In this article, Youssef LOURAOUI (Bayes Business School, MSc. Energy, Trade & Finance, 2021-2022) presents the global macro equity strategy, one of the most widely known strategies in the hedge fund industry. The goal of the global macro strategy is to look for trends or disequilibrium in equity, bonds, currency or alternative assets based on broad economic data using a top-down approach.

This article is structured as follow: we introduce the global macro strategy principle. Then, we present a famous case study to grasp the overall methodology of this strategy. We conclude with a performance analysis of this strategy in comparison with a global benchmark (MSCI All World Index and the Credit Suisse Hedge Fund index).

Introduction

According to Credit Suisse, a global macro strategy can be defined as follows: “Global Macro funds focus on identifying extreme price valuations and leverage is often applied on the anticipated price movements in equity, currency, interest rate and commodity markets. Managers typically employ a top-down global approach to concentrate on forecasting how political trends and global macroeconomic events affect the valuation of financial instruments. Profits are made by correctly anticipating price movements in global markets and having the flexibility to use a broad investment mandate, with the ability to hold positions in practically any market with any instrument. These approaches may be systematic trend following models, or discretionary.”

This strategy can generate returns in both rising and falling markets. However, asset screening is of key concern, and the ability of the fund manager to capture the global macro picture that is driving all asset classes is what makes this strategy profitable (or not!).

The greatest trade in history

The greatest trade in history (before Michael Burry becomes famous for anticipating the Global financial crisis of 2008 linked to the US housing market) took place during the 1990’s when the UK was intending to join the Exchange Rate Mechanism (ERM) founded in 1979. This foreign exchange (FX) system involved eight countries with the intention to move towards a single currency (the Euro). The currencies of the countries involved would be adjustably pegged with a determined band in which they can fluctuate with respect to the Deutsche Mark (DEM), the currency of Germany considered as the reference of the ERM.

Later in 1992, the pace at which the countries adhering to the ERM mechanism were evolving at different rate of growth. The German government was in an intensive spending following the reunification of Berlin, with important stimulus from the German Central Bank to print more money. However, the German government was very keen on controlling inflation to satisfactory level, which was achieved by increasing interest rates in order to curb the inflationary pressure in the German economy.

In the United Kingdom (UK), another macroeconomic picture was taking place: there was a high unemployment coupled with already relatively high interest rates compared to other European economies. The Bank of England was put in a very tight spot because they were facing two main market scenarios:

- To increase interest rates, which would worsen the economy and drive the UK into a recession

- To devalue the British Pound (GBP) by defending actively in the FX market, which would cause the UK to leave the ERM mechanism.

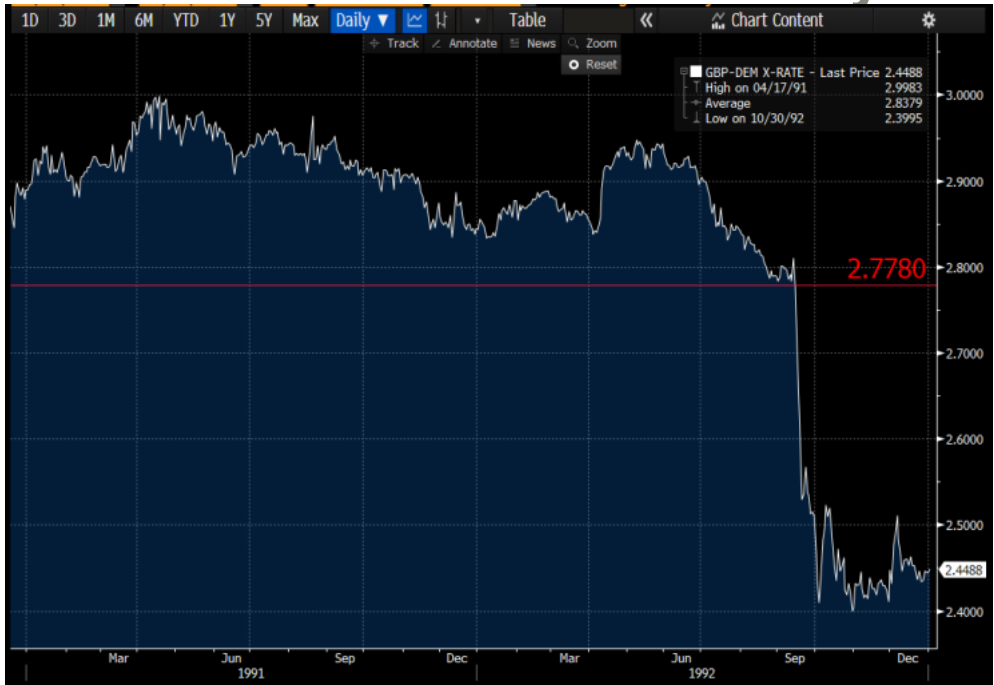

The Bank of England decided to go with the second option by defending the British Pound in the FX market by actively buying pounds. However, this strategy would not be sustainable over time. Soros (and other investors) had seen this disequilibrium and shorted British Pound and bought Deutsche Mark. The situation got completely off control for the Bank of England that in September 1992, they decided to increase interest rates, which were already at 10% to more than 15% to calm the selling pressure. Eventually, the following day, the Bank of England announced the exit of the UK from the ERM mechanism and put a hold on the increase of interest rate to the 12% until the economic conditions get better. Figure 1 gives the evolution of the exchange rate between the British Pound (GBP) and the Deutsche Mark (DEM) over the period 1991-1992.

Figure 1. Evolution of the GBP-DEM (British Pound / Deutsche Mark FX rate).

Source: Bloomberg.

It was reported that Soros amassed a position of $10 billion and gained a whopping $1 billion for this trade. This event put Soros in the scene as the “man who broke the Bank of England”. The good note about this market event is that the UK economy emerged much healthier than the European countries, with UK exports becoming much more competitive as a result of the pound devaluation, which led the Bank of England to cut rates cut down to the 5-6% level the years following the event, which ultimately helped the UK economy to get better.

Performance of the global macro strategy

Overall, the performance of the global macro funds between 1994-2020 was steady, with occasional large drawdowns (Asian crisis 1998, Dot-com bubble 2000’s, Great Financial Crisis of 2008, Covid-19 pandemic 2020). On a side note, the returns seem smaller and less volatile since 2000 onwards (Credit Suisse, 2022).

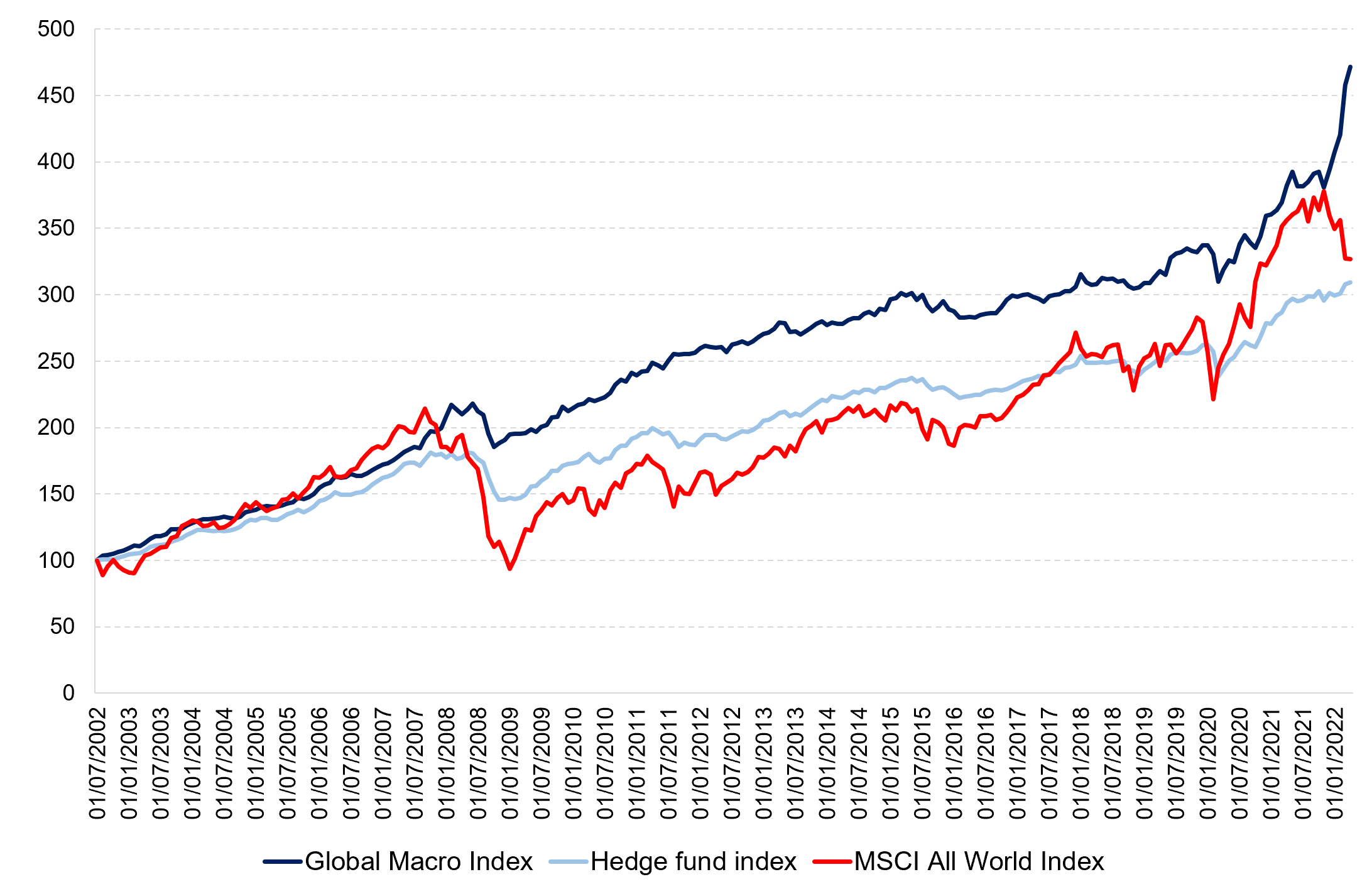

To capture the performance of the global macro strategy, we use the Credit Suisse hedge fund strategy index. To establish a comparison between the performance of the global equity market and the global macro hedge fund strategy, we examine the rebased performance of the Credit Suisse index with respect to the MSCI All-World Index. Over a period from 2002 to 2022, the global macro strategy index managed to generate an annualized return of 7.85% with an annualized volatility of 5.77%, leading to a Sharpe ratio of 0.33. Over the same period, the MSCI All World Index managed to generate an annualized return of 6.00% with an annualized volatility of 15.71%, leading to a Sharpe ratio of 0.08. The low correlation of the long-short equity strategy with the MSCI All World Index is equal to -0.02, which is close to zero. The results are in line with the idea of global diversification and decorrelation of returns derived from the global macro strategy from global equity returns. Overall, the Credit Suisse hedge fund strategy index performed better worse than the MSCI All World Index, leading to a higher Sharpe ratio (0.33 vs 0.08).

Figure 2 gives the performance of the global macro funds (Credit Suisse Global Macro Index) compared to the hedge funds (Credit Suisse Hedge Fund index) and the world equity funds (MSCI All-World Index) for the period from July 2002 to April 2021.

Figure 2. Performance of the global macro strategy.

Source: computation by the author (data: Bloomberg).

You can find below the Excel spreadsheet that complements the explanations about the global macro hedge fund strategy.

Why should I be interested in this post?

Global macro funds seek to profit from market dislocations across different asset classes. reduce negative risk while increasing market upside. They might, for example, invest in inexpensive assets that the fund managers believe will rise in price while simultaneously shorting overvalued assets to cut losses. Other strategies used by global macro funds to lessen market volatility can include leverage and derivatives. Understanding the profits and risks of such a strategy might assist investors in incorporating this hedge fund strategy into their portfolio allocation.

Related posts on the SimTrade blog

▶ Youssef LOURAOUI Introduction to Hedge Funds

▶ Akshit GUPTA Portrait of George Soros: a famous investor

▶ Youssef LOURAOUI Yield curve structure and interest rate calibration

▶ Youssef LOURAOUI Long/short equity strategy

▶ Youssef LOURAOUI Portfolio

Useful resources

Academic research

Pedersen, L. H., 2015. Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined. Princeton University Press.

Business Analysis

Credit Suisse Hedge fund strategy

Credit Suisse Hedge fund performance

Credit Suisse Global macro strategy

Credit Suisse Global macro performance benchmark

About the author

The article was written in January 2023 by Youssef LOURAOUI (Bayes Business School, MSc. Energy, Trade & Finance, 2021-2022).