The BOVESPA index

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023) presents the BOVESPA index and details its characteristics.

The BOVESPA index

The BOVESPA Index, or IBOVESPA, is the benchmark stock market index of the São Paulo Stock Exchange (B3) in Brazil. The index was launched on January 2, 1968, and tracks the performance of the 80 most traded stocks on the exchange.

As of 2021, the top 10 constituents of the BOVESPA Index included companies from a range of sectors such as finance, energy, materials, and consumer goods. Some of the largest companies in the index include Petrobras, Vale, Itau Unibanco, and Banco Bradesco.

The BOVESPA Index is considered a crucial indicator of the Brazilian stock market’s overall health and serves as a benchmark for Brazilian equity mutual funds and exchange-traded funds (ETFs). The index is weighted by free float market capitalization, which means that the more valuable a company is, the more significant its impact on the index’s movements.

The BOVESPA Index has experienced significant fluctuations in the past due to factors such as political instability, economic crises, and shifts in global commodity prices. Trading platforms and financial websites represent the BOVESPA Index using the ticker symbol “IBOV”.

Table 1 below gives the Top 10 stocks in the BOVESPA index in terms of market capitalization as of January 31, 2023.

Table 1. Top 10 stocks in the BOVESPA index.

Source: computation by the author (data: Yahoo! Finance website).

Calculation of the BOVESPA index value

The index is a market-capitalization-weighted index, which means that the weight of each company in the index is determined by its market capitalization, calculated by multiplying the number of outstanding shares by the current market price per share. It tracks the performance of the largest and most actively traded companies listed on the Sao Paulo Stock Exchange (B3).

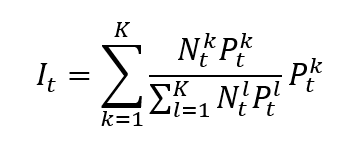

The formula to compute the BOVESPA index is given by

Where I is the index value, k a given asset, K the number of assets in the index, Pk the market price of asset k, Nk the number of issued shares for asset k, and t the time of calculation of the index.

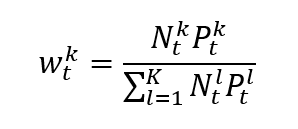

In a market capitalization-weighted index, the weight of asset k is given by formula can be rewritten as

Which clearly shows that the weight of each asset in the index is its market capitalization of the asset divided by the sum of the market capitalizations of all assets.

Note that the divisor, whose calculation is based on the number of shares, is typically adjusted for events such as stock splits and dividends. The divisor is used to ensure that the value of the index remains consistent over time despite changes in the number of outstanding shares.

Use of the BOVESPA index in asset management

The BOVESPA Index is frequently used by investors, analysts, and financial institutions to track the overall trend of the Brazilian stock market and to make investment decisions. It is also used as a basis for the creation of financial products such as exchange-traded funds (ETFs) and index futures contracts.

Benchmark for equity funds

The BOVESPA index is widely considered as the benchmark index for the Brazilian stock market and is used as a measure of the performance of the Brazilian economy. It includes a diverse range of companies from various sectors such as finance, mining, energy, and consumer goods. Some of the largest companies listed on the BOVESPA Index include Petrobras, Vale, Itau Unibanco, and Banco Bradesco.

Financial products around the BOVESPA index

There are various financial instruments available to investors seeking to track the performance of the BOVESPA index.

- ETFs are popular investment products that allow investors to gain exposure to the BOVESPA index. These include the iShares MSCI Brazil ETF and the BMO MSCI Brazil Index ETF.

- Index funds are also designed to track the performance of an index. The BlackRock Brazil Equity Index Fund and the Bradesco FIA BOVESPA Index Fund are examples of index funds that track the BOVESPA index.

- Futures and options contracts based on the BOVESPA index provide investors with the ability to speculate on the future performance of the index. BM&FBOVESPA, the Brazilian futures and options exchange, offers futures contracts based on the BOVESPA index.

- Certificates are investment products that allow investors to gain exposure to the BOVESPA index. Credit Suisse and Itau Unibanco offer certificates linked to the BOVESPA index, such as the Brazil Index Tracker Certificate.

Historical data for the BOVESPA index

How to get the data?

The BOVESPA index is the most common index used in finance, and historical data for the BOVESPA index can be easily downloaded from the internet.

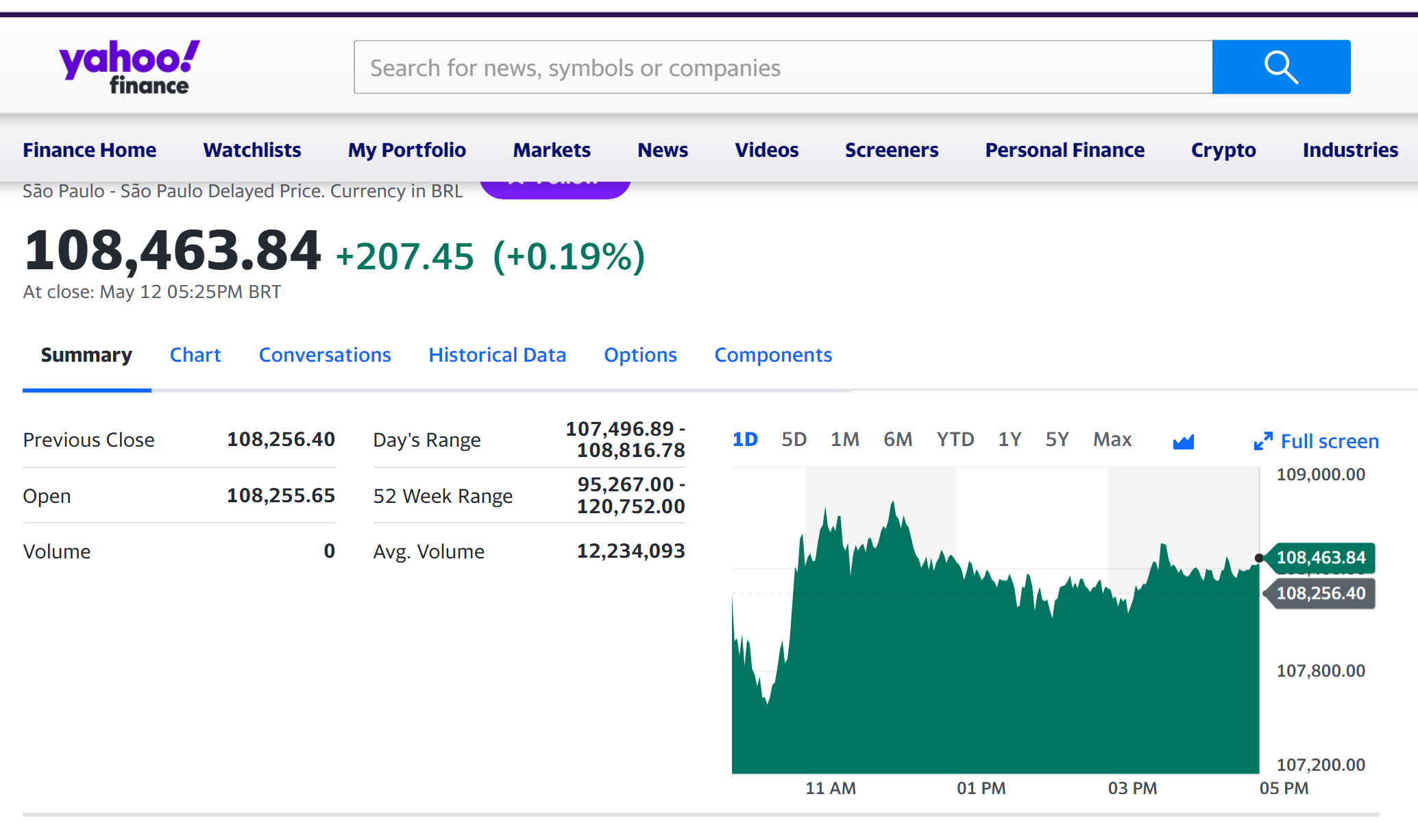

For example, you can download data for the BOVESPA index from January 3, 1984 on Yahoo! Finance (the Yahoo! code for BOVESPA index is ^NSEI).

Source: Yahoo! Finance.

You can also download the same data from a Bloomberg terminal.

R program

The R program below written by Shengyu ZHENG allows you to download the data from Yahoo! Finance website and to compute summary statistics and risk measures about the BOVESPA index.

Data file

The R program that you can download above allows you to download the data for the BOVESPA index from the Yahoo! Finance website. The database starts on January 3, 1984. It also computes the returns (logarithmic returns) from closing prices.

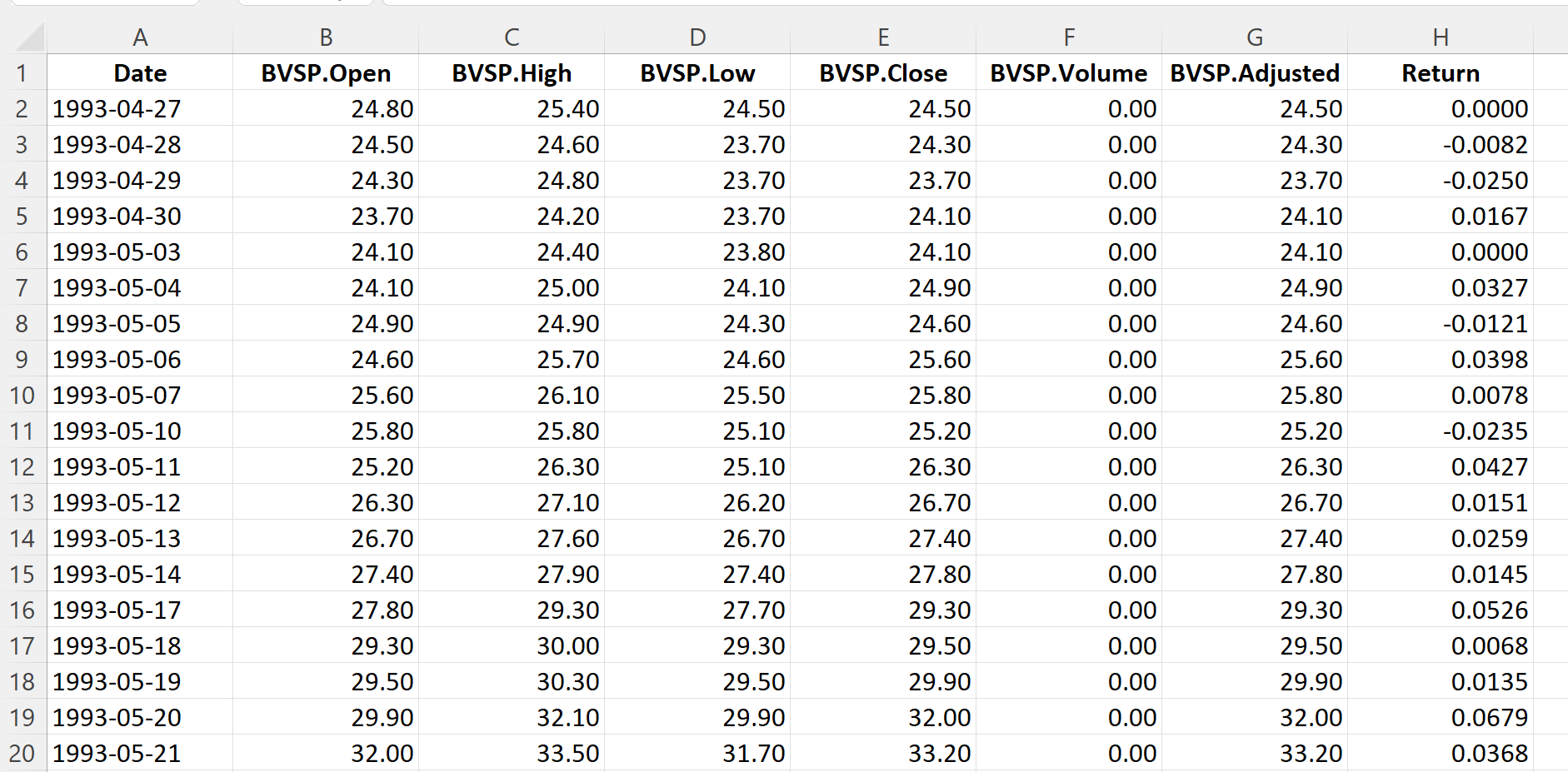

Table 3 below represents the top of the data file for the BOVESPA index downloaded from the Yahoo! Finance website with the R program.

Table 3. Top of the data file for the BOVESPA index.

Source: computation by the author (data: Yahoo! Finance website).

Evolution of the BOVESPA index

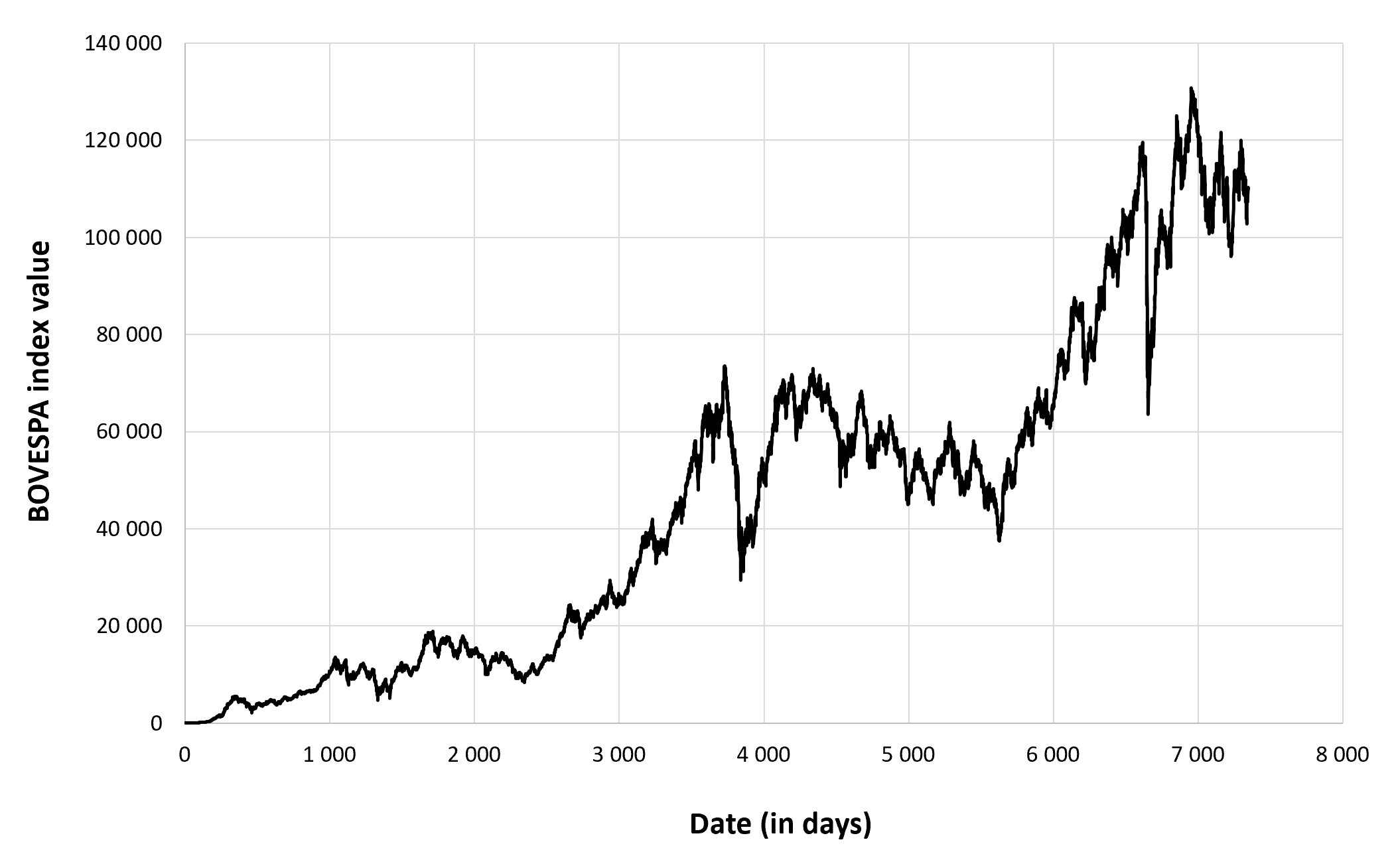

Figure 1 below gives the evolution of the BOVESPA index from January 3, 1984 to December 30, 2022 on a daily basis.

Figure 1. Evolution of the BOVESPA index.

Source: computation by the author (data: Yahoo! Finance website).

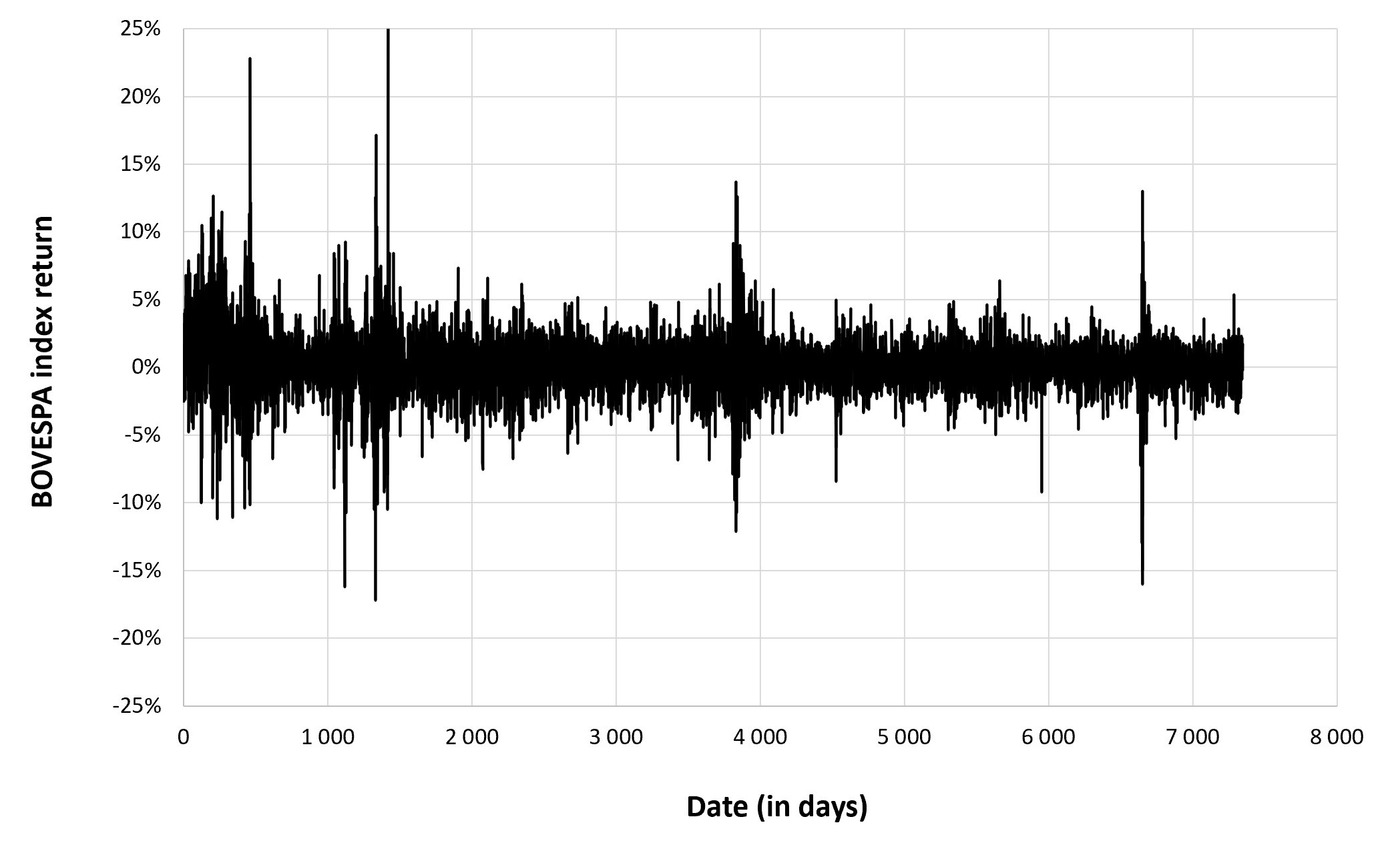

Figure 2 below gives the evolution of the BOVESPA index returns from January 3, 1984 to December 30, 2022 on a daily basis.

Figure 2. Evolution of the BOVESPA index returns.

Source: computation by the author (data: Yahoo! Finance website).

Summary statistics for the BOVESPA index

The R program that you can download above also allows you to compute summary statistics about the returns of the BOVESPA index.

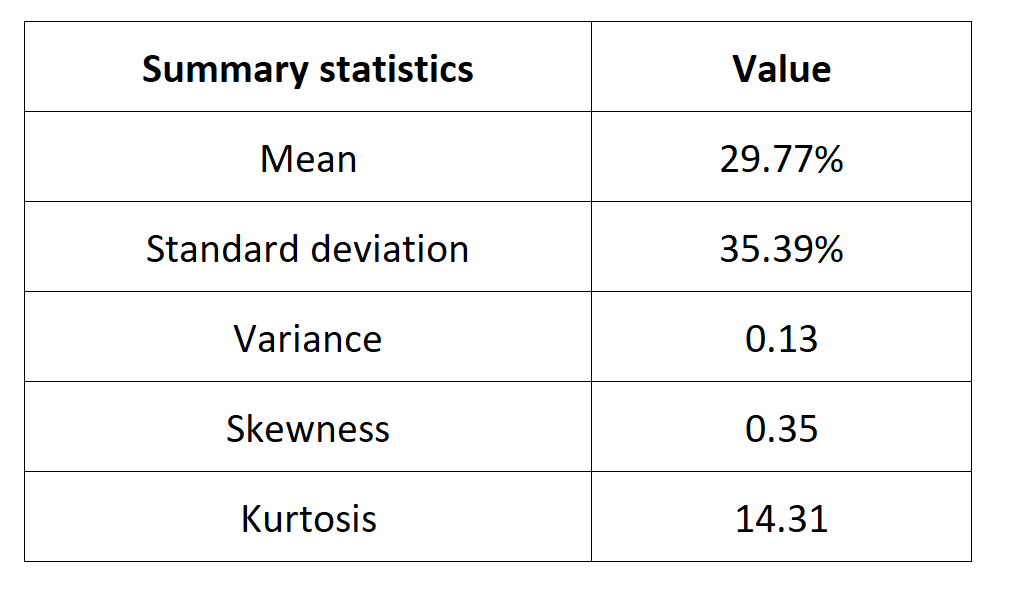

Table 4 below presents the following summary statistics estimated for the BOVESPA index:

- The mean

- The standard deviation (the squared root of the variance)

- The skewness

- The kurtosis.

The mean, the standard deviation / variance, the skewness, and the kurtosis refer to the first, second, third and fourth moments of statistical distribution of returns respectively.

Table 4. Summary statistics for the BOVESPA index.

Source: computation by the author (data: Yahoo! Finance website).

Statistical distribution of the BOVESPA index returns

Historical distribution

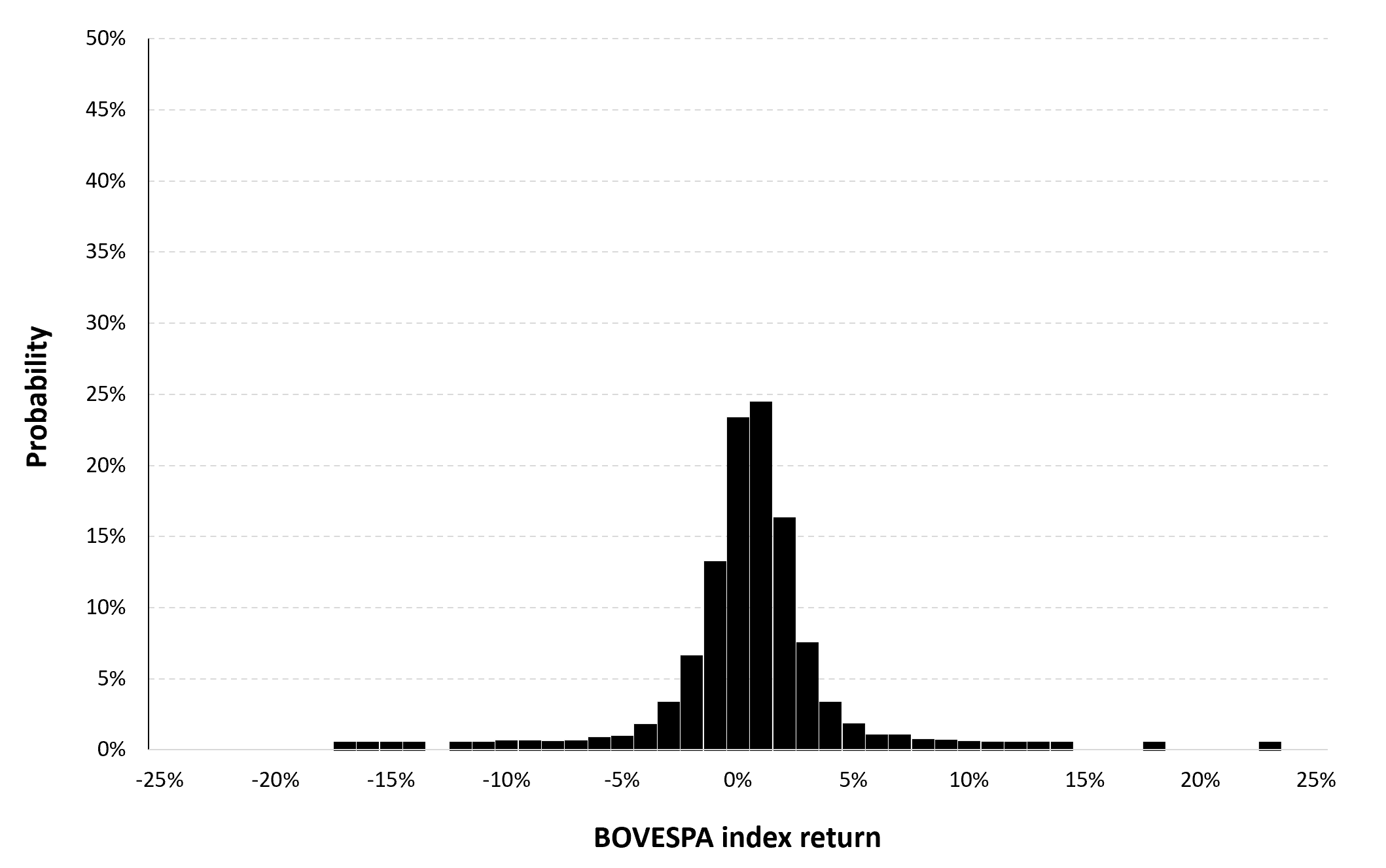

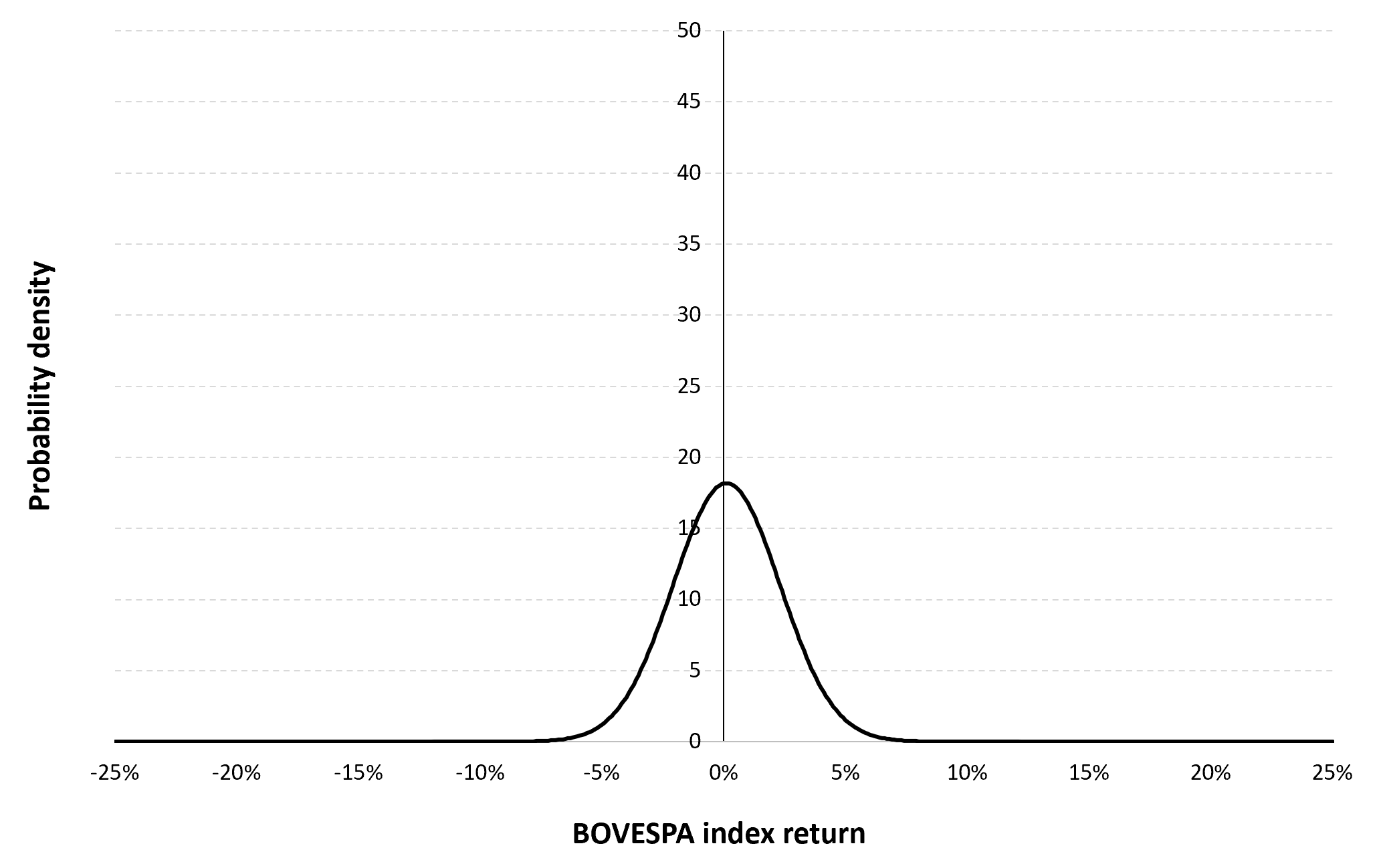

Figure 3 represents the historical distribution of the BOVESPA index daily returns for the period from January 3, 1984 to December 30, 2022.

Figure 3. Historical distribution of the BOVESPA index returns.

Source: computation by the author (data: Yahoo! Finance website).

Gaussian distribution

The Gaussian distribution (also called the normal distribution) is a parametric distribution with two parameters: the mean and the standard deviation of returns. We estimated these two parameters over the period from January 3, 1984 to December 30, 2022. The mean of daily returns is equal to 0.02% and the standard deviation of daily returns is equal to 1.37% (or equivalently 3.94% for the annual mean and 28.02% for the annual standard deviation as shown in Table 3 above).

Figure 4 below represents the Gaussian distribution of the BOVESPA index daily returns with parameters estimated over the period from January 3, 1984 to December 30, 2022.

Figure 4. Gaussian distribution of the BOVESPA index returns.

Source: computation by the author (data: Yahoo! Finance website).

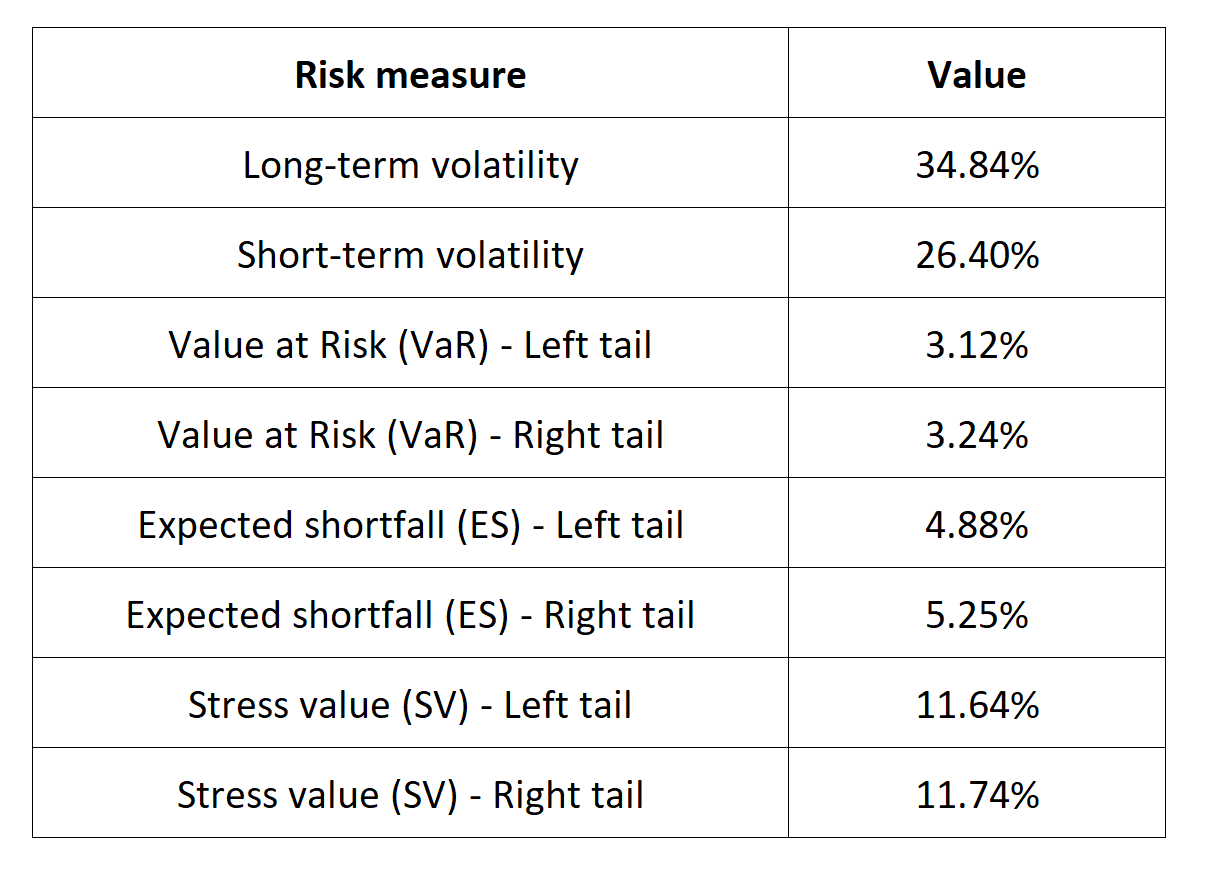

Risk measures of the BOVESPA index returns

The R program that you can download above also allows you to compute risk measures about the returns of the BOVESPA index.

Table 5 below presents the following risk measures estimated for the BOVESPA index:

- The long-term volatility (the unconditional standard deviation estimated over the entire period)

- The short-term volatility (the standard deviation estimated over the last three months)

- The Value at Risk (VaR) for the left tail (the 5% quantile of the historical distribution)

- The Value at Risk (VaR) for the right tail (the 95% quantile of the historical distribution)

- The Expected Shortfall (ES) for the left tail (the average loss over the 5% quantile of the historical distribution)

- The Expected Shortfall (ES) for the right tail (the average loss over the 95% quantile of the historical distribution)

- The Stress Value (SV) for the left tail (the 1% quantile of the tail distribution estimated with a Generalized Pareto distribution)

- The Stress Value (SV) for the right tail (the 99% quantile of the tail distribution estimated with a Generalized Pareto distribution)

Table 5. Risk measures for the BOVESPA index.

Source: computation by the author (data: Yahoo! Finance website).

The volatility is a global measure of risk as it considers all the returns. The Value at Risk (VaR), Expected Shortfall (ES) and Stress Value (SV) are local measures of risk as they focus on the tails of the distribution. The study of the left tail is relevant for an investor holding a long position in the BOVESPA index while the study of the right tail is relevant for an investor holding a short position in the BOVESPA index.

Why should I be interested in this post?

For a number of reasons, management students (as future managers and individual investors) should learn about the BOVESPA index. The BOVESPA index is a key benchmark for the Indian equity market, which is a fast developing market. Understanding how the index is constructed, how it performs, and the companies that make up the index is important for anyone studying finance or business in India or interested in investing in Indian equities.

Individual investors can assess the performance of their own investments in the Japanese equity market with the BOVESPA index. Last but not least, a lot of asset management firms base their mutual funds and exchange-traded funds (ETFs) on the BOVESPA index which can considered as interesting assets to diversify a portfolio. Learning about these products and their portfolio and risk management applications can be valuable for management students.

Related posts on the SimTrade blog

About financial indexes

▶ Nithisha CHALLA Financial indexes

▶ Nithisha CHALLA Calculation of financial indexes

▶ Nithisha CHALLA The business of financial indexes

▶ Nithisha CHALLA Float

Other financial indexes

▶ Nithisha CHALLA The S&P 500 index

▶ Nithisha CHALLA The FTSE 100 index

▶ Nithisha CHALLA The CSI 300 index

▶ Nithisha CHALLA The Nikkei 225 index

About portfolio management

▶ Youssef LOURAOUI Portfolio

▶ Jayati WALIA Returns

About statistics

▶ Shengyu ZHENG Moments de la distribution

▶ Shengyu ZHENG Mesures de risques

Useful resources

Academic research about risk

Longin F. (2000) From VaR to stress testing: the extreme value approach Journal of Banking and Finance, N°24, pp 1097-1130.

Longin F. (2016) Extreme events in finance: a handbook of extreme value theory and its applications Wiley Editions.

Business

Capital What is the Bovespa index?

Wikipedia An introduction to the Bovespa

International Finance Corporation Everything about Bovespa

Data

Yahoo! Finance BOVESPA index

About the author

The article was written in May 2023 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023).