Supply and Demand

In this article, Diana Carolina SARMIENTO PACHON (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021-2022) explains the economic concept of supply and demand, which is key to understand the way markets work.

Supply and demand are the fundamental concepts that shape the way we make business and operate in the world. They construct both simple transactions such as the purchase of coffee or more compounded transactions such as the operations in the financial world. For this reason, it’s crucial to understand and uncover them deeper.

The basic concepts

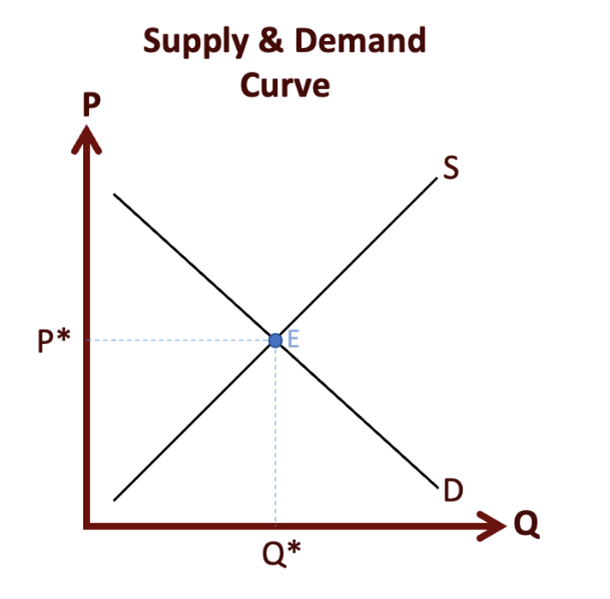

Supply is referred to the amount available of a product that firms offer, whereas demand is the amount desired by consumers or households. When these quantities are equal, an equilibrium is reached and consequently a transaction takes place, leading to the well-known law of supply & demand which shapes the behavior of daily transactions and shifts in the economy. If price increases, then supply also increases; nonetheless, demand decreases as it’s more expensive for consumers to a buy good; on the contrary, if prices decline then supply also decline since producers would make less revenue whereas demand goes up as it is cheaper to buy. This dynamic takes place until the quantities of supply and demand are equal so that the optimum equilibrium is found.

Figure 1. Supply and demand.

Source: computation by the author.

From another perspective, if demand escalates then price rises due to the high desirability of the good, meanwhile when demand drops it can create a surplus of supply which can drag the price down. Likewise, this scenario can be applied in financial markets e.g., in the case of a bullish sentiment in the market, there can be a positive speculation which creates a higher desirability for certain stock resulting in a decrease in price; nevertheless, when demand is low the price may drop because of a low or negative speculation on a specific stock.

Furthermore, the fundamental law of supply and demand can also explain the price movements seen in the financial markets. To illustrate, for a commodity such as coffee, if the surface of cultivation expands or if the harvest is good, it is very likely that the coffee price will sink as its supply will be abundant. Therefore, it is essential to consider the information about the market regularly as it can have a significant influence on the speculation of investors which will eventually define their demands and so the price of a stock. Consequently, it is very important to be able to determine how an announcement or any kind of information can affect the demand or even the supply of a stock, commodity, or financial instrument since this will define how markets will behave.

Special cases

However, it’s also important to mention that there are industries and situations in which the law of supply and demand does not apply. An instance of this is the luxury industry, in which the higher the product price set by firms, the higher the demand from consumers. This may be due to the value that costumers perceive by purchasing such items. Alternatively, oil is another example to be mentioned as its price has a low-price sensitivity which means that any change in its price won’t result in any significant demand changes, this could be due to the high necessity of oil in all industries which makes it crucial for daily operations.

Useful resources

Krugman, P. & Wells, R. (2012) Economics. 3rd edition. United States: Macmillan Learning.

Mankiw, G. (2016) The Market Forces of Supply and Demand (table of content) Principles of Economics. 8th edition. Boston: Cengage Learning.

Mankiw, G. (2016) The Market Forces of Supply and Demand (slides) Principles of Economics. 8th edition. Boston: Cengage Learning.

Deskara Supply and Demand: Law, Curves, and Examples

International Energy Agency (IEA) Supply and demand for oil

Sabiou M. Inoua and Vernon L. Smith The Classical Theory of Supply and Demand

About the author

The article was written in April 2022 by Diana Carolina SARMIENTO PACHON (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021-2022)