In this article, Lilian BALLOIS (ESSEC Business School, Bachelor in Business Administration (BBA), 2019-2023) explains about the M&A Strategies.

Reminder: What are Mergers & Acquisitions?

M&A (short for Mergers and Acquisitions) refers to the processes of combining two or more companies into a single entity or the purchase of one company by another. These activities are typically undertaken to achieve specific objectives such as expanding market share, gaining competitive advantages, increasing efficiency, or accessing new technologies.

In a merger, two companies come together to create a new entity, while in an acquisition, one company acquires another, which may result in the acquired company becoming part of the acquiring company or continuing to operate as a subsidiary.

What are the five main M&A strategies?

M&A activities can take various forms and involve different strategies, such as vertical mergers, horizontal mergers, conglomerate mergers, market extension and product extension. Each approach comes with its own set of benefits and challenges.

Vertical strategy

Vertical strategy.

Source: The author

A vertical strategy involves the consolidation of two or more businesses operating at different stages of the supply chain to create an integrated product or service. A notable example of a vertical merger is the merger between Walt Disney and Pixar Animation Studios in 2006 for $7.4 billion. The merger drove growth between the businesses. The benefits of a vertical strategy include increased operational efficiency, lower operating costs, higher profits, and improved quality control. On the other hand, challenges may arise from opposing company cultures, potential loss of key team members due to role combinations, and increased bureaucratic costs.

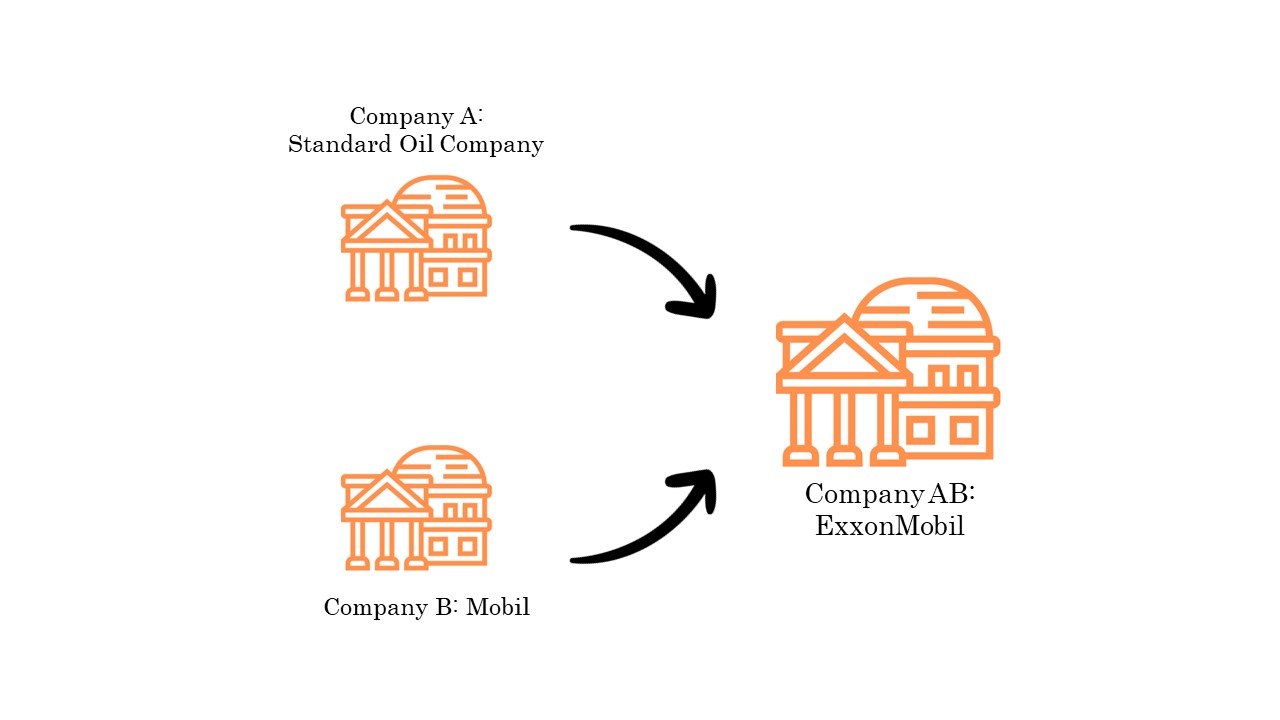

Horizontal strategy

Horizontal Merger.

Source: The author

A horizontal strategy involves two businesses within the same industry merging to eliminate competition. A good example of a horizontal merger is the merger between Exxon and Mobile in 1998 for $75.3 billion. This strategy offers benefits such as increased revenue, diversification of products and services, a larger market reach, and reduced competition. Nonetheless, it comes with challenges, including heightened regulatory scrutiny, decreased business mobility, less control over decision-making, and the risk of providing less value to customers compared to pre-merger offerings.

Conglomerate strategy

Conglomerate Merger.

Source: The author

A conglomerate strategy involves merging two companies with distinct business activities, either through pure mergers, where each company continues operating independently in their respective markets, or mixed mergers, involving product and market extensions. In 2017, Amazon acquired Whole Foods Market for $13.7 billion. The merger enabled Amazon to step foot in the grocery sphere and Whole Foods accessed Amazon’s vast customer base to boost its sales. The benefits of a conglomerate merger include a larger market share, business diversification, and increased revenue through cross-selling. However, challenges may arise, including reduced efficiency, conflicts in workplace cultures, and a shift in core business values that could lead to friction with customers and stakeholders.

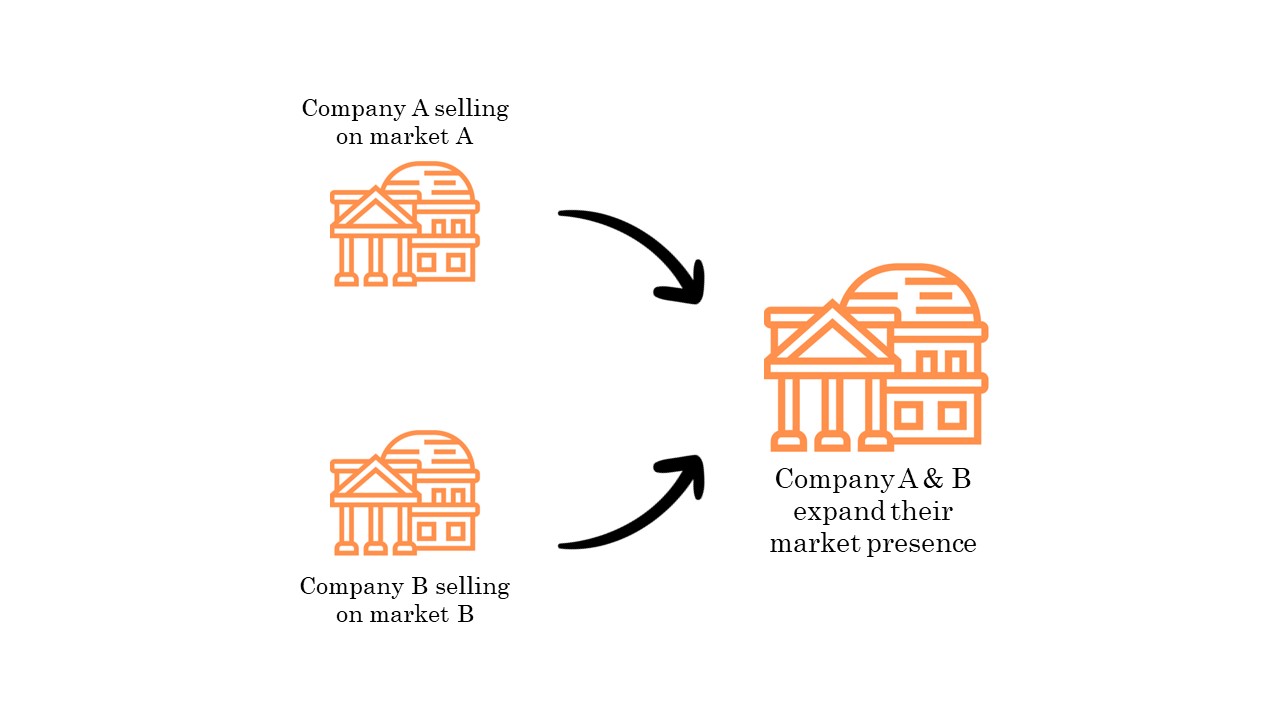

Market extension strategy

Market extension strategy.

Source: The author

The acquisition of LinkedIn (valued at $26.2 billion) by Microsoft from 2016, illustrates a market extension strategy, uniting two entities that offered distinct services — Microsoft’s technology and productivity solutions with LinkedIn’s professional networking platform. While both companies operated in different spheres of the market, the merger aimed to create synergies by integrating their respective strengths. The benefits of this merger allowed Microsoft to broaden its reach and enhance services by tapping into LinkedIn’s extensive database of professional connections. For LinkedIn, the benefits were an expanding client base and market presence. However, challenges such as increased business responsibility, higher capital requirements, and the potential for accumulating debt were factors that need careful consideration in the post-merger landscape.

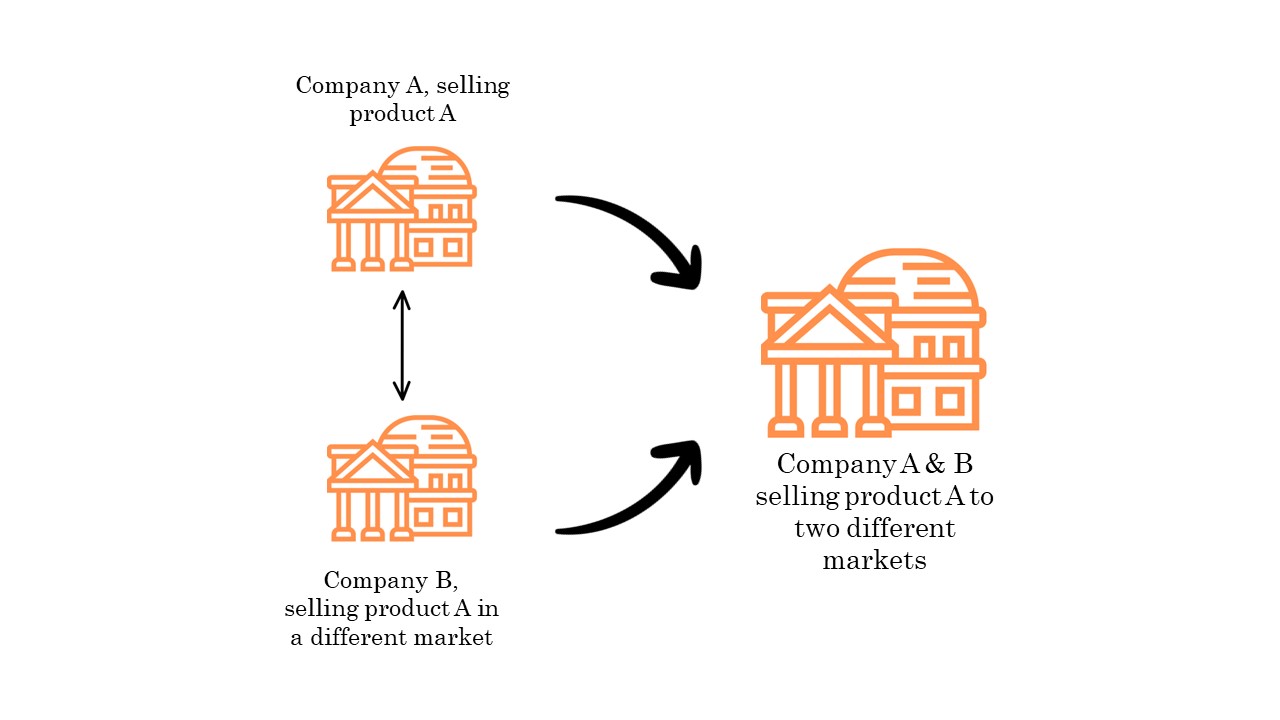

Product extension strategy

Product extension strategy.

Source: The author

An example of a product extension merger is when Pepsi Co acquired Pizza Hut in 1977. This merger involved two companies operating in the same market, offering complementary products designed for joint consumption. Pepsi Co’s acquisition of Pizza Hut aimed to diversify their offerings and tap into a broader customer base. By linking Pizza Hut exclusively to Pepsi beverages, Pepsi Co expanded sales and market reach. Within a year of the merger, Pizza Hut sales exceeded $436 million. Benefits of product extension mergers include an expanded customer base, shared resources, and reduced operational costs through collaboration. However, challenges such as potential market clutter and confusion, as well as decreased efficiency in production and marketing efforts, may arise. Despite these challenges, the primary advantage lies in creating a “mega product” that leverages a wider customer base, while the downside involves the risk of market saturation and reduced operational efficiency.

Ensuring fair competition

L’Autorité de la Concurrence

The French competition authority (Autorité de la Concurrence), uses several mechanisms to prevent mergers and acquisitions from resulting in anti-competitive practices:

- Merger Control Review: The Autorité de la Concurrence conducts a review of proposed mergers and acquisitions to assess their potential impact on competition. It evaluates factors such as market concentration, barriers to entry, and the likelihood of unilateral or coordinated effects that could harm competition.

- Market Analysis: The authority conducts market analyses to understand the dynamics of relevant markets affected by the merger or acquisition. This analysis helps to identify potential competition concerns and assess whether the transaction could lead to the creation or strengthening of a dominant market position.

- Assessment of Efficiencies: While examining mergers and acquisitions, the Autorité de la Concurrence also considers potential efficiencies that could benefit consumers, such as cost savings, improved product quality, or innovation. These efficiencies must outweigh any potential harm to competition.

- Imposition of Resorts: If the authority identifies competition concerns arising from a merger or acquisition, it may impose resorts to address them. Resorts can include divestitures of overlapping businesses or assets, licensing agreements, behavioral commitments, or other measures designed to preserve competition in affected markets.

- Legal Enforcement: If a merger or acquisition raises significant competition concerns and cannot be resolved through resorts, the Autorité de la Concurrence can prohibit the transaction outright. It can also impose fines or other sanctions for violations of competition law.

Securities and Exchange Commission

The Securities and Exchange Commission (SEC) focuses on regulating securities markets and protecting investors, rather than directly overseeing antitrust aspects of mergers and acquisitions. Nevertheless, the SEC plays a crucial role in ensuring transparency and fairness in the disclosure of information related to M&A transactions, which indirectly contributes to preventing anti-competitive practices.

Here’s how the SEC helps ensure that M&A activities do not lead to anti-competitive practices:

- Disclosure Requirements: The SEC mandates that companies involved in M&A transactions disclose relevant information to shareholders and the public. This includes details about the terms of the merger or acquisition, potential risks, and the rationale behind the transaction. By providing comprehensive and accurate disclosures, the SEC helps investors make informed decisions and promotes transparency in M&A transactions.

- Enforcement of Securities Laws: While the SEC’s primary focus is on enforcing securities laws rather than antitrust laws, it may investigate M&A transactions if they involve violations of securities regulations. For example, the SEC may investigate cases of insider trading or fraudulent activities related to M&A deals.

- Proxy Statement Review: The SEC reviews proxy statements filed by companies involved in M&A transactions to ensure compliance with disclosure requirements. Proxy statements contain essential information about the proposed transaction, like details about the parties involved, the terms of the deal, and potential conflicts of interest. Through its review process, the SEC helps to ensure that shareholders receive accurate and complete information about M&A transactions.

- Regulation of Tender Offers: The SEC regulates tender offers to protect shareholders from coercive or fraudulent practices. Companies making tender offers must comply with SEC regulations regarding disclosure and fairness to shareholders. The SEC may intervene if it identifies any irregularities or violations of securities laws in tender offers.

While the SEC’s role in directly preventing anti-competitive practices in M&A transactions is limited, its oversight of disclosure requirements and enforcement of securities laws contribute to promoting transparency, fairness, and investor protection in the M&A process. Additionally, the SEC collaborates with other regulatory agencies, such as the Department of Justice (DOJ) and the Federal Trade Commission (FTC), which have primary responsibility for enforcing antitrust laws related to mergers and acquisitions.

Why should I be interested in this post?

This post offers a comprehensive understanding of Mergers & Acquisitions (M&A) strategies, providing insights into the benefits and challenges associated with various approaches. Covering the five main M&A strategies – vertical, horizontal, conglomerate, market extension, and product extension – the post dives into real-world examples. Readers will gain a deeper understanding of how different M&A strategies are implemented, their advantages as well as the challenges they may encounter. Whether you’re a business professional looking to expand your knowledge of M&A or a student delving into strategic management, this post offers valuable insights into the complexities of M&A strategies in today’s corporate landscape.

Related posts on the SimTrade blog

▶ Louis DETALLE A quick presentation of the M&A field…

▶ Louis DETALLE How does a takeover bid work & how is it regulated?

▶ Raphaël ROERO DE CORTANZE In the shoes of a Corporate M&A Analyst

▶ Rick MARCHESE Difference between a merger and an acquisition

Useful resources

Academic References

Bernile, G., Lyandres, E. and Zhdanov, A. (2011) A theory of strategic mergers European Finance Review, 16(2) 517–575.

A practical guide to mergers, acquisitions, and divestitures Delta Publishing Company

Specialized References

PwC (2020). Mergers & Acquisitions

Securities and Exchange Commission (SEC)

Reuters Mergers and Acquisitions

About the author

The article was written in February 2024 by Lilian BALLOIS (ESSEC Business School, Bachelor in Business Administration (BBA), 2019-2023).