A quick presentation of the Restructuring job…

In this article, Louis DETALLE (ESSEC Business School, Grande Ecole Program – Master in Management, 2020-2023) explains the job of an analyst in Restructuring.

What does Restructuring consist in?

Restructuring is a term that encompasses all professionals working to assist companies in difficulty. In this market, various categories of actors are involved: debtors (often the company in difficulty), creditors (which may be banks), shareholders (of the company in difficulty) and managers.

Restructuring is an activity that comes to the aid of companies facing economic and financial difficulties in the course of their lives that could threaten their survival in the short or medium term. The particularity of this sector is that it requires both a real financial technicality and a legal technicality, which are invaluable during complex collective procedures.

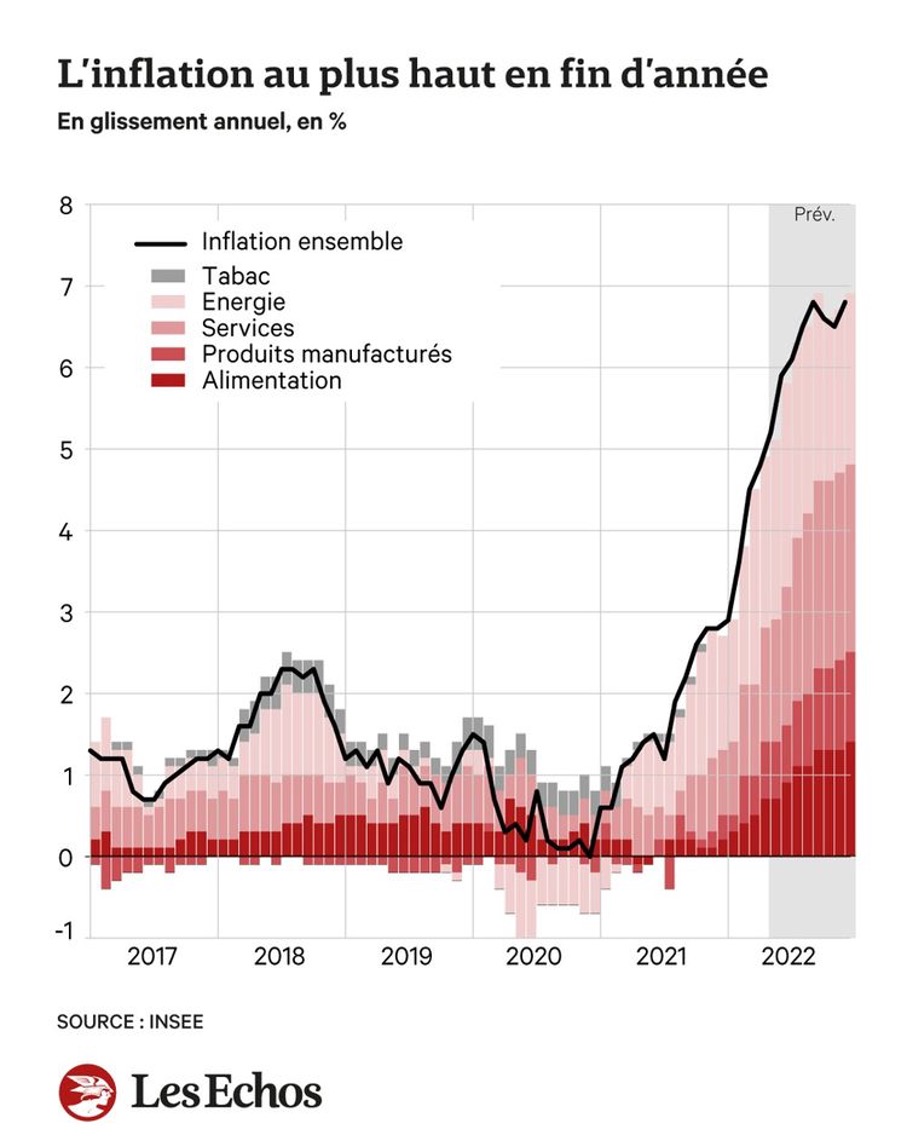

This activity is particularly fashionable in the current context, marked by the post-covid period, and it should be noted that the restructuring profession generally does well in periods of crisis or post-crisis since the number of companies in difficulty increases.

What does an analyst in Restructuring work on?

There are several situations in which a company in difficulty may call on the services of a restructuring consultancy.

However, if a general methodology is to be given, the missions of a restructuring analyst are generally as follow:

Analysis of the company’s history and the choices that led it to find itself in this situation (collective procedure in France for example). The first step is therefore to determine how the company got into such difficulties. The objective is simply to understand the choices and events that led to this situation.

A strategic due diligence is then required: In order to understand the prospects for improving the company and its activity, the business plan submitted by the company must be carefully examined in order to gauge the company’s future ability to repay its creditors.

To do this, a comparative analysis of the business plans of the last 10 years compared to the results actually achieved may be judicious in order to gauge the realistic nature of the company’s management. A forecast analysis of the evolution of the company’s market is also essential to assess whether the company will evolve in a favorable context or not. A strategic analysis must complete this due diligence work to see if the business strategy implemented is consistent with the developments anticipated by the restructuring firm.

Definition of the sustainable debt level and production of a debt repayment plan: Next comes a turnaround plan to suggest ways to improve the company’s management and profitability. This may involve reducing the cost structure, requesting longer payment terms to relieve pressure on operating cash flow.

Finally, the company will have to define its sustainable debt level. The company will propose a new sustainable debt according to the estimates made by the Restructuring firm. This will allow the company to continue its activity under new conditions that will enable it to repay the old debts that have not been honored as well as the new debt intended for the continuation of the activity.

In doing so, the restructuring firm will enable the creditors to assess the company’s future capacity to honor its debts in the event of a continuation of its activity under the terms proposed in the turnaround plan.

What is interesting & demanding in Restructuring?

First of all, a restructuring analyst can work on extremely complex cases, both because of the number and nature of the players involved and because of the situations of the companies in difficulty.

Indeed, if all economic crises are different, it is also because all the events that cause them have a different impact on companies. This is why each restructuring assignment is different from another, and this is an aspect that many professionals in this sector stress.

However, this diversity of subjects obviously suggests complexity since each subject is not like any other. On the other hand, the topics encountered are related to both legal and financial considerations, which requires skills in Law as well as in Financial Modelling. Profiles with these two facets are therefore highly appreciated.

Related posts on the SimTrade blog

▶ Louis DETALLE A quick presentation of the Private Equity field…

▶ Louis DETALLE A quick presentation of the M&A field…

▶ Frédéric ADAM Senior banker (coverage)

Useful resources

KPMG’s definition of Restructuring

An article about how Restructuring creates value for companies…

About the author

The article was written in October 2022 by Louis DETALLE (ESSEC Business School, Grande Ecole Program – Master in Management, 2020-2023).