Venture Capital 101: A Quick Overview

In this article, Alessandro MARRAS (ESSEC Business School, Global Bachelor in Business Administration (GBBA), Exchange Semester, September 2023-December 2023) gives a quick overview of Venture Capital.

What is Venture Capital?

Venture capital (VC) is a specialized form of financing where investors provide funds to startup or early-stage companies with high growth potential. This funding is crucial for startups to develop and expand their business operations. Venture capitalists not only provide financial support but also offer expertise and guidance to help these companies succeed. The goal of venture capital is to generate significant returns by investing in innovative businesses that have the potential to disrupt markets and achieve substantial growth.

VCs have five main functions:

- They serve as financial intermediaries, channeling capital from investors into promising portfolio companies.

- Their investments are directed towards private companies, making them illiquid assets.

- VCs actively participate in the management and oversight of their portfolio companies, embodying active investors.

- The primary objective of VCs is to maximize financial returns, typically through strategic exits like acquisitions or IPOs.

- VCs prioritize investments in entrepreneurial ventures with substantial growth potential, aiming to foster internal growth and increase the likelihood of successful exits. These characteristics highlight the dynamic and strategic nature of venture capital investments, contributing to innovation and economic growth.

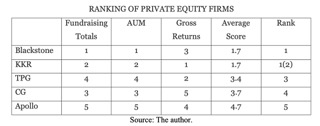

VCs vs others:

- VCs differ from angel investors as they function as financial intermediaries rather than investing personal funds directly.

- Unlike mutual or hedge funds, VCs invest specifically in private companies, placing them within the category of private equity and alternative investments.

- While all VCs are private equity funds, the inverse isn’t true; not all private equity funds engage in venture capital.

- VCs set themselves apart from crowdfunding platforms by actively participating in the companies they invest in, providing ongoing monitoring and management support.

How are VCs organized?

Venture capital firms are typically organized as limited partnerships, structured to facilitate investment activities while providing a degree of protection and incentive for both investors and managers. For investors this protection comes in the form of limited liability, meaning their risk of losing money is confined to their investment amount and they are not personally liable for the debts of the business. This allows them to invest in high-risk ventures with a capped downside. For managers the incentive is often structured as carried interest, a share of the profits of the investments, which aligns their financial interests with the success of the firm’s investments. This ensures that managers are motivated to select and nurture companies that will yield high returns, thereby directly linking their compensation to their performance in managing the venture capital firm’s portfolio.

Limited partnerships in venture capital consist of two main categories of partners. Firstly, there are limited partners, who contribute capital to the fund and bear limited liability. These investors can include wealthy individuals, banks, mutual funds, and other institutional investors. Secondly, there is the general partner, responsible for managing the fund’s operations and investments, and who assumes unlimited liability. Figures like Don Valentine, Ben Horowitz, and Peter Thiel are examples of notable general partners in the venture capital industry.

The lifespan of a typical limited partnership in venture capital is around ten years, during which investors’ capital is committed and cannot be withdrawn. General partners receive compensation in the form of a management fee and a share of the profits generated by successful investments, known as carried interest.

Limited partnerships offer tax efficiency, as they are not subject to corporate taxes, with partners instead paying taxes on their share of the profits. Additionally, distributions of securities to partners incur no immediate tax implications, with taxes only due upon the eventual sale of the securities.

This organizational structure provides a framework that incentivizes efficient investment management and aligns the interests of both limited and general partners in achieving successful outcomes.

Benefits of VC

Venture capital offers a range of benefits to both entrepreneurs and investors, fostering innovation, driving economic growth, and facilitating wealth creation. Firstly, venture capital provides crucial funding to startups and early-stage companies that may otherwise struggle to secure financing from traditional sources such as banks or public markets. This injection of capital enables entrepreneurs to pursue ambitious ideas and develop groundbreaking technologies, driving innovation across various industries. Moreover, venture capitalists often bring valuable expertise, networks, and mentorship to the table, helping startups navigate challenges, refine their business strategies, and accelerate their growth trajectory.

Secondly, venture capital plays a pivotal role in job creation and economic development. By supporting high-growth startups, venture capital investments fuel job creation, as these companies expand their operations, hire new talent, and contribute to local economies. Additionally, successful startups can spawn entire ecosystems of suppliers, service providers, and complementary businesses, further stimulating economic activity and driving regional prosperity.

Furthermore, venture capital investment offers attractive returns for investors willing to accept the inherent risks associated with early-stage ventures. While venture capital investments carry a higher risk of failure compared to traditional investments, they also offer the potential for substantial returns on successful exits, such as acquisitions or initial public offerings (IPOs). As a result, venture capital serves as a vital asset class for investors seeking diversification and opportunities for outsized returns in their investment portfolios.

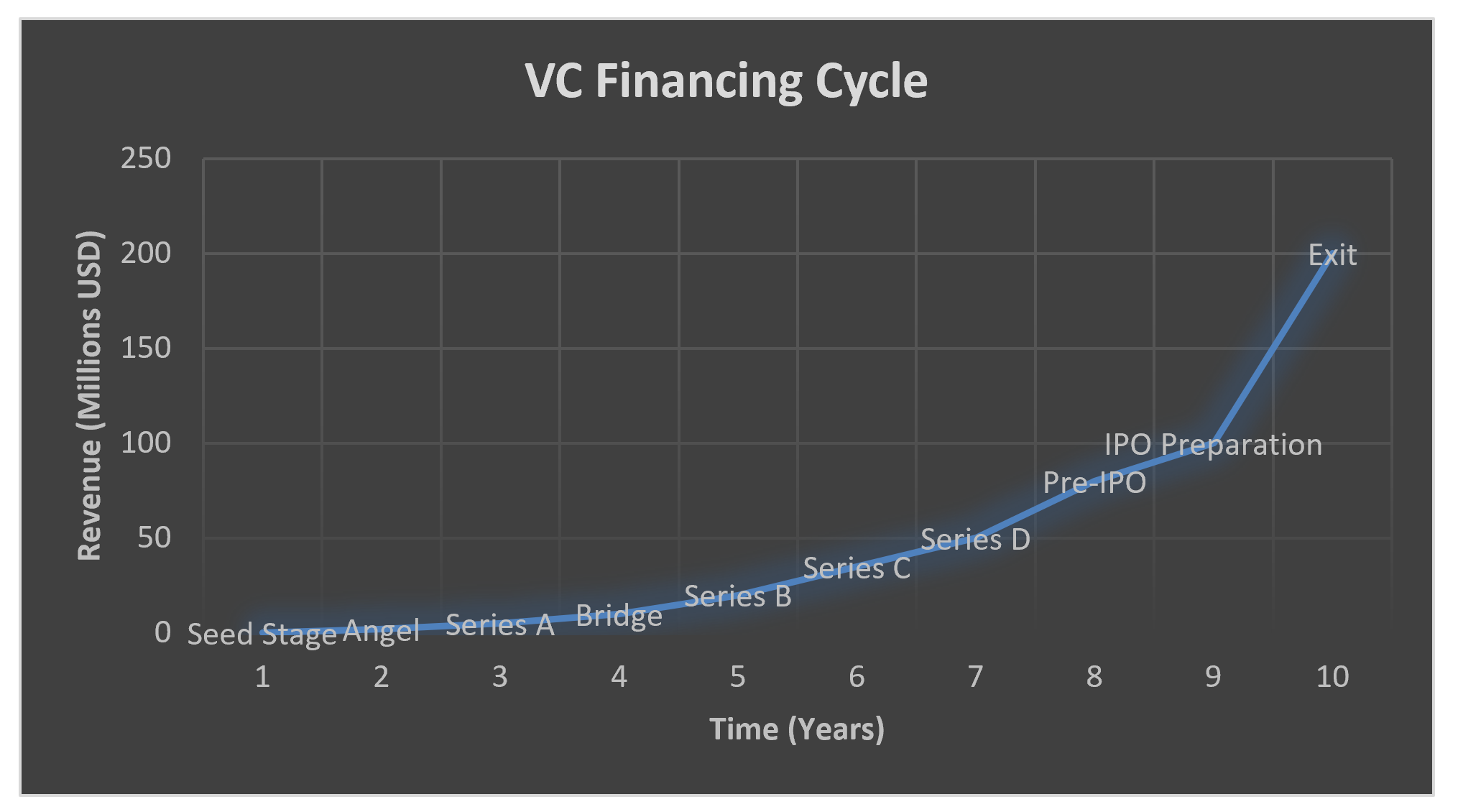

VC Financing Cycle

The Venture Capital Financing Cycle delineates the sequential stages of funding that startups typically undergo, from inception to exit. This cycle starts with the Seed Stage, where initial capital is raised to prove concepts and build prototypes. As the startup matures, it may progress through various rounds of funding—Angel, Series A, Series B, and beyond—each designed to fuel growth, product development, market expansion, and operational scaling. The Bridge stage serves as a critical juncture for preparing more mature startups for substantial future rounds or positioning for exit strategies. The cycle culminates in the Pre-IPO and IPO Preparation stages, where companies ready themselves for public offering or seek acquisition opportunities, marking the exit phase. This framework not only structures the investment landscape but also maps the growth trajectory of startups. The VC financing cycle is emblematic of the symbiotic relationship between investors seeking to maximize returns and startups in need of capital to fuel their growth ambitions, fostering innovation and economic development within the broader ecosystem.

VCs financial performance in 2023

In 2023, the venture capital (VC) market experienced significant shifts, reflecting broader economic challenges and evolving investment trends. The year saw a considerable downturn in VC investments, dropping to the lowest levels in four years, with a year-over-year decrease of 35% from the already declining levels of 2022. The total amount raised by VC-backed startups barely surpassed $140 billion, influenced notably by a few mega-deals in the artificial intelligence (AI) sector. The decline was not just in the amount raised but also in deal volume across nearly all fund classes, reaching the lowest point in a decade. Later-stage investments saw the most significant reduction in dollar volume quarter-over-quarter, while Series A investments showed some resilience with a 9% increase.

The backdrop of economic headwinds, valuation concerns, and an overhang of more than 50,000 existing VC-backed startups created a challenging environment for new investments. VC fund formation also experienced a sharp decline, dropping 62% from the record year in 2022, although there was a slight uptick in the last quarter of the year. This situation has led to increased caution among venture capitalists, with a notable reluctance to engage in mega-round financing. Only 50 mega deals were recorded in the last quarter of 2023, marking the lowest total since 2017.

Despite these challenges, AI continued to garner significant attention and investment, driving many of the largest deals in the U.S. during the last quarter of 2023. This trend suggests that while the overall VC investment has declined, specific sectors, particularly those related to technological innovation and AI, continue to attract substantial interest and funding.

Why should I be interested in this post?

As an ESSEC students interested in finance, this post can be a useful resource due to its relevance in the financial sector. Understanding venture capital offers insights into alternative investments, career opportunities in private equity, and the dynamics of financing innovative startups, enriching your knowledge and potential career paths within the finance industry.

Related posts on the SimTrade blog

▶ Louis DETALLE A quick presentation of the Private Equity field…

▶ Louis DETALLE A quick review of the Venture Capitalist’s job…

▶ Marie POFF Film analysis: The Wolf of Wall Street

Useful resources

Zider B. (1998) How Venture Capital Works Harvard Business Review.

Jeffrey Grabow (29/01/2024) Will venture capital market rebound in 2024 or seek new floor? EY

Deloitte 2024 trends in venture capital

About the author

The article was written in March 2024 by Alessandro MARRAS (ESSEC Business School, Global Bachelor in Business Administration (GBBA), Exchange Semester, September 2023-December 2023).