Dividend policy

In this article, Raphaël ROERO DE CORTANZE (ESSEC Business School, Master in Management, 2018-2022) analyses the effects of dividend policy on the stock price.

What is a dividend?

Firms that generate earnings through their activities must choose between retaining these earnings (increase in reserves on the liabilities side of the balance sheet) or distributing these earnings to shareholders through paid dividends.

A dividend is a payment from a company to its shareholders. Dividends can take several forms:

Cash: the shareholders receive cash

- Regular: the most common form of dividend, usually a quarterly cash distribution charged against retained earnings. These regular dividends are an engagement: the board of directors declares a dividend, of a certain amount and for a certain duration. Regular dividends are thus not very flexible: regular dividends are “sticky” as they represent a higher commitment (compared to special dividends or buybacks for instance).

- Special: a special dividend is a payment made by a company to its shareholders, which the company declares to be separate from the typical recurring dividend cycle

- Liquidating: a liquidating dividend is a distribution of cash or other assets to shareholders, with a view to shutting down the business. It is paid out after all creditor obligations have been settled

Stock dividend: the shareholders receive stock

A stock dividend is a dividend payment with shares rather than cash. It has the advantage to distribute to shareholders without decreasing the company’s cash balance. Nonetheless, it can dilute earnings per share

Dividend policy

Modigliani Miller: irrelevance of the dividend policy

The first theorem formulated by Modigliani and Miller in 1958 states that in a world without taxes, bankruptcy costs, agency costs and asymmetric information, and in an efficient market, the value of a firm is unaffected by how it is financed. In other word, the choice of capital structure is irrelevant as it does not impact the value of the firm. In the same way, the dividend policy (to pay or not to pay dividends to shareholders) does not affect the value of the firm. Dividend policy is thus irrelevant.

In 1963, Modigliani and Miller adapted this theorem by integrating corporate taxation. In this framework, they show that the value of the levered firm is equal to the value the unlevered firm plus the present value of the tax savings associated with the tax deductibility of the interests on the debt in the income statement (tax shield). With corporate taxation, the capital structure matters as debt is more interesting than equity. But they show that the dividend policy still does not affect the value of the firm. Dividend policy is thus irrelevant.

Signaling

First of all, the stock price is expected to fall after the issuance of a dividend by the amount of the dividend itself. Dividend policy conveys information. Michaely, Thaler and Womack (1995) have demonstrated that the market reacts positively to dividend initiations (when the board of directors declares a dividend) and negatively to omissions (when the board of directors announces it won’t distribute a dividend).

As dividend policy conveys information, managers try to smooth out dividends. Dividends are thus less volatile than earnings: payout ratios (Dividend / Earnings per Share) increase in bad times and decrease in good times.

Example

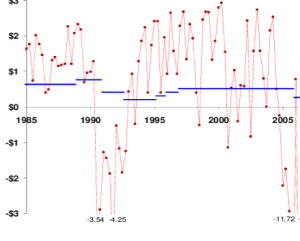

As an example, General Motor’s dividend per share remained fairly stable between 1985 and 2008, even though its earnings were very volatile.

Not all firms pay dividend. Dividend-paying firms are bigger and more profitable. DeAngelo, DeAngelo and Skinner (2004) have shown that dividends have become more concentrated. Indeed, in 1978 in the US, 67% of the total dividends were distributed by the Top 100 dividend-paying firms. In 2000, this proportion increased to 81% (of which 46% in the top 25 players).

Dividends during the COVID-19 crisis

During a financial crisis, it is logical to observe dividend cuts and omissions. Nonetheless, the crisis entailed by the COVID-19 pandemic is notable for the fact these dividend cuts and omissions were found among all firms from all sectors, whereas for instance the financial crisis of 2008 was primarily associated with a sharp drop of dividends across the financial sector (banks, insurance companies, brokers, market infrastructure firms such as stock exchanges, etc.).

In 2020, the pandemic caused a 12% global decline in dividends distribution compared to 2019. Between the second and fourth quarters of 2020, the dividend cuts reached 220 billion US dollars globally. Indeed, firm profitability and debt are determinants of dividend cuts and omissions, especially during crisis.

Nonetheless, part of the global decrease in dividends can be explained by the extraordinary measures taken by governments. In France, the government announced in April 2020 that large companies would be able to benefit from support measures if and only if they undertook not to pay dividends or buy back their shares. Similarly, the Federal Reserve in the US has imposed limits on dividend distribution for US banks and the European Central bank has forbidden to credit institutions (such as banks) to distribute dividends. As financial institutions present a systemic risk, these measures were a way to make sure banks focused on withstanding the economic depression, rather than compensating their shareholders. The Federal Reserve recently declared it would free most banks from the pandemic dividend limits as soon as the large US banks would have cleared the last round of stress tests. As a result, as dividend distribution limitations are lifted and economies return to their long-term trajectory, global dividend distribution is expected to gradually return to normalcy.

Key concepts

Earnings

A company’s earnings refer to its after-tax net income. Located at the bottom of the Income Statement, earnings are also referred as the “bottom line”.

Retained earnings

A company’s retained earnings is the amount of net income (or earnings) left after the company has paid out dividends to its shareholders. Retained earnings remains available for financing the firm business (day-to-day activity, investments, acquisitions of other companies).

Useful resources

Michaely R., R. Thaler and K. Womack (1995) Price Reactions to Dividend Initiations and Omissions: Overreaction or Drift? Journal of Finance, 50(2): 573-608.

DeAngelo H., L. DeAngelo and D. Skinner (2004) Are dividends disappearing? Dividend concentration and the consolidation of earnings, Journal of Financial Economics, 72(3): 425-456.

Krieger K., N. Mauck, S. Pruitt (2020) The impact of the COVID-19 pandemic on dividends, Finance Research Letters.

Holly Ellyatt (February 21, 2021) Pandemic caused $220 billion of global dividend cuts in 2020, research says CNBC.

About the author

Article written in June 2021 by Raphaël ROERO DE CORTANZE (ESSEC Business School, Master in Management, 2019-2022).