Spoofing

This article written by Akshit Gupta (ESSEC Business School, Grande Ecole Program – Master in Management, 2022) presents the technique of spoofing, which is a type of market manipulation in financial markets.

Definition

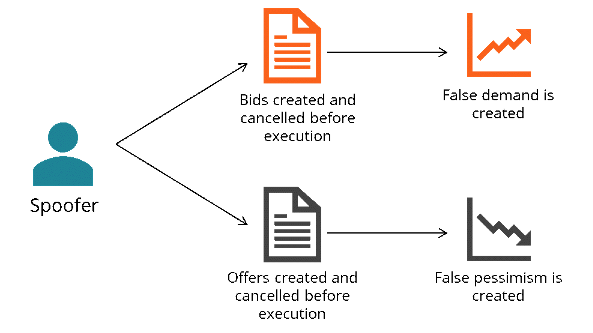

Spoofing is a form of market manipulation in which a trader places a large order to buy or sell a financial asset with no intention of execution of the order but to create the illusion of a change in the demand and/or supply for the asset and eventually maneuver market prices. Upon receiving the market response, the trader then cancels his or her order and then benefits from other investors’ reactions by trading on the asset thus earning huge but illegitimate payoffs. Spoofing is usually based on algorithmic trading, which allows to trade in the market at high speed.

Spoofing Mechanism

Under spoofing, the manipulator places small buy or sell orders at shorter time frames near the best bid (or ask) price in a manner that the order has very less probability of being executed in the market. The orders are placed in such a manner that creates a misleading impression of increasing liquidity in the market. The orders help in creating artificial demand/supply for the asset in the market and lures other investor’s interest towards the asset. The manipulator doesn’t have the intent of executing the order and generally takes advantage of the price movements that might result from the misleading impression of increasing liquidity that the orders created.

Spoofing and financial regulation

According to the Financial Conduct Authority, “Abusive strategies that act to the detriment of consumers or market integrity will not be tolerated” and Spoofing, being a type of market manipulation, is an illegal practice in UK accompanying penalties. In U.S. too, as per the Dodd-Frank Act of 2010, Spoofing is unsanctioned by law. Despite the criminal liability, however, some institutions and individuals continue to get involved in it for undue gains.

Spoofing and high frequency trading

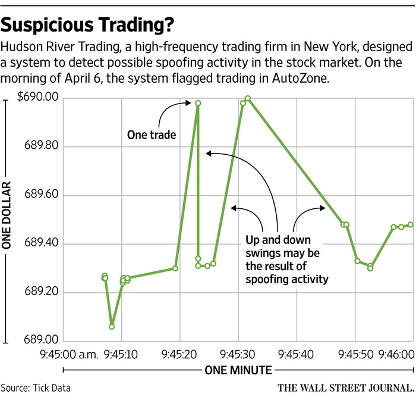

Spoofing has been around for decades as traders attempt to take advantage of other market participants by artificially inflating or deflating the price of an asset. Spoofing became more prominent in the 2010s with the rise of High Frequency Trading (HFT) which is a powerful, automated way to transact a large number of orders at very high speed. HFT provides opportunities for price manipulation through spoofing as orders can be placed and canceled very quickly. However, with time, it also attracted the notice of financial regulators and law enforcement officials as the following case will explain.

The ‘2010 Flash Crash’

On May 6, 2010, a dramatic decline was seen in the US stock market as the Dow Jones Industrial Average index fell more than 1,000 points in 10 minutes along with other stock market indexes such as the S&P 500 and Nasdaq Composite. Over one trillion dollars of market capitalization were wiped out, though 70% was regained back by the market before the end of the day. This dramatic event has been named the ‘2010 Flash Crash’.

Among a frenzy of speculation, the cause for this market crash was attributed to some big HFT bets on the Chicago Mercantile Exchange. London-based futures trader Navinder Sarao was actually spoofing in the e-Mini S&P 500 contracts.

The US Commodity Futures Trading Commission (CFTC) alleged that Sarao’s use of the dynamic layering technique contributed to an order book imbalance between buy-side and sell-side orders, which created downward pressure on prices in the market, especially given the size of orders he was placing. The CFTC said that Sarao made $879,018 in net profits in the e-Mini S&P 500 contracts that day.

Relevance to the SimTrade certificate

The concept of spoofing relates to the SimTrade certificate in many ways:

About theory

- By taking the Exchange orders course, you will know more about the different type of orders that you can use to buy and sell assets in financial markets.

- By taking the Market information course, you will understand how information is incorporated into market prices and the associated concept of market efficiency.

About practice

- By launching the Sending an Order simulation, you will practice how financial markets really work and how to act in the market by sending orders.

- By launching the Efficient market simulation, you will practice how information is incorporated into market prices through the trading of market participants, and grasp the concept of market efficiency.

Related posts on the SimTrade blog

▶ Akshit GUPTA Market manipulation

Article written by Akshit Gupta (ESSEC Business School, Grande Ecole Program – Master in Management, 2022).