Are sellers paying buyers to buy crude oil?

This article written by Akshit Gupta (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) analyzes the crude oil market.

Introduction

Commodity futures refer to a contract of buying or selling a specific quantity of a commodity, at a specific date and a fixed price in the future. Commodity markets function differently than stock markets in terms of its volatility, ownership, and the time horizon for settlement. The commodities traded using such arrangements are those which have a competitively large demand and supply base with fluctuation in prices. The traders invest in commodity futures to prevent any risks arising out of major fluctuations in the prices of the underlying good. Such futures are traded by hedgers and speculators and the positions are closed by both physical as well as cash settlements depending upon the specific needs.

Crude oil futures

Crude oil is an unrefined petroleum product that is naturally occurring and is composed of hydrocarbon deposits and other organic materials. Such oil is refined to produce jet fuel, gasoline, diesel, kerosene, etc.

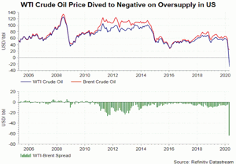

The two most popularly traded grades of crude oil are Brent North Sea Crude and West Texas Intermediate with a major difference arising owing to their geographical location of extraction.

The prices for WTI, the American benchmark for crude oil, have been dipping since the advent of the unrelenting price war between Russia and Saudi Arabia over the concerns of cutting supply in the oversupplied markets. However, the price for WTI May futures entered a sub-zero level of -$37.63 per barrel on April 20, 2020, where the sellers of crude oil were willing to pay buyers to buy the commodity over concerns of overflooding inventories and weaken global demand for crude oil.

The exact reason for this unprecedented decline is very difficult to comprehend. But with the information available in the public domain, it is well believed that such a movement was based on the fear amongst the buyers that with the May Futures Contract expiring on 21st April 2020, they would be required to take physical deliveries of the oil and owing to already overflooding inventories, there was a sharp sell-off for the futures contract in the market resulting in a negative price.

Also, unlike Brent Crude Oil, the storage facilities for WTI crude oil are limited to a very handful of places in and near the USA. With the production going on and demand at its very low, the facilities are expected to run out of space in the coming months. This has proved to be a major concern for all the future buyers and the effects were well portrayed by the steep decline in prices.

What is expected in the coming days?

If the current lockdown pertains along with the current level of production of crude oil witnessed in America, it won’t come as a big surprise if the prices of WTI Futures expiring in June also ends up in the negative territory. Although OPEC+ members agreed to slash production output by 10%, the decline was not enough to balance the ongoing demand. With more than half of the world under lockdown and most of the industrial activities coming at a halt, the inventories of crude oil have been running up many folds with limited storage capacities. The negative futures price doesn’t mean that hedgers can benefit from this dip since the transportation and storage costs have seen a steep rise, which will nearly nullify the benefits of negative pricing. Also, if the current health crisis pertains for a longer period than previously anticipated, the markets will take a long time to come to its previous level.

About the author

Article written in June 2020 by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).