Operating vs Non-Operating Revenue

In this article, Bijal GANDHI (ESSEC Business School, Master in Management, 2019-2022) explains the difference between operating and non-operating revenue.

This read will help you understand in detail various terminologies related to revenue and income statement.

What is operating revenue?

The revenue generated from the primary or core activities of a company is referred to as operating revenue. It is important to differentiate between operating and non-operating revenue to gain insights into the efficiency of a firm’s core operations.

For example, the revenue generated from the total sale of iPhones worldwide is an operating revenue for Apple, whereas the revenue generated from sale of old office furniture would be a non-operating revenue.

What is non-operating revenue?

Non-Operating revenue refers to the revenue generated from operations that are not part of a company’s core business. The items in this section are generally unique in nature and therefore they do not show a true picture of the efficiency of a company’s core business. It is rather attributable to a company’s managerial and financial decisions.

For example, research grants obtained by universities are non-operating revenues as they are not generated from the core business (tuition fees).

How are revenue recorded in the income statement?

We know from the income statement that the COGS is deducted from revenue to derive the gross profit. The operating expenses are further deducted from the gross profit to attain the operating profit. The non-operating revenues and expenses are then combined and deducted from the operating profit to derive the net profit.

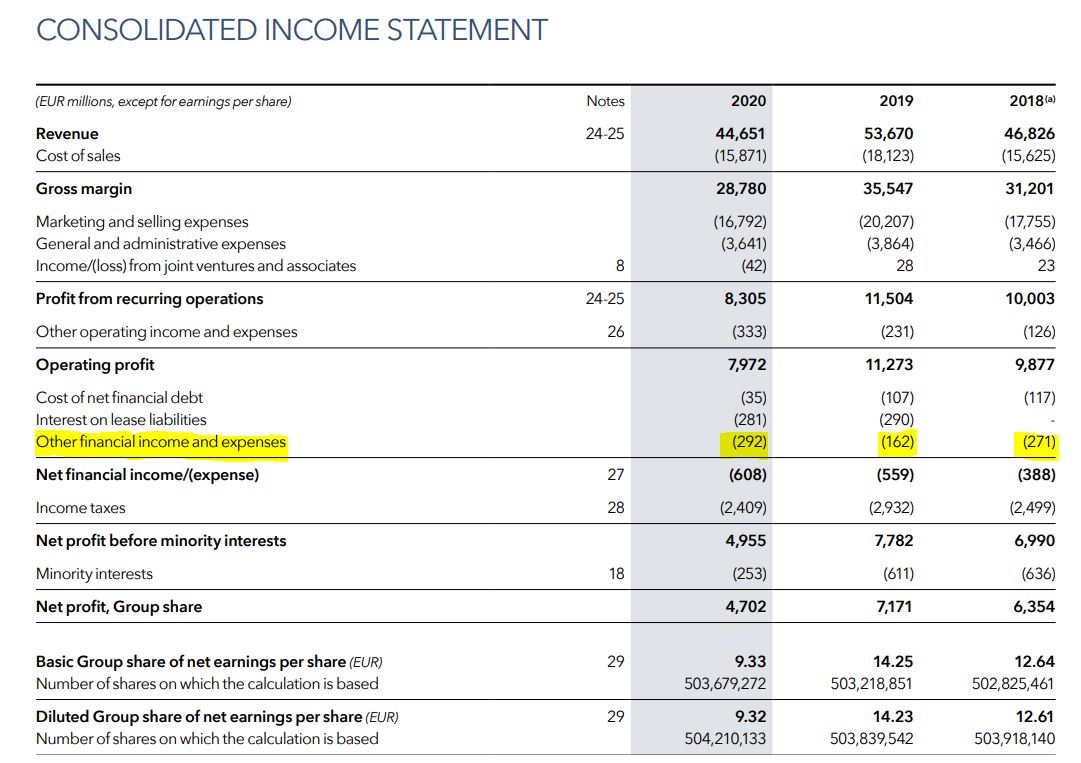

LVMH example

Let us once take the example of Moët Hennessy Louis Vuitton (LVMH). The French multinational company LVMH was founded in 1987. The company headquartered in Paris specializes in luxury goods and stands at a valuation (market capitalization in June 2021) of $329 billion. It is a consortium of 75 brands controlled under around 60 subsidiaries. Here, you can find a snapshot of LVMH Income statement for three years: 2018, 2019 and 2020.

Here, you can see that the highlighted part; “other financial income and expenses” are combined to derive the net profit before taxes

Related posts on the SimTrade blog

▶ Bijal GANDHI Income statement

▶ Bijal GANDHI Revenue

▶ Bijal GANDHI Cost of goods sold

▶ Bijal GANDHI Operating profit

About the author

Article written in August 2021 by Bijal GANDHI (ESSEC Business School, Master in Management, 2019-2022).