structuring Squad which undertook the task of understanding the terms that were included in various credit memos and educating the rest of the 25- member team on what each data point meant and where this information was sourced from.

- Led the team that undertook the process of preparing and analyzing the FX Portfolio Overview File every week and established a reporting framework with the US team lead. The team highlighted and resolved 2 key errors that were previously overlooked.

- Part of the Portfolio Overview team that undertook the preparation of the daily Portfolio Overview File. The team analyzed the daily reports and highlighted any discrepancies that arose. The reports generated were distributed firm-wide.

- Completed Financial Spreading for 46 deals every quarter.

Required skills and knowledge

For the role I needed to have a working knowledge of how credit ratings are relevant during due diligence of a company. I also needed to have basic finance knowledge of how loans are priced and how hedge funds and other investment funds make money. However, the most important skills that were needed were those of ethics and compliance. As we were working with sensitive and private information it was of utmost importance that we were in compliance with the banks guidelines and did not violate any compliance standards.

What I have learnt

My full-time role taught me how hedge funds and large asset managers set up their different funds. It was insightful to learn about the different structures of the various and how they differ across geographies.

Another important learning was how different asset managers have different funds. The funds have different investment strategies such as real estate and each strategy would have different terms and different credit terms to analyze and look at.

There were several soft skills that I learnt too. The biggest one being communication. We were constantly in touch with the team in the US and liaising with them across different time zones to schedule calls and trainings was a new experience for me.

During this job I was also able to significantly improve my excel skills and understanding of several functions. This helped to increase my efficiency at my role and make some files more functional for the organization.

Three key financial concepts

Here are three useful concepts I used during my job at Wells Fargo.

Interest Rate Pricing

During my time working at Wells Fargo, I learnt that LIBOR was no longer the benchmark that was going to be used to determine pricing. The market was transitioning to a new rate called SONIA. SONIA is rate based on the actual overnight rate in active and liquid wholesale cash and derivatives market which makes it more robust and less volatile than LIBOR. The key difference is that LIBOR is forward-looking – it is agreed at the start of an interest period. SONIA is backward-looking – it cannot be determined until the end of an agreed interest period. This means that borrowers will no longer have upfront certainty about the amount of their interest payments and will require the calculations of the interest due at the end of the period.

Sovereign Immunity

Some of the clients of the bank were government backed funds and institutions. For example, a client was Abu Dhabi Investment Council (ADIC), which is the investment arm of the Government of Abu Dhabi and had $829 Billion of AUM as of 2022. These clients had sovereign immunity. Sovereign immunity refers to the fact that government cannot be sued. In the USA this is particularly relevant in the state of Texas. The main learning point was how banks like Wells Fargo treat such special entities, that is to say how it defines the different credit terms for these entities and how it takes into account for the fact that there is no recourse on such loans (due the sovereign immunity of these entities).

Credit Rating

I learnt that the credit rating analysis done by different agencies such as S&P and Moody’s, do not use the same approach. Often the ratings provided by both agencies may vary. The bank used to collate ratings from these two rating agencies for the same entity. Based on the ratings the bank would use an internal credit rating system to provide three different scores across three different categories for the entity. These scores fell into different bands as defined by the bank’s policy. Based on which band they fell into; different terms were offered to the clients and different negotiation was done. For example, a client that had a lower score across the categories would be offered more flexibility and better terms. The credit ratings were also assigned to the various investors of the fund as they were to be used as collateral while availing the loan which resulted in extensive due diligence.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

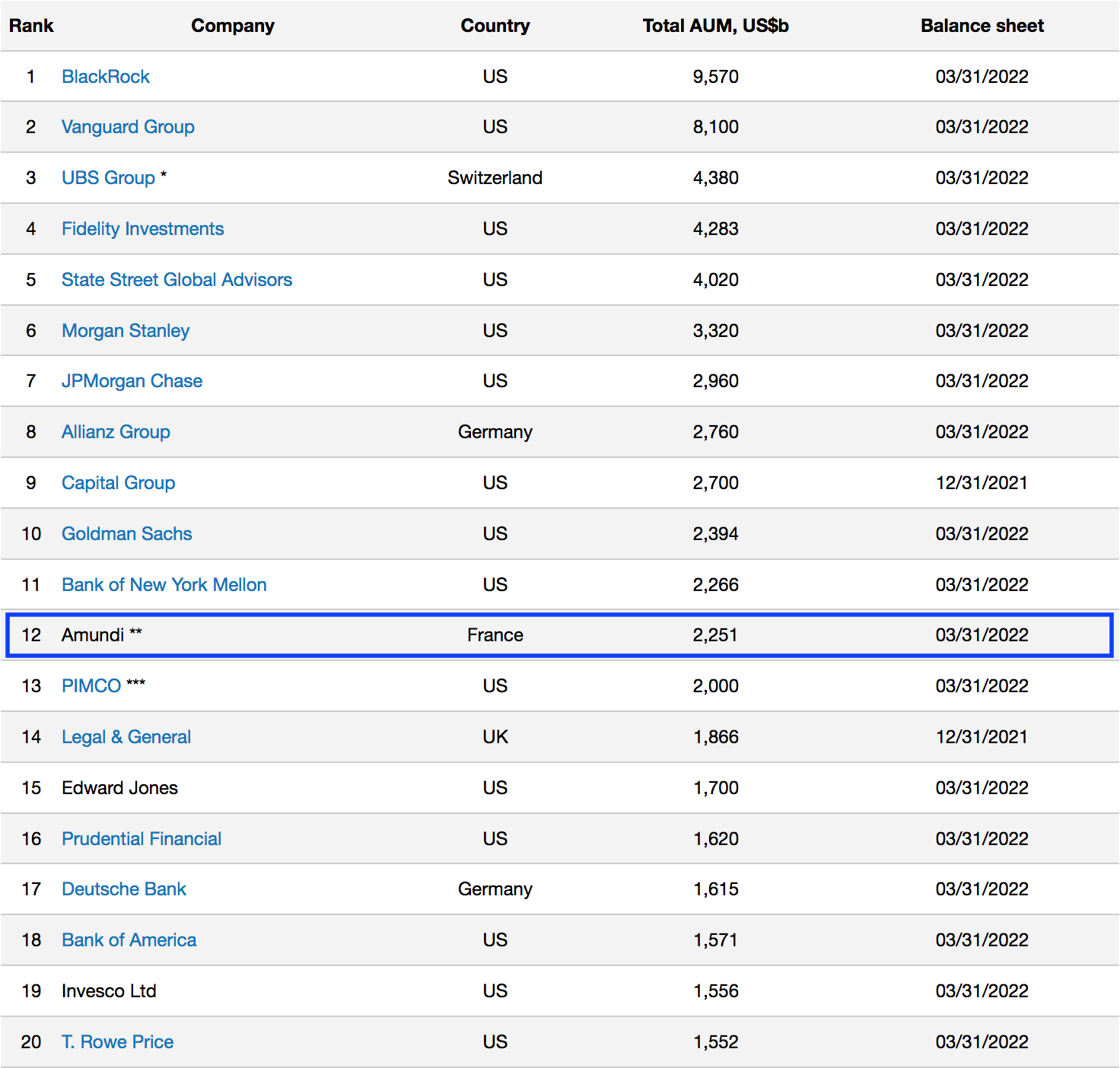

▶ Jayati WALIA My experience as a credit analyst at Amundi Asset Management

▶ Jayati WALIA Credit risk

▶ Georges WAUBERT Credit analyst

▶ Alexandre VERLET Classic brain teasers from real-life interviews

Useful resources

About the author

The article was written in November 2022 by Aamey MEHTA (ESSEC Business School, Master in Finance, Singapore campus, 2022-2023).

Source: www.advratings.com

Source: www.advratings.com Source: Amundi

Source: Amundi