In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024) analyzes the economic factors explaining the premium on the collectible coins like the Elizabeth II coins.

Introduction

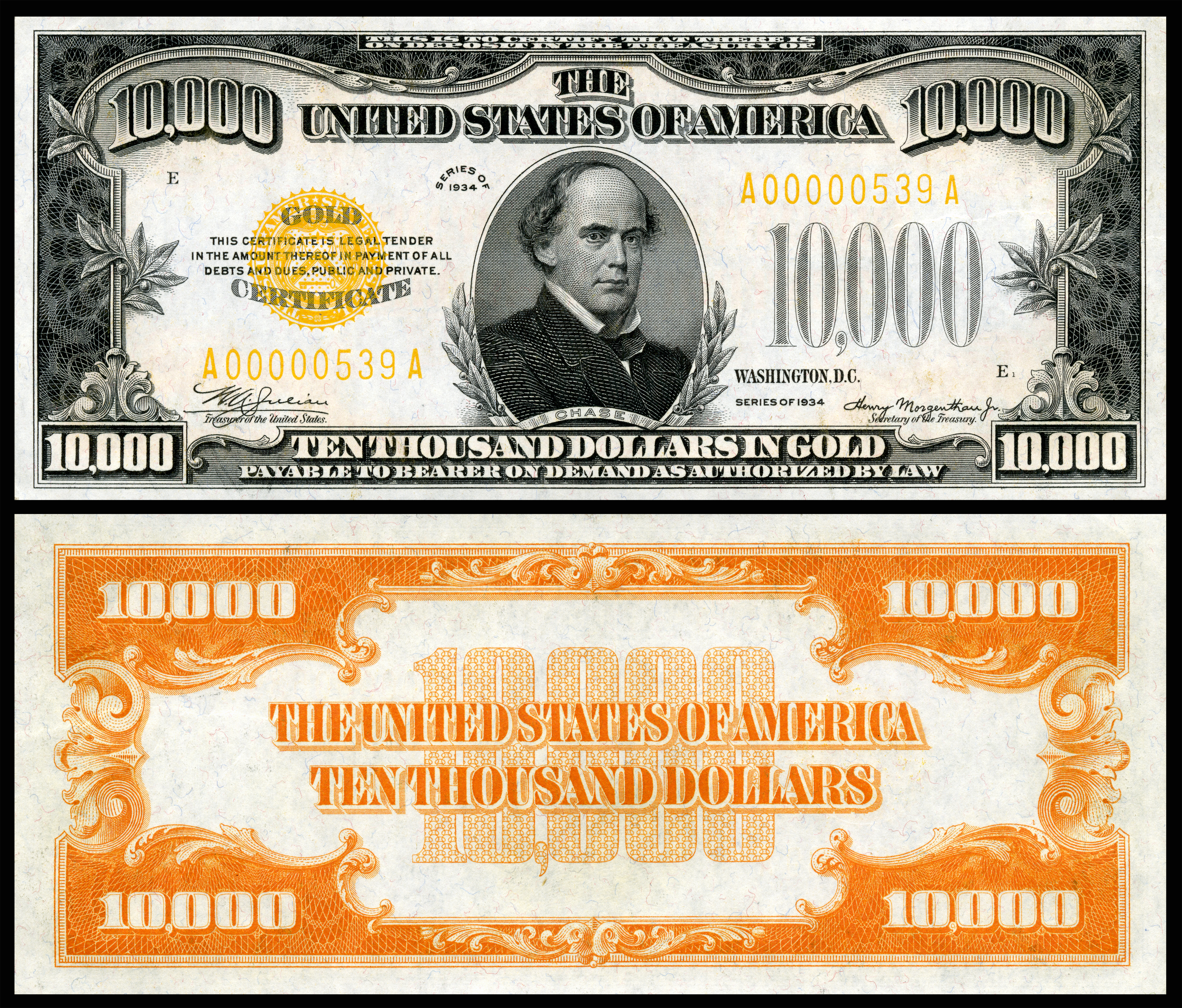

The financial world has long recognized the significance of precious metals, particularly gold, as a reliable store of value. However, beyond the traditional investment vehicles such as bullion bars and coins, there exists a subcategory of numismatic items—collectible coins—whose premiums can exceed the value of the metal content itself. Coins like the Elizabeth II coin series represent a growing segment of this market. While these coins are often minted with a fixed gold or silver content, their value can significantly outpace the value of the metal they contain. The difference between the face value or gold value of an Elizabeth II coin and its market value is commonly referred to as the premium. This difference represents a premium that can explained by several factors.

Elizabeth II bullion

Source: Hatton Garden Metals

Computation of the premium on coins like Elizabeth II

As an example, let us consider a 2022 Queen Elizabeth II Gold Sovereign coin. The gold content for this coin is 7.32 grams (0.2354 troy ounces of gold). In the beginning of 2024, the spot price of gold is $2,000 per troy ounce (or approximately £1,580 per troy ounce). The gold value (or intrinsic value) of this coin is equal to $470 (=0.2354×2,000) or approximately £372. The market value (including the premium) is $600 (or approximately £475). The premium, defined as the difference between the market value and the gold value, is then equal to $130 (=$600−$470) or approximately £103.

The Investment Potential of Numismatic Coins

Numismatic coins, such as those featuring Queen Elizabeth II, have long captured the attention of collectors and investors alike. Beyond their historical and cultural significance, these coins hold substantial financial value, often trading at a premium above their intrinsic metal content. Factors such as rarity, condition, historical context, and market demand significantly determine their market price and explain the premium. In this article, we delve into the economic factors of coins premium, focusing on the Elizabeth II series, their appeal, and their role as an alternative investment vehicle.

Understanding the Premium: What Sets These Coins Apart?

A premium refers to the additional cost above the intrinsic value of a coin’s metal content. For example, if a gold coin contains one ounce of gold, its inherent value will be based on the current market price of gold. However, a coin like the Elizabeth II Gold Coin could carry a premium because of its collectibility, historical significance, rarity, and demand among collectors. This premium is influenced by several factors: mintage numbers and rarity, condition and grading, and demand and market Trends.

Mintage Numbers and Rarity

The mintage number of a coin significantly influences its rarity, and by extension, its premium. Coins with limited mintage, such as special editions or proof versions of the Elizabeth II coin, typically see higher premiums due to their scarcity. For instance, a limited-edition Elizabeth II coin series celebrating the Queen’s milestone events (e.g., her Diamond Jubilee) would likely command a higher price compared to regular-issue coins.

Condition and Grading

Coins are often graded for their condition, which impacts their value. Coins in pristine condition (often graded as MS70 or PF70, which indicates perfect condition) carry a higher premium. This is especially true for coins preserved in perfect, uncirculated condition, making them rare in the market.

Demand and Market Trends

The demand for collectible coins is often driven by trends in the collector community. When a coin series, like the Elizabeth II series, becomes popular among investors and collectors, its premium increases as more people compete for a limited supply. Economic factors, including inflation, interest rates, and even geopolitical events, can also spur increased interest in collectible coins as alternative investments.

Notable Elizabeth II Coins

I give below a list of notable Elizabeth II coins:

- 1953 Coronation Crown: Issued to commemorate Queen Elizabeth II’s coronation, this coin is a prime example of how historical events can add numismatic value. While its melt value is minimal, its collectible value often exceeds 10 times its base worth.

- 2002 Golden Jubilee Coins: Struck in limited numbers, these coins saw a steep rise in market value due to their rarity and the significance of the Golden Jubilee celebration.

- 2022 Memorial Coins: Following Queen Elizabeth II’s passing, the Royal Mint issued special memorial coins, which have become highly sought after. Early buyers have seen considerable price appreciation, driven by emotional and historical factors.

Elizabeth II coin for the 1953 Coronation Crown

Source: The Royal Mint

Elizabeth II coin for the 2002 Golden Jubilee

Source: The Royal Mint

Elizabeth II coin for the 2022 Memorial

Source: The Royal Mint

The Financial Benefits of Investing in Premium Coins

Diversification of Investment Portfolio

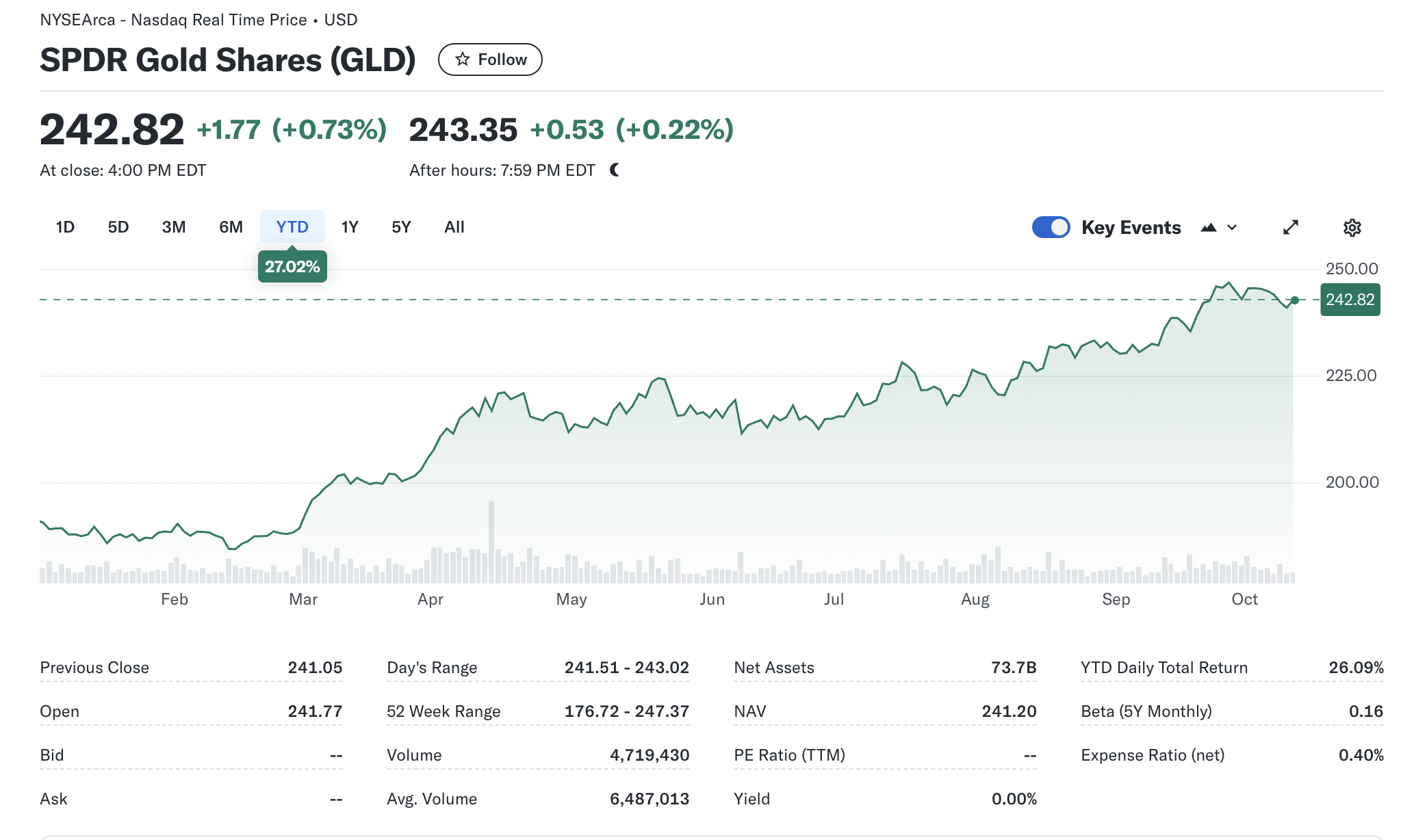

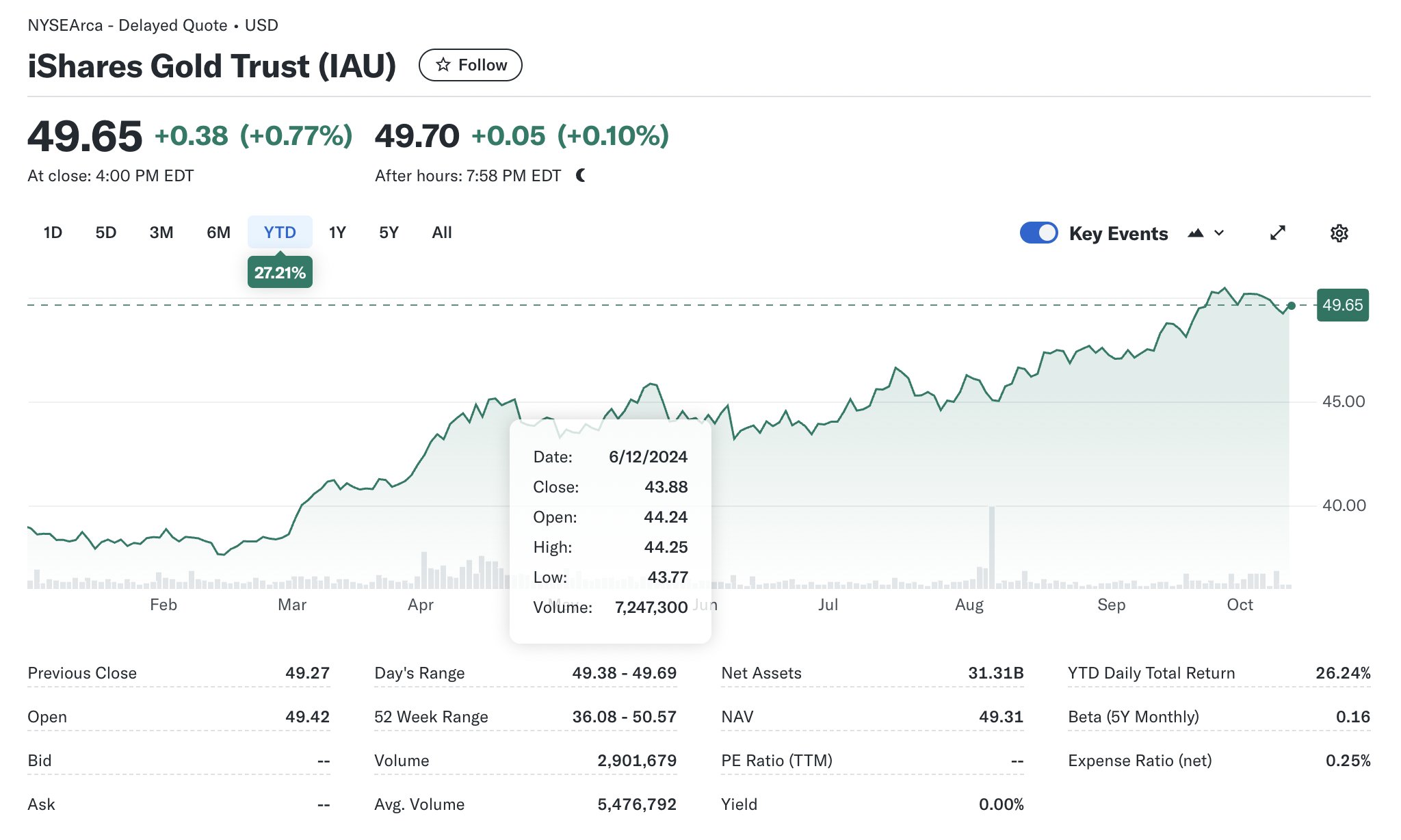

In the world of investing, diversification is often touted as one of the key strategies for managing risk. Coins like the Elizabeth II series offer a unique opportunity for diversification. While traditional assets such as stocks, bonds, and real estate are subject to market fluctuations, gold, and silver coins tend to be less volatile and are often viewed as a hedge against inflation or economic uncertainty (see Erb and Harvey (2013, 2024) for a discussion).

Additionally, premium coins are not just an investment in the precious metals market; they also offer exposure to the world of collectibles, which can experience appreciation independent of broader financial markets. Investors looking to diversify into non-correlated assets may find that numismatic coins, like those in the Elizabeth II series, provide an attractive avenue for diversifying their portfolios.

Appreciation Potential

One of the primary financial attractions of premium coins is their potential for appreciation over time. The value of a collectible coin is driven by both the fluctuating value of the precious metal it contains (gold, silver, etc.) and the coin’s numismatic value. As demand for specific coins rises, their premiums can increase exponentially.

For example, a gold Elizabeth II coin bought at a premium in the 1990s could be worth several times its original purchase price today, due to both the rising price of gold and the increasing demand for coins tied to the late Queen’s reign. Investors in these coins have seen capital appreciation not only from the metal price but also from the unique value placed on these coins by collectors.

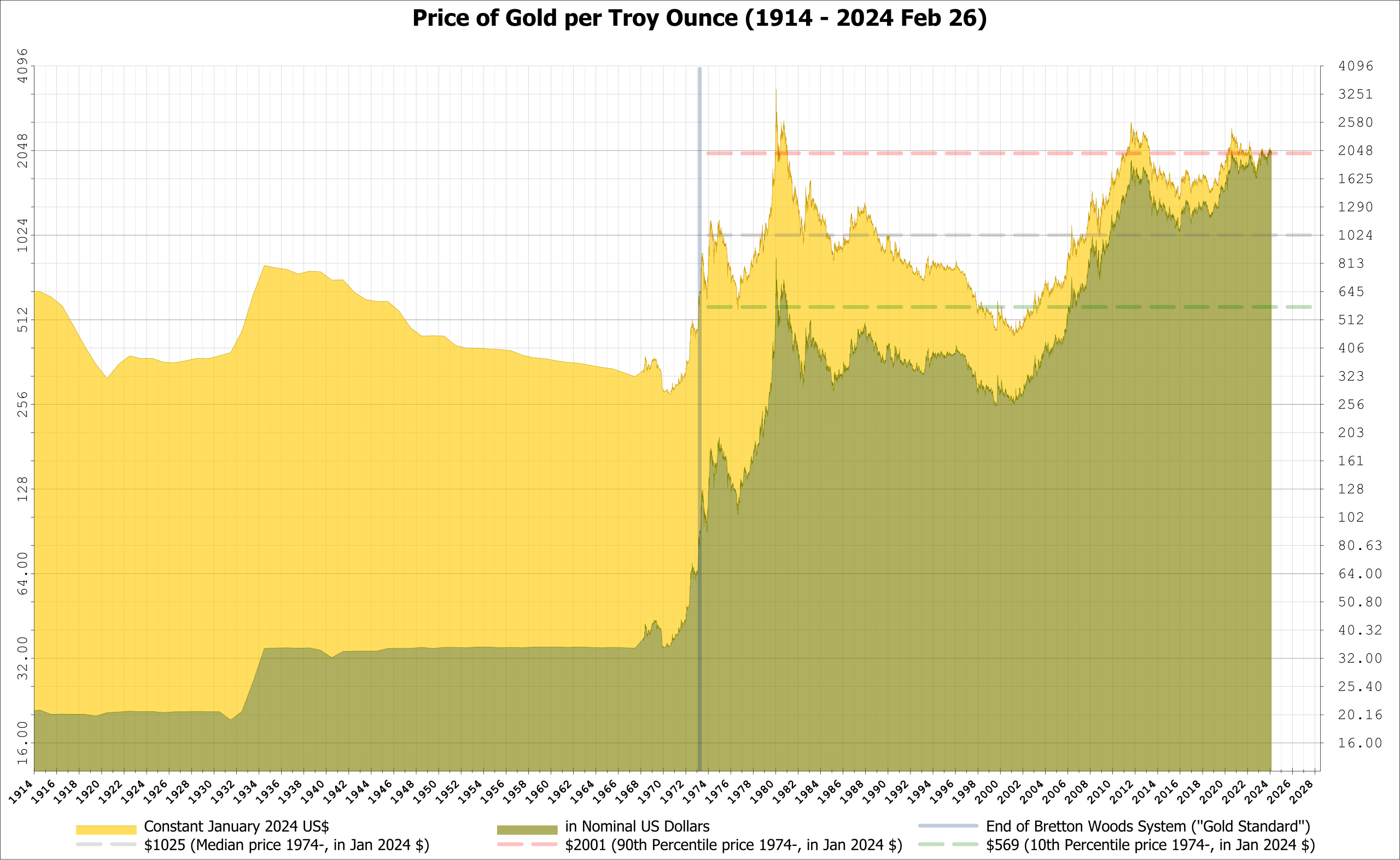

Figure 1 below gives the evolution of the gold price over the period January 1971-September 2024.

Figure 1. Evolution of the Gold price

Source: Wikipedia

Tax Benefits and Legacy Planning

In some jurisdictions, numismatic coins, such as the Elizabeth II gold coins, are subject to favorable tax treatment. Depending on the country, these coins may be exempt from certain sales taxes or capital gains taxes, further enhancing their attractiveness as an investment. The tax advantages, when combined with their appreciation potential, make them an appealing choice for long-term investors seeking wealth preservation.

Additionally, premium coins are often used in legacy planning due to their tangible value, portability, and emotional appeal. Families pass down coin collections across generations, ensuring that the wealth embedded in these coins remains intact and grows over time.

Risks and Considerations for Investors

While coins like those featuring Elizabeth II can be lucrative investments, they are not without risks:

- Market Volatility: The numismatic market can be unpredictable, with premiums fluctuating based on collector sentiment and economic conditions.

- Liquidity Challenges: Selling collectible coins at premium prices requires access to the right buyer market, which may not always be readily available.

- Authentication and Grading Costs: Ensuring the authenticity and proper grading of a coin often incurs additional costs, which should be factored into investment decisions.

Finally why Coins Featuring Elizabeth II Remain an Attractive Investment?

Coins bearing Queen Elizabeth II’s effigy offer a blend of historical appeal, tangible value, and investment potential. The enduring legacy of her reign adds a unique emotional and cultural dimension that elevates their demand. From a financial perspective, these coins offer diversification benefits, a hedge against inflation, and the potential for significant capital appreciation.

Conclusion

Investing in premium coins such as those featuring Elizabeth II requires a balance of sentiment and financial analysis. While their cultural and historical value is undeniable, their economic worth hinges on factors like rarity, condition, and market trends. For investors, these coins are more than just collectibles; they represent a fusion of history and finance, offering opportunities for both preservation of wealth and long-term growth.

Why should I be interested in this post?

As financial markets become more volatile and inflationary pressures rise, the appeal of premium coins as an alternative investment will likely continue to grow. These coins not only provide an investment in precious metals but also represent a tangible, legacy-building asset that can be passed down through generations. For students seeking to understand and diversify their portfolios, learning about the premium on collectible coins presents an intriguing opportunity with considerable upside potential.

Related posts on the SimTrade blog

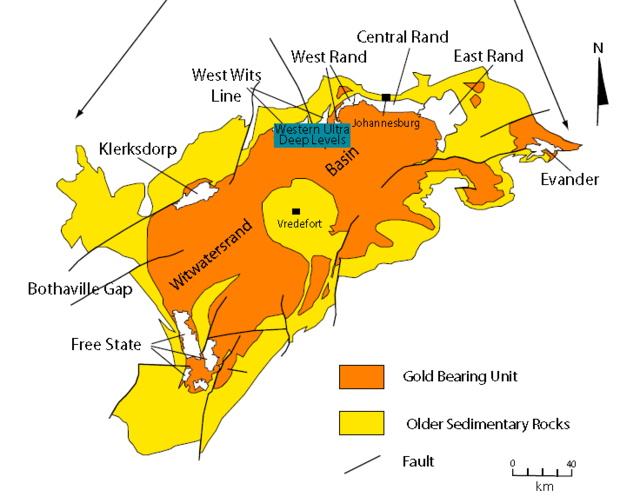

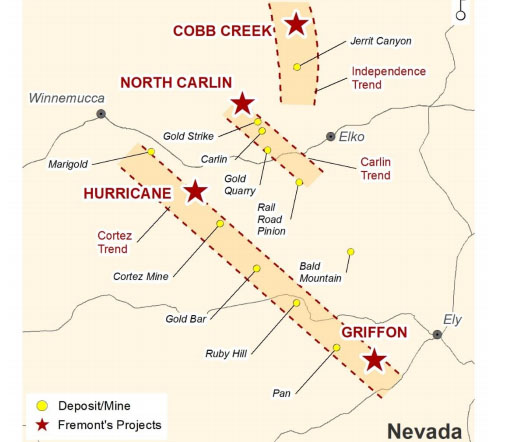

▶ Nithisha CHALLA History of Gold ▶ Nithisha CHALLA Gold resources in the worldUseful resources

Academic research

Erb, C.B., and C.R. Harvey (2013) The Golden Dilemma. Financial Analysts Journal 69 (4): 10–42.

Erb, C.B., and C.R. Harvey (2024) Is there still a Golden Dilemma. Working paper.

Business

US gold bureau The History and Evolution of Queen Elizabeth II on Coins

Change Checker The History of Queen Elizabeth II Coins

The Royal Mint Museum Her Late Majesty Queen Elizabeth II on coins

Physical Gold Gold Coin Premiums Explained

Treasure Coast Bullion Group Gold and Silver Premiums: What You Need to Know

American Bullion What Does MS70 Mean, and Why Is It Important?

Other

Wikipedia Gold

Wikipedia Two pound coin

Rare Coins Vault Top 10 Most Valuable Elizabeth II Coins! | Rare Coins Worth Millions (YouTube video)

About the author

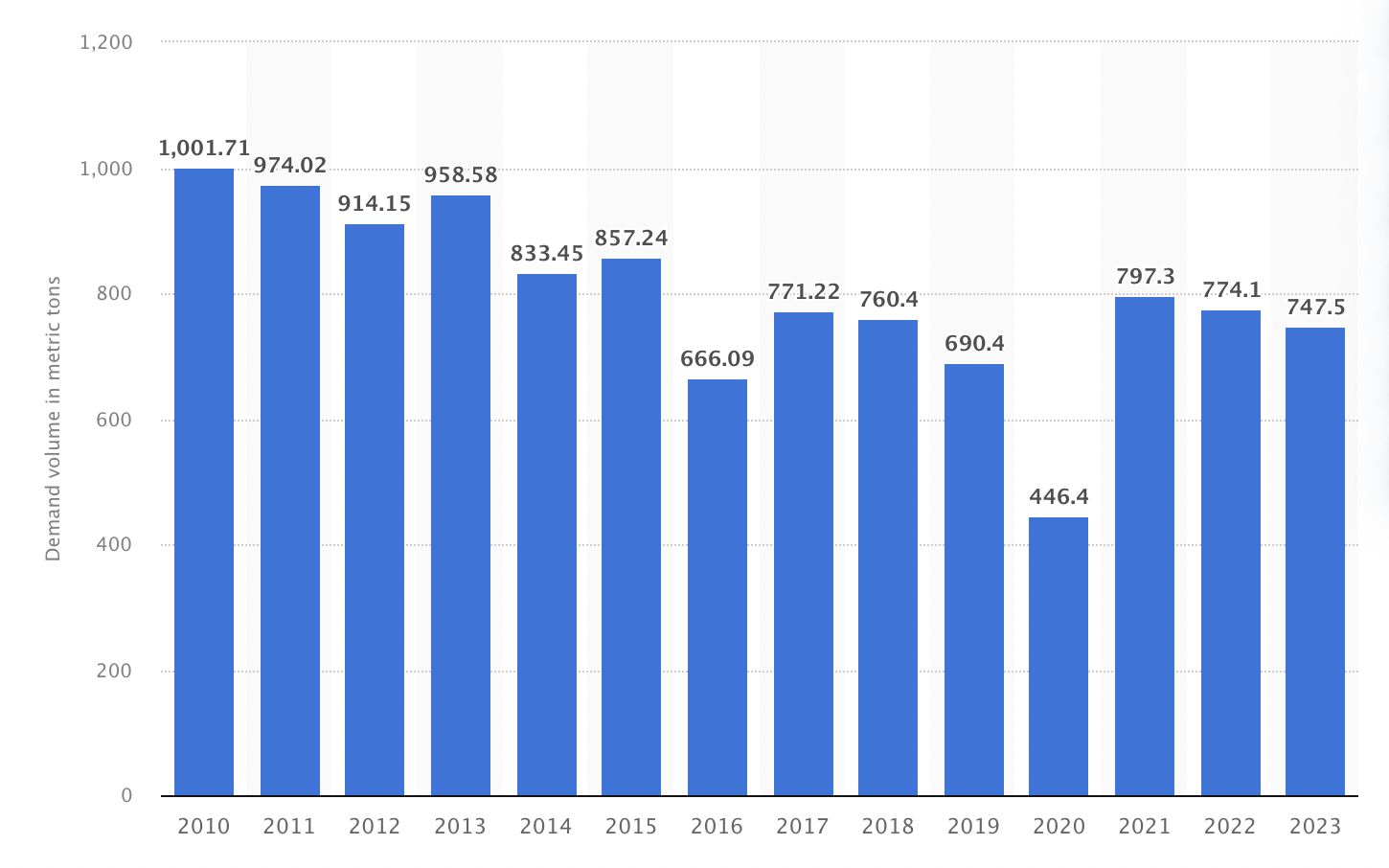

The article was written in November 2024 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024).