Ponzi scheme

This article written by Louis Viallard (ESSEC Business School, Master in Management – Economic Tracks, 2020-2022) presents the basics of a fraudulent financial scheme: the Ponzi scheme. The famous and recent Madoff Affaire is used to illustrate this financial fraud.

In the Letter 142 of The Persian Letters, Montesquieu tells us the mythological tale of the son of Aeolus, god of the wind, who decides to travel the world to sell air-filled otters. The French author presents us with his reflections on a new discipline in gestation in the 17th century that already fascinates minds: modern finance. Indeed, Montesquieu’s work was written in 1720, the same year as the bursting of one of the first financial bubbles of our history following a speculation around the Royal Bank and the Mississippi Company in which Montesquieu, a contemporary of the crash, was interested. The example used in The Persian Letters with the metaphor of the wind to qualify financial speculation and certain fraudulent financial mechanisms is perfectly suited to define a sadly famous fraudulent scheme: the Ponzi Scheme.

Money makes money – What is a Ponzi scheme?

A Ponzi scheme is a form of financial fraud in which participants are paid with money invested by subsequent participants, not by actual profits from investments or business activities. Investors are attracted by windfall dividends that are paid by the entry of new investors into the system to pay the first ones and so on.

The organizers of a Ponzi scheme generally attract investors by offering higher returns than any legitimate business can offer. The rate of growth of new inflows must be exponential in order to be able to remunerate members, and the system inevitably breaks down when the need for funds exceeds new inflows. Most participants then lose their investments, even though the first participants – including the founders – can benefit from high returns or exceptional annuities provided that to have withdrawn from the scheme in time.

Fraudsters organizing such schemes often target groups that have something in common, such as ethnicity, religion or profession, in the hope of exploiting their trust. The example of the Rochette Affaire in 1908 illustrates this well. Henri Rochette managed to capture the small provincial savings by relying on the wave of investment in coal mines at the beginning of the 19th century and by selling the merits of his (fictitious) companies through investment advice journals that he himself controlled.

An example of a Ponzi Scheme – The Madoff scandal

Bernard Madoff was born in 1938. This American broker immersed himself in finance at a very young age and quickly earned a good reputation among the greatest financiers. Reputed to be intuitive, ultra-fast but also very “ethical”, he had finally established himself in the financial community, which earned him the position of President of Nasdaq from 1990 to 1991. Socially-minded, jovial, he managed to capture the confidence of his future clients.

Through his fund (Bernard Madoff Investment Securities), Mr. Madoff received capital to manage, which he supposedly invested in a complex investing technique: the split-strike conversion strategy (see Bernard and Boyle (2009)). It is a three-step technique. First, you buy a portfolio of securities (the S&P100 index in the case of the Madoff). Second, you purchase out of the money put options with a nominal value on the underlying asset equal to the value of your portfolio. The objective is to limit the risk of loss of the portfolio. Third, you write out of the money call options on the underlying asset with a nominal value equal to the value of your portfolio. The sale of calls finances the purchase of puts.

When the performance was not there, instead of reducing the return distributed to investors, Madoff simply took the money from the new investors and used it to pay the old ones. As a result, he gave the impression of an exceptional performance in terms of risk-return trade-off (relatively high performance but delivered regularly year after year). Such an investment track record allowed Mr Madoff to attract more and more investors, but year after year, he squandered the capital they had entrusted to him.

When the stock market crisis broke out in 2008, many investors wanted to withdraw their funds from Madoff investment. Too many at the same time. Mr. Madoff could not give their money back. He informed his son of the situation and he warned the authorities. On December 11th 2008, Bernard Madoff was arrested by the FBI and was then sentenced to 150 years in prison.

Economic and financial damage

Ponzi schemes are expensive for most participants and divert savings from productive investment. If left unchecked, they can grow disproportionately and cause great economic and institutional damage, undermining confidence in financial institutions and regulators and putting pressure on the budget in the event of bailouts. Their collapse can even lead to economic and social instability.

In the case of a Ponzi Scheme detected, there is a need for a rapid government response. However, the authorities often struggle with not only detecting these scams at an early stage but also put an end to it. There are several reasons why it is difficult to stop these practices. Often, neither the leaders nor the schemes are licensed or regulated. In many countries, supervisory authorities do not have appropriate enforcement tools, such as the right to freeze assets and block systems quickly. On the one hand, once a Ponzi scheme has grown, authorities may be reluctant to stop it, because if they do so – thus preventing it from meeting its repayment obligations – subscribers may blame them rather than the inherent flaws in the system. It is not uncommon to see investors supporting the authors of these chains, trusting them blindly. But on the other hand, when the system collapses of its own accord, experience shows that the authorities can be criticized for not acting more quickly.

“Trust does not preclude control” – The necessity to regulate

To prevent Ponzi schemes, authorities must be prepared to intervene on several fronts. Here are the main ideas when it comes to fight Ponzi schemes:

Investigate. Ponzi schemes are generally difficult to detect due to their opaque or even secretive operation, as members are required to maintain confidentiality. In order to detect them, regulators need to develop effective and sophisticated ways to identify this type of fraud. New technologies can provide an answer through an automatic analysis model that identifies (legal) pyramid schemes that would require further analysis.

Intervene urgently. The procedures required for the prosecution of a person alleged to be the perpetrator of a Ponzi scheme are very lengthy. So much time is left for the perpetrator to disappear. It is necessary to have the legal possibility to immediately stop any activity that is proven to be a Ponzi scheme (freezing of assets, protection of spyware interests, etc.).

Arrest. Heavy penalties must be imposed on crooks, including criminal action (as was the case for Bernard Madoff, who was sentenced to 150 years in prison).

Coordinate and cooperate. It is necessary that the financial authorities must collaborate with the legal system to penalize and regularize. To combat scams, financial regulators need effective mechanisms for information exchange and cooperation. To achieve this, the role of the International Organization of Securities Commissions (IOSCO) is central to the articulation of global standards.

Inform. Financial training can be a barrier to scams. It is also essential for financial regulators to inform and educate the public about the main methods used to deceive savers. In the name and shame concept, creating lists of persons or organizations that may or may not be licensed to engage in financial activities, as well as a database describing the actions taken against certain persons and entities, is also a good way to counter any malicious activity.

What lessons can be learned?

Many lessons can be learned from Ponzi schemes, both at the micro and macro levels.

At the micro level, it is important to remind individual investors that the analysis of an investment is essential and must follow three precise criteria: profitability, risk and liquidity (not to be neglected). It is also very wise to follow the adage “don’t put all your eggs in one basket”; portfolio diversification allows you to benefit from the “portfolio effect” due to low statistical correlation among assets.

At the macro level, it is essential for the regulator (like the Securities Exchange Commission (SEC) in the US or the Autorité des Marchés financiers (AMF) in France) to put in place tools to monitor and prevent Ponzi schemes, and to work in collaboration with the legal institutions to dissuade and to punish this type of behavior.

Useful resources

Ponzi schemes

Frankel T. (2012) The Ponzi Scheme Puzzle: A History and Analysis of Con Artists and Victims” Oxford, University Press.

Monroe H., A. Carvajal and C. Pattillo (2010) “Perils of Ponzis” Finance & development , 47(1).

Madoff’s scandal (2008)

Bernard C. and P.P. Boyle (2009) “Mr. Madoff’s Amazing Returns: An Analysis of the Split-Strike Conversion Strategy” The Journal of Derivatives, 17(1): 62-76.

Bernard Madoff’s vision about business (video)

Testimonials by Markopolos (video)

Markopolos Talks About Offering To Go Undercover To Stop Madoff (video)

Wetmann A. (2009) L’affaire Madoff, Pion.

The Rochette Affaire (1908)

Jeannenay J.-N. (1981) L’Argent caché : milieux d’affaires et pouvoirs politiques dans la France du XXe siècle Paris, Editions du Seuil.

Related posts on the SimTrade blog

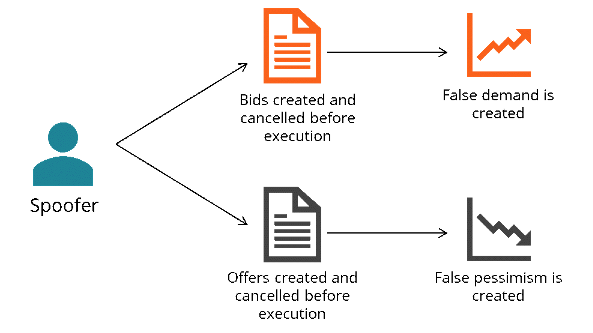

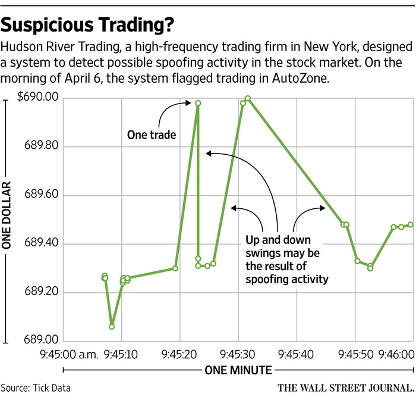

▶ Akshit GUPTA Market manipulation

▶ Louis DETALLE Quick review on the most famous trading frauds ever…

About the author

Article written by Louis Viallard (ESSEC Business School, Master in Management – Economic Tracks, 2020-2022).