In this article, Annie YEUNG (ESSEC Business School, Global Bachelor in Business Administration (GBBA) – Exchange Student, 2025) explains about understanding tariff bargaining that involves international organizations, governments, and industries..

The World Trade Organization (WTO)

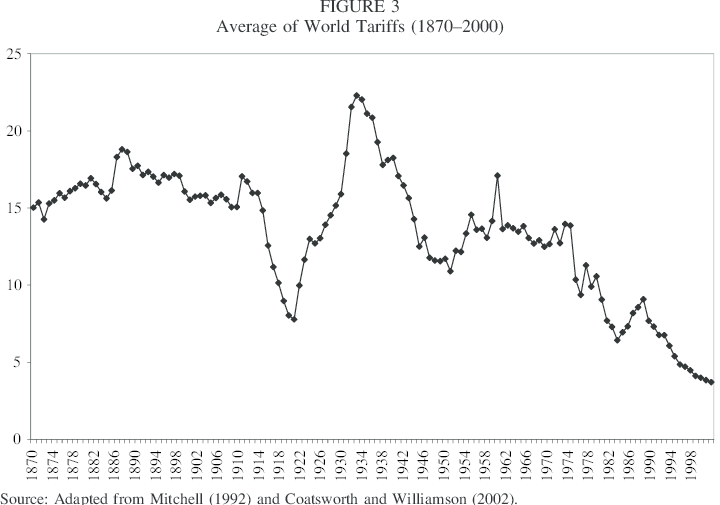

The WTO was established in 1995 and is the most influential international organization in managing and negotiating for global trade. The WTO includes 164 member countries, and its main goal includes facilitating trade negations and monitor trade policies, especially tariffs. There has been statistics showing that average global tariffs has decreased since the establishment of WTO. For example, average bound tariffs for decreased by nearly 3 percent from 1995 to 2023.

The WTO is also plays an important role in bargaining tariffs. For example, the Doha Development Round, launched in 2001 under the WTO has focused on improving trading for developing nations. This negotiation, initiated by the WTO, has aimed to make global trade equitable. Its missions include reducing agricultural subsidies, lowering tariffs, which all have effect in order to help developing nations improve access to trading in the global market. There has been negotiations created amongst developed and undeveloped countries, with these negotiations focusing on farm subsidies and market access, as well as lowering industrial tariffs to allow developed nations to better participate in global trading activities . however it is important to note that despite ongoing talks, this round of negotiation has not been successful in delivering an agreement. This failure could have been attributed to the challenges in different trading activity interests amongst different countries. For example, there has been different perspectives in trading such as agricultural subsidies, and tariffs on services, resulting in unresolved conflicts despite negotiation.

WTO negotiations reflect deeper global power imbalances, which are manifested in trading activities and tariffs imposed. The more influential and wealthier nations often hold more bargaining power and power in the global trading market landscapes. For example, these influential countries, particularly those in the G20, often set agenda in the trade negotiations and possess more negotiating capacity. As a result these countries often dominate in negotiations, setting a dynamic that advocate for their trade interests during the process of bargaining of tariffs.

The African Group, the Association of Southeast Asian Nations (ASEAM) are organizations that have become more active, which these countries have formed organizations in order to bargain for equity in the global trading landscape. These organizations that are forming alliances in order to bargain for equitable trading systems that are recognizing asymmetries between economies to push for stabilization for less developed countries. While developed nations are pushing for lower tariffs across all sectors. However, the countries with large economies often contend that decreased tariffs will destabilize economies. As a result, the WTO plays a crucial role to address this imbalance. For example, the “Special Differential Treatment” proposed by the WTO framework promotes more support for developing countries in implementing trade agreements and reducing tariffs. This could reduce unfair trade advantages and reconcile global trade liberalization amongst developed and undeveloped countries..

Trade Negotiation Teams – Representatives

Trade negotiations are often led by high-ranking officials representing their nations. For example, the U.S. Trade Representative (USTR) is a team of experts that are specializing in multiple fields in industries, including agriculture, technology, labor, environment etc. For example, the negotiation team participating in the 2024 Trade Policy Agenda which the USTR emphasized on commitments for their countries interests, negotiating for high-standard commitments in sustainable trade practice to bolster supply chain resilience. The USTR also participates in the World Trade Organization to unify positions with other organizations such as the African Group and the ASEAN to implement trade agreements with other developing countries.

For example, the United States imposes an average agricultural tariff of 5.1%. India has an average agriculture tariff of 38% to protect domestic producers. The European Union imposes 11% in agricultural tariffs. These disparities often lead complex negotiations, especially with agriculture which is crucial for food security .Hence, negotiation objectives often focus on reciprocity. This means to maximize benefits, which trading partners much seek for equivalent concessions, and negotiate on agreements to match others. For example, if one agrees to lower tariffs, the trading partner shall agree to provide benefits on a similar traded product. This ensures mutual benefit in policy making and reaching political goals. However, reciprocity could sometimes be challenging when two countries are under asymmetrical power dynamics, such as negotiating between developed and developing countries, Furthermore, during negotiation, while trade liberation is a long-term mission in tariff negotiations, each country approaches tariff negotiation seeking to protect strategic sectors, preserve jobs, and ensuring their own country’s interests. In negotiating for tariff cuts, some countries may insist on tariffs in protection for their own domestic producers, or in goal to safeguard their own strategic sectors.

Examples of governments’ Tariffs – a case study

Trump – the U.S. – China Trade War during 2018 to 2020

The U.S. China trade war during the 2018-2020 led to higher prices for American consumers. China responded with retaliatory tariffs on U.S. goods, and global trade dynamics were disrupted. The trade wars between U.S. and China also casted an effect on the economies globally, as the two countries have such large economies.

As a result from the trade war, both the U.S. and China have experienced profound effects in multiple perspectives of their economies. The U.S> economy were affected in their GDP and employment. According to a report from Bloomberg Economics, the trade war in 2019 has costed the US economy at $316 billion. The trade wars has also resulted U.S. in stock market losses, with research from the federal reserve Bank of New York finding U.S. firms losing at least $1.7 trillion in market value as a result from the tariffs imposed on imports from China. China has also experienced economic challenges as a result from the trade wars, with export decline and experiencing economic pressures. China has experienced an export growth slow-down, indicating deepened economic challenges.

Furthermore, the trade wars has casted a great effect to the global economic markets. With the two countries being two of the world’s largest economies, their trade tensions has led to significant shifts in market dynamics and economic growth on a global scale. According to data from Banque de France, 10 percent increase in tariffs could reduce global GDP by 3%. This decline as a result from the trade wars and increased tariffs is a result of increased prices that leads to decreased productivity, higher financing costs and reduced investment demand. According to data from The World Economic Forum, it is documented that the trade war has resulted a decrease of global GDP growth to 2.8% in 2019.

Related posts on the SimTrade blog

▶ Shruti CHAND Balance of Trades

▶ Marine SELLI Trump Trade

▶ Louis DETALLE Understand the mechanism of inflation in a few minutes?

Useful resources

A Quick Review of 250 Years of Economic Theory About Tariffs

Tariff Negotiations and Renegotiations under the GATT and the WTO — Procedures and Practices

A quantitative analysis of multi-party tariff negotiations

About the author

This article was written in June 2025 by Annie YEUNG (ESSEC Business School, Global Bachelor in Business Administration (GBBA) – Exchange Student, 2025).

▶ Read all posts written by Annie YEUNG