Market Capitalization

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023) explains Market Capitalization and its specificities.

What is Market Capitalization?

Market capitalization is a key metric used to assess the size and value of publicly traded companies. It represents the company’s value for the owners of the company (the shareholders or stockholders). This metric allows companies to be classified as large-cap, mid-cap, or small-cap based on their respective market-capitalization sizes.

Large-cap companies are typically more established, with market capitalizations exceeding several billion dollars. They are more stable and frequently represent industry leaders. In the US stock market, Apple, Microsoft, and Amazon are examples of large-cap companies.

Mid-cap companies fall between large-cap and small-cap companies. They are typically businesses that have seen moderate growth and may still have room for expansion. Mid-cap companies are frequently regarded as having a good balance of growth potential and stability. For example, Etsy Inc., DocuSign Inc., Spotify Technology S.A. etc.

Small-cap companies have lower market capitalizations than large-cap and mid-cap firms. They are generally thought to have greater growth potential, but also greater risk due to their smaller size and possibly limited resources. NeoGenomics, Inc., Clean Energy Fuels Corp., Axon Enterprise Inc. etc.

Mathematical formula?

The general formula for calculating market capitalization:

Market Capitalization = Current Share Price x Number of Outstanding Shares

In this formula:

“Current Share Price” refers to the price of a single share of the company’s stock. It is the latest transaction price. As Market Capitalization is usually computed every day, the current share price corresponds to the closing price of the trading session.

“Number of Outstanding Shares” represents the total number of shares of the company’s stock that are publicly available and held by investors.

The Significance of Stock Price

When considering market capitalization, the stock price is an important factor to consider. It represents the current market price at which a company’s shares are bought and sold. Stock prices, which are influenced by factors such as supply and demand, market sentiment, and company-specific news, play a critical role in determining a company’s market capitalization.

On the short term, as the number of shares issued by the company is stable, the stock price is the main factor which influences market capitalization.

How is the Number of Shares Computed?

The total number of outstanding shares of a company’s stock is used to calculate market capitalization. The outstanding shares are those that the company has issued and are held by shareholders, which include individual investors, institutional investors, and insiders.

The number of outstanding shares can be found in the company’s financial statements, specifically the balance sheet and the notes to the financial statements.

Which Shares are Included?

The outstanding shares generally include common shares or ordinary shares, which are the most common types of shares issued by companies. Preferred shares or other types of securities that may have different rights or characteristics are typically excluded from the calculation of market capitalization.

When we compute market capitalization, we take into consideration all outstanding shares of stock, which include publicly traded shares plus restricted shares held by the top management team and the founders of the company. Note that market capitalization is different from the float which takes into consideration only the shares available for trading in the secondary market.

If a company has different classes of shares with different voting rights or other characteristics, each class of shares may have its own market capitalization calculation based on the respective share price and the number of outstanding shares for that class.

Market capitalization provides an estimate of the overall value of the publicly traded portion of a company and is commonly used as a measure to compare companies or track changes in a company’s value over time.

Why should I be interested in this post?

Understanding market capitalization allows management students to analyze the financial health and performance of companies. By considering market capitalization along with other financial indicators, students can assess the relative size and value of companies in the market. Management students need to evaluate investment opportunities and determine the attractiveness of different stocks or companies based on their market capitalization and growth potential. Large-cap companies often offer stability and lower risk, while small-cap companies tend to be riskier but may have higher growth potential. Management students need to understand the risk-return tradeoff associated with different market capitalization segments.

Related posts on the SimTrade blog

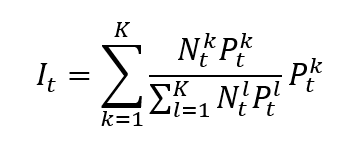

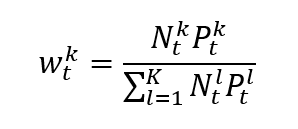

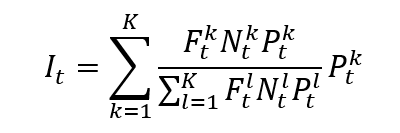

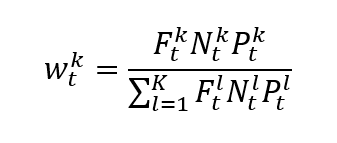

▶ Nithisha CHALLA Financial indexes

▶ Nithisha CHALLA Calculation of financial indexes

▶ Nithisha CHALLA Float

▶ Nithisha CHALLA Top 5 companies by market capitalization in India

▶ Nithisha CHALLA Top 5 companies by market capitalization in China

▶ Nithisha CHALLA Top 5 companies by market capitalization in the United States

▶ Nithisha CHALLA Top 5 companies by market capitalization in Europe

Useful resources

Fidelity Investments Market capitalization

Wikipedia Market capitalization

Motley Fool An Example of Market Capitalization

About the author

The article was written in June 2023 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023).