In this article, Andrea ALOSCARI (ESSEC Business School, Global Bachelor in Business Administration (GBBA) – 2024-2025) explains about three fundamental valuation methods—Comparable Companies Analysis, Precedent Transactions Analysis, and Discounted Cash Flow (DCF) Analysis—and their role in achieving successful deal outcomes.

Which are the main valuation methods?

At the heart of M&A, or Mergers and Acquisitions, stands the concept of valuation, which helps businesses evaluate the idea of expanding or consolidating their position in the market. The estimation of the target company’s implied share price is vitally important both for buyers and sellers and can be conducted with three main valuation methods: Comparable Companies analysis, Precedent Transactions analysis, and Discounted Cash Flow analysis.

Comparable Companies Analysis

The Comparable Companies analysis, colloquially known as “trading comps,” is one of the most common methodologies in M&A valuation. This methodology depends upon the analysis of the target company in comparison to other similar publicly traded companies. The rationale driving this valuation method is simple: a company is valued at a multiple equivalent to that of comparable companies operating in the same industry, same geography and similar financial profiles.

It starts by selecting an industry peer group of companies. Industry, size, geographical location, growth prospects, and profitability usually influence the choice of these groups of companies.

When conducting the valuation of a company, it is necessary to calculate different multiples for the comparable firms and consecutively apply them to the company financials, in order to estimate the value of the target. The most frequently used multiples are Enterprise Value/EBITDA, Price per share/Earnings per share, and Enterprise Value/Revenues.

In specific cases, the analysis can be extended to include industry metrics. For instance, in the case of the telecommunications field, price-per-subscriber metrics may be considered more relevant, while revenue-per-user or annual recurring revenue multiples are more applicable in the case of software companies. Such metrics allow deeper insight, giving a closer approximation for valuation.

While Comparable Companies analysis is market-reflective and easy to apply, there are some limitations. In real life, it is very hard and sometimes impossible to find really comparable companies, especially for niche industries or highly diversified firms. Valuation metrics may also be distorted by recent market volatility and temporary anomalies; therefore analysts need to use judgment when interpreting the results.

Precedent Transactions Analysis

Precedent transaction analysis includes the analysis of past M&A transactions to derive an estimated value of the target company. This technique provides, therefore, an indication of the price that the market has paid in the past, for companies which are similar in some respects.

In carrying out this type of analysis, analysts gather data on transactions similar in nature, deal size, industry and time. Application of the relevant metrics-such as EV/EBITDA and EV/Sales- will subsequently yield a set of valuation multiples. Later on, these are adjusted for synergies, market conditions, and strategic importance, among other factors, to arrive at an estimation of the target company’s value.

The major advantage of Precedent transaction analysis is that this method is derived from actual transaction data, which includes premiums for control and synergies. Despite that, also this methodology has several disadvantages; the historic transactions may not indicate the existing market conditions, and exhaustive data of private deals could be pretty hard to find out. Notwithstanding these disadvantages, this method is one of the main ways to find out the valuation trends in the merger and acquisition market.

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow Analysis works on a completely different tangent, focusing on the intrinsic value of the company. Whereas both Comparable Company analysis and Precedent Transactions analysis estimate the value of a company based on market comparables, unlike them, DCF estimates a company’s value based on its future expected cash flows. This is useful in cases where the companies have a very different business model or operate in an industry with few comparables.

Essentially, DCF starts off with projecting free cash flows for the target company over some predefined period of projection. These are then discounted back to the present using the firm’s cost of capital, reflecting risks involved in the business. Further, will be necessary to calculate the terminal value of the company, discounting it to the present value and adding it back to the value of the projection period.

The strengths of DCF lie in its flexibility and that it is based on fundamental performance, rather than on market sentiment. However, it is highly sensitive to assumptions like growth rates, discount rates, and terminal value calculations. Even small changes in these inputs may strongly affect the final valuation outcome. It therefore requires analysts to be very strict in justifying their assumptions and testing the robustness of their models via sensitivity analysis.

For example, we can consider a technology start-up with very high growth potential. Analysts would project cash flows considering very rapid revenue increases and very significant reinvestments in technology. In contrast, one would focus on stable cash flows and incremental growth while valuing a mature industrial firm. The DCF model would be flexible enough to accommodate those contexts.

Combining Valuation Techniques

No valuation approach is ideal on its own. Each of the techniques gives a different insight and is hence suited for different situations. For instance, Comparable Company analysis would be perfect in judging the relative value of a company with its peers, whereas Precedent Transactions analysis provides a reality check based on actual market transactions. On the other hand, DCF provides an intrinsic in-depth analysis of the business, independent of the market noise.

In order to provide a more complete assessment, the triangulation approach is increasingly being used by incorporating findings from valuations of different techniques. As an example, in technology industries, Comparable Company analysis might provide a view on how markets valued comparable businesses, DCF might be applied with respect to long-term intellectual property value and growth potentials, Precedent Transactions analysis could help identify synergies from historical deals and therefore complement an otherwise forward-looking DCF approach.

Finally, the values are presented through a football field chart, a type of graph that is particularly helpful in visualizing the results and comparing various approaches to valuation. This chart usually assists stakeholders, but not only, in rapidly identifying overlap and outliers by portraying ranges of value generated from multiple approaches on one horizontal axis.

Example of a DCF valuation

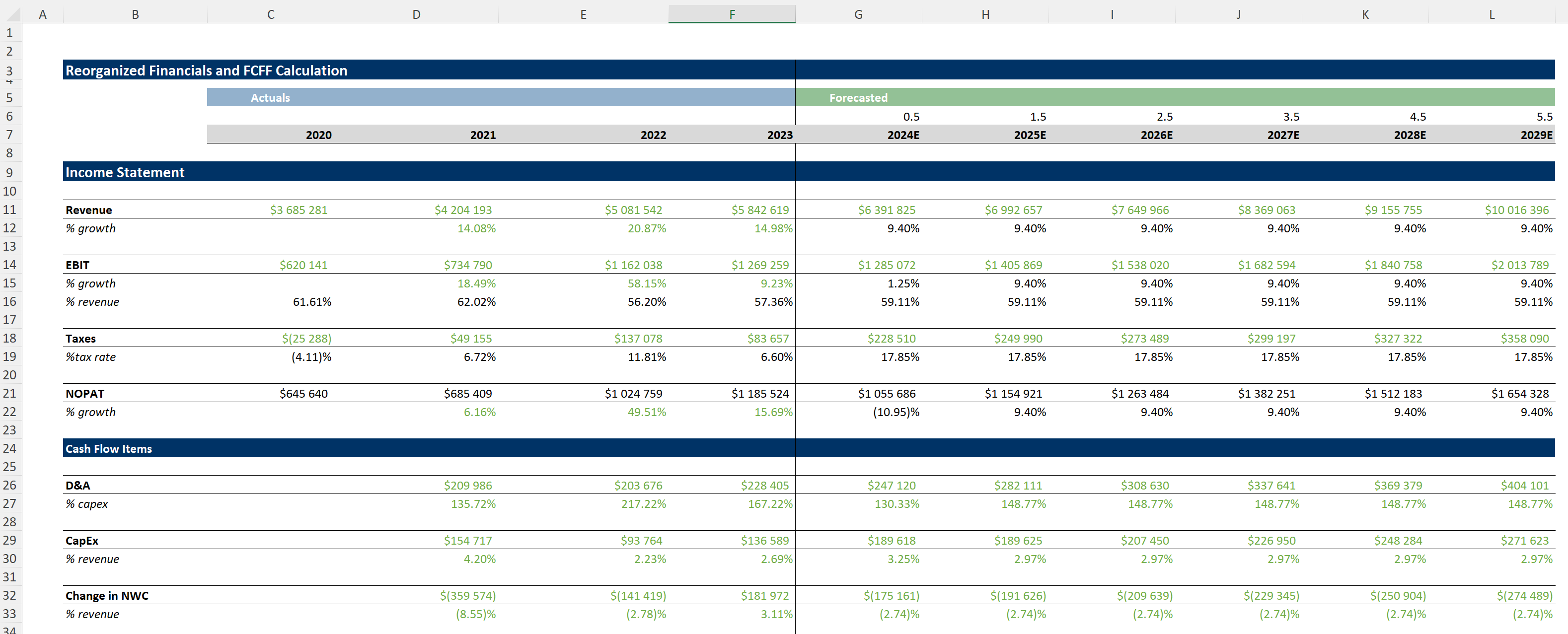

In the following section, you can download an Excel file containing a valuation performed using the discounted cash flow (DCF) method. The file includes all the calculation details, such as projected cash flows, the discount rate applied, and the resulting net present value. Additionally, it contains sheets where various assumptions were made, along with the forecasting of financial statement items.

Example of DCF valuation

Source: Personal analysis

In this discounted cash flow (DCF) analysis, the valuation is performed by projecting future free cash flows to the firm (FCFF) over a specified forecast period. Key assumptions, such as revenue growth, cost of goods sold (COGS) percentage, EBITDA margin, depreciation, capital expenditures (CapEx), and changes in net working capital (NWC), are made to forecast the financial statement items.

The projected FCFF values are then discounted using a weighted average cost of capital (WACC) to estimate their present value. A terminal value is calculated at the end of the forecast period, representing the business’s residual value. The total enterprise value is obtained by summing the discounted FCFFs and the discounted terminal value. Lastly, adjustments for net debt and outstanding shares are made to derive the implied equity value and share price.

Additionally, the file includes a sensitivity analysis to show how changes in growth rate and WACC impact the enterprise value.

You can download below the Excel file for valuation.

Why should I be interested in this post?

The following post outlines some of the key valuation techniques in M&A transactions and is hence very useful for finance professionals, students, and anyone interested in the corporate world. This article offers practical tools that help make an appropriate assessment of deal value utilizing methodologies like Comparable Companies Analysis, Precedent Transactions Analysis, and Discounted Cash Flow Analysis.

Whether it is for an investment banking career or an intrinsic desire to understand how things work in corporate finance, it is possible to find some real actionable insight in this article. The combination of a theoretical base with real applications allows the reader to take these concepts into dynamic market environments.

Related posts on the SimTrade blog

▶ All posts about valuation Valuation methods

▶ Lou PERRONE Free Cash Flow

▶ Bijal GANDHI Cash Flow Statement

▶ Nithisha CHALLA Factset

▶ Andrea ALOSCARI My Internship Experience in the Corporate & Investment Banking division of IMI – Intesa Sanpaolo

Useful resources

Joshua Rosenbaum and Joshua Pearl (2024) “Investment Bnaking : Valuaito, LBOs, M&A and IPOs” Wiley, Third Edition.

Alexandra Reed Lajoux (2019) “The Art of M&A, Fifth Edition: A Merger, Acquisition, and Buyout Guide” McGraw-Hill Education.

Tim Koller, Marc Goedhart, David Wessels (2010) “Valuation: Measuring and Managing the Value of Companies”, McKinsey and Company.

Aswath Damodaran (2024) Valuation Modeling: Excel as a tool (YouTube video).

About the author

The article was written in January 2025 by Andrea ALOSCARI (ESSEC Business School, Global Bachelor in Business Administration (GBBA) – 2024-2025).