Cash flow statement

In this article, Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) explains the meaning of cash flow statement.

This read will help you understand in detail the meaning, structure, components of cash flow statement along with relevant examples.

Cash Flow statement

The cash flow statement is one of the three most important financial statements which acts as a bridge between the balance sheet and the income statement. It is a summary of all the cash and cash equivalents that have entered or left the company in the previous years. It helps to understand how well a company manages its cash position. In many countries, it is a mandatory part of the financial statements for large firms.

Structure of Cash Flow statement

The cash flow statement is divided into three of the following major activity categories: operating activities, investing activities and financing activities.

Cash from operating activities

The operating activities includes all the sources and uses of cash related to the production, sale and delivery of the company’s products and services. Few examples of the operating activities include,

• Sale of goods & services

• Payments to suppliers

• Advertisements and marketing expenses

• Rent and salary expenses

• Interest payments

• Tax payments

Cash from investing activities

As the name suggests, investing activities includes all those sources and use of cash from a company’s investments, assets, and equipment. A few examples of investing activities include,

- Purchase and sale of an asset

- Loans to suppliers

- Loans received from customers

- Expenses related to mergers and acquisitions

Cash from financing activities

Financing activities are those that include all the sources and use of cash from investors. All the inflow and outflow of cash such as,

- Capital raised through sale of stock

- Dividends paid

- Interest paid to bondholders

- Net borrowings

- Repurchase of company’s stock

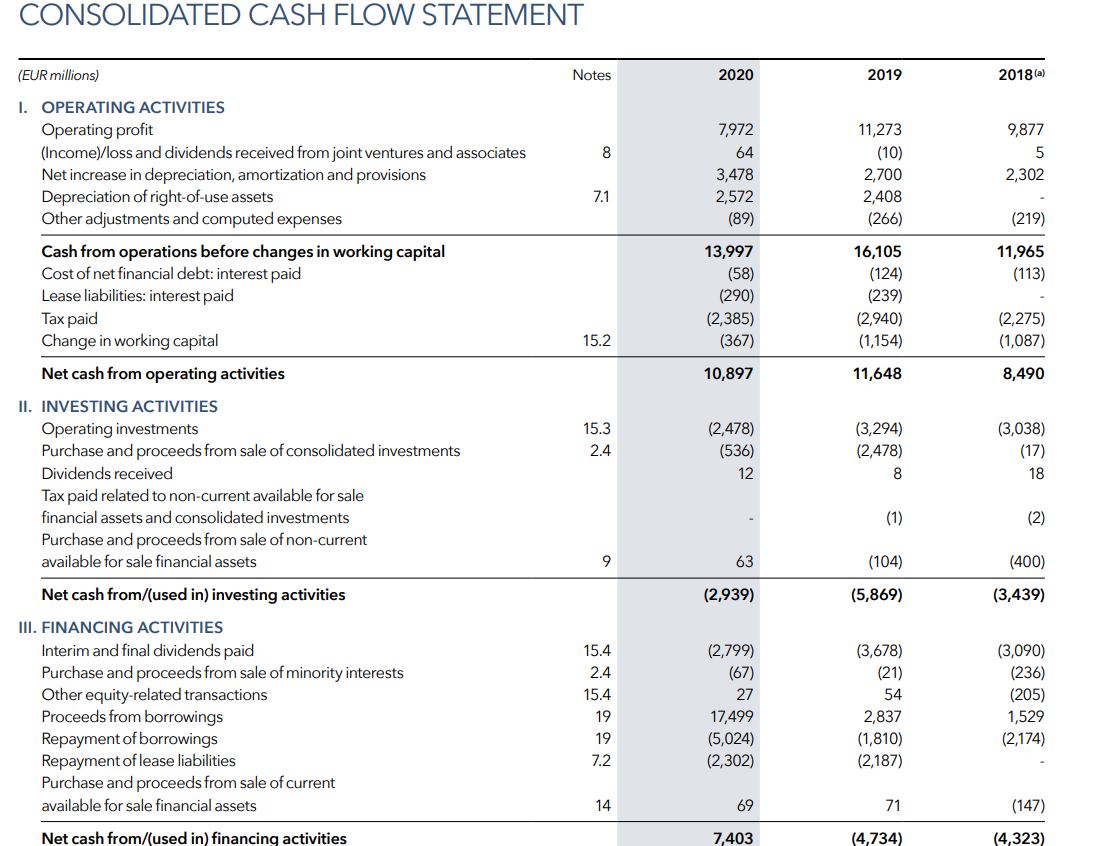

LVMH Example: Cash Flow Statement

Here, we again take the example of LVMH. The French multinational company LVMH Moët Hennessy Louis Vuitton was founded in 1987. The company headquartered in Paris specializes in luxury goods and stands at a valuation of $329 billion (market capitalization in June 2021). It is a consortium of 75 brands controlled under around 60 subsidies. Here, you can find a snapshot of LVMH Cash flow statement for three years: 2018, 2019 and 2020.

Importance and use of cash flow statement

The cash flow statement is a very important indicator of the financial health of a company. This is because a company might make enough profits but might run out of cash to be able to operate. Also, it indicates the company’s abilities to meet its interest obligations and dividend payments if any. Basically, it provides a true picture of a company’s liquidity and financial flexibility. Therefore, a cash flow statement used in conjunction with the income statement and the balance sheet helps provide a holistic view of a company’s strength and weaknesses. The cash flow statement is therefore of great use to the following stakeholders:

- Potential and current debtholders (creditors and bondholders)

- Potential and current shareholders

- Management team and company’s directors

Related posts on the SimTrade blog

▶ Bijal GANDHI Income statement

▶ Bijal GANDHI Revenue

▶ Bijal GANDHI Cost of goods sold

About the author

Article written in July 2021 by Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).