In this article, Theo SCHWERTLE (Maastricht University, School of Business and Economics, Bachelor in International Business, 2023) explains how technical analysis can actually help to make better trading decisions (or not).

Market efficiency

Let’s take a look at the different levels of market efficiency and their implications for a trader.

The efficient market hypothesis (EMH) posits that market prices fully incorporate all available information. If this hypothesis is verified, it is infeasible to consistently achieve higher returns than the market on a risk-adjusted basis. According to the EMH, stocks are believed to consistently trade at their fair value on exchanges, precluding the possibility of purchasing undervalued stocks or selling overvalued ones, thus implicitly dismissing the efficiency of technical analysis (TA) and fundamental analysis. As such, the EMH suggests that outperforming the overall market through security selection or market timing is infeasible, and the only way for investors to attain higher returns is by taking on increased risk in their investments.

Definitions

The EMH has three forms: the weak form, the semi-strong form and the strong form. The weak form of the EMH asserts that historical market data (transaction prices and volumes) cannot be used to predict future price movements. The semi-strong form of the EMH asserts that publicly available information (historical market data, financial account published by firms, reports written by financial analysts, etc.) cannot be used to predict future price movements. The strong form of the EMH asserts that both public and private information cannot be used to predict future movements.

Tests of the EMH

Though the strong form of the EMH is generally rejected, scholars are less consistent with evidence for or against the weak or semi-strong form of the EMH. Focusing on technical analysis, a significant body of literature has examined the relationship between EMH and technical analysis (TA), with many scholars rejecting the weak form (Leigh et al., 2002; Eugster and Uhl, 2022). The results of the tests seem to depend on the length of the investment period, the EMH being less rejected for a longer investment period.

Technical analysis

In the world of finance, Technical Analysis serves as an essential tool for investors and traders alike. The methodology involves forecasting future price movements based on the historical data of financial instruments. This strategy pivots on two core principles: the market discounts everything, and prices move in trends (Kirkpatrick & Dahlquist, 2010).

Chartism is one of the oldest techniques in technical analysis. It rests on the identification and analysis of chart patterns and price formations, with chartists meticulously studying these patterns to anticipate future market trends (Lo, Mamaysky, & Wang, 2000). This form of analysis operates on the principle that certain patterns are recurring and that understanding these patterns can provide insights into future price movements.

Another time-tested tool is Moving Averages, a technique that seeks to smooth out price data by creating a consistently updated average price. This approach comes in several variants, with the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) being the most prevalent. These techniques help to clear out the ‘noise’ from random short-term price fluctuations and allow analysts to focus on the overall trend direction.

In stark contrast to these conventional methods stands the modern, technology-driven approach of High Frequency Trading (HFT). This innovative form of trading capitalizes on the power of advanced algorithms and high-speed data processing to execute trades at astonishing speeds. Unlike traditional technical analysis, which primarily focuses on transaction prices and volumes, HFT leverages real-time data from the order-flow and the order-book, exploring minute market discrepancies that might otherwise go unnoticed (Aldridge, 2010).

All we need is short-term market inefficiencies

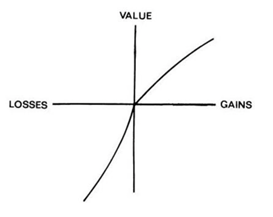

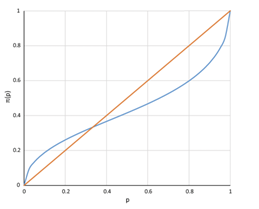

Hirshleifer and Shumway (2003) gave meaningful insight into the relationship between the weather and daily market index return, demonstrating that sunshine is strongly and significantly correlated with stock returns. In line with that argumentation, Edmans et al. (2007) investigate the stock market reaction to sudden changes in investor mood, using international soccer results as the primary mood variable. The results show a significant market decline after soccer losses in equity markets of the losing teams, with a loss in the World Cup elimination stage leading to a next-day abnormal stock return of −49 basis points. This effect is more substantial in small stocks and more meaningful games and is robust to methodological changes. The same loss effect could also be documented for other international tournaments.

So what does that mean? There are human biases that make humans so different from the rational being many financial theories suggest we are.

Discussion about the feasibility of technical analysis for hedge funds

Hedge funds are also using technical analysis in their decision-making process; however, the degree of utilization varies significantly. The main area where TA is used by hedge funds is to find areas of liquidity to full big positions.

Kavajecz und Odders-White (2004) explored the relationship between TA and liquidity by testing the hypotheses that support and resistance levels coincide with peaks in depth on the limit order book and that moving-average forecasts reveal information about the relative position of depth on the book. They found that technical support/resistance levels, as well as moving average indicators, are significantly related to the state of liquidity on the limit order book and concluded that it is tied to the strategic behavior of limit order traders. This provides a reliable method for practitioners to locate liquidity in the book and reduce transaction costs.

The main advantage of TA is the low cost to construct a market perspective as it requires only market data. The implementation of TA is lower than acquiring and analyzing public or private information. So, if used adequately it is in face the cheaper and more accessible investment approach compared to traditional financial analysis tools.

Sounds good! Where is the catch?

According to Timmermann and Granger (2004), using new financial prediction methods may lead to short-term gains as the information is rapidly incorporated into market prices making the market the more efficient. As these new financial prediction methods become more widely used by other market participants, their effectiveness decreases over time. This idea is supported by studies showing that many stock market anomalies diminish, vanish, or even reverse after they are documented in academic literature (publication on the Social Science Research Network (SSRN) for example).

A broad study by Yamamoto (2012) investigated the profitability of exploiting short-term market inefficiencies and concluded that one could not generate consistent positive results that outperform a buy-and-hold strategy. Yamamoto (2012) analyzes technical strategies for 207 individual stocks in the Nikkei 225 over a one-year period and use two statistical procedures to reduce data-snooping bias (the data-snooping bias refers to the tendency to make false discoveries or draw incorrect conclusions when repeatedly testing and analyzing a dataset, often due to the increased likelihood of finding seemingly significant patterns or relationships by chance). The results indicate that all 9 technical trading strategies underperform the buy-and-hold strategy, suggesting that information on past prices and demand/supply imbalances are not sufficient for superior technical trading profits.

Conclusion

Short-term market inefficiencies can be exploited to generate positive returns. However, many of the found profitability diminish after introducing real market conditions, transaction fees or adjusting the returns for the increased risk. Generally, TA offers increased benefits over fundamental analysis in the short-term but loses ground with increased time as the market returns to efficiency. The difference in information costs motivates its popularity, but even if a profitable trading strategy is found, its benefits may only be enjoyed for a short time.

Why should I be interested in this post?

Technical analysis offers a different perspective on the market that is rarely touched on by university curriculums. This alternative approach is used by individual traders as well as institutional traders like hedge funds to find good entries and exits in the market. According to a survey by Menkhoff (2010), 77% of all hedge fund managers in their sample rate TA as really important to their decision-making, attributing a value of at least 10% to it in their decision-making process. About 20% of fund managers even indicate to prefer TA over fundamental analysis. So, it seems to offer some value, despite the academic criticism in line the efficiency of the market.

Related posts on the SimTrade blog

▶ Jayati WALIA Trend Analysis and Trading Signals

▶ Shruti CHAND Technical Analysis

▶ Martin VAN DER BORGHT Market efficiency

Useful resources

Academic articles

Edmans, A., García, D. & Norli, Y. (2007). Sports Sentiment and Stock Returns The Journal of Finance 62(4), 1967–1998.

Eugster, P. & Uhl, M. W. (2022). Technical analysis: Novel insights on contrarian trading. European Financial Management .

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance 25(2), 383-417.

Hirshleifer, D. & Shumway, T. (2003). Good Day Sunshine: Stock Returns and the Weather The Journal of Finance 58(3), 1009–1032.

Kavajecz, K. A. & Odders-White, E. R. (2004). Technical Analysis and Liquidity Provision Review of Financial Studies 17(4), 1043–1071.

Leigh, W., Purvis, R. & Ragusa, J. M. (2002). Forecasting the NYSE composite index with technical analysis, pattern recogniser, neural network, and genetic algorithm: a case study in romantic decision support Decision Support Systems 32(4), 361–377.

Lo, A. W., Mamaysky, H., & Wang, J. (2000). Foundations of technical analysis: Computational algorithms, statistical inference, and empirical implementation. The Journal of Finance 55(4), 1705-1770.

Menkhoff, L. (2010). The use of technical analysis by fund managers: International evidence. Journal of Banking & Finance 34(11), 2573–2586.

Timmermann, A. & Granger, C. W. (2004). Efficient market hypothesis and forecasting International Journal of Forecasting, 20(1), 15–27.

Yamamoto, R. (2012). Intraday technical analysis of individual stocks on the Tokyo Stock Exchange Journal of Banking & Finance, 36(11), 3033–3047.

Books

Aldridge, I. (2010). High-frequency trading: a practical guide to algorithmic strategies and trading systems. John Wiley & Sons.

Kirkpatrick II, C. D., & Dahlquist, J. R. (2010). Technical Analysis: The Complete Resource for Financial Market Technicians. FT press.

Lewis, M. (2014). Flash Boys: A Wall Street Revolt. W. W. Norton & Company.

About the author

The article was written in June 2023 by Theo SCHWERTLE (Maastricht University, School of Business and Economics, Bachelor in International Business, 2018-2023).