Explanations for the recent changes in the Mexican economic landscape

In this article, Jorge KARAM DIB (ESSEC Business School, Master in Strategy and Management of International Business (SMIB), 2024-2025) shares his thoughts about the different financial instruments recently available in Mexico that have been changing the economic landscape for the country and their residents in the recent years. He especially explains the role of high interest rates, new digital banks, and nonbanking financial instruments in Mexico’s recent booming economy, sharp Mexican peso appreciation, and strong increase in its GDP.

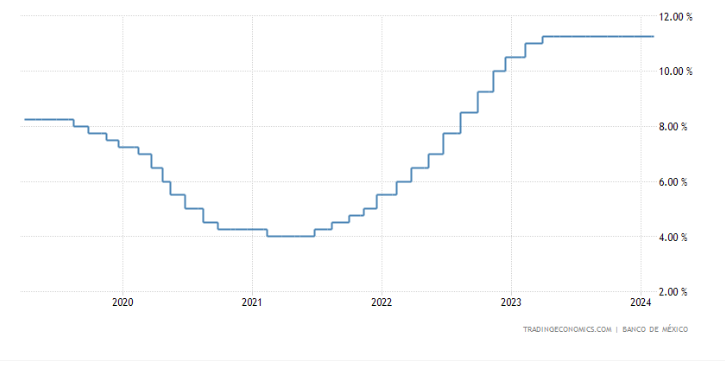

Interest rates in Mexico

For the last couple of years, the world has lived an era of high interest rates, mainly derived from the high inflation we got out of the pandemic and the war in Ukraine. Since then, the priority of most of the central banks of the world has been to cool down the economy and bring down inflation. Mexico has not been the exception. Mexico’s interest rates have been between 10% and 11% in the past three years. Some economists may consider this level -dangerously- high, but the country has seen mostly benefits like increasing peso’s appreciation, and a strong growth in the national GDP, from this level of interest rates than negative outcomes, and most important, Mexico’s government has been able to maintain the interest rates under a “controlled” level.

Evolution of Mexico’s interest rates.

Source: Trading Economics.

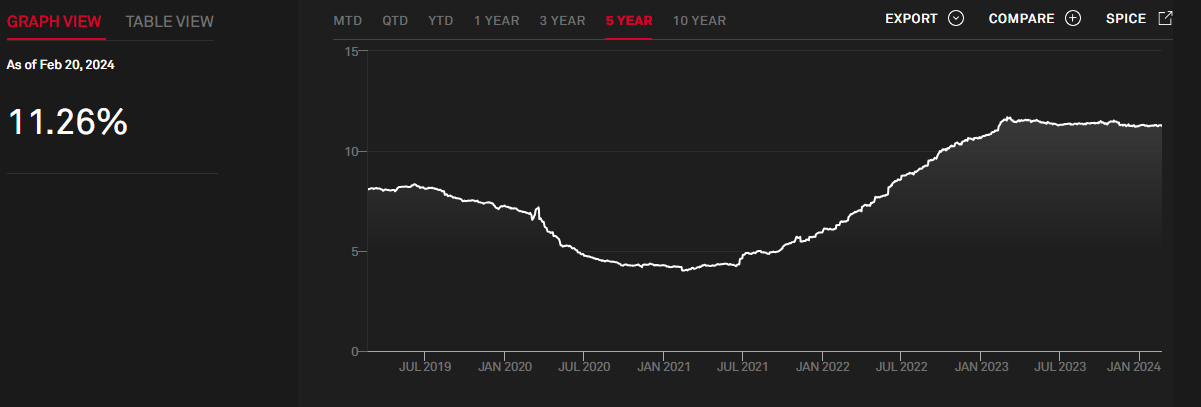

The strategy of Mexico’s Central Bank has been very clear: to stay above the interest rates of the U.S.A. The benefits of staying above the interest of the USA’s is to target the remittances (money, mainly US Dollars, sent to Mexico, by migrant workers to their families), an objective that due the geographical conditions become very relevant. According to Statista, remittances represent a 4% of their GDP, either if it’s from migrant workers sending money to their families, or foreign investors trying to take advantage of the high interest rates in the country. “CETES” (Certificados de la Tesorerís de la Federación) is one of the most attractive instruments for foreign investments, because of the security CETES represent by being an instrument issued by the Mexican government, in the form of bonds mainly, with a return rate oscillating between 10%-12%.

CETES.

Source: S&P Dow Jones indices.

Digital Banks

There’s a recent uptrend in Latin America, but specially in Mexico of digital banks. In the last couple of years, we’ve seen multiple companies trying to gain market share, derived from the massive success of the Brazilian “unicorn” start-up Nu bank. In Mexico, the number of digital banks is starting to get closer to the traditional banks. Just in the last years, digital banks like Klar, Ualá, Hey Banco, RappiPay, among many others have entered the Mexican market with the objective to compete for market share with Nu bank.

Apart from the many benefits and functionalities that digital banks provide, better than the traditional banks, they’ve tried to attract more customers by trying to take advantage by offering the customers the possibility of investing their money inside their organization by adding a tool to their services called a “SOFIPO”, which will be explained further in the article. The return offered by each SOFIPO will depend on each institution issuing the instrument, but it will be mainly linked to the interest rate in the country. As we mentioned before, we are in a high interest rate season, which has turned into a “bidding war” for digital banks to offer better returns. As of February 2024, Nu bank offers one of the highest with 15%, Klar 14%, Hey Banco 11%, Ualá 15%.

The Mexican peso appreciated against the dollar in 2023 by 14%, reaching an eight-year low. Important to note that all these attractive financial instruments joined with a strong benefit from the world’s leading trends like nearshoring, have made Mexico become one of the best performing countries in terms of economy in the past few years and also one of the most attractive to invest in.

Mexican peso.

Source: Yahoo finance.

¿What is a SOFIPO?

Acronym for “Sociedad Financiera Popular” (Popular Financial Society), are defined as financial institutions -nonbanking- regulated by the CNBV (Comisión Nacional Bancaria y de Valores en México). They offer a wide variety of financial instruments such as personal loans, credits, financing for small companies, and more. The intention of why this instruments (SOFIPO’s) were created is mainly to open the financial services to a broader public and/or have more inclusion when it comes about investing, credits, and more.

Conclusions

There is no doubt that Mexico has a good advantage when it comes to macroeconomic trends, mainly due its geographical position. But recently, they have been able to complement the attractiveness with financial instruments and rates extremely attractive to the foreign audience and the local one. The challenge lies in keeping under control the high interest rates, even though inflation is not in double digits anymore, the benefits that the actual rates have brought to the country have been substantial, besides as the original plan is to follow with a margin the decisions of the U.S.A., there is no decision yet to bring down the rates. Not everything is positive with this financial conditions, the cost of debt in the country is very high at the moment, which will slow down the sales of houses and cars.

Why should I be interested in this post?

This post is with the intention to shine a light on potential advantages and trends that are happening in one of the most attractive countries, financially and economically speaking in the world. In any way this article pretends to be an investment advice and/or suggestion. Any decision should be taken under personal responsibility and with their respective due diligence previous to the decision.

Related posts on the SimTrade blog

▶ Cynthia LIN Financial products marketing in neobanks

Useful resources

Trading Economics Mexico interest rate

Mexico Business News Nonbanking financial institutions face historic opportunity

Statista Remesas en Mexico

S&P Dow Jones IndicesS&P BMV Government CETES Bond Index

El Economista Nu Mexico busca combatir el ahorro pasivo lanza oficialmente cuenta de ahorro

El Universal Guerra de tasas, Nu ofrece rendimientos de 15 en cuenta de ahorro

Mexico Business News Mexican peso appreciation 2023 affects public revenues

About the author

The article was written in March 2024 by Jorge KARAM DIB (ESSEC Business School, Master in Strategy and Management of International Business (SMIB), 2024-2025).