In this article, Martin VAN DER BORGHT (ESSEC Business School, Master in Finance, 2022-2024) explains the activity of market making which is key to bring liquidity in financial markets.

Market Making: What is It and How Does It Work?

Market making is a trading strategy that involves creating liquidity in a security by simultaneously being ready to buy and sell amount of that security. Market makers provide an essential service to the market by providing liquidity to buyers and sellers, which helps to keep stock prices stable (by limiting the price impact of incoming orders). This type of trading is often done by large institutional investors such as banks. In this article, I will explore what market making is, how it works, and provide some real-life examples of market makers in action.

What is Market Making?

Market making is a trading strategy that involves simultaneously being ready to buy and sell amounts of a security in order to create or improve market liquidity for other participants. Market makers are also known as “specialists” or “primary dealers” on the stock market. They act as intermediaries between buyers and sellers, providing liquidity to the market by always being willing to buy and sell a security at a certain price (or more precisely at two prices: a price to buy and a price to sell). The remuneration of a market maker is obtained by making a profit by taking the spread between the bid and ask prices of a security.

How Does Market Making Work?

Market makers create liquidity by always having an inventory of securities that they can buy and sell. They are willing to buy and sell a security at any given time, and they do so at a certain price. The price they buy and sell at may be different from the current market price, as market makers may be trying to influence the price of a security in order to make a profit.

Market makers buy and sell large amounts of a security in order to maintain an inventory, and they use a variety of techniques to do so. For example, they may buy large amounts of a security when the price is low and sell it when the price is high. They may also use algorithms to quickly buy and sell a security in order to take advantage of small price movements.

By providing liquidity to the market, market makers help to keep stock prices stable. They are able to do this by quickly buying and selling large amounts of a security in order to absorb excess demand or supply. This helps to prevent large price fluctuations and helps to keep the price of a security within a certain range.

Market making nowadays

One of the most well-known examples of market making is the role played by Wall Street banks. These banks act as market makers for many large stocks on the NYSE and NASDAQ. They buy and sell large amounts of a security in order to maintain an inventory, and they use algorithms to quickly buy and sell a security in order to take advantage of small price movements.

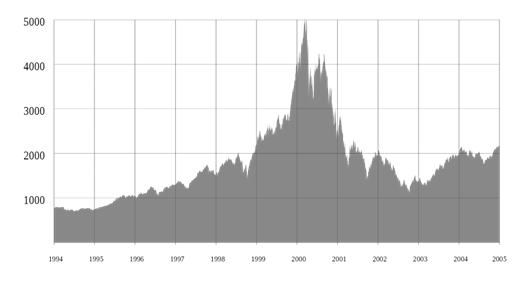

Another example of market making is the practice of high-frequency trading. In his book Flash Boys, author Michael Lewis examines the impact of high frequency trading (HFT) on market making. HFT uses powerful computers and sophisticated algorithms to rapidly analyze large amounts of data, allowing traders to make trades in milliseconds. This has led to an increased use of HFT for market making activities, which has caused some to argue that it may be harming market liquidity and efficiency. Market makers have begun using HFT strategies to gain an edge over traditional market makers, allowing them to make markets faster and at narrower spreads. This has resulted in tighter spreads and higher trading volumes, but it has also been argued that it has led to increased volatility and decreased liquidity. As a result, some investors have argued that HFT strategies have created an uneven playing field, where HFT firms have an advantage over traditional market makers.

The use of HFT has also raised concerns about the fairness of markets. HFT firms have access to large amounts of data, which they can use to gain an informational advantage over other market participants. This has raised questions about how well these firms are able to price securities accurately, and whether they are engaging in manipulative practices such as front running. Additionally, some argue that HFT firms are able to take advantage of slower traders by trading ahead of them and profiting from their trades.

These concerns have led regulators to take a closer look at HFT and market making activities. The SEC and other regulators have implemented a number of rules designed to protect investors from unfair or manipulative practices. These include Regulation NMS, which requires market makers to post their best bid and ask prices for securities, as well as Regulation SHO, which prohibits naked short selling and other manipulative practices. Additionally, the SEC has proposed rules that would require exchanges to establish circuit breakers and limit the amount of order cancellations that can be done in a certain period of time. These rules are intended to ensure that markets remain fair and efficient for all investors.

Conclusion

In conclusion, market making is a trading strategy that involves creating liquidity in a security by simultaneously being ready to buy and sell large amounts of that security. Market makers provide an essential service to the market by providing liquidity to buyers and sellers, which helps to keep stock prices stable. Wall Street banks and high-frequency traders are two of the most common examples of market makers.

Related posts on the SimTrade blog

▶ Akshit GUPTA Market maker – Job Description

Useful resources

SimTrade course Market making

Michael Lewis (2015) Flash boys.

U.S. Securities and Exchange Commission (SEC) Specialists

About the author

The article was written in January 2023 by Martin VAN DER BORGHT (ESSEC Business School, Master in Finance, 2022-2024).