In this article, Isaac ALLIALI (ESSEC Business School, Bachelor in Business Administration (BBA), 2019-2023) decodes the business performance by analyzing the top line, the line, and the bottom line.

Introduction

In the realm of finance and business, terms like “top line,” “the line,” and “bottom line” often dominate discussions. But what do they really mean, and why are they so important in evaluating a company’s financial health? This article aims to elucidate these key financial terms and their relevance to business performance assessment.

The Top Line

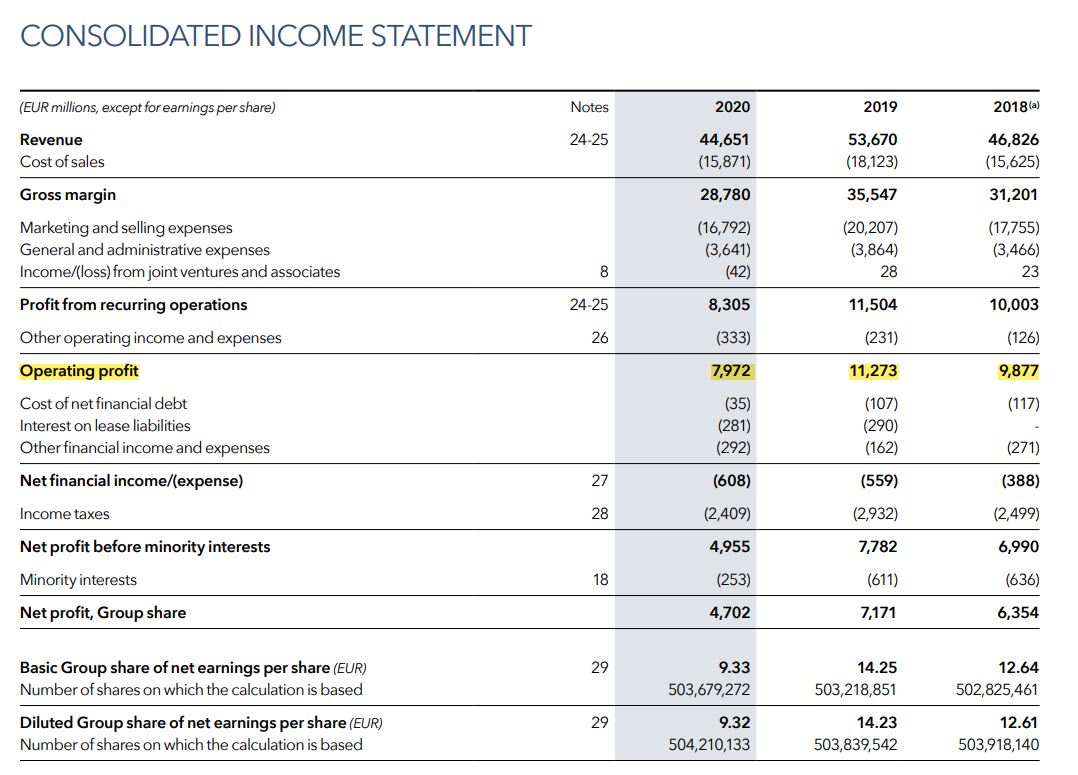

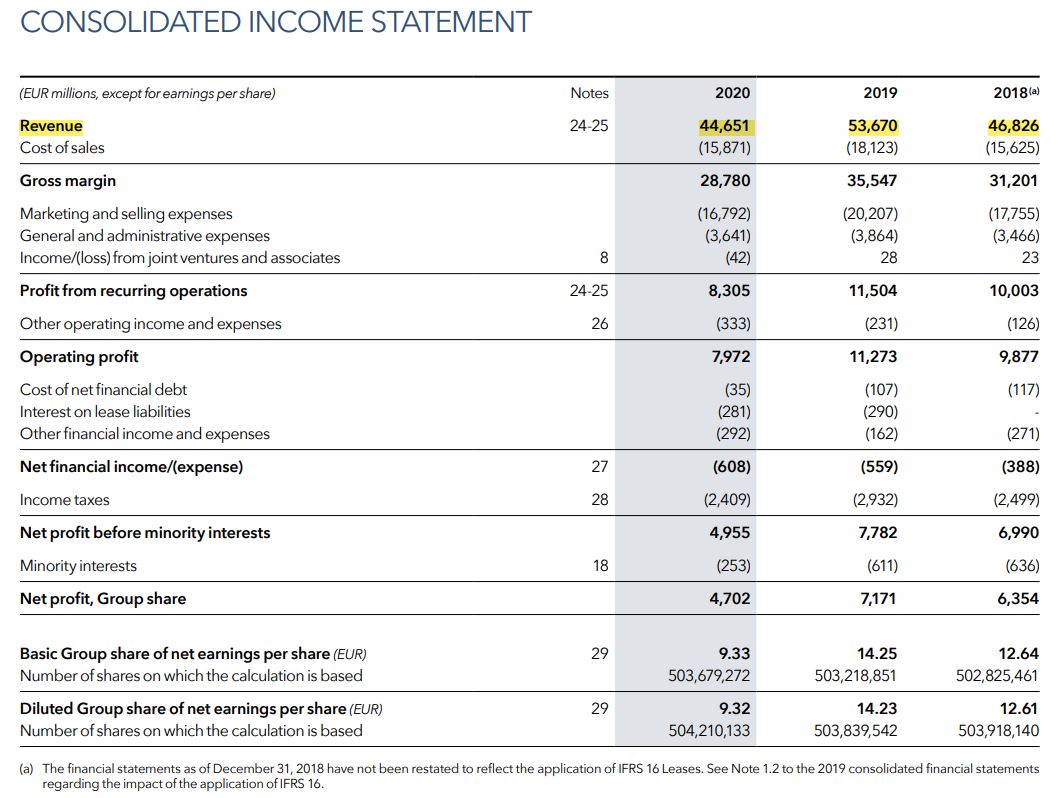

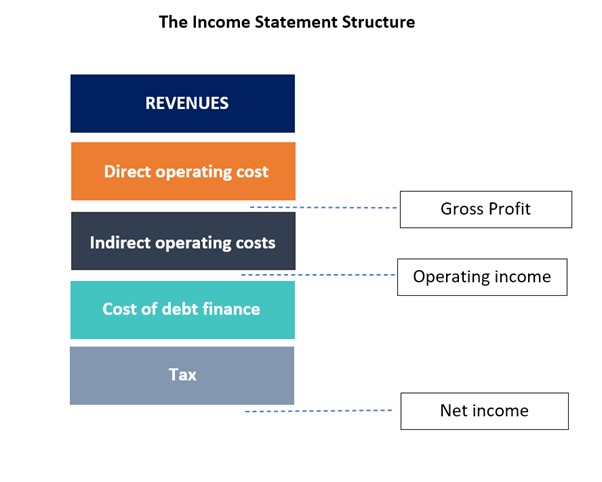

The “top line” refers to a company’s gross revenue or sales, so named because it appears at the top of a company’s income statement. It reflects the total revenue earned from the sale of goods or services before deducting any costs or expenses. This figure is crucial as it indicates the company’s ability to sell its products or services, which is fundamental to its business operations.

The strategies for increasing the top line generally focus on enhancing sales through marketing efforts, pricing strategies, product development, or expanding into new markets. While it may seem that a growing top line (revenue) is indicative of profitability, it is important to recognize that this metric alone does not consider the expenses associated with generating that revenue. In other words, the increase in revenue does not guarantee increased profitability. It is crucial for investors to understand that a company’s top line growth does not always align with its profitability.

For instance, if the cost of producing goods or services is rising faster than sales, profits might be shrinking despite increased revenues.

The Line

While “the line” is a less commonly used term in comparison to the “top line” and “bottom line”, it is often used to refer to the “break-even line.” The break-even line represents a point where total costs (including both fixed and variable costs) are equal to total revenue.

At this juncture, the company isn’t making a profit, but it isn’t incurring a loss either. Understanding the break-even point is essential for businesses because it provides a clear target to cover costs and start making profits.

Knowing when a company will hit its break-even point can help investors understand when it might start turning a profit. In addition, a company with a lower break-even point can withstand market fluctuations better, representing a potentially less risky investment.

The Bottom Line

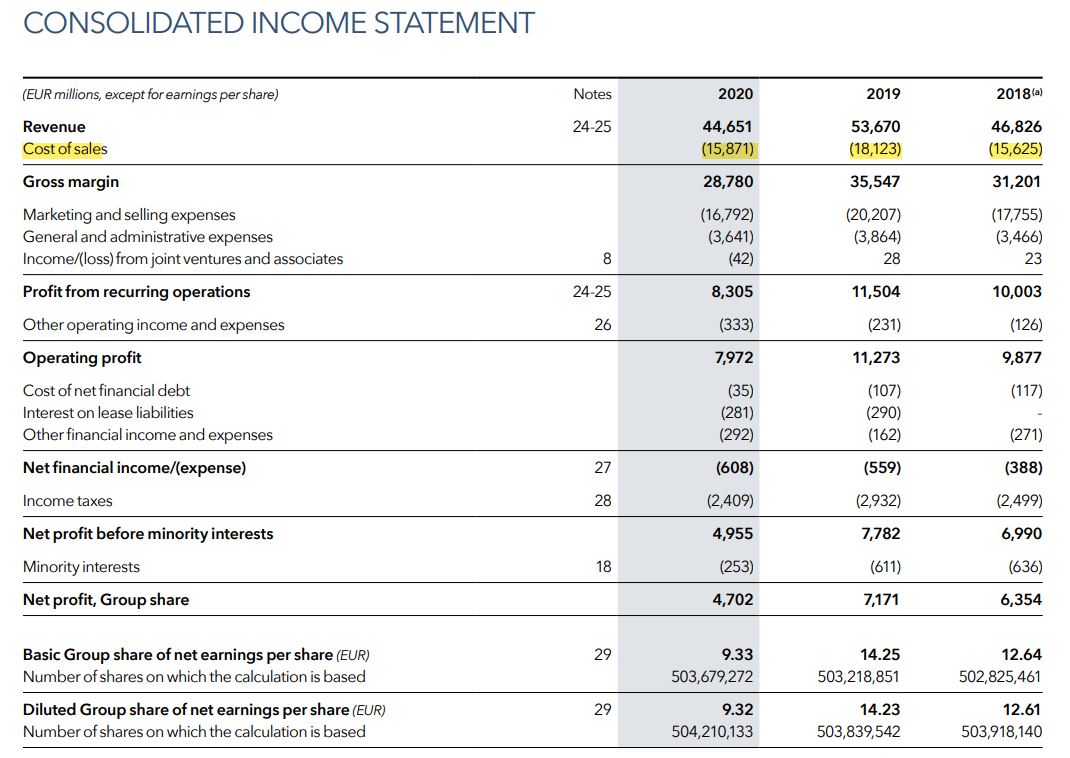

The “bottom line” is arguably the most significant figure on an income statement, representing the company’s net income. It’s the residue left after deducting all expenses, including cost of goods sold (COGS), operating expenses, interest payments, and taxes from the top line. This term gets its name because net income is listed at the bottom of the income statement.

The bottom line demonstrates a company’s profitability, and strategies to improve it usually focus on enhancing gross revenue or reducing costs. Shareholders closely monitor the bottom line because it directly affects earnings per share and dividends. However, solely focusing on improving the bottom line can sometimes lead to unsustainable strategies like excessive cost-cutting.

However, investors should also be aware that an increasing bottom line can sometimes be achieved through aggressive cost-cutting, which may not be sustainable in the long run. It’s important to scrutinize the sources of bottom-line growth: Is it due to increased sales, improved operational efficiency, or simply cost-cutting?

Conclusion

Understanding the terms “top line,” “the line,” and “bottom line” is crucial for interpreting a company’s financial performance. While the top line provides insight into sales performance and the bottom line into profitability, it’s the intricate story that unfolds between these two lines that often holds the most valuable insights for sustainable growth and profitability. As such, a holistic view of a company’s financial health should consider all these aspects.

By focusing on each line in tandem, companies can better navigate their path to profitability, creating strategies that stimulate sales growth (top line), manage costs effectively (the line), and ultimately drive profit (bottom line). However, these metrics should not be used in isolation. Investors should use them in conjunction with other financial ratios and indicators to make informed decisions.

By aligning their strategies to promote sales growth (top line) and efficient cost management practices (the line), companies can navigate their path to profitability. The aim is to strike a balance between revenue generation and cost control to drive profitability (bottom line). However, it’s important to note that these metrics should not be evaluated in isolation. Investors should consider utilizing other financial ratios and indicators to gain a comprehensive understanding of a company’s financial health. These may include profitability ratios (such as gross profit margin, operating margin, and net profit margin), liquidity ratios (like current ratio and quick ratio), debt ratios (such as debt-to-equity ratio and interest coverage ratio), and efficiency ratios (like inventory turnover and receivables turnover). Evaluating these indicators collectively provides a more comprehensive assessment of a company’s performance and prospects, empowering investors to make informed investment decisions. Each line tells a different part of the company’s financial story, and understanding the interplay between them is crucial for investment decision-making.

Illustration

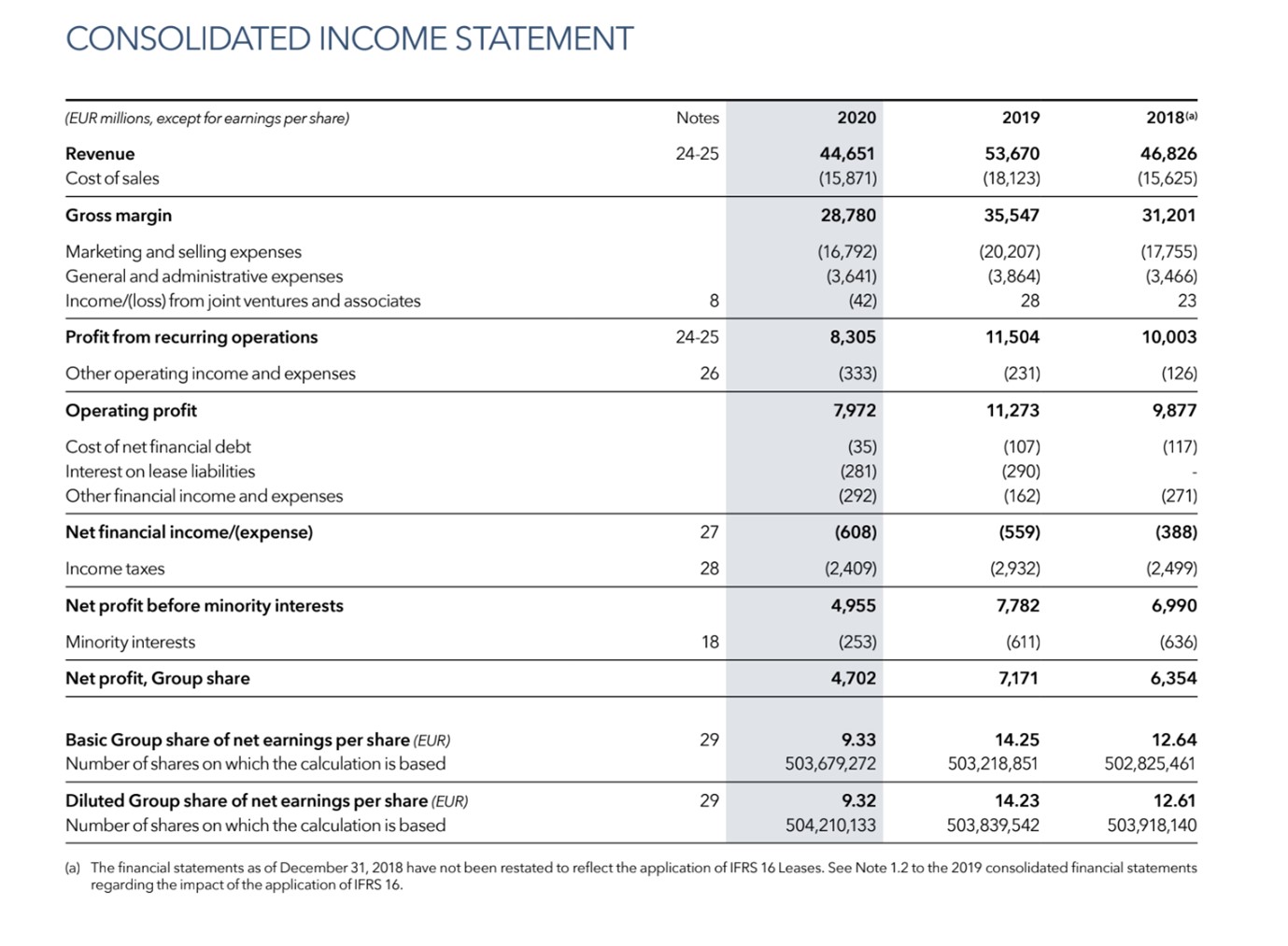

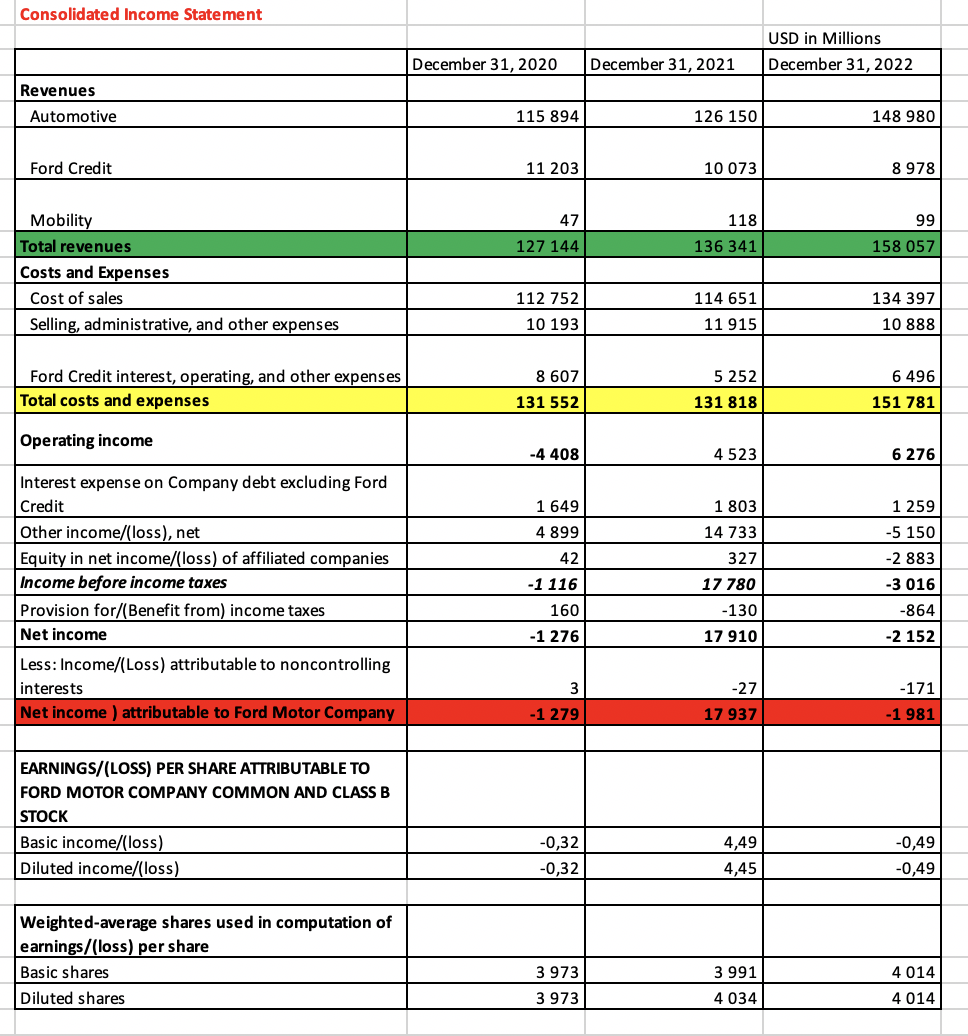

Income statement of Ford.

Source: the company.

Why should I be interested in this post?

These concepts form the foundation of financial analysis and provide valuable insights into a company’s financial performance. Understanding the top line, which represents revenue or sales, is crucial as it demonstrates a company’s ability to generate income and sustain growth. The bottom line, which reflects the net income or profit after deducting expenses, taxes, and interest, provides a measure of overall profitability. By delving into the line, which encompasses various expenses impacting profitability, finance students can gain a comprehensive understanding of financial statements and develop the analytical skills necessary to evaluate a company’s financial health, make informed investment decisions, and contribute to effective financial strategies. This knowledge is highly applicable in various finance-related roles and is instrumental in navigating the complexities of the business world.

Related posts on the SimTrade blog

▶ Bijal GANDHI Income Statement

▶ Bijal GANDHI Revenue

▶ Bijal GANDHI Cost of goods sold

About the author

The article was written in June 2023 by Isaac ALLIALI (ESSEC Business School, Bachelor in Business Administration (BBA), 2019-2023).