Recent Financial Innovations in China in the 2020s

In this article, Samia DARMELLAH (ESSEC Business School, Global BBA, 2020-2024) present recent financial innovations in China in the 2020s.

Introduction

During my academic exchange at Fudan University in China, I was captivated by the innovation and dynamism of the financial sector. In 2024, China is considerably ahead of other countries in terms of financial progress, reshaping the services landscape with revolutionary technologies. In this article, we will explore some of the most striking developments, including the rise of digital payments, blockchain integration, Intelligence Artificial in China, robo-advisors and the launch of the Digital Yuan.

By diving into these innovations, the aim is to show how they are improving the efficiency of financial services while creating new opportunities for businesses and consumers, providing a glimpse into the trends shaping the future of finance.

Digital Payments via QR Codes

Digital payments have become a revolution in China, especially those made using QR codes. Whether shopping or paying for a cab, scanning a QR code is the most common method. This trend was driven primarily by Covid-19 and has since multiplied across the country. By June 2024, over 969 million users were actively making payments via applications such as WeChat Pay and Alipay, according to Statista’s report on mobile payment users in China, published in 2024. What’s fascinating is the extent to which this practice has become ingrained in everyday life: almost 72% of consumers will regularly use mobile payments by early 2024.

Payment via QR Code.

Source: Google Image.

Although mobile payments in physical stores have fluctuated, reaching almost 84% in the second third quarter of 2024 before dropping and rising again to 72% in the first quarter of 2024 according to Statista. Digital transaction trends remain strong and dominant across China, facilitating billions of transactions seamlessly and securely.

Blockchain for Security and Transparency

Blockchain is a technology that allows a database to be shared in a decentralized manner, that is, between actors who do not necessarily trust each other and without a central controlling entity. In China, blockchain technology has become an essential pillar of financial security and transparency. It has enormous potential, according to a study carried out by Statista between 2017 and 2022, the market size is expected to reach more than 27 billion yuan by 2025 and nearly 69 billion yuan by 2030.

One of the growing sectors that benefits from blockchain in China is logistics. Companies like Alibaba are using this technology to track goods at every stage of their shipment, from manufacturing to delivery. Thanks to blockchain, data on the origin, quality and transport conditions of products are recorded transparently and securely. This not only helps to strengthen consumer confidence, but also to combat counterfeiting, a major challenge for companies operating in China.

AI-Powered Lending

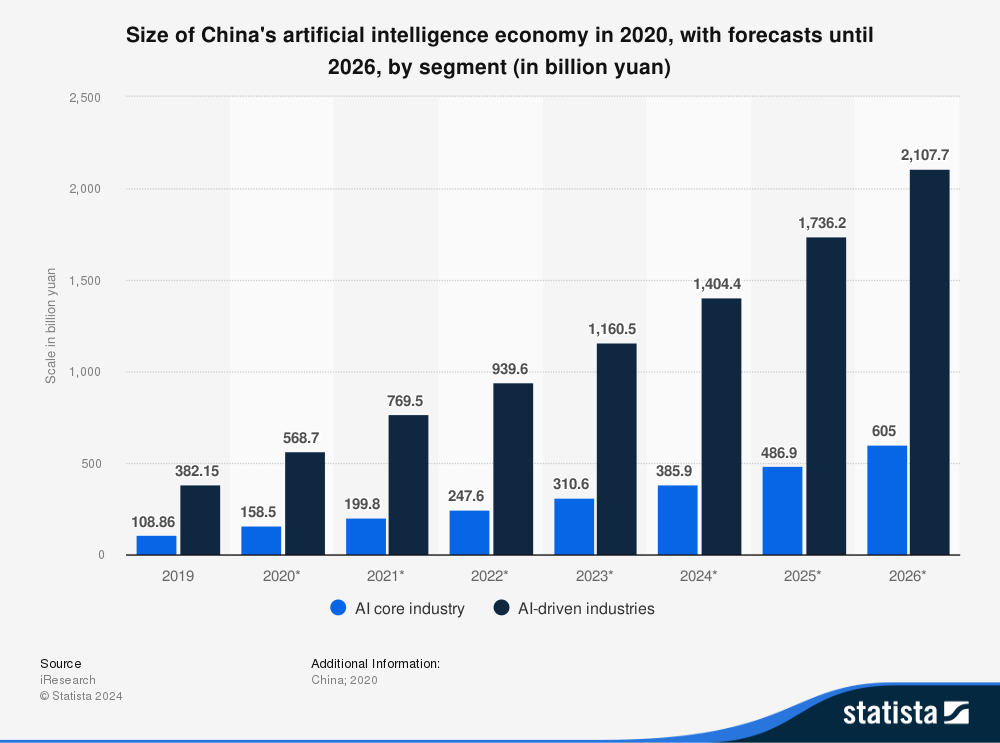

Artificial intelligence (AI) plays a major role in China, with the market reaching around 70 billion yuan in 2020. Forecasts indicate that it could reach nearly 170 billion yuan by 2026. The technology is being integrated into a variety of sectors, including healthcare, financial services, and retail. Companies like Alibaba and Baidu are investing heavily in the development of AI solutions, driving growth, and transforming the way businesses operate. China’s dominance in this field could position it as a global leader in AI in the years to come.

Size of China’s artificial intelligence economy in 2020

Source: Statista.

Size of China’s artificial intelligence economy in 2020, with forecasts until 2026, by segment (in billion yuan)

Robo-Advisors in Wealth Management

In China, innovation in wealth management is booming thanks to robo-advisors. These automated platforms use artificial intelligence to provide personalized investment advice, tailored to each user’s financial goals. The Chinese robo-advisor market is expected to reach $2.67 billion by 2024, with annual growth of 10% to 2027 according to Statista.

According to a BlueWeave Consulting report on artificial intelligence in China in 2024, this expansion is fueled by the growth of the middle class, which will number over 400 million people in 2020. Robo-advisors are making it easier and cheaper to access financial services.

Today, many financial companies are adopting these technologies to attract younger customers. For example, the MyBank platform, a digital bank affiliated to Ant Financial (Alibaba) uses AI algorithms to offer automated, personalized financial services. This model has transformed the way financial services are offered, making wealth management more accessible for the new generation. Robo-advisors are no longer reserved for high-net-worth investors but have also become accessible to ordinary customers. This phenomenon illustrates how China’s innovations are transforming the wealth management landscape.

The Digital Yuan and Cryptocurrencies

The digital yuan, or “e-CNY” as it is also known, is a digital version of China’s currency launched in a test phase in 2020 by the People’s Bank of China. Unlike decentralized crypto-currencies, the digital yuan is fully state-controlled, enabling secure and traceable transactions. It has revolutionized the payments market in China, offering an alternative to platforms such as Alipay and WeChat Pay. By facilitating instant payments, even offline, it has improved financial inclusion, particularly for unbanked populations.

The e-CNY also enables the government to strengthen economic surveillance and stimulate the growth of digital commerce. As the digital yuan develops, it could potentially influence the dynamics of digital currencies worldwide.

Conclusion

In summary, China’s financial sector is evolving rapidly thanks to innovative technologies that are making services more accessible and efficient. The rise of digital payments, the use of blockchain, artificial intelligence, robo-advisors and the launch of the digital yuan show how China is transforming its financial landscape. These changes are opening up new opportunities for consumers and businesses and paving the way for the future of financial services, both in China and internationally.

Related posts on the SimTrade blog

▶Nithisha CHALLA Top financial innovations in the 21st century

▶Nithisha CHALLA Top 5 companies by market capitalization in China

Useful resources

BlueWeave Consulting (2024) China Artificial Intelligence Market

Fullerton, E. J. (2022) The People’s Republic of China’s Digital Yuan: Its environment, design, and implications. Asian Development Bank

Marin-Dagannaud, G. (2017) Le fonctionnement de la blockchain. Annales Des Mines – Réalités Industrielles

Shen, K., Tong, X., Wu, T., & Zhang, F. (2022) The next frontier for AI in China could add $600 billion to its economy

Statista (2024) Number of mobile payment users in China from 2024 to June 2024

Statista (2018-2024) Mobile payments adoption in POS in China from 2018 to 2024

Statista (2017-2022) Blockchain market size in China from 2017 to 2022

Statista (2019-2026) Scale of AI industry in China by segment from 2019 to 2026

Statista (2017-2027) Robo-advisors market in China from 2017 to 2027

About the author

The article was written in October 2024 by Samia DARMELLAH (ESSEC Business School, Global BBA, 2020-2024).