World Gold Council

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024) provides an overview of World Gold Council (WGC), its key roles and impact in shaping the global gold market.

Introduction

The World Gold Council (WGC) is a market development organization founded in 1987 to promote the responsible use of gold. It’s a non-profit organization that works with governments, central banks, jewelers, investors, and other stakeholders to shape the gold market. Its main purpose is to stimulate and sustain demand for gold and provide leadership on global issues that affect the gold industry. The World Gold Council website states information such as, “For instance, in 2023, the demand for gold (excluding over-the-counter investments) fell by 5% compared to 2022, due to reduced central bank buying and fluctuations in ETF investments. Total annual gold supply increased by 3%, driven by a 1% rise in mine production and a 9% increase in recycling, spurred by high gold prices”.

Logo of the World Gold Council

Source: World Gold Council

Who owns the World Gold Council?

The World Gold Council has 32 members that are some of the world’s most forward-thinking gold mining companies. They are headquartered across the world and have mining operations in over 45 countries.

Key roles of the World Gold Council

The World Gold Council organization plays key roles in shaping the global gold market such as market development, market intelligence, advocacy, and policy.

Market Development

Consumer Demand: The WGC works to stimulate consumer demand for gold jewelry, particularly in emerging markets.

Industrial Demand: The WGC highlights the industrial applications of gold, such as its use in electronics and dentistry.

Investment Demand: The organization promotes gold as a long-term investment option, emphasizing its role as a store of value and a hedge against inflation.

According to the World Gold Council website, jewelry remains a significant driver, particularly in markets like China and India, while gold’s industrial uses include electronics and medical devices. In 2023, technology demand for gold dipped slightly, yet it remains a crucial component in the electronics sector.

Market Intelligence

Research and Analysis: The WGC conducts extensive research and analysis on the global gold market, providing insights into trends, supply and demand dynamics, and economic factors affecting gold prices.

Market Data: The organization publishes regular market reports, including the Gold Demand Trends report, which provides detailed information on global gold demand and supply.

WGC invests in research to explore new uses for gold, aiming to increase its demand in areas such as health, environmental technology, and sustainable jewelry.

Advocacy and Policy

Policy Engagement: The WGC engages with policymakers and regulators to promote responsible mining practices and sound gold market policies.

Industry Standards: The organization works to establish and maintain industry standards for gold, ensuring quality and transparency.

Impact of the World Gold Council

Promoting Gold Investment: The WGC has successfully promoted gold as an investment asset, leading to increased demand for gold ETFs and other investment products.

According to WGC website, adding between 4% and 15% in gold to hypothetical average portfolios over the past decade, depending on the composition and the region, would have increased risk-adjusted returns. Along with this information, they also explain every type of possible investment for gold such as Gold-backed ETFs, Gold futures, options and forwards, Internet Investment Gold, Gold savings plans, Investment bars and coins, and Gold certificates.

Supporting Responsible Mining: The organization has been a strong advocate for responsible mining practices, working to improve environmental and social standards in the gold mining industry.

On the WGC website, the Responsible Gold Mining Principles (RGMPs) was launched in 2019 as a framework that sets out clear expectations for consumers, investors, and the gold supply chain as to what constitutes responsible gold mining.

Key Statistics and Trends

Key statistics and trends are useful for finance students which help them understand the global gold market.

Global Gold Demand

Global gold demand has fluctuated over the years, influenced by factors such as economic growth, inflation, and geopolitical events.

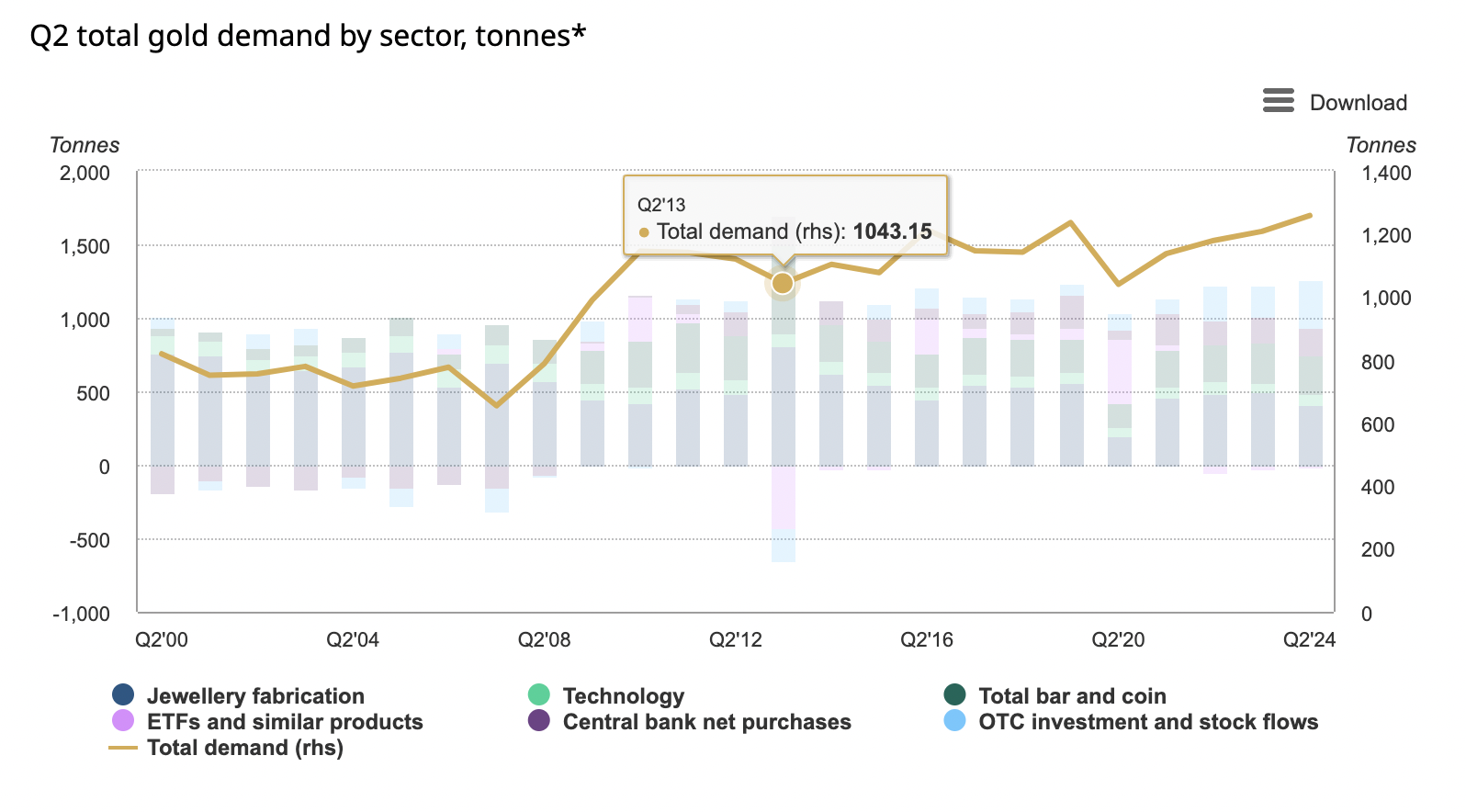

The figure below shows the global gold demand in different sectors such as jewelry, technology, ETFs, and similar products dated in 2024 (Q2).

Global gold demand in different sectors in 2024

Source: World Gold Council

Central Bank Gold Reserves

Central banks around the world hold significant gold reserves, which can impact gold prices.

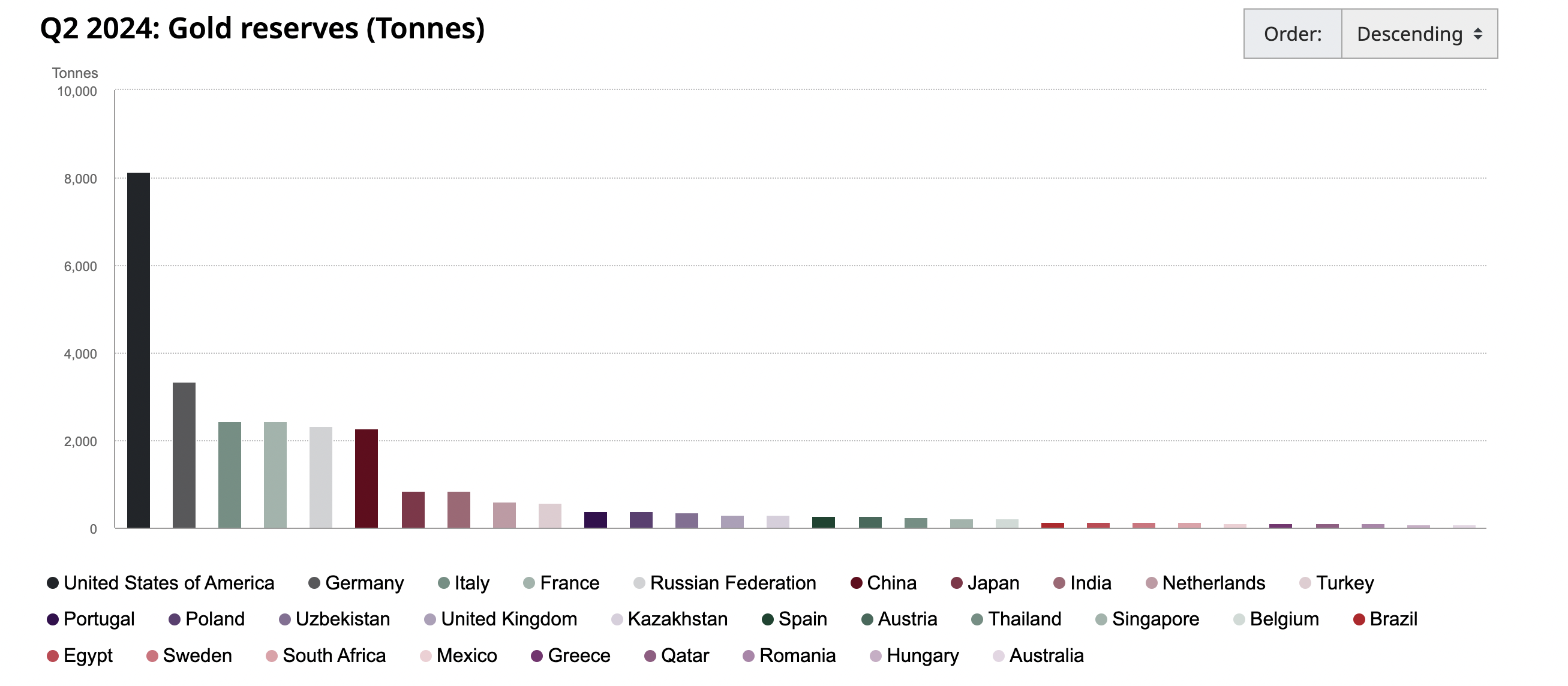

The figure below shows the gold reserves in different countries all over the world dated in 2024 (Q2).

Gold reserves in different countries in 2024

Source: World Gold Council

Gold Investment

Gold ETFs and other investment products have gained popularity in recent years, providing investors with exposure to gold without the need to physically own the metal.

Role of Gold in environmental, social and governance (ESG)

Responsible gold mining supports sustained socio-economic development in the countries and communities where gold is found. It creates well-paid jobs, valuable tax revenues for host governments, and generates sustained benefits for local communities. In recent years, we have seen increased focus from a growing number of consumers and investors on environmental, social, and governance (ESG) factors and the sustainability of our planet.

p>Gold also plays an important role in supporting technologies that enable our daily lives, as well as supporting the transition to a low-carbon economy. There is increasing evidence that including gold can make investment portfolios more robust and resilient in light of climate risks.In 2019, the World Gold Council launched the Responsible Gold Mining Principles (RGMPs) – a framework that sets out clear expectations for consumers, investors, and the gold supply chain as to what constitutes responsible gold mining. The WGC has long believed that responsible gold mining supports sustained socio-economic development in countries and communities that host gold mining operations, through its contribution to jobs, tax revenue and investment in local communities.

Conclusion

The World Gold Council plays a crucial role in shaping the global gold market. By promoting gold as an investment, industrial, and consumer asset, the WGC contributes to the long-term health and sustainability of the gold industry.

Why should I be interested in this post?

Gold has been a key financial asset for centuries. It is often considered as a store of value, a hedge against inflation, and a safe-haven asset during economic crises. Understanding its investment options helps students grasp fundamental market dynamics and investor behavior, especially during periods of economic uncertainty.

Related posts on the SimTrade blog

▶ Nithisha CHALLA History of Gold

▶ Nithisha CHALLA Gold resources in the world

▶ Nithisha CHALLA How to invest in Gold

Useful resources

World gold council Members

World gold council Gold Demand Trends

World gold council Gold Reserves by Country

World gold council Environmental, Social and Governance (ESG)

Other

Wikipedia Gold

About the author

The article was written in November 2024 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024).