In this article, Mathis HOUROU (ESSEC Business School, Global Bachelor in Business Administration (GBBA) 2022-2026) explores the definition of green bonds and their limits to see if they are a real financial innovation or primarily a marketing tool.

Introduction

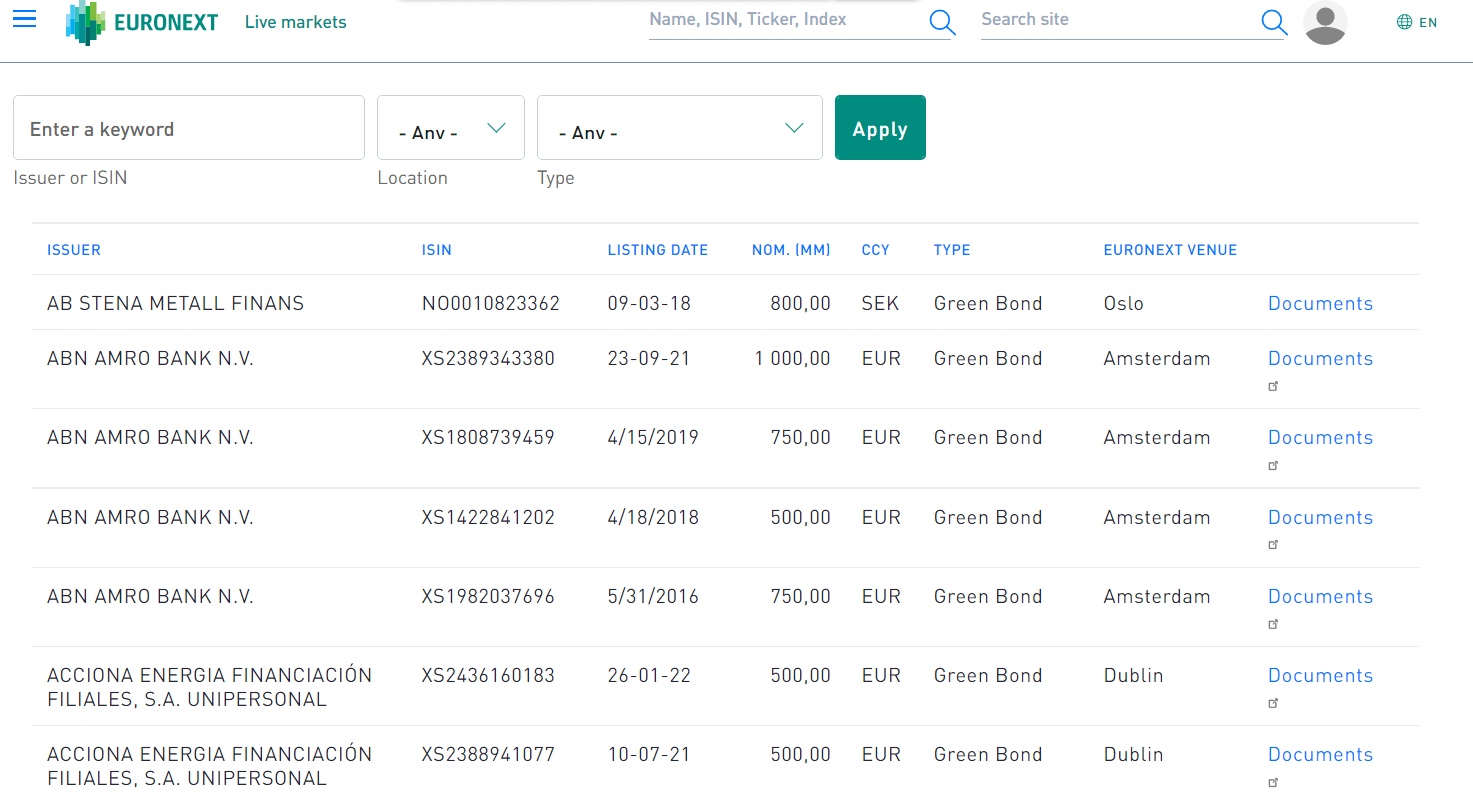

In the last ten years, green bonds have become very popular in sustainable finance. Governments and big companies use them to finance projects with a positive impact on the environment, like green energy or clean transport.

In the last ten years, green bonds have become very popular in sustainable finance. Governments and big companies use them to finance projects with a positive impact on the environment, like green energy or clean transport. For example, in January 2017 France issued its first sovereign green bond for €7 billion, one of the largest green bond issuances at the time, to finance climate-related and environmental projects.

Today, environmental criteria are very important for investors. Green bonds are often seen as a perfect solution to mix profit and sustainability. In fact, according to the Climate Bonds Initiative, the global green bond market surpassed $550 billion in annual issuance in 2021, showing a growing demand. However, are green bonds really different from traditional bonds, or are they just a marketing strategy from companies to appear more ethical?

This article looks at the definition of green bonds and their limits to see if they are a real financial innovation or just some greenwashing used to make even more money.

What is a Green Bond?

First, a green bond is a debt instrument, so the money raised must be used only for projects that help the environment.

Technically, green bonds work exactly like normal bonds. They have a maturity date, they pay interests (coupons). For instance, if a company issues a green bond to build a solar farm and goes bankrupt, the investor loses money, just like with a standard bond.

The only real difference is that the money must finance green projects. There are voluntary rules, like the Green Bond Principles by the ICMA (International Capital Market Association), for transparency, but they are not laws.

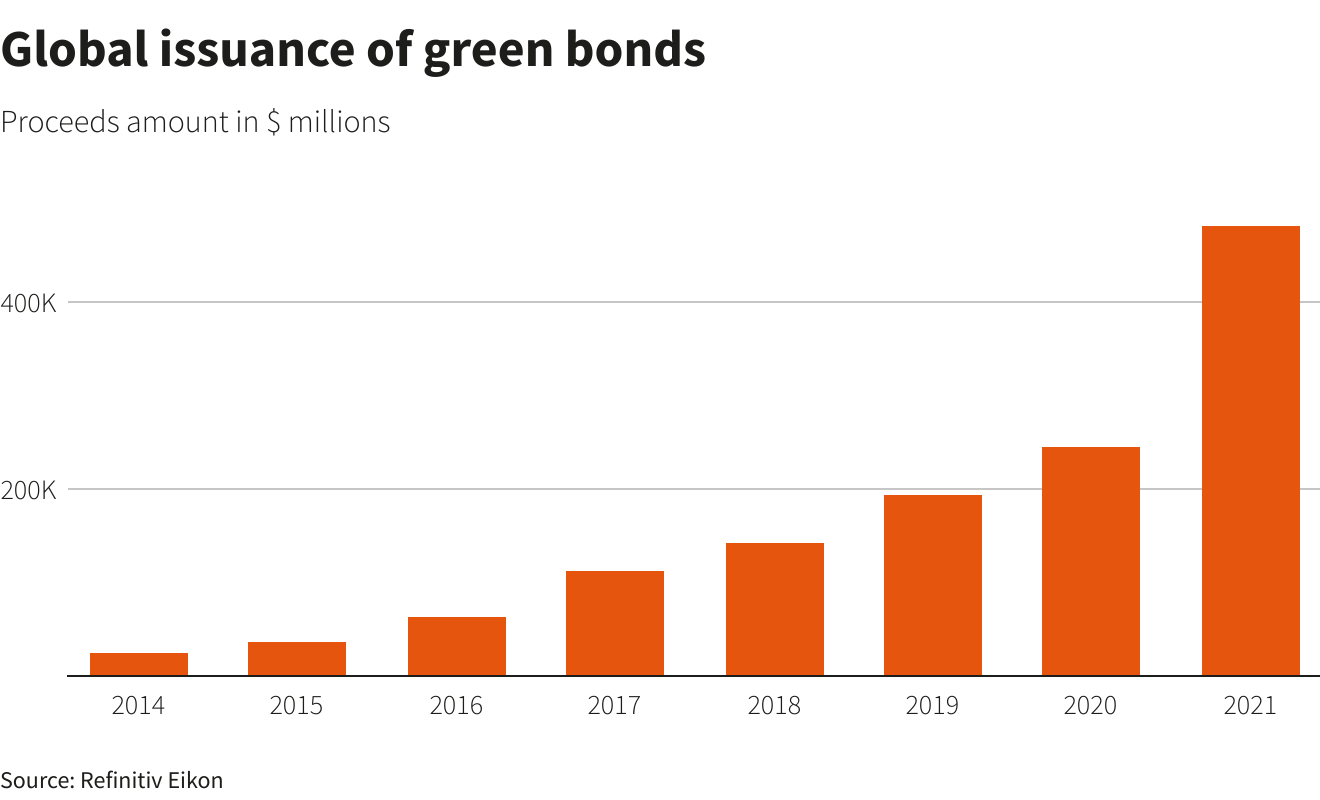

Global annual green bond issuance (USD bn).

Source: Reuters

A Fast-Growing Market

Since the first green bond by the European Investment Bank in 2007, the market has grown a lot. Now, it is a big part of the bond market. There are three main reasons for this evolution:

- Demand: Investors want to respect ESG (Environmental, Social, and Governance) rules and are more eco-conscious.

- Regulations: Governments encourage green finance and incentivize people to invest in those funds by creating advantages.

- Reputation: For companies, issuing a green bond is good for their image. It shows they care about the planet and the future.

Are They Financially Different?

From a financial point of view, green bonds are very similar to classic bonds. The risk and the return are usually equivalent.

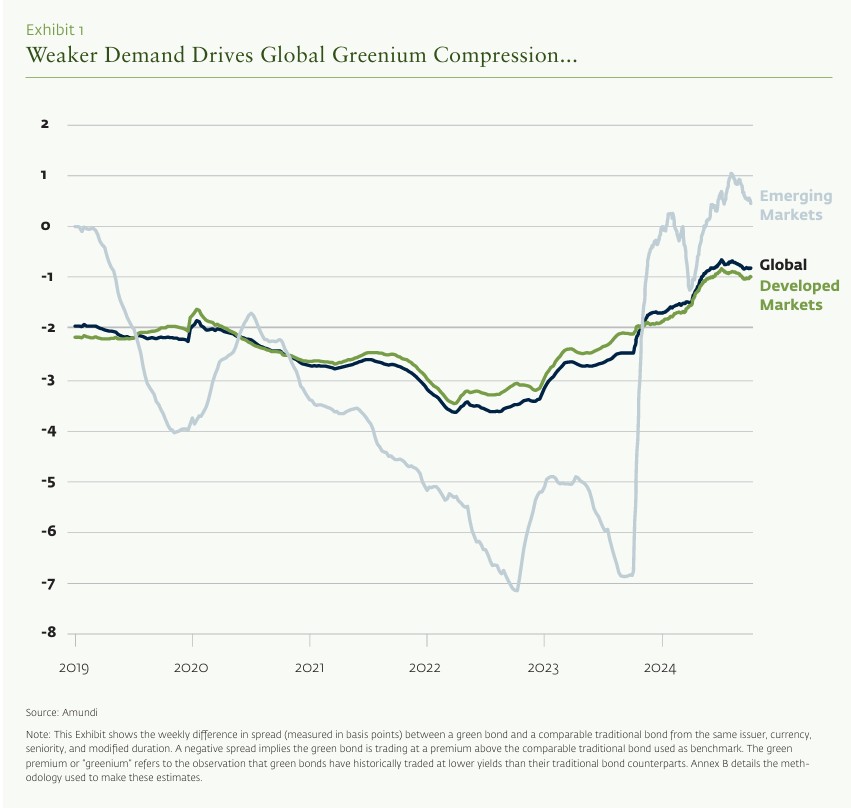

There is a debate about a “greenium” or green premium. This means that investors might accept a lower interest rate because the bond is green. But in reality, the price of the bond depends mostly on interest rates and the credit quality of the issuer, not just the “green label”.

Evolution of the “Greenium” (yield difference between green and non-green bonds).

Source: Amundi

The Risk of Greenwashing

The main problem with green bonds is transparency. The definition of a “green project” can be vague.

This creates a big risk of “greenwashing.” A company might label a bond as green for a project that is not very ambitious, just to attract investors. The OECD has also warned that greenwashing can undermine trust in sustainable finance markets if issuers exaggerate environmental benefits.

Even if there are auditors to look into the projects, there are still not enough binding rules and laws to compare and verify whether a project is truly green. The International Capital Market Association (ICMA) notes that its Green Bond Principles remain voluntary guidelines rather than legal regulation.

Why do Investors Buy Them?

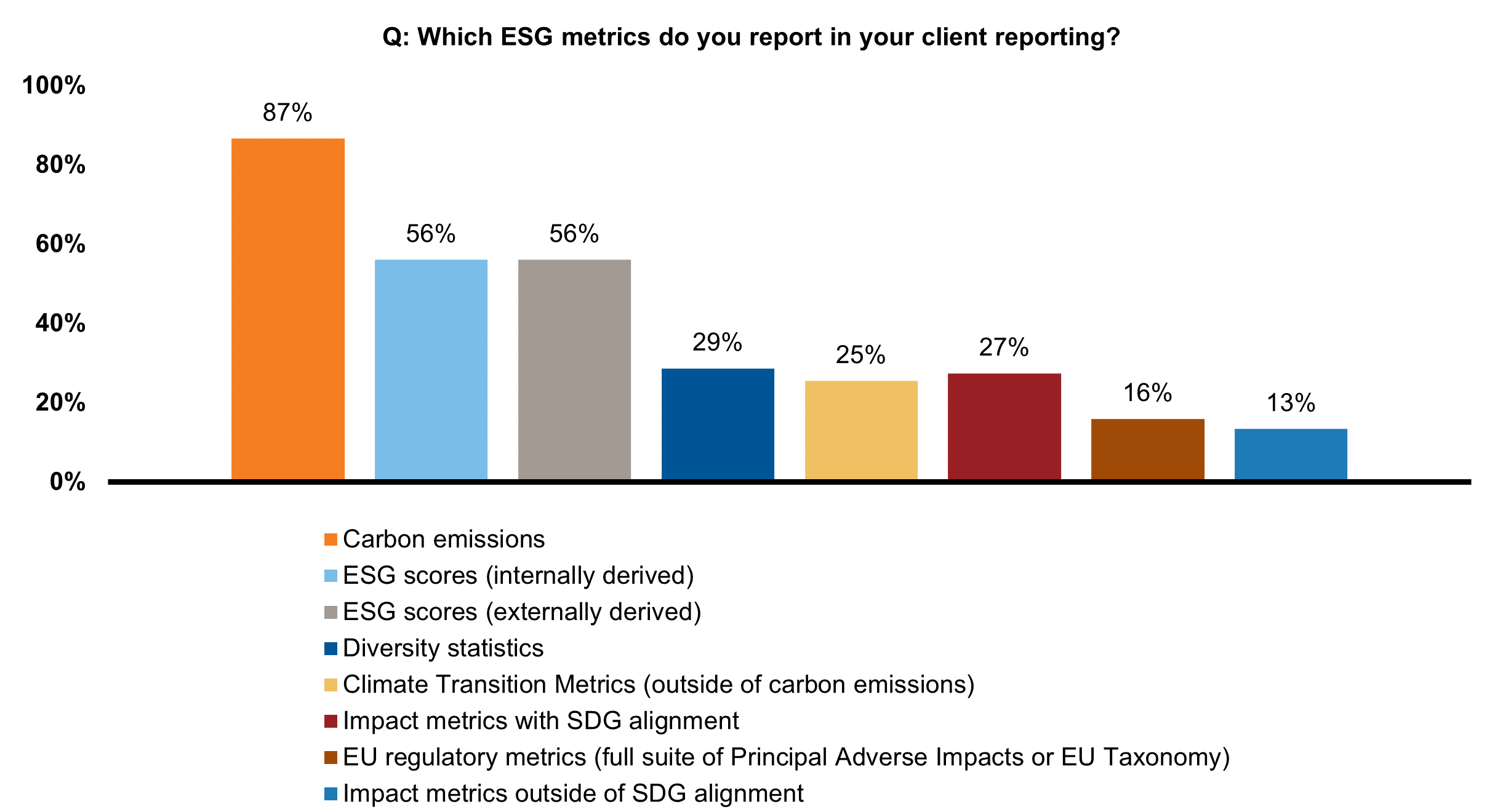

For investors, green bonds are very useful. They allow them to respect their sustainability goals without changing the risk of their portfolio. In particular, they are widely purchased by institutional investors such as pension funds, insurance companies, and asset managers, who increasingly integrate ESG criteria into their investment strategies.

However, buying a green bond does not always mean better returns or better diversification. It is often a decision based on strategy and regulation, not just financial performance.

The Spectrum of Capital: positioning green bonds between traditional investment and impact investing.

Source: Russell Investments

Conclusion

From a technical standpoint, green bonds do not represent a new financial mechanism. They function exactly like traditional bonds.

However, from a strategic perspective, they are a real innovation. They shift how capital is allocated by directing funds specifically toward environmental goals, forcing issuers to be more transparent.

While they are not a perfect solution for climate change and carry risks of greenwashing, green bonds remain a vital tool. They bridge the gap between financial markets and the urgent needs of our planet.

Related posts on the SimTrade blog

▶ Anant JAIN Social Impact Bonds

▶ Louis DETALLE What are green bonds?

▶ Anant JAIN Environmental, Social & Governance (ESG) Criteria

▶ Nithisha CHALLA US Treasury Bonds

Useful resources

OECD Protecting and empowering consumers in the green transition

ESG News US Green Bond Sales Near Record High, Reaching $550B: BloombergNEF Repor

Banque de France (April 2025) Obligation verte

Climate Bonds Initiative Market Data

Amundi Research Center ESG & Green Bonds

About the author

The article was written in February 2026 by Mathis HOUROU (ESSEC Business School, Global Bachelor in Business Administration (GBBA)).

▶ Discover all articles by Mathis HOUROU.